Lunch Wrap: ASX runs out of puff as Kogan, Nuix post losses

ASX runs out of puff at lunch. Picture via Getty Images

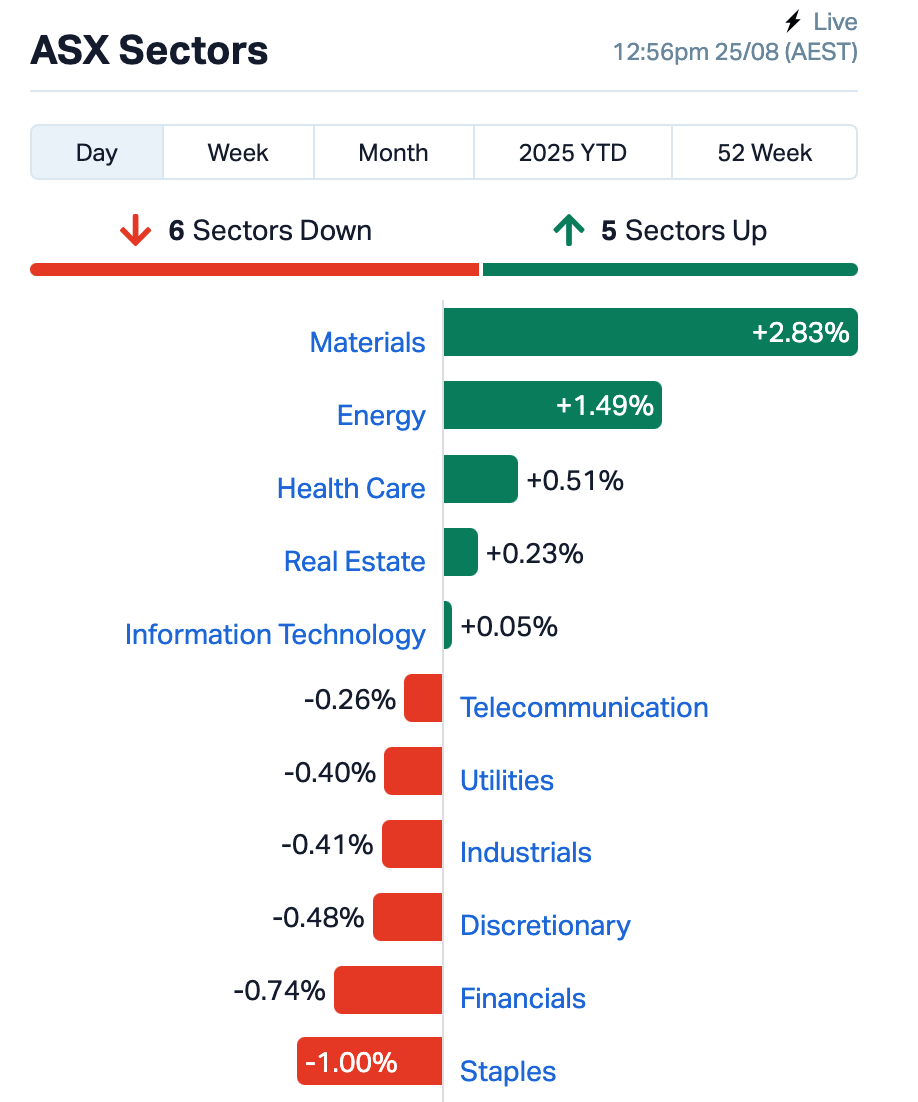

- ASX clings onto gains as miners muscle up

- Earnings season bites with Reece torched 20pc

- Ansell and NIB shine while Santos drags

The ASX came out charging on Monday, jumping 0.9% to set fresh record highs. But by lunchtime in the east it had cooled a tad, holding on to a 0.2% gain.

Local investors had every reason to feel confident this morning.

Wall Street closed out Friday in full party mode after Jerome Powell finally blinked at Jackson Hole.

The Fed chair, at last, hinted at rate cuts, maybe as soon as September. That was enough to send the S&P 500, Dow, and Nasdaq surging close to 2% each.

On the ASX today, BHP (ASX:BHP), Rio Tinto (ASX:RIO), and Fortescue (ASX:FMG) all scored gains north of 2% as iron ore prices climbed past US$102 a tonne.

Even beaten-down Pilbara Minerals (ASX:PLS) managed a 3.5% bounce.

Meanwhile, staple stocks such as supermarkets and liquor giants were dragging the index down.

Monday’s ASX earnings wrap

Earnings season is now properly baring its teeth, and the scoreboard has been mixed.

Reece (ASX:REH), the plumbing behemoth that doubles as a housing thermometer, was belted this morning. Full-year profit slid 24% to $317m as housing markets in Australia, NZ and the US went soggy. EPS fell from 65c to 49c and the stock was flogged 20% lower.

Santos (ASX:STO) somehow eked out a 1% gain despite a 22% half-year profit drop to US$508m. The real soap opera is still its Middle Eastern suitor. Due diligence has been stretched yet again, now to September 19, with Abu Dhabi’s XRG still lurking. Investors are starting to wonder if this deal is more mirage than marriage.

Ansell (ASX:ANN), the gloves-and-gowns giant, pulled the opposite trick. Full-year sales shot 23.7% higher to $2b and a $200m buyback was thrown on the table. Management swears it can dodge higher US tariffs with price hikes. Gutsy stuff, and the market gave it a nod.

Health insurer NIB Holdings (ASX:NHF) also had a good trot. Profit was up 9.4% to $198.6m, revenue rose nearly 8%, and the dividend edged up to 29c. The market liked the steady hand, pushing shares 2% higher.

Endeavour Group (ASX:EDV), landlord to Dan Murphy’s and BWS, served up a flat pint. Profit fell 17% to $426m as wellness trends pinched liquor sales. Hotels chipped in with a 4% lift, but not enough to save the dividend. Shares slipped 2%, proof you can’t drink your way out of a downturn.

Kogan (ASX:KGN) posted a $39.5m full-year loss after costs chewed through improving margins. Customers surged past 3.5m, revenue rose 6.2% and a 7c dividend was tossed out as a sweetener. Shares somehow lifted 2%. Maybe investors are just relieved it wasn’t worse.

And Nuix (ASX:NXL), the investigations software shop, had another shocker. A $9.2m full-year loss replaced last year’s $5m profit as legal bills mounted and contracts dried up. Investors have heard the turnaround story too many times, and patience is wearing thin. Shares sank 7%.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| AUH | Austchina Holdings | 0.002 | 100% | 500,000 | $3,025,384 |

| AHK | Ark Mines Limited | 0.265 | 43% | 553,597 | $12,239,729 |

| LKY | Locksley Resources | 0.315 | 40% | 27,386,274 | $55,314,374 |

| T92 | Terra Uranium | 0.038 | 31% | 19,973,260 | $3,781,677 |

| PPY | Papyrus Australia | 0.017 | 31% | 942,874 | $7,837,463 |

| APC | APC Minerals | 0.009 | 29% | 1,037,201 | $2,050,534 |

| PEB | Pacific Edge | 0.135 | 29% | 147,395 | $107,258,598 |

| BMM | Bayanminingandmin | 0.260 | 27% | 5,221,106 | $22,540,771 |

| CAE | Cannindah Resources | 0.025 | 25% | 2,788,379 | $14,561,599 |

| ADG | Adelong Gold Limited | 0.005 | 25% | 1,909,513 | $9,267,345 |

| CTO | Citigold Corp Ltd | 0.005 | 25% | 425,030 | $12,000,000 |

| ERA | Energy Resources | 0.003 | 25% | 127,826 | $810,792,482 |

| ICE | Icetana Limited | 0.088 | 22% | 556,895 | $38,291,466 |

| 8IH | 8I Holdings Ltd | 0.012 | 20% | 8,498 | $3,481,609 |

| CZN | Corazon Ltd | 0.003 | 20% | 1,341,840 | $3,086,431 |

| ENT | Enterprise Metals | 0.006 | 20% | 10,109,757 | $6,856,586 |

| RLG | Roolife Group Ltd | 0.006 | 20% | 555,107 | $9,392,478 |

| SLZ | Sultan Resources Ltd | 0.006 | 20% | 83,594 | $1,305,418 |

| SXL | Sthn Cross Media | 0.790 | 20% | 959,367 | $158,333,438 |

| ABB | Aussie Broadband | 5.290 | 19% | 9,451,573 | $1,278,677,982 |

| GNM | Great Northern | 0.083 | 19% | 42,024,331 | $10,824,035 |

| GT1 | Greentechnology | 0.039 | 18% | 445,386 | $15,680,611 |

| AHN | Athena Resources | 0.007 | 17% | 142,857 | $13,595,742 |

| CCO | The Calmer Co Int | 0.004 | 17% | 35,000 | $9,034,060 |

| ROG | Red Sky Energy. | 0.004 | 17% | 1,373,257 | $16,266,682 |

Ark Mines (ASX:AHK) has locked in $4.5m from Queensland’s Critical Minerals and Battery Tech Fund to push ahead at Sandy Mitchell, its rare earths project north-west of Cairns. The deal includes $4m in up-front royalty funding and a $500k equity stake, subject to shareholder nod. Ark says the cash is non-dilutive, lets it accelerate drilling into a bigger resource, and keeps it aligned with the Queensland government’s push to build a local critical minerals supply chain.

Locksley Resources (ASX:LKY) has kicked off its US critical minerals strategy by teaming up with Rice University to fast-track antimony processing and new uses for the metal from its Mojave Project. The legally binding R&D deal covers two fronts: building green extraction tech and developing antimony-based materials for batteries and energy storage. Locksley is stumping up US$550k to back the research, and any IP will be jointly owned.

Terra Metals (ASX:TM1) has expanded its deal with Axiom Group to chase rare earths and antimony assets across the US, tapping into Axiom’s deep experience on the ground. The timing is sharp – Washington is pouring billions into critical minerals. Terra said it wants to position itself as a front-runner in America’s critical minerals push.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| DM1 | Desert Metals | 0.019 | -34% | 19,762,560 | $12,826,311 |

| TMX | Terrain Minerals | 0.002 | -33% | 1,330,000 | $7,745,443 |

| VFX | Visionflex Group Ltd | 0.002 | -33% | 950,000 | $10,103,581 |

| ASR | Asra Minerals Ltd | 0.002 | -25% | 22,608,588 | $8,000,396 |

| BIT | Biotron Limited | 0.003 | -25% | 257,654 | $5,308,983 |

| MEM | Memphasys Ltd | 0.003 | -25% | 61,112 | $7,934,392 |

| PRM | Prominence Energy | 0.003 | -25% | 3,241,449 | $3,556,706 |

| SRJ | SRJ Technologies | 0.006 | -25% | 1,917,065 | $8,727,221 |

| CLG | Close Loop | 0.032 | -24% | 4,684,729 | $22,337,694 |

| IPB | IPB Petroleum Ltd | 0.007 | -22% | 236,209 | $6,357,628 |

| FEG | Far East Gold | 0.145 | -22% | 846,091 | $67,900,079 |

| 1AD | Adalta Limited | 0.004 | -20% | 30,276,023 | $5,773,249 |

| TKL | Traka Resources | 0.002 | -20% | 3,000,000 | $6,055,348 |

| PAT | Patriot Resourcesltd | 0.038 | -16% | 328,846 | $7,426,010 |

| REH | Reece Limited | 11.990 | -15% | 2,849,280 | $9,088,997,427 |

| BPM | BPM Minerals | 0.076 | -15% | 517,982 | $7,769,729 |

| IRD | Iron Road Ltd | 0.030 | -14% | 87,130 | $29,074,247 |

| LCL | LCL Resources Ltd | 0.006 | -14% | 1,168,372 | $8,394,800 |

| MRD | Mount Ridley Mines | 0.003 | -14% | 1,230,001 | $3,133,418 |

| NAG | Nagambie Resources | 0.012 | -14% | 78,419 | $12,538,541 |

| RDS | Redstone Resources | 0.006 | -14% | 3,567,777 | $7,239,871 |

| RNX | Renegade Exploration | 0.003 | -14% | 27,674,999 | $5,608,272 |

| SPX | Spenda Limited | 0.006 | -14% | 312,786 | $32,306,508 |

| MVL | Marvel Gold Limited | 0.019 | -14% | 6,008,680 | $30,649,645 |

IN CASE YOU MISSED IT

Bayan Mining and Minerals (ASX:BMM) has attracted strong investor support, raising $3.27m to accelerate exploration at its Desert Star and Desert Star North projects in California.

Perpetual Resources’ (ASX:PEC) XRF testing of historical pollucite mining reject piles at the Igrejinha project has returned high-grade caesium oxide.

Power Minerals (ASX:PNN) has recorded grades up to 4.34% total rare earth oxide in ongoing auger drilling at its Santa Anna project in Brazil.

Locksley Resources (ASX:LKY/OTCQB: LKYRF) and Rice University will work together on antimony processing and utilisation to build a US supply chain for the critical mineral.

Argent BioPharma (ASX:RGT) has released positive results of an in vivo study evaluating the efficacy of ArtemiC in a severe viral inflammatory model targeting acute respiratory distress syndrome (ARDS).

Verity Resources (ASX:VRL) has wrapped up a drilling program at the Monument gold project’s Korong deposit which will inform a resource upgrade.

LAST ORDERS

DY6 Metals (ASX:DY6) is advancing exploration programs at its Central rutile project in Cameroon at pace, with a regional soil sampling campaign progressing well.

The company has now collected 161 samples from the Nsimbo and Alamba licences and 33 samples from the Bounde licence, as well as drilling 24 auger holes for 237.9m on Nsimbo and Alamba’s northern edge. Sampling continues across all other licences within the project.

X2M Connect (ASX:X2M) has closed out an oversubscribed capital raise after placing just under 127m shares in a shortfall entitlement offer managed by Cygnet Capital.

X2M has added a total of $5.4m to its war chest via the placements, shortfall and entitlement offer, positioning the company to eliminate its debt and prepare for its next growth phase.

Asra Minerals (ASX:ASR) has wrapped up a 57-hole aircore drilling program at the Leonora South gold project, targeting the Cosmopolitan and Altona South prospects.

The program was designed to test shallow gold zones intersected in historical drilling, and test extensions associated with historical production from the Cosmopolitan and Altona gold mines, which produced 360k ounces and 88.7k ounces respectively between 1892 and 1965.

At Stockhead, we tell it like it is. While DY6 Metals, X2M Connect and Asra Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.