Lunch Wrap: ASX bruised; ANZ swings the axe; Telix gets an FDA lifeline

The ASX has been on the verge of closing lower on Tuesday. Picture via Getty Images

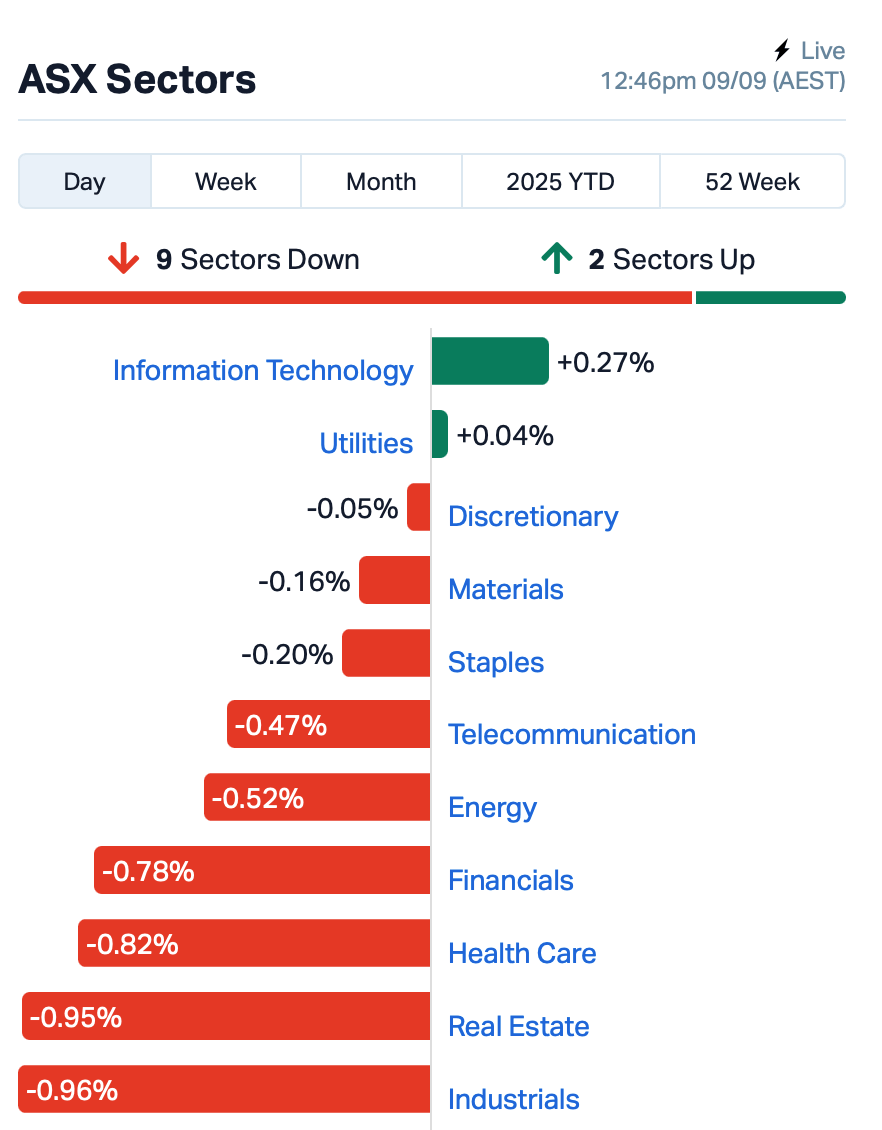

- ASX sinks as banks, energy and real estate bleed

- Gold smashes records, while tech clings to green

- ANZ to axe 3,500 jobs, Telix shines

Wall Street might have had a modest spring in its step overnight, but the local bourse clearly didn’t get the memo.

By lunch time in the east today, the ASX had plunged 0.5%, and it wasn’t pretty.

Gold, of course, was the only one at the party still potting shots.

The yellow metal smashed yet another record last night, sprinting up to as high US$3,646 as central banks kept stacking it away like doomsday preppers.

UBS reckons the gold price will stretch to US$3,700, while Goldman’s out there whispering US$5,000 if the big money really starts bailing out of Treasuries.

Also read > Broker Upgrades: As gold cracks new record, analysts continue to rewrite price targets for ASX miners

Back home, though, almost everything else was red.

Nine out of 11 sectors were swimming backwards, with industrials the biggest sinker.

The banks weren’t much better.

Australia and New Zealand Banking Group (ASX:ANZ) managed to steal the headlines by announcing it will cull 3,500 jobs – news some staff apparently discovered mid-toast, courtesy of a push alert.

The Finance Sector Union called it “corporate vandalism” and “unhinged”.

That’s the kind of PR line you’d expect for a mining spill, not a bank trying to boost profits. The other three big banks were all down as well this morning.

Energy stocks kept dragging too, still sulking after OPEC+ decided to pump an extra 137,000 barrels a day from October.

The one bright spot was tech, the one green shoot in a paddock otherwise trampled flat.

In large caps news, Telix Pharmaceuticals (ASX:TLX) jumped 5% after striking a deal with the US FDA on how to get its TLX101-CDx (Pixclara) brain cancer imaging agent back on track for approval.

The drug’s first shot at the big time ended with a Complete Response Letter, FDA-speak for “nice try, but no cigar.”

Now, after a so-called Type A meeting (which is basically the FDA’s equivalent of a crisis counselling session), both sides have agreed on what the resubmission needs to look like.

Elsewhere, JB HiFi (ASX:JBH)’s The Good Guys has officially buried the hatchet with the ACCC, after the Federal Court signed off on their settlement over dodgy store credit promos run between 2019 and 2023. JBH’s shares were up 0.5%,

BHP (ASX:BHP), on the other hand, shed nearly 1% after agreeing to fork out $110 million to settle a class action over the Samarco dam disaster.

The miner insists it’s not admitting liability, and most of the payout will come from insurers anyway, but investors weren’t in a forgiving mood. BHP’s shares

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| T3D | 333D Limited | 0.094 | 135% | 1,109,329 | $7,554,152 |

| NTM | Nt Minerals Limited | 0.003 | 50% | 800,834 | $2,421,806 |

| JLL | Jindalee Lithium Ltd | 0.580 | 45% | 1,667,848 | $31,948,338 |

| MOH | Moho Resources | 0.007 | 40% | 9,015,608 | $3,727,070 |

| ADG | Adelong Gold Limited | 0.007 | 30% | 62,722,928 | $11,584,182 |

| LIT | Livium Ltd | 0.015 | 25% | 61,855,662 | $20,425,285 |

| CNJ | Conico Ltd | 0.005 | 25% | 2,939,811 | $1,088,583 |

| GUM | Gumtree Australia | 0.160 | 23% | 70,000 | $41,726,436 |

| CCO | The Calmer Co Int | 0.003 | 20% | 1,559,695 | $7,528,383 |

| WLD | Wellard Limited | 0.044 | 19% | 652,582 | $19,656,262 |

| CR3 | Core Energy Minerals | 0.013 | 18% | 5,161,292 | $4,610,164 |

| TX3 | Trinex Minerals Ltd | 0.165 | 18% | 363,572 | $6,535,402 |

| CTO | Citigold Corp Ltd | 0.007 | 17% | 344,301 | $18,000,000 |

| DTI | DTI Group Ltd | 0.007 | 17% | 285,856 | $5,382,617 |

| ECS | ECS Botanics Holding | 0.007 | 17% | 379,220 | $7,776,297 |

| GSM | Golden State Mining | 0.014 | 17% | 1,043,309 | $3,352,448 |

| LEX | Lefroy Exploration | 0.150 | 15% | 690,896 | $32,294,618 |

| DRE | Dreadnought Resources | 0.024 | 14% | 24,470,864 | $106,669,500 |

| GL1 | Globallith | 0.355 | 14% | 430,189 | $81,791,288 |

| NTI | Neurotech Intl | 0.017 | 13% | 740,817 | $15,744,329 |

| MEU | Marmota Limited | 0.047 | 13% | 9,559,374 | $48,899,690 |

| OSX | Osteopore Limited | 0.013 | 13% | 29,070,258 | $2,728,490 |

| OSL | Oncosil Medical | 1.400 | 13% | 29,480 | $23,342,869 |

| BUS | Bubalus Resources | 0.135 | 13% | 203,918 | $6,886,561 |

Jindalee Lithium (ASX:JLL) has inked a non-binding deal with US SPAC Constellation Acquisition Corp to merge its HiTech Minerals unit – owner of the giant McDermitt lithium project – into a new US-listed vehicle valued at US$500m. The plan includes a US$20-30m cap raise, with US$4m already committed, and would see NewCo list on a US exchange while Jindalee keeps more than 80% ownership. It’s early days, the deal’s non-binding and subject to due diligence, shareholder votes and regulatory ticks.

Adelong Gold (ASX:ADG) has locked in a $1.25m strategic raise, with $1m coming from Nova Minerals and $250k from Barclay Wells clients. The deal shores up funding for the Adelong Gold project in NSW and frees up cash to accelerate drilling at Apollo and Lauriston in Victoria. As part of the tie-up, Nova gets first rights over any antimony offtake, an option to take its stake up to 19.99%, a board seat, and a 12-month escrow on its shares.

Livium (ASX:LIT) has signed a term sheet with the University of Melbourne to lock in exclusive global rights over its microwave tech for rare earths extraction. The method has delivered recovery rates above 95% for neodymium, and more than 80% for praseodymium, while slashing energy use by around 85% compared to old-school processes. Livium said the deal opens the door to build an Aussie-first prototype and chase a slice of the US$7.3b REE market.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| SRN | Surefire Rescs NL | 0.001 | -33% | 17,673,575 | $5,860,289 |

| AYT | Austin Metals Ltd | 0.003 | -25% | 305,000 | $6,336,765 |

| CT1 | Constellation Tech | 0.002 | -25% | 100,000 | $2,949,467 |

| MTL | Mantle Minerals Ltd | 0.002 | -25% | 1,950,000 | $12,894,892 |

| RTR | Rumble Res Limited | 0.029 | -24% | 16,445,813 | $36,134,206 |

| SNS | Sensen Networks Ltd | 0.076 | -20% | 4,577,483 | $75,338,560 |

| FBR | FBR Ltd | 0.004 | -20% | 5,380,844 | $30,371,388 |

| GGE | Grand Gulf Energy | 0.002 | -20% | 452,000 | $7,051,062 |

| 4DX | 4Dmedical Limited | 1.920 | -17% | 14,526,756 | $1,083,082,195 |

| LMG | Latrobe Magnesium | 0.025 | -17% | 3,659,360 | $79,034,974 |

| 4DS | 4Ds Memory Limited | 0.010 | -17% | 114,931,067 | $24,730,785 |

| CZN | Corazon Ltd | 0.003 | -17% | 3,500,000 | $3,703,717 |

| TEG | Triangle Energy Ltd | 0.003 | -17% | 1,260,000 | $6,567,702 |

| VAR | Variscan Mines Ltd | 0.005 | -17% | 1,525,274 | $5,401,718 |

| H2G | Greenhy2 Limited | 0.011 | -15% | 1,296,587 | $8,942,854 |

| KLR | Kaili Resources Ltd | 0.460 | -15% | 368,825 | $79,596,196 |

| RB6 | Rubixresources | 0.115 | -15% | 37,873 | $8,295,750 |

| 14D | 1414 Degrees Limited | 0.018 | -14% | 245,516 | $6,124,802 |

| ALY | Alchemy Resource Ltd | 0.006 | -14% | 3,717,121 | $8,246,534 |

| ARV | Artemis Resources | 0.006 | -14% | 35,596,919 | $20,059,705 |

| BLU | Blue Energy Limited | 0.006 | -14% | 3,931,923 | $14,900,337 |

| CHM | Chimeric Therapeutic | 0.003 | -14% | 1,464,537 | $11,390,956 |

| LML | Lincoln Minerals | 0.006 | -14% | 2,629,154 | $18,045,558 |

| NAE | New Age Exploration | 0.003 | -14% | 246,436 | $9,470,690 |

| PIL | Peppermint Inv Ltd | 0.003 | -14% | 2,255,833 | $8,544,935 |

In Case You Missed It

Clever Culture Systems (ASX:CC5) is strengthening its position as a leader in AI-driven microbiology automation, with top pharmaceutical companies like AstraZeneca, Bristol Myers Squibb and Pfizer set to present new evaluation performance data for its Automated Plate Assessment System.

Red Mountain Mining (ASX:RMX) has highlighted the potential prize lurking within its Fry Lake project in Ontario with channel sampling returning assays of up to 25.1g/t gold.

333D (ASX:T3D) is back on the ASX after exiting voluntary suspension, with the digital asset company highlighting a profitable turnaround and sights set on scalable growth.

Victory Metals (ASX:VTM) has flagged more than two dozen high-value heavy rare earth zones and reinforced its North Stanmore project as one of the world’s more advanced REE clay projects.

Astral Resources (ASX:AAR) has struck bedrock gold going up to 26m at 2g/t at a newly acquired project as it looks towards assays from several deposits and further advancing a multi-project WA gold strategy.

Adavale Resources (ASX:ADD) has hit gold immediately below the existing pit floor at its formerly producing London Victoria mine in NSW, with the maiden campaign returning high-grade intersections up to 14.6g/t and extended mineralisation as the company looks toward a second round of drilling and substantial resource growth.

Miramar Resources (ASX:M2R) has spotted up multiple large conductors at its Bangemall project in WA which may be related to Noril’sk-style nickel, copper and platinum group element mineralisation as the company finalises an exploration JV with major mineral power Sumitomo to look for that very same kind of high-value deposit.

Stockhead chatted with Orthocell (ASX:OCC) CEO and managing director Paul Anderson after a new real-world study demonstrated an 81.1% treatment success rate for the company’s nerve repair device, with Anderson explaining why this real-world validation was so significant for surgeons.

Ora Banda Mining (ASX:OBM) has every reason to expect a Sand King coronation after hitting strikes of up to 18.7m at 8.9g/t gold around 300m north of a mine which is quickly building from a supporting act to a meaningful, long-term source of ore feed for its Davyhurst mill.

Last Orders

West Coast Silver (ASX:WCE) has welcomed Bulls N’ Bears founder and former Member for Kalgoorlie Matt Birney to the board effective immediately as non-executive director.

Executive chairman Bruce Garlick said that Birney brings along significant ASX exploration experience and a wealth of contacts, while the new NED said that companies with high-grade, high-quality silver assets like WCE would inevitably be in the vanguard of those placed to take advantage of an ascendant silver pricing environment.

Norwest Minerals (ASX:NWM) has heritage clearance for multiple RC drilling pads as it looks to get going again at its fully owned Bulgera gold project in the WA Mid West.

The company is already keenly awaiting the imminent assays from a previous 11-hole program and is also preparing a heap leach cashflow model for 4Mt of soft, near-surface gold bearing oxide lying within its greater resource.

American Uranium (ASX:AMU) cornerstone investor and North American yellowcake power Snow Lake Energy (NASDAQ:LITM) has completed its investment to now hold 9.9% of AMU.

AMU believes it is well positioned to deliver value from its Lo Herma project in Wyoming for a US nuclear revival, and executive director and CEO Bruce Lane said it was delighted that Snow Lake had completed a strategically significant investment as it advances its own JV project along trend from Lo Herma.

At Stockhead, we tell it like it is. While West Coast Silver, Norwest Minerals and American Uranium are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.