Lunch Wrap: ASX dips as Viva Energy plunges; RIP Sir Michael Hill, jeweller

RIP Sir Michael Hill. Picture via Getty Images

- ASX dips despite energy stocks firing up

- Viva Energy dives but Liontown, Ramelius, Sandfire shine

- Jeweller Sir Michael Hill dies

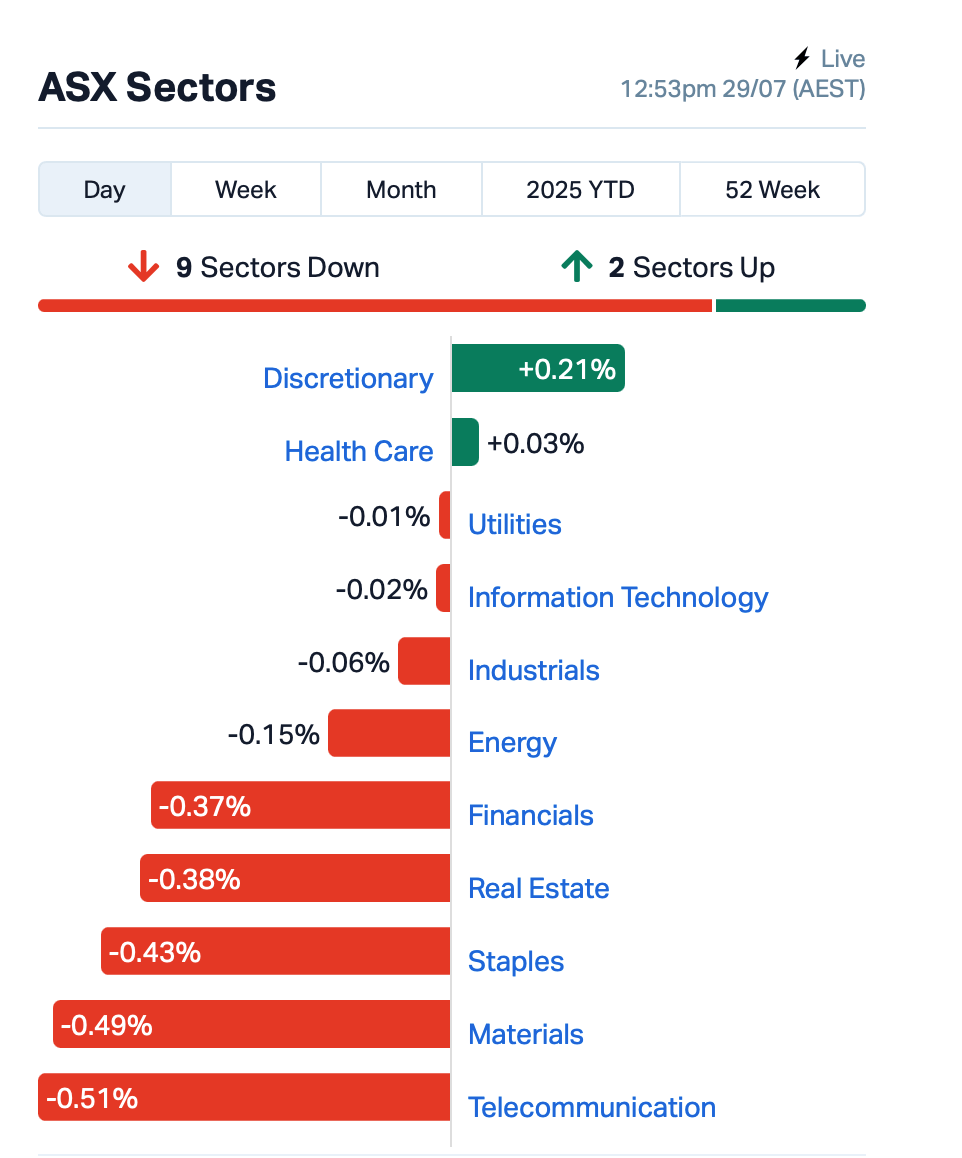

The ASX was down 0.25% at Tuesday lunchtime on the eastern seaboard.

Markets also softened across Asia, with investors now bracing for a week of crucial economic data, which includes the Fed Reserve decision on Wednesday.

Most ASX sectors were bleeding red this morning, and discretionary was the only one offering any resistance.

Most energy stocks rose, and you can thank Donald Trump for that.

He was back with another geopolitical ultimatum, this time telling Russia it’s got 10 to 12 days to pull its troops out of Ukraine or face a 100% tariff wall.

Markets didn’t exactly like that, but oil sure did. Brent cracked US$70 and WTI surged 2% overnight.

In the large end of town, Woodside Energy Group (ASX:WDS) climbed 1.4% after taking the reins of Bass Strait gas operations from ExxonMobil Australia.

The move, it said, gives Woodside control over a massive east coast energy source and could unlock US$60 million in synergies, not to mention the potential to drill four new gas wells.

But not all energy names were basking in the oil glow.

Viva Energy (ASX:VEA) tumbled 9% after warning that first-half earnings were set to disappoint.

The culprits, it said, were weak convenience store sales, a 27% collapse in tobacco revenue (blame new packaging laws and black-market smokes), and refining margins that ran out of puff.

Meanwhile, lithium player Liontown Resources (ASX:LTR) fell 3% despite reporting a record $23 million in positive operating cash flow for the June quarter, and $301 million in full-year revenue.

LTR confirmed it’s still on track to become Australia’s first fully underground lithium operation.

Still in large caps, Ramelius Resources (ASX:RMS) popped champagne, up 2% after clocking record gold production and free cash flow in the June quarter. The miner produced over 300,000 ounces at top-end guidance and raked in nearly $700 million in free cash.

Sandfire Resources (ASX:SFR) also brought the goods: copper equivalent output up 12% in the quarter, despite floods and blackouts.

CEO Brendan Harris credited the turnaround to a “simple strategy” and aggressive deleveraging, slicing net debt by $273 million. SFR’s shares climbed 1%.

ASX SMALL CAP WINNERS

Here are the best-performing ASX small cap stocks for July 29 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| OLI | Oliver'S Real Food | 0.010 | 100% | 6,705,197 | $2,703,660 |

| BSA | BSA Limited | 0.125 | 39% | 9,179,570 | $6,777,023 |

| MX1 | Micro-X Limited | 0.083 | 34% | 1,577,987 | $41,366,540 |

| SFG | Seafarms Group Ltd | 0.002 | 33% | 583,466 | $7,254,899 |

| IS3 | I Synergy Group Ltd | 0.012 | 33% | 2,502,653 | $15,356,699 |

| PIM | Pinnacleminerals | 0.052 | 30% | 1,332,998 | $1,818,533 |

| SP3 | Specturltd | 0.015 | 25% | 4,097,386 | $3,802,801 |

| BUY | Bounty Oil & Gas NL | 0.003 | 25% | 172,811 | $3,122,944 |

| ECT | Env Clean Tech Ltd. | 0.003 | 25% | 4,252,072 | $8,030,871 |

| MOH | Moho Resources | 0.005 | 25% | 888,795 | $2,981,656 |

| TMK | TMK Energy Limited | 0.003 | 25% | 362,333 | $20,444,766 |

| IMI | Infinitymining | 0.011 | 22% | 1,157,816 | $3,807,142 |

| X2M | X2M Connect Limited | 0.017 | 21% | 630,275 | $6,090,796 |

| REM | Remsensetechnologies | 0.040 | 21% | 150,580 | $5,518,722 |

| AAU | Antilles Gold Ltd | 0.006 | 20% | 3,108,381 | $11,895,340 |

| CUF | Cufe Ltd | 0.012 | 20% | 4,636,229 | $13,465,749 |

| LSR | Lodestar Minerals | 0.019 | 19% | 3,927,452 | $6,361,448 |

| KZR | Kalamazoo Resources | 0.105 | 17% | 4,101,528 | $19,745,417 |

| TYX | Tyranna Res Ltd | 0.004 | 17% | 127,750 | $9,865,276 |

| UNT | Unith Ltd | 0.007 | 17% | 49,396 | $8,872,713 |

| PPK | PPK Group Limited | 0.565 | 15% | 76,329 | $44,498,124 |

| SP8 | Streamplay Studio | 0.008 | 14% | 350,000 | $8,969,552 |

| CMB | Cambium Bio Limited | 0.330 | 14% | 569 | $5,301,973 |

| SEQ | Sequoia Fin Grp Ltd | 0.270 | 13% | 1,781,964 | $29,663,256 |

Beonic (ASX:BEO) has signed a $15.2 million contract to deploy its LiDAR passenger flow tech across seven major airports in North Africa, its largest deal in the region to date.

It will kick off with a proof-of-concept at the country’s main international airport, then roll out to all seven within 12 months. Beonic’s share of the deal is $10.6 million, covering an initial 2.5-year term with a three-year extension option.

Helix Resources (ASX:HLX) reckons its White Hills Project in northern Arizona could host a large-scale porphyry-style copper-gold system, based on early results.

The site shows signs of two distinct mineralisation events along a belt known for big copper and gold finds.

Historic drillholes focused only on gold and missed copper, despite rock chip samples showing grades up to 5.7% copper across a +1km anomaly zone.

White Hills spans 23km² over seven tenements, and sits just 1.5 hours from Vegas.

Black Dragon Gold (ASX:BDG) has entered the public consultation phase for its Salave Gold Project’s PIER application in northern Spain, a key step toward getting the project classed as a Strategic Project under new regional investment laws. The 20-day consultation, running until 25 August, covers the proposed rezoning of farmland to industrial use for Salave’s surface infrastructure. It’s not the final sign-off, but a crucial legal step before the Agency makes its recommendation to the Asturian Government.

Fintech lender Wisr (ASX:WZR) surged past its own guidance with a 154% jump in loan originations to $140 million in Q4. That marks five straight quarters of growth, as demand for personal and vehicle loans climbs. Net losses and late arrears both improved, and CEO Andrew Goodwin credited tech-driven automation for the company’s comeback.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for July 29 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AYT | Austin Metals Ltd | 0.002 | -33% | 1,004,003 | $4,752,574 |

| DTM | Dart Mining NL | 0.003 | -25% | 9,197,764 | $4,792,222 |

| MRQ | Mrg Metals Limited | 0.003 | -25% | 625,000 | $10,906,075 |

| SFG | Seafarms Group Ltd | 0.002 | -25% | 1 | $9,673,198 |

| ANR | Anatara Ls Ltd | 0.007 | -22% | 4,393,904 | $1,920,454 |

| GGP | Greatland Resources | 5.440 | -21% | 5,377,202 | $4,621,479,027 |

| LM1 | Leeuwin Metals Ltd | 0.115 | -21% | 857,352 | $14,616,926 |

| PRX | Prodigy Gold NL | 0.002 | -20% | 1,400,849 | $15,875,278 |

| KZR | Kalamazoo Resources | 0.089 | -19% | 4,839,858 | $24,133,287 |

| SLA | Solara Minerals | 0.240 | -17% | 94,426 | $16,815,599 |

| TMX | Terrain Minerals | 0.003 | -17% | 3,666,666 | $7,595,443 |

| IFG | Infocusgroup Hldltd | 0.016 | -16% | 1,640,572 | $5,546,844 |

| GRL | Godolphin Resources | 0.011 | -15% | 100,000 | $5,835,353 |

| CHR | Charger Metals | 0.051 | -15% | 543,152 | $4,645,215 |

| AKN | Auking Mining Ltd | 0.006 | -14% | 379,149 | $4,816,814 |

| OVT | Ovanti Limited | 0.006 | -14% | 1,632,882 | $29,920,265 |

| SP3 | Specturltd | 0.012 | -14% | 205,778 | $4,436,602 |

| TEM | Tempest Minerals | 0.006 | -14% | 233,585 | $7,712,565 |

| SRL | Sunrise | 1.040 | -13% | 313,231 | $140,188,562 |

| RTR | Rumble Res Limited | 0.026 | -13% | 999,143 | $28,527,005 |

| AON | Apollo Minerals Ltd | 0.007 | -13% | 625,000 | $7,427,655 |

| CTO | Citigold Corp Ltd | 0.004 | -13% | 30,000 | $12,000,000 |

| VR8 | Vanadium Resources | 0.032 | -13% | 3,362,648 | $20,314,507 |

Michael Hill (ASX:MHJ) has announced the passing of its founder and non-executive director, Sir Michael Hill.

Sir Michael, who built the brand from a single store in Whangārei into a global jewellery name, was remembered as a visionary and creative force.

He began with dreams of being a concert violinist, but turned to jewellery as a teen, making waves in the industry. MHJ shares were down 1%.

Last Orders

QPM Energy (ASX:QPM) says commissioning work on the Townsville Power Station has continued, with a number of successful extended runs completed at full load for the gas turbine and generator.

The company expects to be handed dispatch control under a new agreement over the next few days, from when a new transportation and storage agreement with North Queensland Gas Pipeline will begin as QPM looks towards dispatching the power station for extended periods and taking advantage of near-term market pricing.

Firetail Resources (ASX:FTL) has further expanded the discovery potential of its newly acquired Excelsior gold project in Nevada, with interpretation of existing data supporting both an extension of the prospective Buster trend to beyond 5km and the existence of one lying parallel.

Field mapping and sampling also spotted up more undocumented exploration adits, and Firetail managing director Glenn Poole said the active exploration campaign was delivering important information as the company looks towards getting a rig on the ground and testing the project’s enormous potential.

New World Resources (ASX:NWC) has entered a binding US$6.5m loan facility agreement with Kinterra to continue advancing its Antler copper project towards development in Arizona.

The proceeds are marked to meet state bonding requirements, secure key land parcels, and provide general working capital and payment of costs related to Kinterra’s takeover.

In Case You Missed It

Brazilian Critical Minerals (ASX:BCM) continues to advance its flagship Ema rare earths project in Brazil on multiple fronts as offtake interest grows and BCM works to complete a key bankable feasibility study.

Nimy Resources (ASX:NIM) has capped off a gallium-focused drilling campaign with more high-grade returns as the company turns its attention towards a maiden resource.

Elevate Uranium (ASX:EL8) has entered a transformative stage in its U-pgrade™ beneficiation process, with the final factory testing and shipment of a pilot plant to Namibia on track for early next month.

At Stockhead, we tell it like it is. While QPM Energy, Firetail Resources and New World Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.