Lunch Wrap: ASX sinks with all 11 sectors bleeding; gold roars to new record

Gold roars to record high again. Picture via Getty Images

- ASX bleeds as tech cracks under bond yield pressure

- GDP beats, but Canberra’s chest-beating looks thin

- Gold roars to record

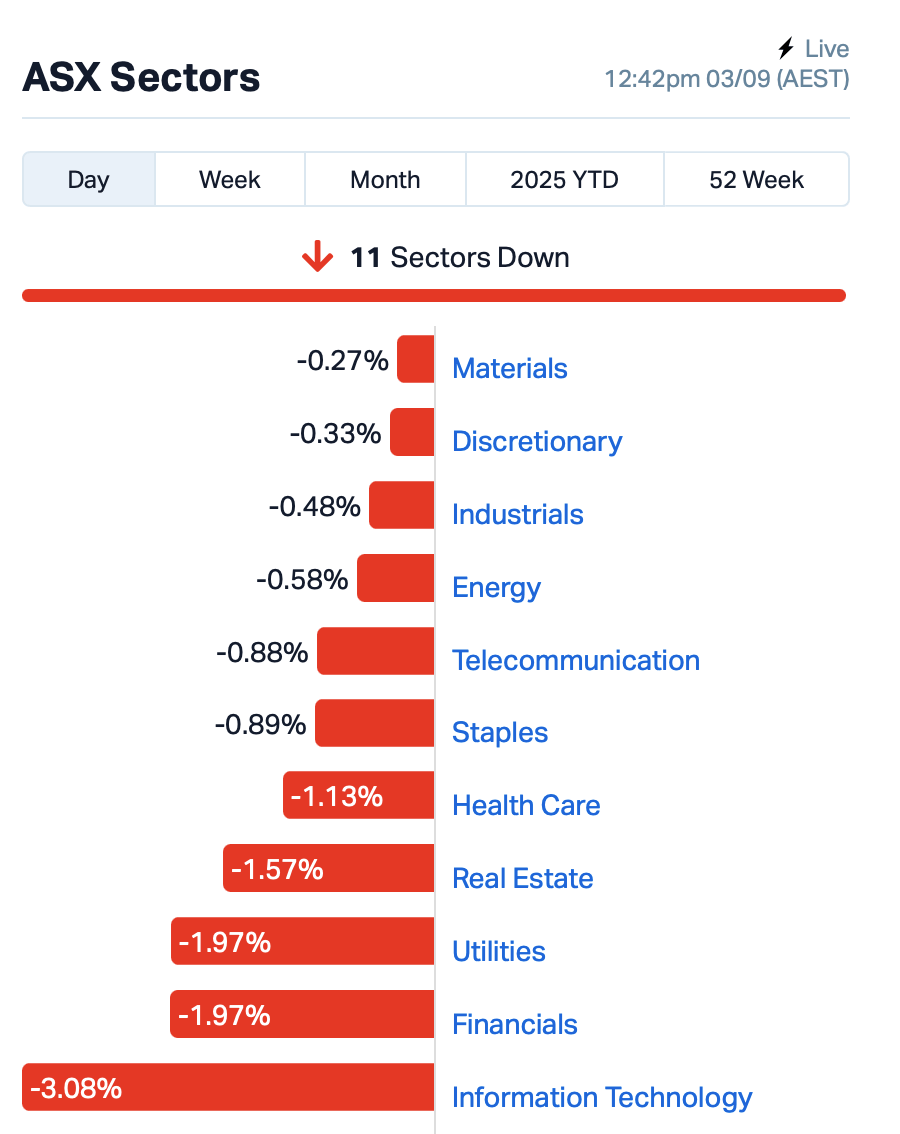

The ASX was down 0.8% by Wednesday lunchtime in the east, and it wasn’t a pretty picture.

All 11 sectors were bleeding red ink, with tech dragging the whole pack downhill.

If you’re looking for inspiration, don’t bother glancing across to the US, where Wall Street wilted overnight under the weight of rising bond yields.

The US 10-year yield is parked above 4.2% and the 30-year is edging toward that dreaded 5% line. Yields at those levels usually turn equities from opportunity into dead weight.

The so-called Magnificent Seven cracked, and our own tech mob duly followed.

Xero (ASX:XRO) slipped 5% this morning, and Life360 (ASX:360) fell 2%.

WiseTech Global (ASX:WTC), supposedly still a “buy” in Citi’s eyes, also lost 2%. When brokers keep the rating but slash the target, you know conviction is running thin.

Then came the GDP data at 11.30am.

Growth clocked in at 0.6% for the June quarter, twice the pace of Q1 and a touch ahead of forecasts. Annual growth lifted to 1.8%.

Michele Bullock fronts up in WA tonight, and investors will hang off every line, hoping for a clue on when the next cut drops.

Odds are, though, they’ll get more central-bank poetry than policy.

Gold, meanwhile, was the saviour once again.

The yellow metal has hit a fresh record above US$3,530 an ounce, a six-day rally that’s starting to look more like a statement than just a spike.

Data shows that global central banks are hoarding gold over Treasuries for the first time since the ’90s, which essentially translates to a vote of no confidence in Uncle Sam.

And… in large caps news, Medibank Private (ASX:MPL) had the more colourful headline this morning. Former SA Premier Jay Weatherill chucked in another $30k, taking his stash to 22,600 shares.

A nice little show of faith from the politician.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| ABX | ABX Group Limited | 0.091 | 122% | 22,088,890 | $10,327,142 |

| BUS | Bubalus Resources | 0.155 | 35% | 4,606,087 | $6,599,621 |

| 4DX | 4Dmedical Limited | 1.005 | 31% | 14,230,000 | $358,509,371 |

| GIB | Gibb River Diamonds | 0.061 | 30% | 854,517 | $10,081,944 |

| CTO | Citigold Corp Ltd | 0.005 | 25% | 6,895,965 | $12,000,000 |

| MEL | Metgasco Ltd | 0.003 | 25% | 3,646,564 | $3,674,173 |

| HIQ | Hitiq Limited | 0.021 | 24% | 199,505 | $8,025,788 |

| AVW | Avira Resources Ltd | 0.011 | 22% | 188,774 | $2,070,000 |

| MNC | Merino and Co | 0.205 | 21% | 106,889 | $9,023,017 |

| FLG | Flagship Min Ltd | 0.077 | 20% | 1,912,990 | $16,048,465 |

| AU1 | The Agency Group Aus | 0.024 | 20% | 442,913 | $8,791,532 |

| ERL | Empire Resources | 0.006 | 20% | 940,000 | $7,419,566 |

| M2R | Miramar | 0.003 | 20% | 1,000,000 | $2,987,308 |

| BDG | Black Dragon Gold | 0.105 | 18% | 731,315 | $28,439,896 |

| TAS | Tasman Resources Ltd | 0.020 | 18% | 21,057 | $4,748,997 |

| 8CO | 8Common Limited | 0.035 | 17% | 183,940 | $6,722,847 |

| CR1 | Constellation Res | 0.140 | 17% | 5,800 | $9,647,334 |

| AZL | Arizona Lithium Ltd | 0.007 | 17% | 2,286,920 | $32,281,887 |

| BUY | Bounty Oil & Gas NL | 0.004 | 17% | 30,000 | $4,684,416 |

| CTN | Catalina Resources | 0.004 | 17% | 250,000 | $7,278,057 |

| VHM | Vhmlimited | 0.255 | 16% | 501,703 | $55,785,389 |

ABx Group (ASX:ABX) has had its Deep Leads rare earth results confirmed by ANSTO, with leach tests pulling out more than 70% of dysprosium and terbium – the two heavy rare earths everyone wants. The tests showed Deep Leads can be leached above pH 4, which means fewer impurities, lower costs and a cleaner process. It’s now on track to deliver its first mixed rare earth carbonate sample in Q4 2025, with prospective customers already waiting on it.

Bubalus Resources (ASX:BUS) has flagged high-grade gold targets at its Wilson’s Hill project in Victoria, a field with historic bonanza grades and strong geological similarities to Bendigo. Historic drilling by Western Mining confirmed mineralisation at depth, including hits like 8m at 23.83 g/t gold. Wilson’s Hill sits in one of the country’s most productive belts, with the geology matching Bendigo and Falcon’s nearby Blue Moon project.

4D Medical (ASX:4DX) has locked in US Medicare reimbursement for its CT:VQ software, a move that clears the way for broad adoption. CMS will pay US$650.50 per scan on top of the standard chest CT fee. With FDA clearance already in the bag, the reimbursement decision removes the last big hurdle. CT:VQ can now be rolled out widely without extra infrastructure, offering hospitals a cheaper, cleaner way to assess lung function.

Gibb River Diamonds (ASX:GIB) has kicked off mining at the Edjudina Gold Project in WA’s Eastern Goldfields, with private contractor BML Ventures running the show. Under the deal, BML covers all mining and processing costs, leaving Gibb with minimal financial exposure. Ore from the Neta deposit will be toll-treated at nearby mills, with cashflow split 50/50 once expenses are covered. The resource sits at 378,000 tonnes at 1.9 g/t for 24,000 ounces, and all gold will be sold into the spot market.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AGN | Argenica | 0.255 | -60% | 7,157,476 | $82,854,579 |

| HLX | Helix Resources | 0.001 | -50% | 8,573,784 | $6,728,387 |

| RLC | Reedy Lagoon Corp. | 0.002 | -33% | 1,991,567 | $2,330,120 |

| SFG | Seafarms Group Ltd | 0.001 | -33% | 16,717,812 | $7,254,899 |

| AX8 | Accelerate Resources | 0.007 | -22% | 3,619,013 | $7,354,698 |

| LML | Lincoln Minerals | 0.007 | -22% | 32,471,847 | $19,148,128 |

| ADG | Adelong Gold Limited | 0.004 | -20% | 407,495 | $11,584,182 |

| SMM | Somerset Minerals | 0.013 | -19% | 16,605,418 | $12,901,610 |

| TMK | TMK Energy Limited | 0.003 | -17% | 10,353,275 | $30,667,149 |

| MVL | Marvel Gold Limited | 0.016 | -16% | 5,554,888 | $26,695,267 |

| EQR | Eq Resources Limited | 0.035 | -15% | 12,199,662 | $126,753,289 |

| PVW | PVW Res Ltd | 0.018 | -14% | 5,269 | $4,177,000 |

| MRD | Mount Ridley Mines | 0.003 | -14% | 18,700 | $3,133,418 |

| ROG | Red Sky Energy. | 0.003 | -14% | 163 | $18,977,795 |

| TYX | Tyranna Res Ltd | 0.003 | -14% | 600,000 | $11,697,542 |

| EQX | Equatorial Res Ltd | 0.165 | -13% | 70,529 | $24,974,617 |

| 1AD | Adalta Limited | 0.004 | -13% | 8,350,000 | $5,285,266 |

| AUR | Auris Minerals Ltd | 0.007 | -13% | 140,726 | $3,813,008 |

| AYT | Austin Metals Ltd | 0.004 | -13% | 1,480,012 | $6,336,765 |

IN CASE YOU MISSED IT

Bubalus Resources (ASX:BUS) is filling a binder with prospective gold targets at the Wilson’s Hill project in the heart of the Victorian goldfields region after completing a review.

Nimy Resources (ASX:NIM) has added technical advisor Tony Tang to the team as it looks to develop a process flowsheet for its Block 3 gallium discovery at the Mons project in WA.

Encryption specialist Senetas (ASX:SEN) has streamlined operations and enters FY2026 with record sales pipeline and strong cash backing.

Miriam’s flashing plenty of gold for Future Battery Minerals (ASX:FBM) with early drilling returning thick, high-grade hits and extending a gold lode.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.