Lunch Wrap: ASX dragged as CBA gets smashed on margin fears; gold stocks still glitter

CBA got smashed hard today after reporting its quarterly. Pic: Getty Images

- Gold shines as Fed hint lifts miners

- CBA cops a beating on margins

- Westfield booms as Aussie shoppers feel rich again

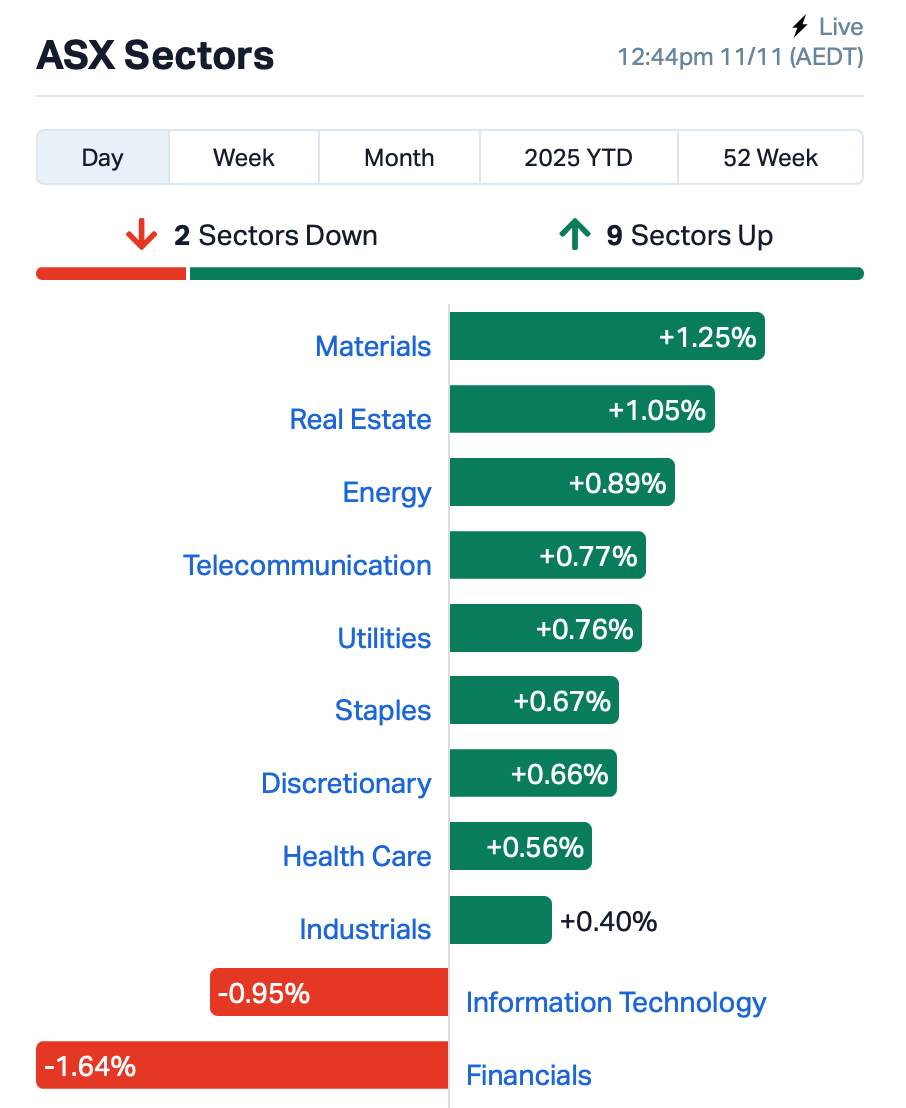

At lunchtime in the east, the ASX had slipped 0.1%, giving back its early morning gains.

Overnight, the US finally started digging itself out of the world’s longest government shutdown, now in its 41st painful day.

Washington’s circus tent was still flapping in the wind, but investors could at least see a faint light at the end of the tunnel.

That helped Wall Street post a strong session last night, with the Nasdaq up more than 2% as the tech herd stampeded back into AI names such as Nvidia and Alphabet.

Back home, the early rally was coming from the miners.

Gold stocks glistened as the yellow metal jumped nearly 3% overnight to US$4,110 an ounce, its highest level in months.

This came after news the Fed might start refilling its ‘liquidity bucket’ once the US government reopens.

That’s marketspeak for “maybe they’ll print a little more money”, and gold bugs love that sort of talk.

Northern Star Resources (ASX:NST), Evolution Mining (ASX:EVN), and Newmont Corporation (ASX:NEM) all climbed more than 3%.

Capricorn Metals (ASX:CMM), meanwhile, jumped 4% after a new study hinted there might be more gold hiding beneath its Mt Gibson project.

In the large cap space, Commonwealth Bank (ASX:CBA) was the worst of the bunch this morning, tumbling 5% even after reporting a $2.6 billion unaudited cash profit for the September quarter.

Concerns around margin pressure and higher costs, however, had traders scrambling for the exit door.

Bendigo and Adelaide Bank (ASX:BEN) also dived 4% after its September-quarter earnings fell 3.2%.

And, Scentre Group (ASX:SCG), the owner of Westfield malls, rose slightly after reporting fresh numbers showing shoppers are still out in force: 453 million visits this year, up 3.1%.

It lines up perfectly with the mood.

The Westpac-Melbourne Institute index released today jumped 12.8% to a four-year high, showing Aussies are feeling good again.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| AOK | Australian Oil. | 0.003 | 50% | 7,663,000 | $2,504,457 |

| BMO | Bastion Minerals | 0.002 | 50% | 500,000 | $2,236,450 |

| SFG | Seafarms Group Ltd | 0.003 | 50% | 4,066,068 | $9,673,198 |

| VBS | Vectus Biosystems | 0.385 | 45% | 349,080 | $14,133,333 |

| CBL | Control Bionics | 0.065 | 41% | 1,702,734 | $16,261,835 |

| C7A | Clara Resources | 0.004 | 33% | 1,399,068 | $2,544,885 |

| PRM | Prominence Energy | 0.004 | 33% | 4,275,000 | $2,667,529 |

| D3E | D3 Energy Limited | 0.415 | 28% | 132,584 | $25,829,377 |

| 1TT | Thrive Tribe Tech | 0.003 | 25% | 1,200 | $843,923 |

| EM2 | Eagle Mountain | 0.010 | 25% | 7,709,063 | $9,080,298 |

| BMG | BMG Resources Ltd | 0.018 | 24% | 5,325,652 | $13,389,259 |

| AKN | Auking Mining Ltd | 0.006 | 20% | 875,556 | $4,100,155 |

| AQX | Alice Queen Ltd | 0.006 | 20% | 200,000 | $7,534,863 |

| RDS | Redstone Resources | 0.003 | 20% | 950,000 | $3,074,954 |

| SLA | Solara Minerals | 0.220 | 19% | 177,976 | $10,958,442 |

| SGA | Sarytogan | 0.130 | 18% | 92,311 | $19,908,166 |

| NXD | Nexted Group Limited | 0.325 | 18% | 2,054,177 | $61,176,424 |

| LIO | Lion Energy Limited | 0.013 | 18% | 53,684 | $4,973,845 |

| CZN | Corazon Ltd | 0.170 | 17% | 207,459 | $7,280,743 |

| BEO | Beonic Ltd | 0.175 | 17% | 14,677 | $10,139,333 |

| 1AD | Adalta Limited | 0.004 | 17% | 5,554,112 | $5,676,588 |

| ATV | Activeportgroupltd | 0.028 | 17% | 10,820,665 | $24,259,448 |

| NAG | Nagambie Resources | 0.014 | 17% | 3,093,361 | $10,760,268 |

| NES | Nelson Resources. | 0.007 | 17% | 90,877 | $13,179,566 |

| BDG | Black Dragon Gold | 0.065 | 16% | 183,559 | $17,894,766 |

Control Bionics (ASX:CBL) has taken a big step forward in accessibility tech, integrating Apple’s new brain-computer interface (BCI) protocol into its NeuroNode and NeuroNode Trilogy devices. The move means faster setup, smoother neural feedback, and instant activation on iOS, a real upgrade for users with severe speech and mobility challenges.

The update cuts setup headaches, improves real-time signal feedback, and gives a true plug-and-play experience. Already backed by NDIS in Australia and HCPCS funding in the US, it is now rolling this out globally, reinforcing its position as a leader in assistive communication tech.

Eagle Mountain Mining (ASX:EM2) has locked in $1.66 million from a placement at $0.009 a share, with strong backing from new and existing investors. Each three shares come with a free attaching option. It’s also launching a $1.9 million rights issue on the same terms, offering one new share for every six held.

The raise comes at a small premium to its 10-day VWAP, giving Eagle fresh funds to advance its copper projects and shore up the balance sheet ahead of the next development phase.

Sarytogan Graphite (ASX:SGA) has wrapped up its reserve definition drilling at the Sarytogan deposit in Central Kazakhstan, with the final 17 holes confirming thick, high-grade graphite near surface, including 50.2m at 34.5% TGC.

The program infilled the first 25 years of planned mining to support an upcoming resource and reserve upgrade, which will feed directly into the Definitive Feasibility Study now underway with consultants WSP. It marks another solid step as Sarytogan sharpens the picture of one of the world’s highest-grade graphite deposits.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CRN | Coronado Global Res | 0.255 | -31% | 36,557,313 | $620,287,880 |

| MEL | Metgasco Ltd | 0.002 | -20% | 12,712 | $4,592,717 |

| TYX | Tyranna Res Ltd | 0.004 | -20% | 192,833 | $16,770,762 |

| BLU | Blue Energy Limited | 0.005 | -17% | 844,935 | $18,071,842 |

| BNL | Blue Star Helium Ltd | 0.005 | -17% | 4,249,304 | $21,617,312 |

| LIB | Liberty Metals | 0.003 | -17% | 16,550,000 | $18,377,371 |

| KLI | Killiresources | 0.055 | -15% | 12,641 | $9,114,543 |

| VRC | Volt Resources Ltd | 0.006 | -14% | 507,868 | $32,793,946 |

| WTM | Waratah Minerals Ltd | 0.605 | -14% | 2,371,393 | $216,482,828 |

| ATT | Altitude Minerals | 0.026 | -13% | 312,807 | $7,774,430 |

| AXP | AXP Energy Ltd | 0.013 | -13% | 5,391 | $5,638,315 |

| EUR | European Lithium Ltd | 0.200 | -13% | 12,638,271 | $377,214,532 |

| BEL | Bentley Capital Ltd | 0.020 | -13% | 79,042 | $1,750,942 |

| PIL | Peppermint Inv Ltd | 0.004 | -13% | 317,498 | $10,036,083 |

| FGR | First Graphene Ltd | 0.087 | -11% | 1,181,372 | $81,985,423 |

| ALM | Alma Metals Ltd | 0.008 | -11% | 666,993 | $16,715,134 |

| TOU | Tlou Energy Ltd | 0.016 | -11% | 6,027 | $23,374,518 |

| RB6 | Rubixresources | 0.125 | -11% | 114,153 | $8,603,000 |

| OMX | Orangeminerals | 0.090 | -10% | 97,720 | $16,958,561 |

| AON | Apollo Minerals Ltd | 0.009 | -10% | 6,850,554 | $9,284,569 |

| BRU | Buru Energy | 0.018 | -10% | 1,127,409 | $20,046,592 |

| WHK | Whitehawk Limited | 0.009 | -10% | 100,000 | $9,152,594 |

| ADD | Adavale Resource Ltd | 0.047 | -10% | 408,516 | $13,971,618 |

| 4DS | 4Ds Memory Limited | 0.010 | -9% | 3,312,489 | $22,669,886 |

IN CASE YOU MISSED IT

Javelin Minerals (ASX:JAV) will soon start geotechnical drilling to support pit design and determine metallurgical characteristics for Eureka gold mining and processing.

ASX-listed Tinybeans Group (ASX:TNY) has unveiled a new in-app Photo Store hot on the heels of its major US acquisition, Boston-based journaling platform Qeepsake.

New high-grade assays from Antipa Minerals’ (ASX:AZY) Minyari drilling have reinforced the gold-copper project’s ongoing growth potential.

Belararox (ASX:BRX) has commenced geophysical surveys at the Toro South target at its TMT copper project in Argentina ahead of drilling planned for later this month.

LAST ORDERS

Petratherm (ASX:PTR) has officially changed its name to PTR Minerals Limited, reflecting its focus on advancing the Muckanippie titanium-richHeavy Minerals Sands (HMS) discovery in South Australia. The company’s ticker will remain unchanged as PTR.

Stellar Resources (ASX:SRZ) has secured firm commitments to raise $9 million at $0.022 a share, a small discount to today’s opening price of $0.025 each. The funding will go to developing the flagship Heemskirk tin project in Tasmania.

At Stockhead, we tell it like it is. While Control Bionics, PTR Minerals and Stellar Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.