Lunch Wrap: ASX left dazed as CBA and AGL land heavy blows

CBA and AGL have been smacked hard so far today. Picture via Getty Images

- ASX slips as CBA and AGL drag hard

- AGL profit miss darkens outlook

- Evolution pops on gold-fuelled dividend surge

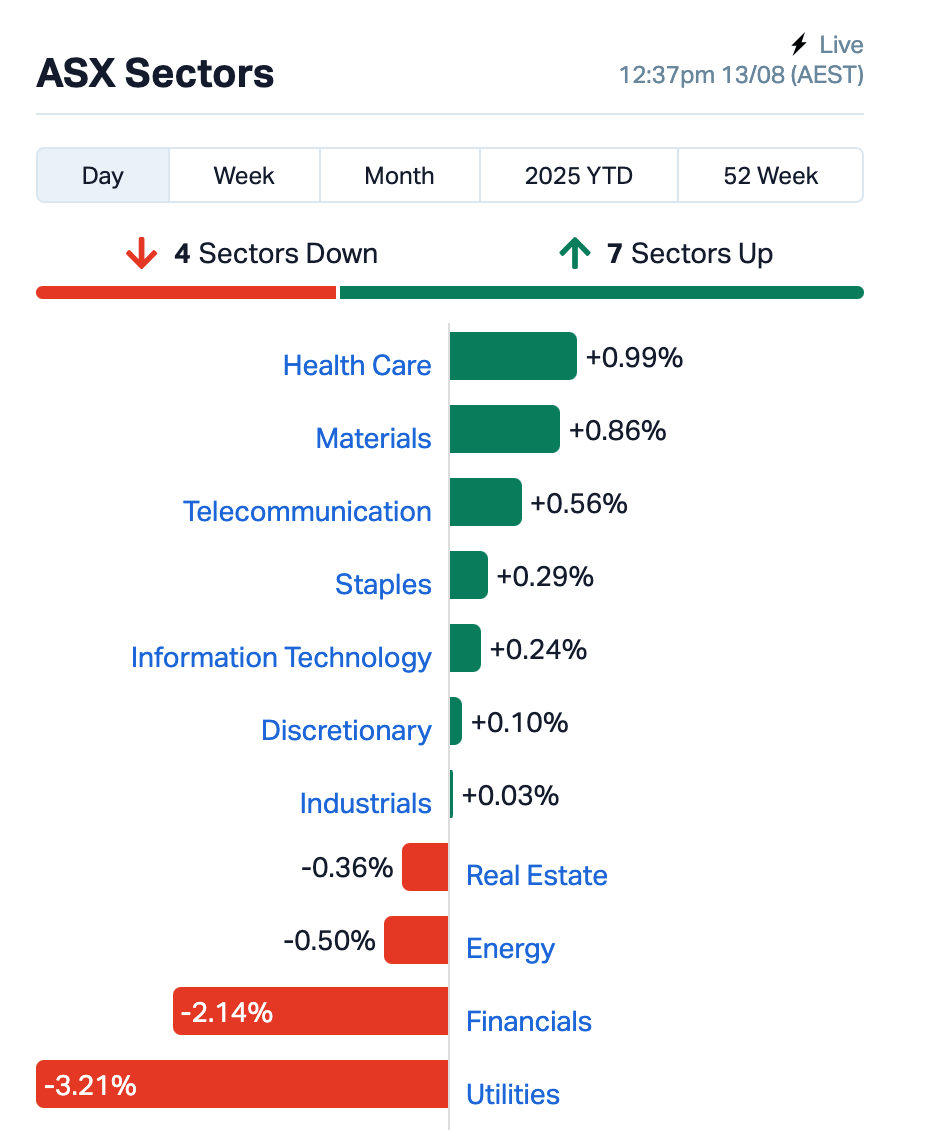

The ASX was looking a little pale after Tuesday’s record close, and was down 0.55% by Wednesday lunchtime in the east.

Wall Street had done its bit overnight – the big US indices closed at record highs again after an in-line CPI print kept a September Fed rate cut in play.

The main problem was homegrown.

Commonwealth Bank (ASX:CBA) and AGL Energy (ASX:AGL), two index heavyweights, were both weighing heavily on the index this morning.

CBA dropped 6% despite posting a $10.25 billion cash profit that was up 4% and bang in line with forecasts.

CBA’s issue, though, wasn’t the numbers, it was the valuation. At more than $200 in June, analysts say the stock had been priced like nothing could go wrong.

But the RBA’s rate cuts are squeezing margins, and investors have been quietly moving money into cheaper-looking stocks. CBA’s shares have slipped to $170 since.

AGL Energy (ASX:AGL) fared even worse today, down 14% after a 21.2% slide in full-year core profit thanks to thinner retail margins in a hyper-competitive market.

AGL’s core profit slid to $640m, missed forecasts, and guidance of $500m–$700m suggested the coming year won’t be much brighter.

Utilities as a sector shed more than 3%, with AGL doing most of the damage.

In other large cap news, Treasury Wine Estates (ASX:TWE) gained 1% on a $200 million buyback and a lifted final dividend to 20c, but the tone wasn’t all celebratory.

Growth in Penfolds is tipped to slow in FY26, with Citi analysts noting that Chinese demand is cooling.

Meanwhile, Evolution Mining (ASX:EVN) was a standout, up 5% after handing shareholders triple last year’s dividends on the back of record gold prices and higher copper production.

Annual profit more than doubled to $926 million, with a 20-cent total payout for the year that makes the 7-cents of 2024 look like loose change.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| SFG | Seafarms Group Ltd | 0.002 | 100% | 4,406,440 | $4,836,599 |

| OD6 | OD6 Metals | 0.054 | 54% | 8,991,415 | $5,616,378 |

| LIO | Lion Energy Limited | 0.018 | 50% | 1,095,403 | $5,426,013 |

| BUY | Bounty Oil & Gas NL | 0.003 | 50% | 203,786 | $3,122,944 |

| CYQ | Cycliq Group Ltd | 0.007 | 40% | 1,558,254 | $2,302,583 |

| BMO | Bastion Minerals | 0.002 | 33% | 10,151,000 | $3,307,430 |

| CHM | Chimeric Therapeutic | 0.004 | 33% | 170,503 | $9,763,676 |

| RGL | Riversgold | 0.004 | 33% | 1,399,250 | $5,051,138 |

| IS3 | I Synergy Group Ltd | 0.011 | 31% | 9,962,533 | $13,650,399 |

| AVE | Avecho Biotech Ltd | 0.007 | 30% | 14,675,337 | $15,867,318 |

| THB | Thunderbird Resource | 0.015 | 25% | 1,976,575 | $4,676,897 |

| VEN | Vintage Energy | 0.005 | 25% | 75,000 | $8,347,655 |

| OEC | Orbital Corp Limited | 0.335 | 24% | 1,850,802 | $44,490,524 |

| FUL | Fulcrum Lithium | 0.061 | 22% | 66,310 | $3,775,000 |

| ATT | Altitude Minerals | 0.024 | 20% | 7,184,017 | $3,729,213 |

| DKM | Duketon Mining | 0.155 | 19% | 553,620 | $15,913,506 |

| REM | Remsensetechnologies | 0.032 | 19% | 973,382 | $5,238,418 |

| BCK | Brockman Mining Ltd | 0.021 | 17% | 755,402 | $167,044,178 |

| WC1 | Westcobarmetals | 0.021 | 17% | 393,264 | $3,750,831 |

| AUR | Auris Minerals Ltd | 0.007 | 17% | 582,666 | $2,859,756 |

| BCM | Brazilian Critical | 0.014 | 17% | 4,211,799 | $15,726,399 |

| IPB | IPB Petroleum Ltd | 0.007 | 17% | 108,000 | $4,238,418 |

OD6 Metals (ASX:OD6) has hit a key milestone at Splinter Rock, producing high-quality mixed rare earth carbonate (~56% TREO) and mixed rare earth hydroxide (~59% TREO) from its 682Mt resource via a simple, scalable heap leach process. The product is magnet-rich and low in impurities. OD6 is now courting offtake partners across North America, Europe, and Asia.

Tyro Payments (ASX:TYR) rallied after revealing multiple unsolicited takeover approaches, though the board says none yet reflect the company’s “intrinsic value”. That, in finance-speak, means “try again, and bring a bigger cheque”.

iSynergy Group (ASX:IS3) has locked in a $300k deal with Nasdaq-listed Treasure Global (TGL) to supply high-performance AI GPUs and specialised software, paid over six monthly instalments. The agreement covers delivery, inspection, and IP rights, with a perpetual licence for any embedded TGL tech.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| BEL | Bentley Capital Ltd | 0.017 | -35% | 890,068 | $1,979,326 |

| 1AD | Adalta Limited | 0.002 | -33% | 436,601 | $3,463,949 |

| DTM | Dart Mining NL | 0.002 | -33% | 5,750,468 | $3,594,167 |

| PRM | Prominence Energy | 0.002 | -33% | 205,220 | $1,459,411 |

| PSL | Paterson Resources | 0.015 | -29% | 25,990,153 | $9,576,795 |

| SKK | Stakk Limited | 0.005 | -29% | 3,300 | $14,525,558 |

| AYT | Austin Metals Ltd | 0.003 | -25% | 4,674,800 | $6,336,765 |

| ECT | Env Clean Tech Ltd. | 0.003 | -25% | 7,260,928 | $16,061,742 |

| MRQ | Mrg Metals Limited | 0.003 | -25% | 691,143 | $10,906,075 |

| PR2 | Piche Resources | 0.110 | -21% | 15,416 | $11,688,502 |

| PRX | Prodigy Gold NL | 0.002 | -20% | 1 | $16,854,657 |

| MRD | Mount Ridley Mines | 0.003 | -17% | 323,599 | $2,335,467 |

| TMK | TMK Energy Limited | 0.003 | -17% | 10,691,395 | $30,667,149 |

| UBI | Universal Biosensors | 0.020 | -17% | 683,295 | $7,153,618 |

| EM2 | Eagle Mountain | 0.006 | -14% | 5,000 | $7,945,261 |

| GTR | Gti Energy Ltd | 0.003 | -14% | 2,121,280 | $13,029,292 |

| MTB | Mount Burgess Mining | 0.006 | -14% | 921,363 | $2,979,468 |

| TYX | Tyranna Res Ltd | 0.003 | -14% | 591,884 | $11,697,542 |

| AGL | AGL Energy Limited. | 8.880 | -13% | 12,565,495 | $6,875,476,721 |

| AM5 | Antares Metals | 0.007 | -13% | 46,558 | $4,118,823 |

IN CASE YOU MISSED IT

Asra Minerals (ASX:ASR) is preparing to drill the Leonora project, hunting for new gold discoveries near two historical WA mines.

Freshly listed StepChange Holdings has beaten the financial targets set out in its June IPO prospectus.

Imagion Biosystem (ASX:IBX) has strengthened a push into AI-enabled cancer diagnostics through collaboration with leading experts at Wayne State University.

Norfolk Metals’ (ASX:NFL) has embarked on a maiden drill campaign aimed at unlocking the potential for a low-cost, high-margin heap leach operation at its Carmen copper project.

LAST ORDERS

Firetail Resources (ASX:FTL) will soon trade under the name Mammoth Minerals with the new ticker (ASX:M79) after getting the tick of approval from both shareholders and ASIC.

The changes will come into effect from tomorrow, Thursday August 14, 2025 with rebranding to take place over the following weeks.

Ausgold (ASX:AUC) has advanced several development streams at the Katanning gold project in WA following the release of a definitive feasibility study in June.

AUC has since begun testing of local bore water, having entered into a binding easement agreement with the local landholder for water access and infrastructure. The company has also agreed to acquire a farm about 2.5km from a proposed processing plant for the project for $1.5m that could support infrastructure for mine life extensions.

At Stockhead, we tell it like it is. While Firetail Resources and Ausgold are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.