Lunch Wrap: ASX sent reeling as tech, miners crumble and crypto caves

The ASX has copped a gut punch on Friday. Pic: Getty Images

- ASX wobbles as Nvidia nerves bite

- WiseTech rallies amid AGM fireworks

- Miners down and crypto flinches

The ASX looked genuinely rattled at the open on Friday, sliding as much as 1.9% in early trade before clawing its way back to sit around 1.45% lower across the eastern states.

Overnight in the US, Nvidia was meant to be the calming influence after delivering another blockbuster result.

But a stronger-than-expected US jobs print stirred fresh debate over whether the Fed is really done tightening, and that was enough to turn optimism into a full blown risk-off session.

The S&P 500 gave up 1.6% and the Nasdaq slid 2%, with Nvidia itself swinging hard from 5% up to 2% down at the bell.

Back home this morning, the selloff wasn’t picky.

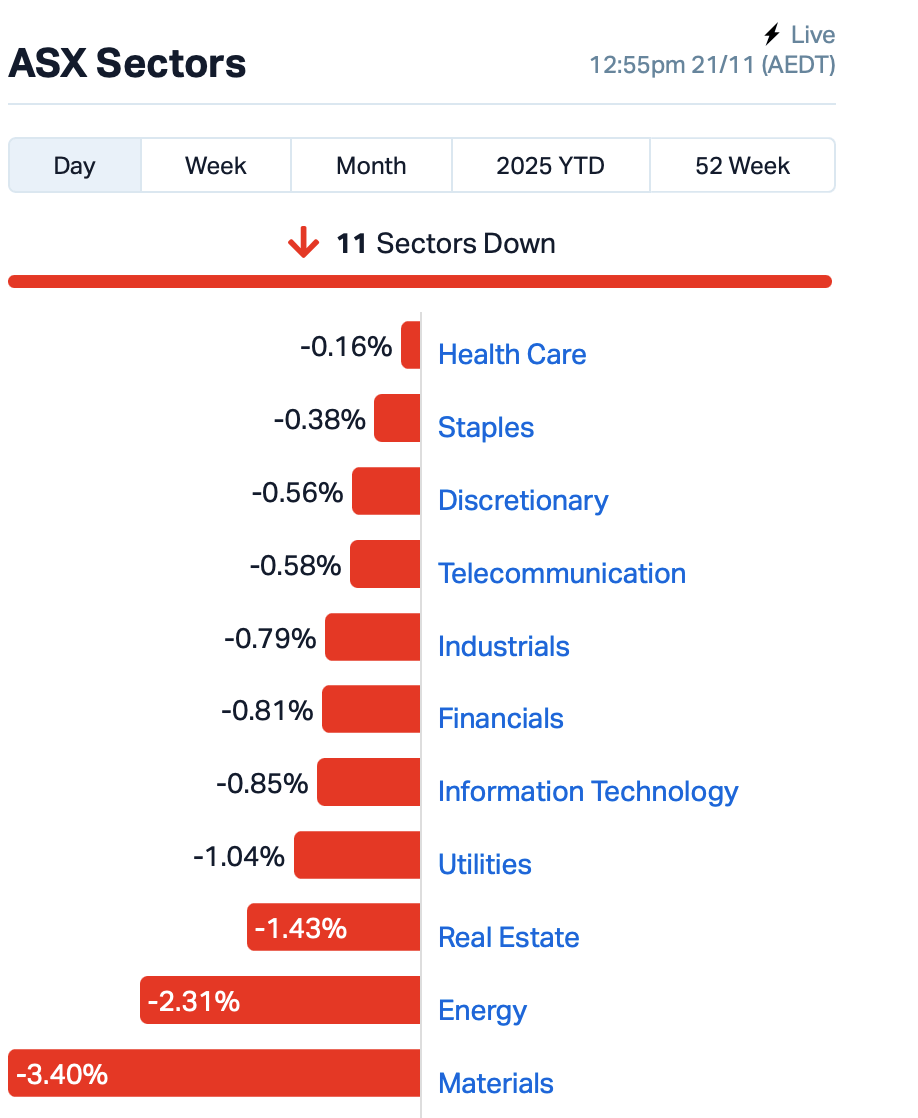

Every ASX sector dipped into the red, with miners leading the charge lower.

BHP (ASX:BHP), Fortescue (ASX:FMG) and Rio Tinto (ASX:RIO) all pulled back sharply, while the gold space looked fragile as uncertainty over US rates knocked the shine off bullion.

Meanwhile, crypto followed equities down the rabbit hole, with Bitcoin sliding back under $90k zone as risk appetite thinned out.

The “digital gold” narrative is once again behaving more like a leveraged tech proxy.

In the large caps space, the news were full of sharp reminders that not every story is about macro.

WiseTech Global (ASX:WTC) reversed early losses and rose 4% as the drama unfolded inside its AGM halls.

What started as another routine box-ticking exercise quickly turned into a slightly emotional episode as founder Richard White apparently teared up during his address, apologising for getting “very passionate” about the company.

But WTC shareholders delivered a clear warning shot across the bow – with 49.46% voting against the remuneration report, enough for a first strike.

Jewellery retailer Lovisa Holdings (ASX:LOV) took a 10% hit after signalling a slowdown in growth, a warning sign that aggressive expansion is starting to bump up against softer consumer demand.

Accent Group (ASX:AX1) and Kogan (ASX:KGN) also felt the squeeze this morning, with patchy offshore performance exposing just how unforgiving retail conditions remain right now.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| ALV | Alvomin | 0.057 | 63% | 22,654,350 | $6,834,268 |

| MEM | Memphasys Ltd | 0.004 | 33% | 42,583 | $7,364,677 |

| WEL | Winchester Energy | 0.002 | 33% | 6,540,270 | $2,044,528 |

| GT1 | Greentechnology | 0.036 | 29% | 9,024,843 | $16,630,951 |

| MRD | Mount Ridley Mines | 0.028 | 27% | 20,710,579 | $26,331,718 |

| VBS | Vectus Biosystems | 0.200 | 25% | 22,275 | $8,533,333 |

| AYT | Austin Metals Ltd | 0.005 | 25% | 500,000 | $6,336,765 |

| RLC | Reedy Lagoon Corp. | 0.005 | 25% | 1,000,000 | $3,106,827 |

| RNX | Renegade Exploration | 0.005 | 25% | 401,800 | $8,279,187 |

| CND | Condor Energy Ltd | 0.023 | 21% | 5,081,427 | $13,617,648 |

| BNL | Blue Star Helium Ltd | 0.006 | 20% | 3,480,258 | $18,014,426 |

| LIB | Liberty Metals | 0.003 | 20% | 183,333 | $15,314,476 |

| SPX | Spenda Limited | 0.003 | 20% | 14,871,149 | $12,162,146 |

| MYX | Mayne Pharma Ltd | 5.720 | 19% | 973,158 | $389,167,511 |

| AXE | Archer Materials | 0.380 | 19% | 731,613 | $81,551,044 |

| CXO | Core Lithium | 0.260 | 18% | 44,924,106 | $585,313,509 |

| GW1 | Greenwing Resources | 0.036 | 16% | 534,161 | $11,710,813 |

| SKK | Stakk Limited | 0.051 | 16% | 49,238,055 | $108,519,747 |

| AMS | Atomos | 0.030 | 15% | 508,489 | $31,828,899 |

| GCM | Green Critical Min | 0.015 | 15% | 12,682,693 | $37,425,394 |

| WLD | Wellard Limited | 0.015 | 15% | 712,716 | $6,906,254 |

| KGD | Kula Gold Limited | 0.038 | 15% | 8,281,830 | $38,001,714 |

| ADG | Adelong Gold Limited | 0.012 | 15% | 11,464,884 | $25,668,364 |

| HWK | Hawk Resources. | 0.031 | 15% | 253,413 | $9,143,869 |

Ragusa Minerals (ASX:RAS) is moving toward finalising a binding Heads of Agreement to secure around 60% control of Pegasus Tel Inc and the Purple Pansy manganese-gold project in Arizona, a mineral-rich belt with historical production and strong exploration potential.

It sees the asset as strategically aligned with US critical minerals policy, giving it exposure to manganese for defence and energy security plus gold at record prices, while it also reviews other complementary mineral opportunities.

Star Entertainment Group (ASX:SGR) has received full regulatory approval from NSW and Queensland authorities to proceed with the strategic investment, clearing the way for Bally’s and Investment Holdings to convert their $300 million injection into equity and take board seats. It expects this to roll through in the coming days and will update shareholders at its November AGM.

Patriot Resources (ASX:PAT) has locked in an 80% stake in the Mirkal and Chimban exploration licences in Zambia’s copper-rich Mumbwa district, reshaping the deal to include a 20% free carry and no further cash payments.

It has dropped the CBR Worldwide licence and now aligns these assets with Kitumba, where it also holds 80% and has just reported strong early exploration results.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| BMO | Bastion Minerals | 0.001 | -33% | 68,000 | $3,849,675 |

| AUK | Aumake Limited | 0.003 | -25% | 737,540 | $12,093,435 |

| RNV | Renerve Limited | 0.120 | -23% | 3,487,137 | $17,177,254 |

| FHS | Freehill Mining Ltd. | 0.004 | -20% | 750,000 | $17,588,018 |

| SFG | Seafarms Group Ltd | 0.002 | -20% | 139,142 | $12,091,498 |

| XGL | Xamble Group Limited | 0.013 | -19% | 645,350 | $7,232,303 |

| BUY | Bounty Oil & Gas NL | 0.003 | -17% | 325,000 | $4,684,416 |

| C7A | Clara Resources | 0.003 | -17% | 16,019,821 | $2,910,413 |

| ERA | Energy Resources | 0.003 | -17% | 4,490 | $1,216,188,722 |

| NAE | New Age Exploration | 0.003 | -17% | 631,260 | $9,923,996 |

| RDN | Raiden Resources Ltd | 0.005 | -17% | 27,578,289 | $20,705,349 |

| BSA | BSA Limited | 0.105 | -16% | 725,198 | $9,412,533 |

| ENV | Enova Mining Limited | 0.006 | -14% | 85,085 | $11,053,200 |

| ATS | Australis Oil & Gas | 0.013 | -13% | 504,623 | $20,006,466 |

| FRX | Flexiroam Limited | 0.013 | -13% | 511,153 | $22,760,979 |

| LCY | Legacy Iron Ore | 0.007 | -13% | 1,779,086 | $78,096,341 |

| SVY | Stavely Minerals Ltd | 0.015 | -12% | 285,000 | $11,641,368 |

| GBE | Globe Metals &Mining | 0.045 | -12% | 115,779 | $43,259,060 |

| 8IH | 8I Holdings Ltd | 0.016 | -11% | 93,386 | $6,266,895 |

| CZN | Corazon Ltd | 0.165 | -11% | 140,193 | $9,289,224 |

| GAL | Galileo Mining Ltd | 0.165 | -11% | 333,215 | $36,560,611 |

| EVE | EVE Health Group Ltd | 0.025 | -11% | 583,528 | $7,920,545 |

| SIO | Simonds Grp Ltd | 0.130 | -10% | 25,000 | $52,186,435 |

| TR2 | Tali Resources Ltd | 0.610 | -10% | 5,610 | $25,503,400 |

| NTD | Ntaw Holdings Ltd | 0.270 | -10% | 80,292 | $50,312,283 |

Mayne Pharma (ASX:MYX) plunged before the company put itself on a trading halt after Treasurer Jim Chalmers blocked Cosette’s $672 million takeover bid on national interest grounds.

The decision wiped billions off market value in minutes and highlighted a risk investors don’t always price in properly – politics.

IN CASE YOU MISSED IT

Orthocell’s (ASX:OCC) lead nerve repair device Remplir continues to gain momentum in the US with a new surgical indication.

LAST ORDERS

PolarX (ASX:PXX) has rung the bell on the US OTCQB market, listing under the ticker PXXXF.

The secondary listing is part of the precious metal and copper developer’s strategy to broaden its US investor base and improve access for North American investors as PXX advances its Alaska Range copper gold project in Alaska and the Humboldt Range gold project in Nevada.

MoneyMe (ASX:MME) has executed a $44.5 million autopay deal with the ABS 2025-1 Trust.

MD and CEO Clayton Howes said the deal would improve capital efficiencies and lower cost of funds, pointing out the beneficial terms of the deal were a result of its growing loan book, strong portfolio performance and funding execution capability.

At Stockhead, we tell it like it is. While PolarX and MoneyMe are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.