Lunch Wrap: ASX set to snap winning streak as Moody’s US downgrade puts markets on edge

ASX snaps streak as Moody’s spooks markets. Picture via Getty Images

- ASX looks set to snap winning streak as Moody’s spooks markets

- New Hope tanks on coal squeeze and soft prices

- Domino’s reshuffles, MinRes names new chair

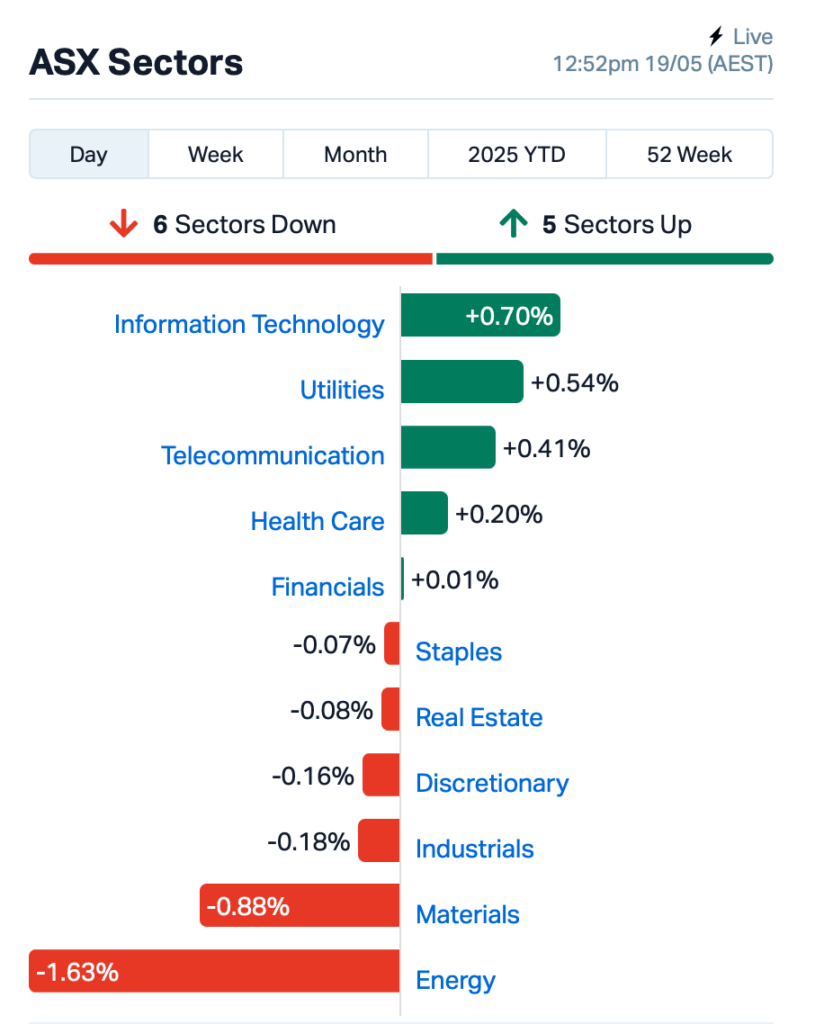

The ASX was down 0.15% by Monday lunch AEST, on track to snap its longest winning streak since August and fall just short of a ninth straight win.

Local mood turned after Moody’s threw a bit of cold water on markets, downgrading US government debt from its prized AAA status to Aa1.

Its reason is ballooning US deficits, rising interest costs, and a fiscal house that’s looking increasingly creaky at the seams.

Moody’s timing didn’t help. Congress is about to go ahead with a Trump-era bill loaded with permanent tax cuts and a US$4 trillion lift to the debt ceiling.

This morning, the S&P 500 futures contracts fell 0.8% on the Moody’s news, while Nasdaq 100 futures dropped 1% – a sign where Wall Street could open later tonight.

Elsewhere, gold found its shine again, climbing as much as 1.5% to US$3,245 an ounce after its roughest week in six months, as Moody’s US downgrade pulled investors back toward safe ground.

Iron ore slipped further below the psychological US$100-a-tonne mark, with Singapore futures trading at US$99.85 this morning.

On the ASX, that left a dent in the majors. BHP (ASX:BHP) fell 1.7% and Rio Tinto (ASX:RIO) dropped 1.3%.

Energy stocks were the worst performers despite oil prices holding flat.

In the large caps space, New Hope Corp (ASX:NHC) was among the hardest hit, tumbling 7.5% this morning after its quarterly update laid out a tough picture for investors.

Production held up across the group, but margins copped a whack. NHC’s quarterly EBITDA dropped 27% as the average realised coal price slipped to $147.50/t, down from $159/t in January.

And it’s not just the price chart softening. At New Acland, the miner said it was still battling to move coal out the gate, with rail constraints leaving stocks piling up and waiting.

Mineral Resources (ASX:MIN) also lost over 6% after naming Malcolm Bundey as its next chair. The Brickworks deputy chair and former Pact Group CEO will take over from James McClements in July.

And still in large caps, Domino’s Pizza Enterprises (ASX:DMP) slipped 1.7% after flagging the exit of its Australia/NZ CEO Kerri Hayman, who’s set to hang up the apron in August after nearly four decades with the pizza giant.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for May 19 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| RDN | Raiden Resources Ltd | 0.007 | 63% | 55,018,242 | $13,803,566 |

| PIL | Peppermint Inv Ltd | 0.003 | 50% | 854,216 | $4,475,279 |

| XAM | Xanadu Mines Ltd | 0.076 | 49% | 39,554,693 | $97,522,075 |

| NSX | NSX Limited | 0.032 | 45% | 2,114,653 | $11,075,006 |

| SFG | Seafarms Group Ltd | 0.002 | 33% | 100,246 | $7,254,899 |

| SIS | Simble Solutions | 0.004 | 33% | 514,408 | $2,628,991 |

| ASR | Asra Minerals Ltd | 0.003 | 25% | 66,666 | $5,412,094 |

| BP8 | Bph Global Ltd | 0.003 | 25% | 945,021 | $2,101,969 |

| LML | Lincoln Minerals | 0.005 | 25% | 146,733 | $8,410,279 |

| OLI | Oliver'S Real Food | 0.005 | 25% | 469,592 | $2,162,928 |

| RLL | Rapid Lithium Ltd | 0.003 | 25% | 968,621 | $2,489,889 |

| TFL | Tasfoods Ltd | 0.005 | 25% | 753,402 | $1,748,382 |

| LDR | Lode Resources | 0.155 | 19% | 2,595,504 | $21,031,939 |

| 8CO | 8Common Limited | 0.020 | 18% | 545,196 | $3,809,613 |

| AMN | Agrimin Ltd | 0.089 | 17% | 322,673 | $26,087,971 |

| UVA | Uvrelimited | 0.110 | 17% | 520,224 | $5,658,800 |

| BLU | Blue Energy Limited | 0.007 | 17% | 450,071 | $11,105,842 |

| CTQ | Careteq Limited | 0.014 | 17% | 640,299 | $2,845,425 |

| M24 | Mamba Exploration | 0.014 | 17% | 822,908 | $3,541,987 |

| OVT | Ovanti Limited | 0.004 | 17% | 501,402 | $8,380,545 |

| OFX | OFX Group Ltd | 1.315 | 16% | 427,130 | $263,428,096 |

| ASE | Astute Metals NL | 0.029 | 16% | 1,657,822 | $15,453,506 |

| EOS | Electro Optic Sys. | 1.490 | 16% | 2,645,566 | $248,908,208 |

Raiden Resources (ASX:RDN) has hit gold in all eight holes from its Phase 2 drilling at the Vuzel project in Bulgaria, confirming a shallow, potentially large gold system. Top results included 24.8m at 1.96g/t from surface, with a high-grade zone of 13.3m at 3.4g/t.

Another hole returned 56m at 1.09g/t, including 8.3m at nearly 5g/t. The flat, near-surface nature of the gold means cheaper, faster follow-up drilling, said Raiden. The explorer is now testing 1.5km of a 4km target zone, with more assays pending and rigs still turning.

Stock exchange operator NSX (ASX:NSX) is set to be fully acquired by Canada’s CNSX, owner of the Canadian Securities Exchange, in a $0.035-a-share deal. CNSX already owns a slice of NSX and now wants the lot, offering a 59% premium to Friday’s close. The NSX board is backing the deal, saying it’ll bring financial muscle, tech upgrades and a stronger shot at shaking up Aussie capital markets.

Agrimin (ASX:AMN) says the strategic review of its Mackay Potash Project is still ticking along, with a sharp eye on cost control while market conditions remain tough. At the same time, its 40%-owned Tali Resources is now planning an ASX listing by mid-2025, and intends to offer Agrimin shareholders priority access to up to $2 million worth of shares in the IPO.

And, Xanadu Mines (ASX:XAM) has entered into a bid deal with Bastion Mining, which’s offering 8 cents a share, a 56% premium to Xanadu’s last close.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for May 19 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| EEL | Enrg Elements Ltd | 0.001 | -50% | 10,161 | $6,507,557 |

| AOA | Ausmon Resorces | 0.001 | -33% | 140,669 | $1,966,820 |

| VPR | Voltgroupltd | 0.001 | -33% | 10 | $16,074,312 |

| HMD | Heramed Limited | 0.014 | -26% | 8,581,508 | $16,636,452 |

| OSL | Oncosil Medical | 0.003 | -25% | 760,099 | $18,426,329 |

| AZL | Arizona Lithium Ltd | 0.007 | -22% | 30,212,220 | $41,056,331 |

| SRH | Saferoads Holdings | 0.087 | -21% | 29,758 | $4,807,595 |

| EIQ | Echoiq Ltd | 0.255 | -20% | 7,141,237 | $206,460,067 |

| HLX | Helix Resources | 0.002 | -20% | 125,000 | $8,410,484 |

| TEM | Tempest Minerals | 0.004 | -20% | 3,404 | $3,672,649 |

| TYX | Tyranna Res Ltd | 0.004 | -20% | 600,000 | $16,442,127 |

| ZMM | Zimi Ltd | 0.009 | -18% | 879 | $4,702,982 |

| IVX | Invion Ltd | 0.079 | -17% | 96,009 | $7,360,447 |

| AQX | Alice Queen Ltd | 0.005 | -17% | 4,370,921 | $6,881,340 |

| EM2 | Eagle Mountain | 0.005 | -17% | 142,889 | $6,810,224 |

| EMU | EMU NL | 0.020 | -17% | 234,588 | $5,069,963 |

| ERA | Energy Resources | 0.003 | -17% | 4,686,336 | $1,216,188,722 |

| MEM | Memphasys Ltd | 0.005 | -17% | 675,910 | $11,901,589 |

| CNQ | Clean Teq Water | 0.170 | -15% | 83,418 | $14,448,461 |

| HTM | High-Tech Metals Ltd | 0.145 | -15% | 1 | $7,849,468 |

| ARV | Artemis Resources | 0.006 | -14% | 2,122,460 | $17,699,705 |

| GCM | Green Critical Min | 0.012 | -14% | 5,379,945 | $27,484,496 |

| MOH | Moho Resources | 0.006 | -14% | 382,458 | $5,116,122 |

| XPN | Xpon Technologies | 0.012 | -14% | 995,862 | $5,799,545 |

IN CASE YOU MISSED IT

Impact Minerals (ASX:IPT) has raised the final $635,000 for a renounceable rights issue, under a shortfall offer. The funds will support a drilling program at the Arkun project, which will test the Caligula nickel-copper-platinum group element anomaly. With $180,000 from the WA government’s Exploration Incentive Scheme partially funding the drilling program, IPT is keen to get drills turning at Arkun.

At Stockhead, we tell it like it is. While Impact Minerals is a Stockhead advertiser, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.