Lunch Wrap: ASX holds breath as RBA call looms; tech darling Life360 soars again

Nervous wait for RBA watchers. Picture via Getty Images

- ASX nudges higher before RBA call

- US inflation set to flare in July

- JB Hi-Fi jumps, Life360 rockets, Star sells stake

By Tuesday lunchtime in the east, the ASX had edged up 0.15%.

The bulls are circling as the market limbered up for the main act: the RBA’s 2.30pm rate call.

This one’s a biggie.

Markets have already priced in a 25bps cut, and the thinking is simple: Aussie inflation’s easing, and household purses are still tight.

Another trim now, and maybe one more in November to 3.35%, could be the shove the economy’s been waiting for.

But there’s another subplot brewing offshore, and it’s the kind of thing the RBA can’t control.

Over in the US, July’s CPI is tipped to come in hotter at 2.8% tonight, the highest since February.

The big question for the Fed Reserve (and every investor) is whether this is just a passing sting, or the start of an inflation rash that keeps flaring up.

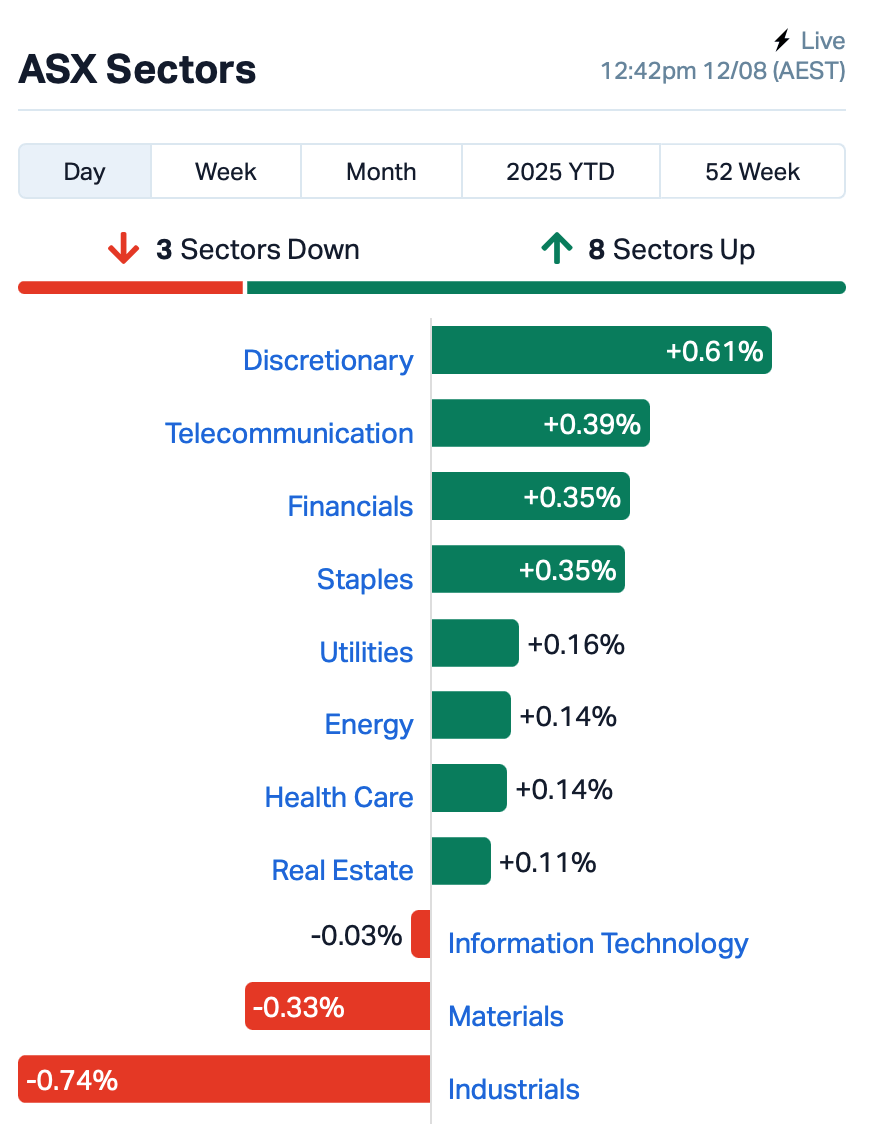

Back to the ASX and anything rate-sensitive, like discretionary stocks, were in demand this morning.

JB HiFi (ASX:JBH), for example, roared back 7% after a Monday stumble.

Breville (ASX:BRG) was also up 2%, presumably on the hope that cheaper borrowing costs mean more Aussies will splurge on coffee machines.

This is where things stood at about 12:40pm AEST:

In other large cap news, tech darling Life360 (ASX:360) lit up the leaderboard, surging 8% after reporting second-quarter revenue of $115.4 million, a 36% jump year-on-year. The shares of 360 have surged 135% over the past 12 months.

And, casino giant Star Entertainment Group (ASX:SGR) has sealed a binding deal to offload its Queen’s Wharf stake to partners Chow Tai Fook and Far East Consortium. Shares soared 30%.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| AJL | AJ Lucas Group | 0.013 | 117% | 28,388,359 | $8,254,378 |

| LNU | Linius Tech Limited | 0.002 | 50% | 5,649,399 | $6,501,216 |

| AUA | Audeara | 0.027 | 42% | 2,134,758 | $3,418,753 |

| BEL | Bentley Capital Ltd | 0.022 | 38% | 1,366,253 | $1,218,047 |

| TUA | Tuas Limited | 7.220 | 31% | 2,725,900 | $2,577,974,009 |

| SGR | The Star Ent Grp | 0.115 | 29% | 28,190,040 | $255,312,598 |

| ERA | Energy Resources | 0.003 | 25% | 204,765 | $810,792,482 |

| FRX | Flexiroam Limited | 0.005 | 25% | 23,901 | $6,069,594 |

| PIL | Peppermint Inv Ltd | 0.003 | 25% | 2,499,992 | $4,662,820 |

| PRX | Prodigy Gold NL | 0.003 | 25% | 2,001,571 | $13,483,725 |

| QXR | Qx Resources Limited | 0.005 | 25% | 2,739,496 | $5,241,315 |

| SUH | Southern Hem Min | 0.036 | 22% | 7,946,112 | $21,350,961 |

| LU7 | Lithium Universe Ltd | 0.009 | 21% | 27,920,854 | $8,476,857 |

| HTG | Harvest Tech Grp Ltd | 0.018 | 20% | 1,063,908 | $13,635,275 |

| EMT | Emetals Limited | 0.006 | 20% | 1,299,999 | $4,250,000 |

| SHP | South Harz Potash | 0.003 | 20% | 1,874,572 | $3,679,308 |

| PV1 | Provaris Energy Ltd | 0.025 | 19% | 507,547 | $16,372,405 |

| VRX | VRX Silica Ltd | 0.130 | 18% | 1,797,853 | $82,203,362 |

| GRL | Godolphin Resources | 0.013 | 18% | 9,563,497 | $4,937,606 |

| AM5 | Antares Metals | 0.007 | 17% | 2,149,936 | $3,089,117 |

| CLA | Celsius Resource Ltd | 0.007 | 17% | 2,439,734 | $18,812,931 |

| GTR | Gti Energy Ltd | 0.004 | 17% | 910,094 | $11,167,964 |

AJ Lucas (ASX:AJL), an oil and gas drilling services company, has settled a dispute over a carry agreement tied to its UK shale gas exploration licences. Its UK arm, Cuadrilla, has received £12.5 million (about $26 million) in cash as part of the deal, with the agreement now terminated and of no further effect.

Audeara (ASX:AUA) has taken a significant step towards expanding into the Chinese market by securing a licensing deal with Eastech (Huizhou), a subsidiary of Taiwan-listed Eastech Holding.

Lithium Universe (ASX:LU7) has bought global rights to Macquarie University’s Jet Electrochemical Silver Extraction technology. It uses a low-voltage acid jet to strip high-purity silver from solar cells without damaging the silicon wafer. The method works alongside LU7’s Microwave Joule Heating process, giving it a full solar panel recycling solution that recovers clean glass, silicon and critical metals.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 1AD | Adalta Limited | 0.002 | -33% | 80,006 | $3,338,949 |

| MEL | Metgasco Ltd | 0.002 | -33% | 134,516 | $5,511,260 |

| NTM | Nt Minerals Limited | 0.001 | -33% | 8,000 | $1,816,354 |

| RLC | Reedy Lagoon Corp. | 0.002 | -33% | 1,999,998 | $2,330,120 |

| ASR | Asra Minerals Ltd | 0.002 | -25% | 4,541,296 | $8,000,396 |

| C7A | Clara Resources | 0.003 | -25% | 800 | $2,353,084 |

| HLX | Helix Resources | 0.002 | -25% | 2,025,000 | $6,728,387 |

| SRN | Surefire Rescs NL | 0.002 | -25% | 4,000,000 | $6,457,219 |

| SHE | Stonehorse Energy Lt | 0.006 | -21% | 400,000 | $4,791,046 |

| ARV | Artemis Resources | 0.004 | -20% | 209,742 | $14,328,361 |

| BUY | Bounty Oil & Gas NL | 0.002 | -20% | 101,964 | $3,903,680 |

| MOH | Moho Resources | 0.004 | -20% | 284,500 | $3,727,070 |

| NTI | Neurotech Intl | 0.014 | -18% | 3,103,601 | $17,843,573 |

| CRR | Critical Resources | 0.005 | -17% | 1,150,775 | $16,620,513 |

| PRM | Prominence Energy | 0.003 | -17% | 200,083 | $1,459,411 |

| RGL | Riversgold | 0.003 | -14% | 1 | $5,892,994 |

| TEM | Tempest Minerals | 0.006 | -14% | 15,000 | $7,712,565 |

| EDE | Eden Inv Ltd | 0.040 | -13% | 399,432 | $9,452,787 |

| AUZ | Australian Mines Ltd | 0.007 | -13% | 2,643,051 | $13,688,097 |

| AZL | Arizona Lithium Ltd | 0.007 | -13% | 12,343,739 | $43,042,516 |

| BNL | Blue Star Helium Ltd | 0.007 | -13% | 128,773 | $26,943,082 |

IN CASE YOU MISSED IT

Green Technology Metals (ASX:GT1) now controls the entire Seymour lithium project area after being granted two 21-year leases from Ontario’s Ministry of Mines.

Cyclone Metals’ (ASX:CLE) Iron Bear iron ore mine could produce 25Mtpa of high-grade products north of Quebec, Canada.

Loyal Metals (ASX:LLM) is leveraging the power of AI to rapidly generate drill targets at its Highway Reward copper-gold project.

Australian Mines (ASX:AUZ) is preparing to start drilling at its high-grade Boa Vista gold project in Brazil.

Core Energy Minerals (ASX:CR3) has fielded up to 2921ppm REE in first-pass sampling at Tunas in Brazil and is moving to drill.

LAST ORDERS

HyTerra (ASX:HYT) has brought US strategic advisor Dr Douglas Wicks into the fold, gaining access to 25 years’ experience across industry, startups, and academia.

Most recently the program director at the US Department of Energy’s advanced energy research agency, Dr Wicks led national efforts to develop geological hydrogen as a viable, naturally occurring primary energy resource.

Taiton Resources (ASX:T88) has unearthed its highest gold results in soil sampling yet at the Challenger West gold project with a result of 210 parts per billion.

T88 has highlighted low-level rare earth element results at the Highway project’s Yogi prospect, coincident with a gravity anomaly.

Management says it’s evidence of iron oxide copper-gold style mineralisation, with Taiton working toward permitting for drilling programs on both projects.

Island Pharmaceuticals (ASX:ILA) has added $350,000 to the war chest after substantial shareholder MWP Partners exercised 5 million options at 7c each. The fresh funding added to ILA’s existing cash of $7.25m as of the end of June as well as an option exercise in July that provided $780,000 in funding.

At Stockhead, we tell it like it is. While HyTerra, Taiton Resources and Island Pharmaceuticals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.