Lunch Wrap: ASX bounces back as banks muscle up, lithium stocks spark

The ASX has bounced back from yesterday’s near 2pc selloff. Picture via Getty Images

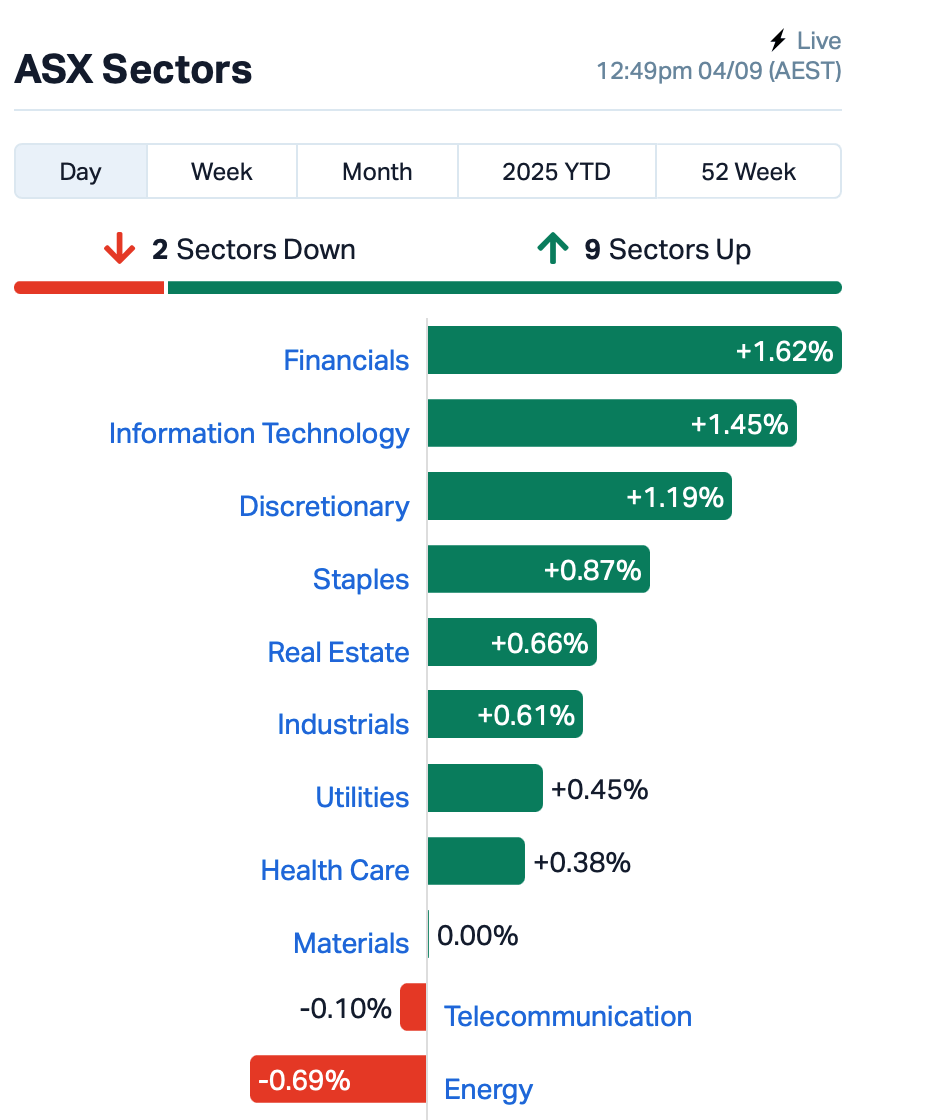

- ASX bounces as banks, tech and lithium rally

- Oil giants slump as OPEC+ eyes more supply

- Domino’s chair buys more shares, IAG blocked by ACCC

After getting thumped 1.8% yesterday, the ASX had its mojo back by Thursday lunchtime in the east, up 0.7%.

The local rebound came on the coattails of Wall Street overnight, where tech stocks did the heavy lifting as bond yields finally came down.

Alphabet surged 9% after a judge decided Chrome and Android could keep their empires intact, no forced amputations.

On the ASX this morning, the big four banks led the charge, rallying by more than 1% each.

Tech tagged along too, buoyed by Nasdaq’s 1% rally.

Investors also piled into lithium stocks, with Pilbara Minerals (ASX:PLS) and Mineral Resources (ASX:MIN) up around 2%.

Energy, meanwhile, was left sulking in the corner.

Woodside Energy Group (ASX:WDS) and Santos (ASX:STO) dropped as Brent crude slid on rumours OPEC+ might turn the taps back on in October.

The cartel spent last year pretending to be the responsible adult with supply cuts. Now it smells blood and wants its market share back.

Oil traders should know the script by now: the house always wins, and the house is run by people who don’t take calls from Wall Street.

In large caps news, Domino’s Pizza Enterprises (ASX:DMP) was back in the headlines after chairman Jack Cowin tipped in $5.06 million of his own cash, buying 335,000 shares at just over $15 apiece.

At 83, he’s not sitting back on the boardroom leather. He’s already running the shop floor since the last CEO bolted. DMP’s shares rallied 4%.

Iress (ASX:IRE) jolted higher by 5% after naming Andrew Russell as CEO. The market clearly thinks he can whip the trading software group into sharper shape than his predecessor.

Insurance Australia (ASX:IAG) wasn’t so lucky, but was still up 1%.

Its $1.35 billion grab for WA’s RAC Insurance just got the red light from the ACCC.

The competition watchdog reckons letting the country’s biggest insurer swallow one of the state’s fiercest rivals would choke what little competition is left.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| BMO | Bastion Minerals | 0.002 | 50% | 268,000 | $2,204,953 |

| SFG | Seafarms Group Ltd | 0.002 | 50% | 1,028,082 | $4,836,599 |

| PLG | Pearl Gull Iron | 0.026 | 44% | 13,922,151 | $3,681,752 |

| THR | Thor Energy PLC | 0.014 | 40% | 22,553,496 | $7,326,361 |

| AMS | Atomos | 0.008 | 33% | 4,301,409 | $7,290,111 |

| C7A | Clara Resources | 0.004 | 33% | 126,500 | $2,229,885 |

| TYX | Tyranna Res Ltd | 0.004 | 33% | 500,000 | $10,026,464 |

| SRL | Sunrise | 2.180 | 31% | 1,029,737 | $196,534,935 |

| LU7 | Lithium Universe Ltd | 0.013 | 30% | 19,331,770 | $14,389,796 |

| BP8 | Bph Global Ltd | 0.003 | 25% | 120,767,084 | $2,101,969 |

| DTM | Dart Mining NL | 0.003 | 25% | 721,026 | $2,749,052 |

| VFX | Visionflex Group Ltd | 0.003 | 25% | 2,020,994 | $6,735,721 |

| 4DX | 4Dmedical Limited | 1.435 | 24% | 17,516,224 | $537,764,057 |

| RCR | Rincon | 0.021 | 24% | 10,640,677 | $5,364,561 |

| SNS | Sensen Networks Ltd | 0.080 | 23% | 2,704,014 | $51,547,436 |

| AUA | Audeara | 0.029 | 21% | 99,401 | $4,318,425 |

| ZGL | Zicom Group Limited | 0.150 | 20% | 6,590 | $26,820,001 |

| ADR | Adherium Ltd | 0.006 | 20% | 245,007 | $9,315,831 |

| CTQ | Careteq Limited | 0.012 | 20% | 190,810 | $2,371,187 |

| MOH | Moho Resources | 0.006 | 20% | 14,439,806 | $3,727,070 |

| CPV | Clearvue Technologie | 0.260 | 18% | 1,462,944 | $61,297,537 |

Pearl Gull Iron (ASX:PLG) has signed a binding deal to sell its Cockatoo Island Project for $4.5 million cash, a 4% stake in Crestlink, and future royalties on material taken from the site. The deal still needs shareholder approval.The cash injection will give Pearl Gull room to chase new projects and growth opportunities, while it keeps a foot in the door at Cockatoo through its Crestlink holding and royalties. The board sees the sale as a solid outcome given the early-stage nature and heavy costs still required on the project.

Thor Energy (ASX:THR) has signed a term sheet with DISA Technologies to process old uranium waste dumps at its Colorado projects, with no capex or opex on its side. If successful, it will earn a 2.5%–4% gross revenue share from any uranium or critical minerals recovered, while DISA funds and runs the operation using its patented HPSA system. The process not only extracts saleable product, but also cleans up legacy sites, with US regulators close to granting DISA a first-of-its-kind licence.

Lithium Universe (ASX:LU7) has nailed lab trials of its Jet Electrochemical Silver Extraction tech with Macquarie Uni, pulling more than 95% of silver from old solar cells and hitting 90% recovery in just seven minutes under low voltage and weak acid. The process uses less energy, less acid and leaves far less waste, while keeping the silicon wafers intact for reuse. For LU7, it’s a big step toward turning solar panel junk into high-value silver and silicon.

BPH Global (ASX:BP8) has locked in a 12-month deal with Marchwood Laboratory Services to analyse seaweed samples for rare earths, precious metals and critical minerals. The program zeroes in on four high-value REEs – lanthanum, terbium, yttrium and neodymium – seen as vital for EVs and renewables. For BPH, it’s a step up in proving seaweed can act as a natural bio-accumulator, opening the door to sustainable recovery of critical minerals.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| HCD | Hydrocarbon Dynamics | 0.002 | -33% | 1,838,255 | $3,554,305 |

| TMX | Terrain Minerals | 0.002 | -33% | 981,371 | $7,745,443 |

| CNJ | Conico Ltd | 0.005 | -29% | 3,400,076 | $1,905,020 |

| RNX | Renegade Exploration | 0.003 | -25% | 5,988,204 | $6,409,454 |

| JAL | Jameson Resources | 0.100 | -20% | 54,000 | $88,841,665 |

| TKL | Traka Resources | 0.002 | -20% | 2,000 | $6,055,348 |

| AVD | Avada Group Limited | 0.175 | -19% | 12,242 | $18,261,030 |

| FMR | FMR Resources Ltd | 0.400 | -18% | 438,353 | $19,436,008 |

| FZR | Fitzroy River Corp | 0.140 | -18% | 30,000 | $18,352,223 |

| NTD | Ntaw Holdings Ltd | 0.285 | -17% | 12,080 | $57,859,125 |

| LOT | Lotus Resources Ltd | 0.188 | -17% | 31,789,543 | $533,667,827 |

| BPP | Babylon Pump & Power | 0.005 | -17% | 1,600,000 | $22,841,346 |

| ERL | Empire Resources | 0.005 | -17% | 119,628 | $8,903,479 |

| ADN | Andromeda Metals Ltd | 0.011 | -15% | 27,210,430 | $49,616,793 |

| MGL | Magontec Limited | 0.210 | -14% | 249 | $13,955,647 |

| BNL | Blue Star Helium Ltd | 0.006 | -14% | 8,658,845 | $23,575,197 |

| PPY | Papyrus Australia | 0.012 | -14% | 2,457,406 | $8,440,344 |

| VRL | Verity Resources | 0.024 | -14% | 3,914,091 | $7,837,073 |

IN CASE YOU MISSED IT

Asra Minerals (ASX:ASR) has appointed experienced geologist and “proven company-maker” Ziggy Lubieniecki as non-executive technical director.

ClearVue Technologies (ASX:CPV) has unveiled its third-generation Solar Vision Glass, with independent testing showing a 66% uplift in power per square metre than its previous generation product.

Astral Resources’ (ASX:AAR) infill drilling has returned 4m at 21.3g/t gold at Iris deposit that is likely to support a lift in indicated resources at the Mandilla project.

LAST ORDERS

Locksley Resources (ASX:LKY) has officially listed to the Frankfurt Stock Exchange under ticker X5L, elevating its visibility among European markets.

LKY says the fresh dual listing adds momentum to its plans to develop the Mojave antimony and rare earths project within the US Mojave Critical Minerals Corridor of California.

Mammoth Minerals (ASX:M79) has obtained a 17% interest in Cloudbreak Discovery, a London Stock Exchange-listed company, in return for a 90% interest in the Paterson project in WA.

M79’s new stake in Cloudbreak is valued at $3.1m. The company also retains a 10% interest in Paterson itself, to be free-carried until Cloudbreak produces a definitive feasibility study with a positive NPV.

At Stockhead, we tell it like it is. While Locksley Resources and Mammoth Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.