Lunch Wrap: ASX healthcare stocks get a Trump whack, silver runs hot

Trump’s latest pharma tariff hit ASX healthcare stocks this morning. Pic: Getty Images

- ASX dips as Trump drugs tariff smacks CSL (ASX worm turns up at lunch)

- Move over gold… high-ho silver gallops past US$45

- Vulcan Energy jumps on $179m German power deal

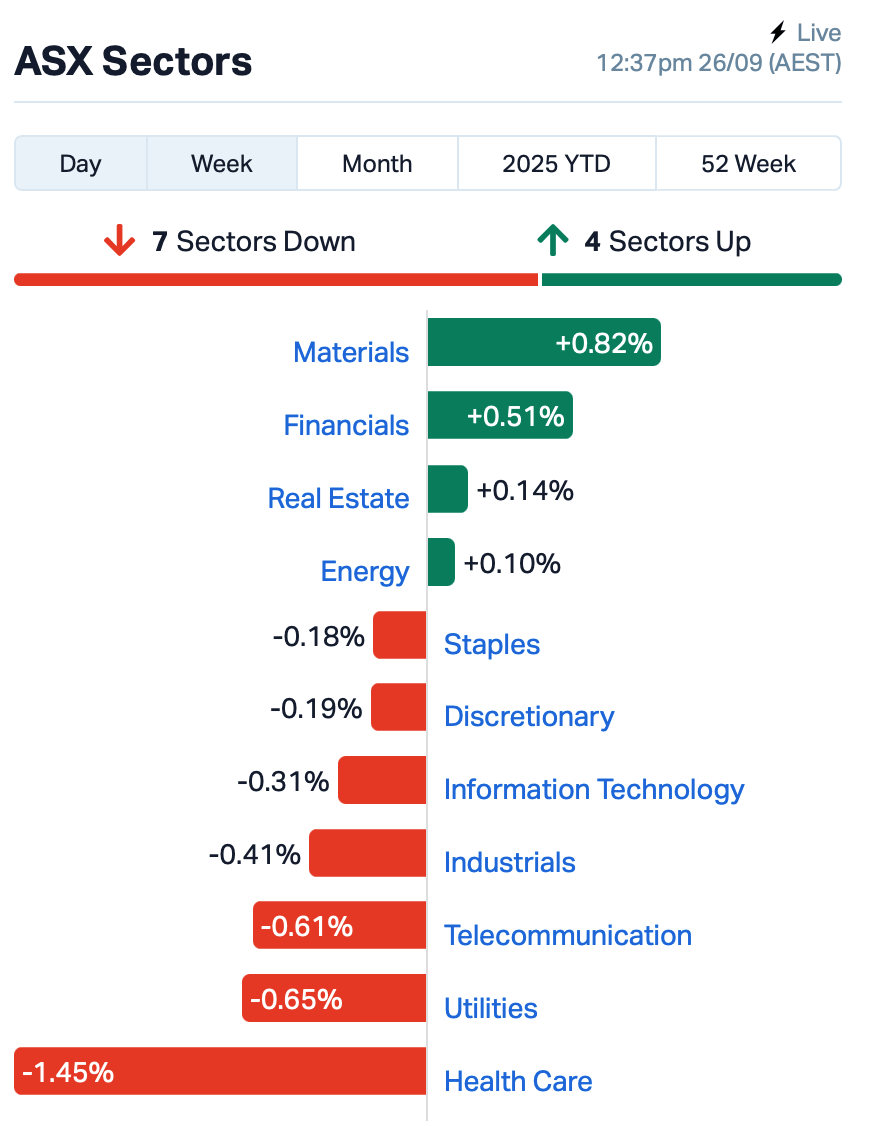

The ASX was bobbing just above water by Friday lunchtime in the east, up around 0.1%.

Wall Street didn’t help – three down days on the trot with all three major indices down last night.

Stronger-than-expected US GDP and jobless claims data had US traders suddenly remembering that a humming economy means Jerome Powell doesn’t have to ride in with a dove on his shoulder any time soon.

Meanwhile, Donald Trump has found his new tariff toy.

Forget steel or chips, now he’s whacking a 100% duty on branded and patented drugs unless companies break ground on a US manufacturing plant.

“Starting October 1, 2025, we will be imposing a 100% Tariff on any branded or patented Pharmaceutical Product, unless a Company IS BUILDING their Pharmaceutical Manufacturing Plant in America,” Trump said on Truth Social.

“‘IS BUILDING’ will be defined as, ‘breaking ground’ and/or ‘under construction.’ There will, therefore, be no Tariff on these Pharmaceutical Products if construction has started. Thank you for your attention to this matter!”

CSL (ASX:CSL) was smacked early, down as much as 7% on the news. ProMedicus (ASX:PME) wasn’t spared, dropping 2.5%.

Even Telix Pharmaceuticals (ASX:TLX), which actually makes its products in the US and should be insulated, got dragged 3.5% lower – because in markets, guilt by association always gets priced in.

And if tariffs are back on pharma, what’s next?

Silver, though, was the real star this morning. Spot prices smashed through US$45 an ounce, the first time since 2011.

That’s got stocks like South32 (ASX:S32) and Sandfire Resources (ASX:SFR) in sharper focus.

With silver up 55% this year, even outpacing gold’s 45% sprint, punters are suddenly rediscovering the joys of shiny rocks.

In other large cap news, Vulcan Energy Resources (ASX:VUL) leapt 15% after signing a $179 million deal to build a geothermal power plant in Germany.

The so-called Lionheart Project is pitched to pump out 275 gigawatt-hours of power and churn enough lithium hydroxide for half a million EVs a year.

Fortescue (ASX:FMG) also edged a bit higher after inking deals with a quartet of green energy heavyweights: BYD for EVs and batteries, Longi for solar, XCMG for mining gear, and Envision Energy for wind and storage.

Oh, and it’s bought Spanish renewable outfit Nabrawind, too.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| CC9 | Chariot Corporation | 0.255 | 42% | 3,073,513 | $28,790,393 |

| ORP | Orpheus Uranium Ltd | 0.045 | 41% | 37,649 | $9,014,308 |

| SRN | Surefire Rescs NL | 0.002 | 33% | 7,246 | $5,860,289 |

| EG1 | Evergreenlithium | 0.043 | 26% | 758,958 | $8,939,750 |

| LMG | Latrobe Magnesium | 0.034 | 26% | 5,947,531 | $71,131,477 |

| SPX | Spenda Limited | 0.005 | 25% | 3,866,295 | $18,460,862 |

| M4M | Macro Metals Limited | 0.008 | 23% | 20,242,022 | $27,428,052 |

| TM1 | Terra Metals Limited | 0.195 | 22% | 3,526,888 | $100,067,324 |

| ALM | Alma Metals Ltd | 0.006 | 20% | 6,339,937 | $9,286,186 |

| BPP | Babylon Pump & Power | 0.006 | 20% | 1,080,841 | $19,034,455 |

| EM2 | Eagle Mountain | 0.012 | 20% | 24,667,156 | $11,350,373 |

| RMX | Red Mount Min Ltd | 0.031 | 19% | 73,542,269 | $16,323,778 |

| 1AE | Auroraenergymetals | 0.091 | 18% | 744,443 | $13,787,908 |

| FME | Future Metals NL | 0.034 | 17% | 8,142,371 | $27,793,624 |

| ARV | Artemis Resources | 0.007 | 17% | 936,912 | $22,625,533 |

| CHM | Chimeric Therapeutic | 0.004 | 17% | 1,565,000 | $9,763,676 |

| OM1 | Omnia Metals Group | 0.014 | 17% | 542,692 | $2,605,100 |

| SPQ | Superior Resources | 0.007 | 17% | 2,142,248 | $14,225,896 |

| SRK | Strike Resources | 0.036 | 16% | 81,677 | $8,796,250 |

| AGR | Aguia Res Ltd | 0.029 | 16% | 1,219,772 | $37,349,991 |

| SNG | Siren Gold | 0.087 | 16% | 3,420,428 | $19,853,296 |

| DVL | Dorsavi Ltd | 0.045 | 15% | 5,425,920 | $43,891,135 |

| STH | Stepchange Holdings | 0.150 | 15% | 199,752 | $20,831,892 |

| SW1 | Swift Networks Group | 0.015 | 15% | 2,155,759 | $12,264,729 |

Eagle Mountain Mining (ASX:EM2) told the ASX it’s got nothing new to disclose after its share price jump. The company pointed out copper stocks have been running hot since the Grasberg landslide in Indonesia, and reminded the market it’s still in long-running talks with Marble Mountain Ventures over rights near Oracle Ridge, while also re-negotiating its loan deal with Vincere. Both discussions have been bubbling away for about a year and are ongoing. Eagle Mountain confirmed it’s fully compliant with disclosure rules.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| LNU | Linius Tech Limited | 0.001 | -50% | 1,000,000 | $13,179,029 |

| MOM | Moab Minerals Ltd | 0.001 | -50% | 2,152,781 | $3,749,332 |

| EEL | Enrg Elements Ltd | 0.002 | -25% | 1,891,666 | $6,507,557 |

| SFG | Seafarms Group Ltd | 0.002 | -25% | 729,103 | $9,673,198 |

| DTM | Dart Mining NL | 0.002 | -20% | 1,764,706 | $3,436,392 |

| ERA | Energy Resources | 0.002 | -20% | 9,090 | $1,013,490,602 |

| TKL | Traka Resources | 0.002 | -20% | 1,039,201 | $6,055,348 |

| IPT | Impact Minerals | 0.007 | -19% | 6,481,933 | $32,906,640 |

| 1AD | Adalta Limited | 0.003 | -17% | 182,867,315 | $4,380,616 |

| TMK | TMK Energy Limited | 0.003 | -17% | 200,000 | $35,692,149 |

| DEV | Devex Resources Ltd | 0.130 | -16% | 1,279,505 | $68,462,054 |

| AHN | Athena Resources | 0.006 | -14% | 510,350 | $15,861,699 |

| AVE | Avecho Biotech Ltd | 0.006 | -14% | 355,185 | $22,214,246 |

| BLU | Blue Energy Limited | 0.006 | -14% | 27,928,667 | $14,900,337 |

| MOH | Moho Resources | 0.006 | -14% | 5,947,610 | $5,217,898 |

| RAU | Resouro Strategic | 0.203 | -14% | 717 | $11,582,157 |

| ENV | Enova Mining Limited | 0.007 | -13% | 19,220 | $12,632,229 |

| JAV | Javelin Minerals Ltd | 0.004 | -13% | 12,594,830 | $25,008,900 |

| NES | Nelson Resources. | 0.004 | -13% | 6,446,530 | $8,687,711 |

| PGY | Pilot Energy Ltd | 0.007 | -13% | 10,394,138 | $17,269,280 |

| VKA | Viking Mines Ltd | 0.007 | -13% | 3,628,000 | $10,751,590 |

| EVG | Evion Group NL | 0.029 | -12% | 86,146 | $14,492,830 |

| T92 | Terra Critical | 0.088 | -12% | 1,102,507 | $14,657,555 |

| ALV | Alvomin | 0.023 | -12% | 128,862 | $5,076,885 |

IN CASE YOU MISSED IT

Aldoro Resources’ (ASX:ARN) Kameelburg resource has jumped 85% to 520.61Mt, putting the company firmly on the map with a globally significant rare earths deposit in Namibia.

Nova Mineral (ASX:NVA) has wrapped an almost 24/7 Alaskan summer drilling campaign at its Estelle gold and critical minerals project.

Recce Pharmaceuticals (ASX:RCE) has started patient dosing in its registrational Phase 3 clinical trial of R327G in diabetic foot infections in Indonesia.

Harvest Technology Group’s (ASX:HTG) technology and strategic direction receives tick of approval with $6 million RiverFort Capital funding facility.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.