Lunch Wrap: ASX bobs up and down, as iron ore stocks ride China’s mega dam news

The ASX is trying to stabilise after yesterday’s smackdown. Picture via Getty Images

- ASX struggles to keep afloat but miners are on front foot

- Iron ore pops on China dam dreams

- Insignia jumps on $3.3bn buyout bid

After Monday’s sharp stumble, the ASX opened Tuesday with a bit of fight, climbing 0.2% in the morning.

But by lunch in the eastern states, it was struggling to stay afloat, sinking to a narrow loss of 0.02%.

Overnight, Wall Street powered higher, with fund managers continuing to chase risk assets.

The S&P 500 cracked 6,300 for the first time, while earnings season kicks into top gear this week with the Magnificent Seven on deck.

On the macro front, the RBA’s July meeting minutes dropped this morning, and they offered a bit more colour on why the board kept rates steady at 3.85%.

The decision, according to the minutes, came down to the RBA wanting to move “cautiously”, particularly with inflation now tracking closer to target.

A minority of board members were leaning toward a cut, citing downside risks, but the majority felt it would send the wrong message.

Back to the ASX, and miners were back in the driver’s seat as iron ore jumped 3%, the highest it’s been in four months.

The bounce was powered by hopes of more stimulus out of China, and its headline-grabbing plan to build the world’s largest dam in Tibet. According to analysts, that mega project could give a decent jolt to demand for steel and concrete.

BHP (ASX:BHP) and Fortescue (ASX:FMG) climbed around 2% on the news, while Rio Tinto (ASX:RIO) surged 3%.

Champion Iron (ASX:CIA) also rallied 4% to its highest level since March after locking in a deal with Nippon Steel and Sojitz to jointly develop its Kami iron ore project in Canada.

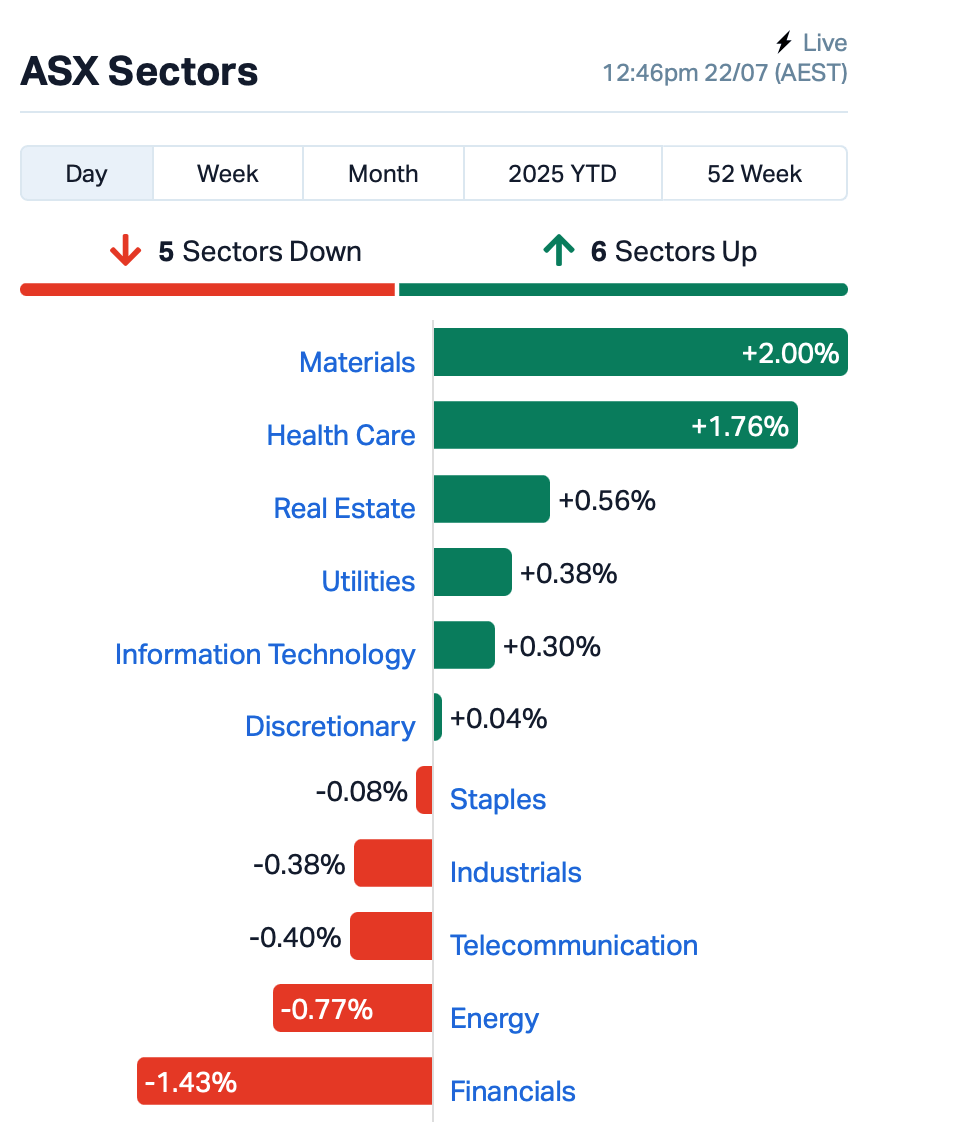

While the miners flexed, it was a softer showing for the banks, the worst-performing sector by 12:45pm AEST:

Still in large caps news, Insignia Financial (ASX:IFL) surged 12% after US-based private equity firm CC Capital agreed to buy the lot in a $3.3 billion deal at $4.80 a share.

Over in the construction space, Fletcher Building (ASX:FBU) fell 1% after revealing it’s weighing a potential sale of parts of its construction business following inbound interest.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for July 22 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| IS3 | I Synergy Group Ltd | 0.012 | 300% | 7,074,192 | $5,118,900 |

| MPA | Mad Paws | 0.130 | 73% | 20,653,624 | $30,468,169 |

| VR8 | Vanadium Resources | 0.036 | 57% | 17,604,059 | $12,978,713 |

| CUL | Cullen Resources | 0.006 | 50% | 162,840 | $2,773,607 |

| PAB | Patrys Limited | 0.002 | 50% | 121,448 | $2,365,810 |

| AON | Apollo Minerals Ltd | 0.007 | 40% | 4,298,989 | $4,642,284 |

| ALR | Altairminerals | 0.004 | 33% | 7,799,123 | $12,890,233 |

| SHP | South Harz Potash | 0.004 | 33% | 56,178 | $3,849,186 |

| 14D | 1414 Degrees Limited | 0.033 | 32% | 119,612 | $7,290,629 |

| AIV | Activex Limited | 0.026 | 30% | 5,941,874 | $4,310,052 |

| KGD | Kula Gold Limited | 0.009 | 29% | 12,753,484 | $6,448,776 |

| BET | Betmakers Tech Group | 0.125 | 25% | 13,417,818 | $109,863,128 |

| FHS | Freehill Mining Ltd. | 0.005 | 25% | 50,000 | $13,655,414 |

| MMR | Mec Resources | 0.005 | 25% | 155,000 | $7,399,063 |

| SP8 | Streamplay Studio | 0.009 | 21% | 1,397,252 | $8,969,552 |

| OLI | Oliver'S Real Food | 0.006 | 20% | 83,366 | $2,703,660 |

| PRM | Prominence Energy | 0.003 | 20% | 200,000 | $1,216,176 |

| SLZ | Sultan Resources Ltd | 0.006 | 20% | 444,069 | $1,157,350 |

| TFL | Tasfoods Ltd | 0.006 | 20% | 334,313 | $2,185,478 |

| NTI | Neurotech Intl | 0.025 | 19% | 2,350,715 | $22,042,060 |

| EVG | Evion Group NL | 0.032 | 19% | 1,789,175 | $11,742,839 |

| LMG | Latrobe Magnesium | 0.013 | 18% | 4,376,810 | $28,892,490 |

| LTP | Ltr Pharma Limited | 0.425 | 18% | 1,184,604 | $40,306,667 |

| EXL | Elixinol Wellness | 0.020 | 18% | 159,399 | $3,913,254 |

Affiliate marketing platform, iSynergy Group (ASX:IS3) rocketed 300% before the ASX stepped in with a speeding ticket and slapped the stock with a trading halt. IS3 says it’s now working on a response to the price query and reckons the halt should be lifted by Thursday, with nothing else to add for now.

Pet stock Mad Paws (ASX:MPA) has inked a $62 million takeover deal with US pet care giant Rover, with shareholders set to receive 14 cents a share in cash, an 87% premium to its last closing price. As part of the deal, it’s offloading its Pet Chemist business to VetPartners for around $13 million and shutting down its Sash and Waggly brands. The board’s backing the deal, and so are major holders.

Vanadium Resources (ASX:VR8) has locked in a binding two-year offtake deal with China Precious Asia for 100,000 tonnes per month of vanadium-rich magnetite direct shipping ore from its Steelpoortdrift project in South Africa. It’s a major step in moving from developer to producer, though pricing still needs to be finalised by August 30 and mining is yet to begin.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for July 22 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| NAE | New Age Exploration | 0.003 | -25% | 60,216 | $10,823,646 |

| PKO | Peako Limited | 0.002 | -20% | 4,801,244 | $3,719,355 |

| PRX | Prodigy Gold NL | 0.002 | -20% | 28,500 | $15,875,278 |

| QXR | Qx Resources Limited | 0.004 | -20% | 49,149 | $6,551,644 |

| RLG | Roolife Group Ltd | 0.004 | -20% | 3,485,000 | $7,963,906 |

| BEL | Bentley Capital Ltd | 0.009 | -18% | 5,658 | $837,407 |

| AMS | Atomos | 0.005 | -17% | 90,872 | $7,290,111 |

| SIS | Simble Solutions | 0.005 | -17% | 525,549 | $6,493,982 |

| STX | Strike Energy Ltd | 0.135 | -16% | 14,603,237 | $458,834,578 |

| BLU | Blue Energy Limited | 0.006 | -14% | 1,053,411 | $12,956,815 |

| BYH | Bryah Resources Ltd | 0.006 | -14% | 7,103,753 | $6,789,675 |

| LML | Lincoln Minerals | 0.006 | -14% | 6,850,020 | $14,717,988 |

| SPX | Spenda Limited | 0.006 | -14% | 125,000 | $32,306,508 |

| CMO | Cosmometalslimited | 0.019 | -14% | 200,000 | $7,086,984 |

| FAL | Falconmetalsltd | 0.615 | -13% | 1,714,011 | $125,670,000 |

| SFM | Santa Fe Minerals | 0.300 | -13% | 37,034 | $25,122,482 |

| HAL | Halo Technologies | 0.027 | -13% | 43,599 | $3,987,728 |

| ATS | Australis Oil & Gas | 0.007 | -13% | 110,000 | $10,544,500 |

| GTR | Gti Energy Ltd | 0.004 | -13% | 8,832,499 | $14,835,762 |

| LU7 | Lithium Universe Ltd | 0.007 | -13% | 4,524,839 | $7,487,837 |

| LMS | Litchfield Minerals | 0.110 | -12% | 14,551 | $3,630,757 |

| LOC | Locatetechnologies | 0.115 | -12% | 1,151,106 | $30,572,664 |

| BUX | Buxton Resources Ltd | 0.039 | -11% | 2,111,227 | $15,060,428 |

IN CASE YOU MISSED IT

Kingsland Minerals (ASX:KNG) is wrapping up early-stage studies at Leliyn graphite project in the NT, where it intends to build a mine and processing plant.

Core Energy Minerals (ASX:CR3) has started aircore drilling at its Cummins uranium project in South Australia.

West Coast Silver’s (ASX:WCE) latest rock chip and float sampling program has identified high grade silver and elevated copper and gold.

Cannindah Resources (ASX:CAE) has identified the potential to substantially increase the amount of copper at its Mt Cannindah project.

LAST ORDERS

ClearVue (ASX:CVP) has enlisted advisory firm Kidder Williams to review its structure and strategic growth options. The company will assess narrowing the focus of sales and marketing to the Asia Pacific market, identifying and securing qualified distributors in other markets, and optimal capital structure.

Buxton Resources (ASX:BUX) has drilled down to 404 metres of depth at the Centurion project, but was unable to complete the first hole due to ground conditions. A second hole is underway, the program has been delayed to mid-August, and the drilling contractor has taken responsibility for the costs of the abandoned hole.

Future Battery Minerals (ASX:FBM) has wrapped up a 21-hole, 1900m drilling program at the Miriam project, targeting gold at the Forrest and Canyon prospects. Results from the program won’t be available until early September, after which FBM will follow up with a second phase of drilling ahead of a mineral resource estimate.

At Stockhead, we tell it like it is. While ClearVue, Buxton Resources and Future Battery Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.