Lunch Wrap: ASX smashes 8700 for first time as BHP crushes records, Mesoblast soars

ASX smashed 8700 as BHP broke records and Mesoblast lit up the US. Pic: Getty Images

- ASX smashes through 8700 as Wall Street rally lifts all boats

- BHP belts out record copper and iron ore

- Mesoblast soars after booking first Ryoncil sales in US

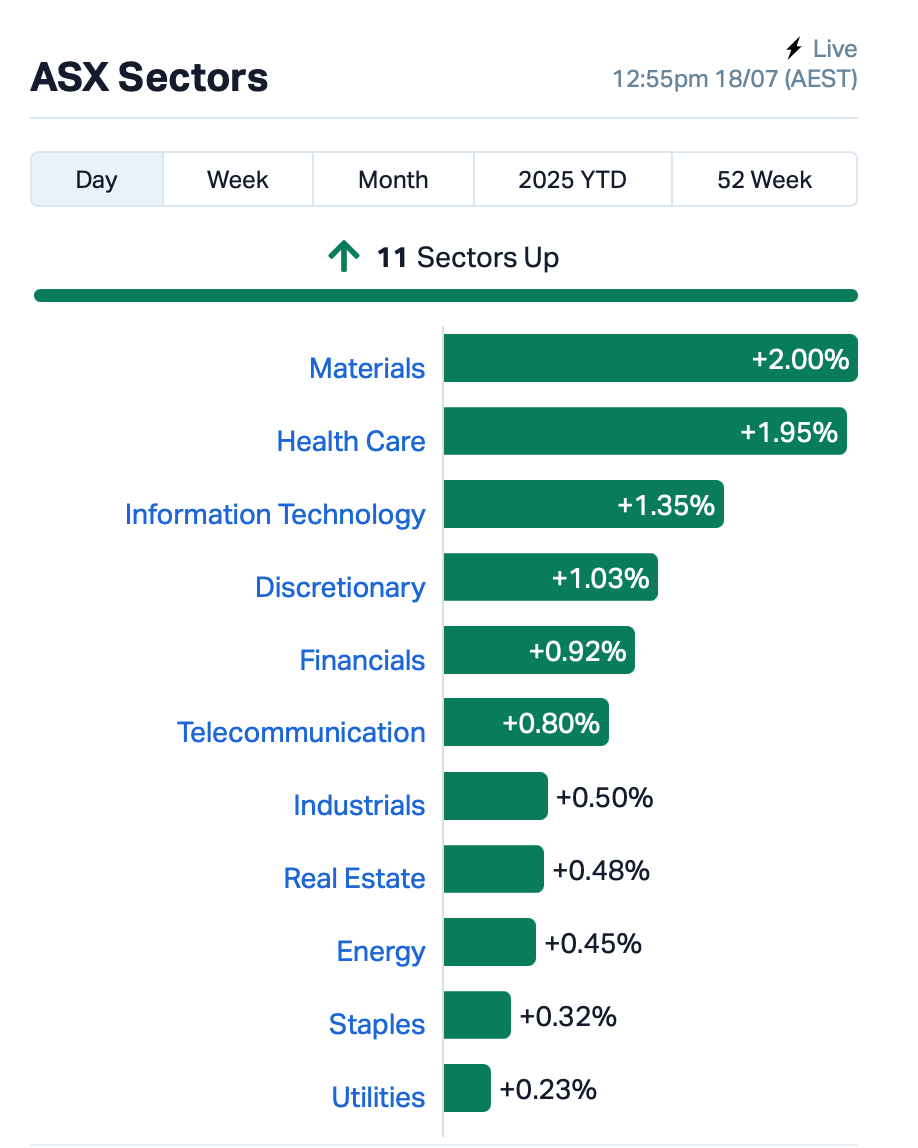

At lunchtime in the east, the ASX 200 was up over 1% and trading above 8700 for the first time, with all 11 sectors in the green.

Wall Street laid the groundwork overnight, notching up fresh records across the board.

The rally came off stronger-than-expected US retail sales and a fifth straight week of falling jobless claims.

Nvidia added more than 1%, pushing its market cap towards a gobsmacking US$4.25 trillion.

“Right now, as long as the markets don’t have a reason to sell off, they’re going to go up,” said Steve Sosnick of Interactive Brokers.

Asian markets caught the Wall Street wave this morning, with TSMC jumping 2% in Taiwan on bullish AI vibes.

Back home, this is where things stood at around 1pm AEST:

BHP (ASX:BHP) was the main headline after reporting a massive annual ops review.

Record copper. Record iron ore. And some of the best numbers BHP’s ever put on the board.

Iron ore out of WA smashed records, with South Flank running above nameplate in its first full year. Even the coal division chipped in, lifting output 5% despite getting slapped by wet weather and moody geology at Broadmeadow.

Over in copper, BHP pumped out over 2 million tonnes group-wide, a record haul in a metal that’s fast becoming the lifeblood of the clean energy boom.

Escondida in Chile hit its highest production in 17 years, Spence broke records, and Copper SA wrapped the year with a strong June quarter. On the downside, costs and timelines have blown out at BHP’s next growth project, the Jansen potash mine in Canada.

BHP’s shares were up 2%.

ALSO READ: Monsters of Rock: BHP’s big year and battery metals comeback

Meanwhile another large cap, Mesoblast (ASX:MSB), was off the leash, up a scorching 29% after reporting its first quarter of revenue from the US launch of Ryoncil.

The stem cell therapy, approved by the FDA in March for kids with steroid-resistant graft-versus-host disease, pulled in US$13.2 million in sales. Another US$1.6 million rolled in from royalties in Japan.

Elsewhere, Fletcher Building (ASX:FBU) jumped up 3% despite warning that the construction market won’t bounce back until at least 2027.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for July 18 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| TR2 | Tali Resources Ltd | 0.430 | 115% | 766,597 | $7,501,000 |

| AS2 | Askari Metals | 0.013 | 63% | 32,662,215 | $3,233,365 |

| AUH | Austchina Holdings | 0.002 | 50% | 250,100 | $3,025,384 |

| FAU | First Au Ltd | 0.004 | 33% | 1,052,057 | $6,228,874 |

| HLX | Helix Resources | 0.002 | 33% | 1,760,084 | $5,046,291 |

| SHP | South Harz Potash | 0.004 | 33% | 741,773 | $3,849,186 |

| DTZ | Dotz Nano Ltd | 0.039 | 30% | 957,221 | $17,761,929 |

| MSB | Mesoblast Limited | 2.305 | 29% | 13,728,960 | $2,291,141,265 |

| KNG | Kingsland Minerals | 0.150 | 25% | 296,220 | $8,707,309 |

| CTN | Catalina Resources | 0.005 | 25% | 10,061,003 | $9,704,076 |

| PXX | Polarx Limited | 0.010 | 25% | 3,526,872 | $19,004,008 |

| CNQ | Clean Teq Water | 0.255 | 24% | 95,867 | $14,809,672 |

| PEC | Perpetual Res Ltd | 0.021 | 24% | 8,903,926 | $14,844,880 |

| LSR | Lodestar Minerals | 0.018 | 20% | 3,356,635 | $5,963,857 |

| CYP | Cynata Therapeutics | 0.180 | 20% | 1,043,773 | $33,893,155 |

| TRI | Trivarx Ltd | 0.012 | 20% | 2,843,773 | $6,198,263 |

| AI1 | Adisyn Ltd | 0.075 | 19% | 5,838,920 | $45,619,913 |

| NVQ | Noviqtech Limited | 0.038 | 19% | 351,275 | $8,049,170 |

| NVX | Novonix Limited | 0.555 | 18% | 14,512,926 | $299,013,652 |

| MLS | Metals Australia | 0.020 | 18% | 3,815,865 | $12,388,232 |

| SYR | Syrah Resources | 0.340 | 17% | 13,844,584 | $302,250,996 |

| CDE | Codeifai Limited | 0.021 | 17% | 2,945,529 | $8,494,218 |

| NAE | New Age Exploration | 0.004 | 17% | 1,045,751 | $8,117,734 |

| MCP | McPherson's Ltd | 0.305 | 15% | 627,213 | $38,146,522 |

Askari Metals (ASX:AS2) has uncovered high-grade copper hits at its newly acquired Nejo Gold Project in Ethiopia, with historic drilling at the Katta Target returning standout intercepts like 14.3m at 3.2% copper. It’s sitting on a district-scale 1,174km2 landholding in the heart of the Arabian-Nubian Shield, surrounded by multi-million-ounce gold deposits and barely scratched by modern exploration.

Novonix (ASX:NVX) has welcomed a US move to slap 93.5% antidumping tariffs on Chinese graphite, lifting the total effective tariff rate to a whopping 160% when you stack on earlier duties and Trump’s blanket tariffs. The decision backs Novonix’s push to build a North American supply chain, with its Chattanooga site set to become the first large-scale synthetic graphite hub on the continent.

Metals Australia (ASX:MLS) wrapped up a major drilling program at its Lac Carheil graphite project in Quebec, with assays confirming a 595% jump in graphite intercepts. now feeding into an updated mineral resource due this quarter. Over 9,500m of drilling was completed, with more than half delivering graphite, including standout grades of 12.4% TGC in the newly confirmed SE extension zone.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for July 18 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| VFX | Visionflex Group Ltd | 0.002 | -33% | 777,230 | $10,103,581 |

| EEL | Enrg Elements Ltd | 0.002 | -25% | 20,495,001 | $6,507,557 |

| BDM | Burgundy D Mines Ltd | 0.031 | -21% | 3,577,961 | $55,431,959 |

| BUY | Bounty Oil & Gas NL | 0.002 | -20% | 200,000 | $3,903,680 |

| MEL | Metgasco Ltd | 0.002 | -20% | 120,000 | $4,581,467 |

| SRI | Sipa Resources Ltd | 0.016 | -20% | 3,924,274 | $8,327,966 |

| TON | Triton Min Ltd | 0.004 | -20% | 82,000 | $7,841,944 |

| ICG | Inca Minerals Ltd | 0.013 | -19% | 9,013,545 | $26,157,778 |

| ADG | Adelong Gold Limited | 0.005 | -17% | 11,258,929 | $13,492,060 |

| HCD | Hydrocarbon Dynamics | 0.003 | -17% | 129,152 | $3,234,328 |

| PRM | Prominence Energy | 0.003 | -17% | 485,016 | $1,459,411 |

| MDI | Middle Island Res | 0.017 | -15% | 227,772 | $5,864,679 |

| FRM | Farm Pride Foods | 0.295 | -14% | 147,823 | $79,622,983 |

| ECT | Env Clean Tech Ltd. | 0.003 | -14% | 200,000 | $14,054,024 |

| GTR | Gti Energy Ltd | 0.003 | -14% | 9,000 | $12,981,292 |

| TMS | Tennant Minerals Ltd | 0.006 | -14% | 30,000 | $7,461,233 |

| TNY | Tinybeans Group Ltd | 0.120 | -14% | 39,935 | $20,707,461 |

| TYX | Tyranna Res Ltd | 0.003 | -14% | 79,120 | $11,509,489 |

| ATS | Australis Oil & Gas | 0.007 | -13% | 1,629,539 | $10,544,500 |

| AUZ | Australian Mines Ltd | 0.007 | -13% | 2,052,254 | $13,688,097 |

| CCO | The Calmer Co Int | 0.004 | -13% | 200,767 | $12,045,413 |

| EMT | Emetals Limited | 0.004 | -13% | 133,277 | $3,400,000 |

| M4M | Macro Metals Limited | 0.007 | -13% | 6,591,552 | $31,819,340 |

| OVT | Ovanti Limited | 0.007 | -13% | 2,109,831 | $34,194,589 |

IN CASE YOU MISSED IT

Pitt Street Research sees strong upside in Prescient Therapeutics (ASX:PTX) as one of the most advanced oncology companies on the ASX as it kicks off a phase 2a trial.

Prospect Resources’ (ASX:PSC) test results from Nyungu Central and Kabikupa samples indicate that Mumbezhi features a conventional copper processing profile suitable for low-cost treatment.

It’s been a promising start for Miramar Resources (ASX:M2R) at 8 Mile target within the Gidji JV, with the first drill hole hitting high-grade gold and ending in mineralisation.

LAST ORDERS

Axel REE (ASX:AXL) has dual listed to the Frankfurt exchange under the ticker FSE.HN8. The company also intends to list to the OTC markets in North America in a bid to capitalise on growing interest in REEs following deals between MP Materials, Apple and the US Department of Defense.

Lithium Universe (ASX:LU7) has acquired New Age Minerals in a move the company calls “transformational”, gaining an exclusive licencing agreement with Macquarie University for a patented photovoltaic solar panel recycling technology known as Microwave Joule Heating Technology.

Sipa Resources (ASX:SRI) has closed out a $1.61m placement at 1.4 cents each, having received strong support from both existing major shareholders and new investors. All four directors participated, with funds to go to a suite of drilling programs across Sipa’s gold projects.

At Stockhead, we tell it like it is. While Axel REE, Lithium Universe and Sipa Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.