Lunch Wrap: ASX slides again; Fortescue down 4pc on Trump’s copper tariff threat

The ASX slides again. Picture via Getty Images

- ASX extends losses, crypto and oil tumble

- Wisetech shines while Fortescue, Kelsian and Flight Centre drop

- Worley surges on $500m buyback, Woolworths hits profit

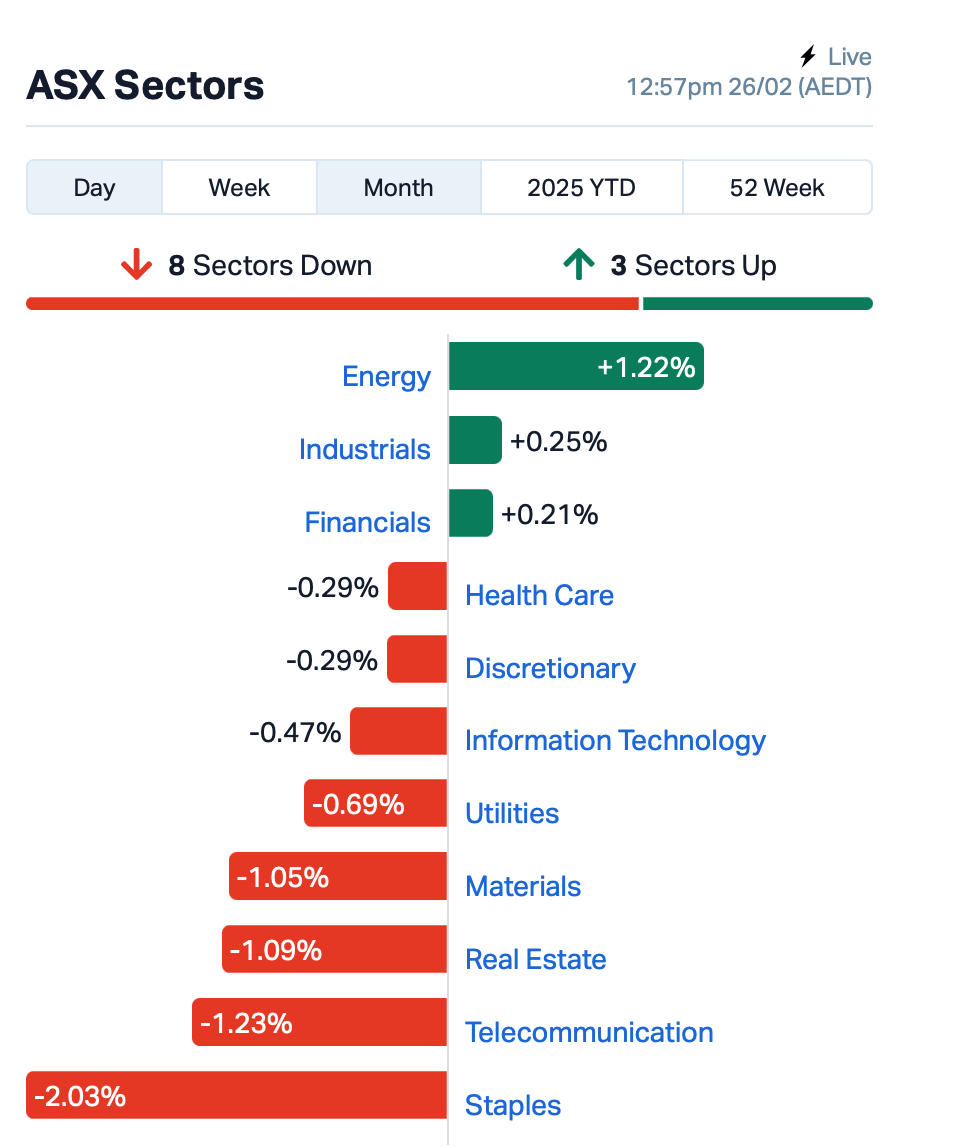

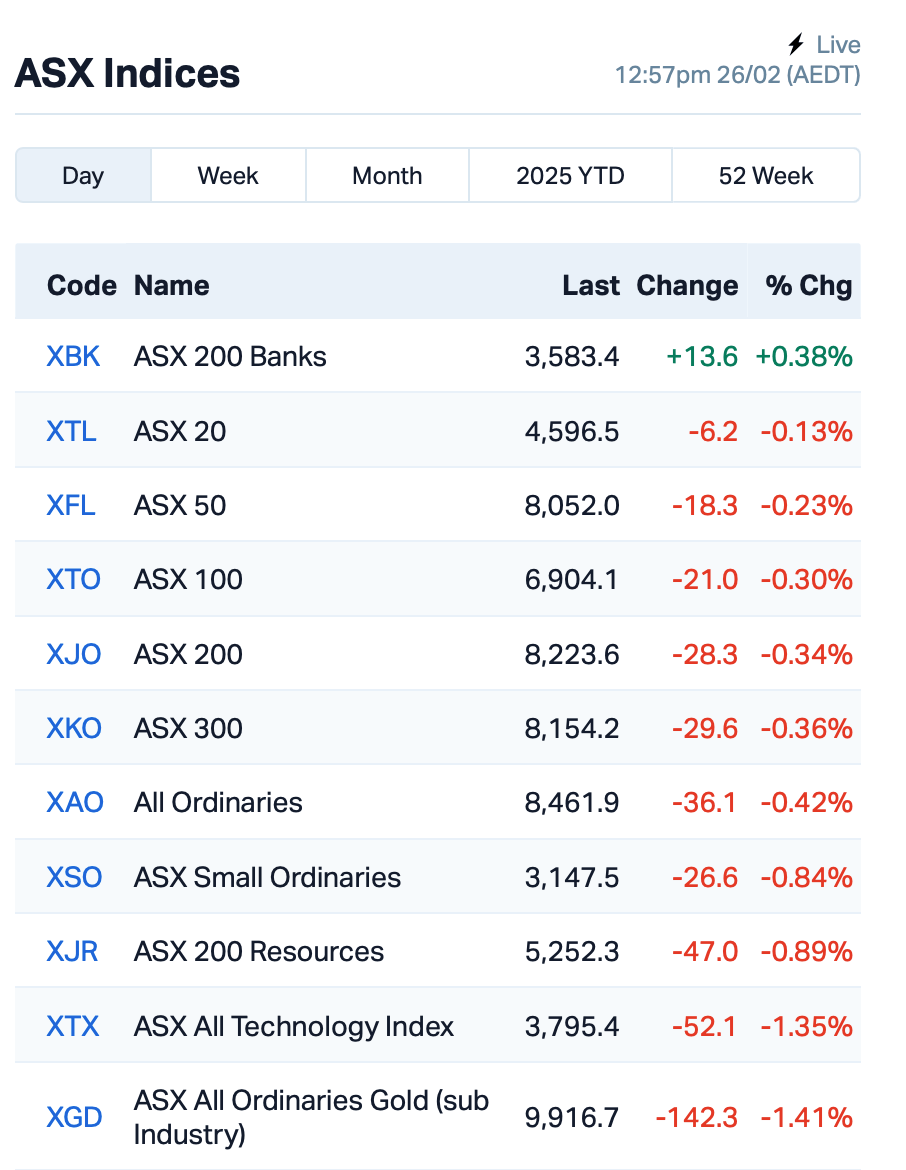

The ASX extended its losses once again on Wednesday, and it’s now on track for its seventh down day in eight.

The benchmark S&P/ASX 200 index fell 0.25% at about lunchtime AEDT, dipping even further below the six-week low it hit yesterday.

Nearly every sector was in the red this morning, with staples and telcos taking the biggest hit.

Overnight, Wall Street dropped to its lowest level in over a month, driven by a big slump in consumer confidence. US markets have been rattled by Trump’s revived tariff threats and concerns over China curbs.

The tech-heavy Nasdaq dropped around 1.3%, pulled down by big names like Nvidia and Tesla, while the S&P 500 slid 0.4%.

In cryptos, Bitcoin tumbled below US$90,000, touching a low near US$86,000, before trading now at around US$88,000.

Ether also dropped 6% to just over US$2,470. US crypto stocks like Coinbase and MicroStrategy also felt the pressure.

“Hopes for a pro-crypto Trump administration fuelled Bitcoin’s rally to all-time highs, but with no concrete policy follow-through, momentum faded,” said Charlie Sherry at BTC Markets.

Meanwhile, the Federal Reserve’s Tom Barkin didn’t do the market any favours after saying that he’d like to play it cautious with rates.

“We learned in the ’70s that if you back off inflation too soon, you can allow it to reemerge. No one wants to pay that price,” Barkin said.

Over in oil, prices slipped more than 2.5%, with WTI crude dipping below US$69 per barrel, its lowest since December.

The drop comes amid murky demand outlooks and fresh sanctions on Iran.

Back on Aussie turf, the monthly Consumer Price Index (CPI) came in steady at 2.5% for January, matching the figure from December.

The market had expected a slight bump to 2.6%, so this was pretty much right on the money.

But the spotlight today was on WiseTech Global (ASX:WTC) once again.

WTC’s shares jumped 3% in early trade (before paring gains) after the company announced that its billionaire founder, Richard White, was stepping back into the role of executive chairman. This came after the departure of four directors.

In the meantime, WiseTech also posted a solid 1H result with revenue up 17%. EBITDA jumped 28%, and the margin expanded to 50%.

Elsewhere, news that Trump might slap tariffs on copper had Australian miners feeling uneasy. Fortescue (ASX:FMG) dropped 4.6%.

Trump said last night his team will launch an investigation into the copper market, claiming that global actors have decimated the US copper industry.

Woolworths (ASX:WOW) tumbled by 4% despite swinging back to profit with $739 million in the six months to December.

Transport company Kelsian Group (ASX:KLS) was another one to struggle, shedding 18% after posting a 7.9% fall in profit in the first half.

At Flight Centre (ASX:FLT), shares dropped 12% despite a 7% jump in underlying profit, as investors weren’t too thrilled by the outlook the company gave.

Meanwhile, the large caps’ winners circle included Light & Wonder (ASX:LNW). The gaming giant surged 5% after announcing a full-year profit of US$480 million. The company is also mulling a dual listing on both NASDAQ and the ASX.

And engineering firm Worley (ASX:WOR) had a cracker morning, up 11% thanks to a $500m share buyback and a massive 72% jump in interim net profit to $183m for the half.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for February 26 [intraday]:

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| FFF | Forbidden Foods | 0.008 | 60% | 20,212,634 | $3,560,510 |

| HTM | High-Tech Metals Ltd | 0.270 | 59% | 912,946 | $5,582,802 |

| ADD | Adavale Resource Ltd | 0.003 | 50% | 204,000 | $4,546,558 |

| EEL | Enrg Elements Ltd | 0.002 | 50% | 500,000 | $3,253,779 |

| OLY | Olympio Metals Ltd | 0.059 | 48% | 6,106,392 | $3,479,059 |

| WOA | Wide Open Agricultur | 0.018 | 46% | 32,572,108 | $6,404,239 |

| VRC | Volt Resources Ltd | 0.005 | 43% | 59,414,961 | $15,852,877 |

| RLL | Rapid Lithium Ltd | 0.004 | 33% | 22,361,992 | $3,097,334 |

| WYX | Western Yilgarn NL | 0.034 | 31% | 100,000 | $3,219,048 |

| PBH | Pointsbet Holdings | 1.080 | 30% | 6,249,041 | $275,331,976 |

| ZMI | Zinc of Ireland NL | 0.014 | 27% | 7,860,467 | $6,237,118 |

| ALV | Alvomin | 0.059 | 26% | 219,720 | $5,506,468 |

| PER | Percheron | 0.015 | 25% | 3,419,156 | $13,049,252 |

| 1TT | Thrive Tribe Tech | 0.003 | 25% | 14,167 | $4,063,446 |

| ERA | Energy Resources | 0.003 | 25% | 11,821,205 | $810,792,482 |

| LNR | Lanthanein Resources | 0.003 | 25% | 35,399 | $4,887,272 |

| ENV | Enova Mining Limited | 0.008 | 23% | 4,486,313 | $7,999,184 |

| AMS | Atomos | 0.006 | 20% | 4,003,331 | $6,075,092 |

| ASR | Asra Minerals Ltd | 0.003 | 20% | 1,900,000 | $5,932,817 |

| EVR | Ev Resources Ltd | 0.006 | 20% | 15,000 | $9,662,517 |

| IS3 | I Synergy Group Ltd | 0.006 | 20% | 270,313 | $1,981,089 |

| WBE | Whitebark Energy | 0.006 | 20% | 162,698 | $1,541,046 |

| FBR | FBR Ltd | 0.024 | 18% | 23,129,395 | $101,197,175 |

| BNL | Blue Star Helium Ltd | 0.007 | 17% | 15,050,141 | $16,169,312 |

| MGU | Magnum Mining & Exp | 0.007 | 17% | 1,142,857 | $4,856,168 |

High-Tech Metals (ASX:HTM) has acquired the Mt Fisher and Mt Eureka gold projects, which include a 100% stake in Mt Fisher and 51% gold rights for Mt Eureka. These projects are in the Northern Goldfields, with a big 1,150km² area and active mining leases. Mt Fisher has previously produced 30,000 ounces of gold, and there’s potential for more, with nearby mills just 120km away. It’s a prime spot for gold, close to major deposits like Jundee and Bronzewing, and the region has been hot for acquisitions with big players like Northern Star and Kedalion snapping up projects nearby.

Adavale Resources (ASX:ADD) has hit high-grade gold, copper, and silver at the Ashes prospect in NSW, just 10km from Northparkes. First rock chip results include 7.95 g/t gold, 2.2% copper, and 96.4 g/t silver. These results back up historical findings, showing promising gold and copper levels. The area also shows high levels of pathfinder elements, hinting at strong mineralisation. Adavale is now planning a soil geochemistry program and more rock chip sampling to explore the 5km² area.

Olympio Metals (ASX:OLY) is set to acquire up to 80% of the Bousquet gold project in Quebec, Canada. The project’s located on the Cadillac Break, known for world-class gold and copper, and has high-grade prospects like Paquin East with a historic intercept of 9m at 16.96g/t Au. It’s close to major gold mines like Agnico Eagle’s La Ronde and Iamgold’s Westwood. The property’s got a 24km² area with quartz-hosted veins, similar to nearby high-yield projects. And, it’s underexplored, with most drilling done before 1947.

Bluebet (ASX:BBT) has made an offer to acquire Pointsbet (ASX:PBH) for $340-$360 million, including a cash pool of $240-$260 million and $100-$120 million in scrip. The deal could unlock $40 million in annual synergies, and BlueBet reckons it’s a solid offer for PointsBet shareholders.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for February 26 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.001 | -50% | 5,510,526 | $13,149,361 |

| OVT | Ovanti Limited | 0.008 | -38% | 93,263,524 | $27,978,574 |

| ALA | Arovella Therapeutic | 0.125 | -36% | 6,958,457 | $207,509,941 |

| VPR | Voltgroupltd | 0.001 | -33% | 16,584 | $16,074,312 |

| IDX | Integral Diagnostics | 1.970 | -31% | 7,148,867 | $1,063,402,254 |

| APX | Appen Limited | 2.060 | -28% | 24,315,930 | $752,131,172 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 2,418,329 | $57,867,624 |

| TIG | Tigers Realm Coal | 0.003 | -25% | 124,949 | $52,266,809 |

| PTM | Platinum Asset | 0.595 | -21% | 6,549,592 | $436,625,337 |

| ATV | Activeportgroupltd | 0.012 | -20% | 8,819,849 | $10,274,656 |

| HLO | Helloworld Travl Ltd | 1.640 | -20% | 1,835,474 | $333,776,129 |

| AAU | Antilles Gold Ltd | 0.004 | -20% | 187,998 | $9,476,880 |

| CAV | Carnavale Resources | 0.004 | -20% | 42,666 | $20,451,092 |

| HFY | Hubify Ltd | 0.008 | -20% | 900,000 | $5,111,363 |

| PRX | Prodigy Gold NL | 0.002 | -20% | 125 | $7,937,639 |

| VFX | Visionflex Group Ltd | 0.002 | -20% | 900,000 | $8,419,651 |

| ACL | Au Clinical Labs | 3.040 | -18% | 1,945,956 | $742,130,604 |

| KLS | Kelsian Group Ltd | 2.990 | -17% | 2,252,962 | $981,526,586 |

| 1AI | Algorae Pharma | 0.005 | -17% | 20,000 | $10,124,368 |

| BPP | Babylon Pump | 0.005 | -17% | 4,952,001 | $14,997,294 |

| DTM | Dart Mining NL | 0.005 | -17% | 8,301,772 | $3,588,333 |

| RNX | Renegade Exploration | 0.005 | -17% | 2,000,000 | $7,704,021 |

| TEG | Triangle Energy Ltd | 0.005 | -17% | 800,001 | $12,535,404 |

| PGD | Peregrine Gold | 0.105 | -16% | 30,103 | $9,932,996 |

IN CASE YOU MISSED IT

Recce Pharmaceuticals (ASX:RCE) has received a notice of allowance from the Japanese Patent Office for Patent Family 4 for its anti-infectives with an expiry of 2041.Recce said the Japan patent claims are for its two anti-infective products RECCE 327 (R327) and RECCE 529 (R529) for the treatment of disease, particularly bacterial and viral infections and more. Recce said this is the fourth Family 4 patent, alongside Australia, Canada, and Israel, with further Patent Cooperation Treaty (PCT) country submissions in respective stages of review or approval.

Summit Minerals (ASX:SUM) has mutually agreed to withdraw from acquiring the Mundo Novo niobium-REE-phosphate carbonatite project in Brazil. The decision aligns with the company’s focus on advancing its flagship Ecuador niobium and rare earth project.

Blue Star Helium (ASX:BNL) has completed drilling the intermediate hole section of Jackson 31 at its Galactica helium project in Las Animas County, Colorado. The company is now casing and cementing, with the next steps including a cement bond log (CBL) and drilling into the target Lyons formation to reach total depth (TD).

At Stockhead, we tell it like it is. While Recce Pharmaceuticals, Summit Minerals and Blue Star Helium are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.