Lunch Wrap: ASX bleeds as Powell and hot Aussie CPI snuff out rate-cut hopes

Hot Aussie CPI snuffs out rate cut dreams. Pic: Getty Images

- Jerome Powell slams the brakes on rate cuts

- Hot Aussie CPI also kills cut hopes

- NZ names first female RBNZ governor

The ASX was bleeding almost 1% by Wednesday lunchtime in the east, and for once you can’t blame Wall Street alone.

Yes, New York stumbled overnight after Fed chair Jerome Powell doused everyone’s rate-cut hopes by saying there’s “no risk-free path” on rates and that equities are “fairly highly valued.”

But our own backyard threw in a nasty surprise with inflation running hotter than expected.

August CPI popped up to 3% year-on-year, hotter than the 2.9% forecast and the sharpest print since July last year.

The RBA’s trimmed mean eased a tick to 2.6%, but no one’s buying the comfort story.

Rate-cut punters who were 70% sure of a November move last week are now hanging on with just 60% odds.

As for next week? Forget it, markets give it less than one chance in ten.

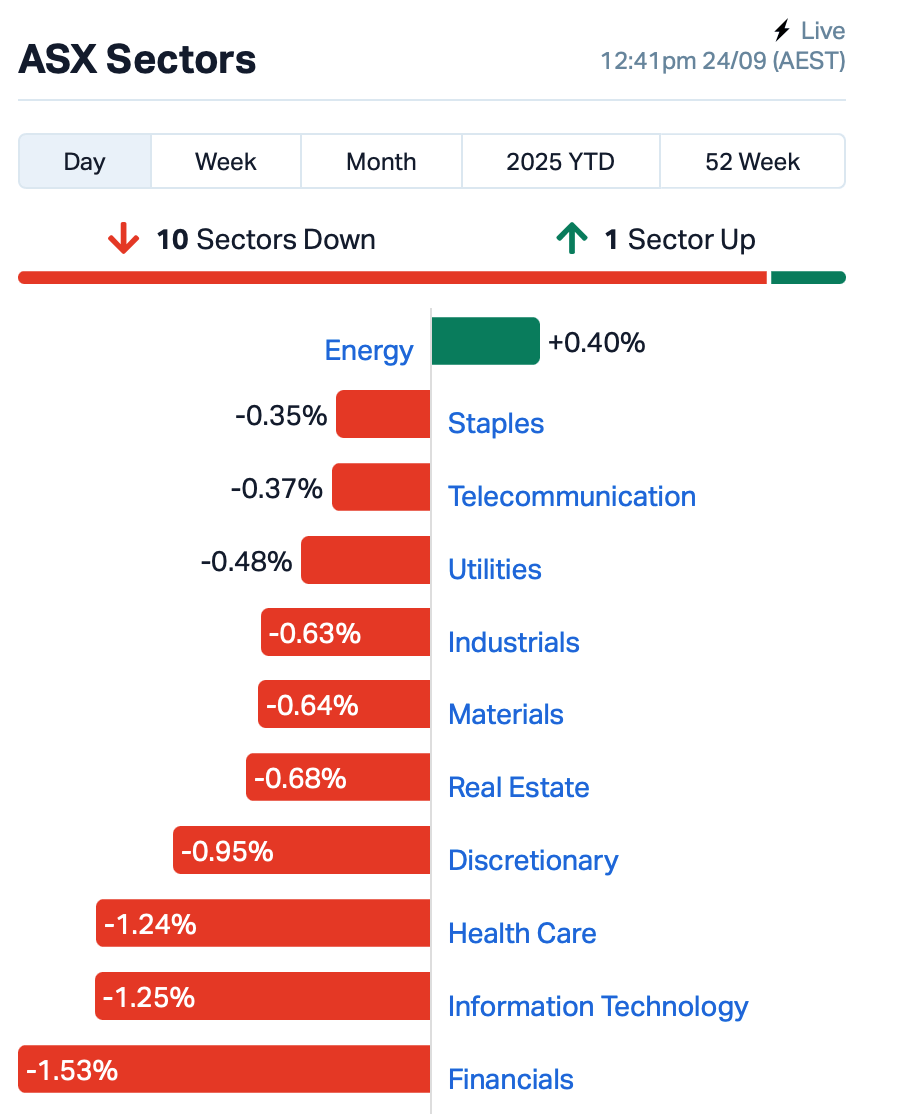

To the ASX and the pain was broad-based, but banks and tech led the charge down this morning.

In large cap news, Super Retail Group (ASX:SUL) finally closed the book on its ugly bullying and harassment case, signing off on a settlement cheque to two former staff.

The saga, which dragged the alleged relationship of ousted CEO Anthony Heraghty into the spotlight, is now over with a payout smaller than originally flagged. SUL shares were down 0.5%.

Deterra Royalties (ASX:DRR) rose 2% after flogging its non-core gold assets to Vox Royalties for US$60m.

Investors obviously liked it, though cynics might say selling the shiny stuff when gold is on a tear isn’t exactly textbook timing. Deterra’s cornerstone asset is its royalty over BHP’s Mining Area C deposits, part of the Big Australian’s 290Mtpa Pilbara iron ore operations.

And … New Zealand has finally smashed a 90-year glass ceiling, naming Anna Breman, currently deputy at Sweden’s Riksbank, as its first female governor of the Reserve Bank.

She starts in December, inheriting an economy still limping out of recession and a central bank mid-cut cycle.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| PIL | Peppermint Inv Ltd | 0.003 | 50% | 2,450,000 | $4,943,648 |

| GAS | State GAS Limited | 0.033 | 50% | 1,270,490 | $8,642,719 |

| CHM | Chimeric Therapeutic | 0.004 | 33% | 1,559,063 | $9,763,676 |

| YRL | Yandal Resources | 0.348 | 31% | 3,621,082 | $81,947,270 |

| NOV | Novatti Group Ltd | 0.038 | 31% | 4,960,951 | $16,306,586 |

| AMU | American Uranium | 0.280 | 27% | 3,119,638 | $23,565,798 |

| AT1 | Atomo Diagnostics | 0.028 | 27% | 6,495,483 | $17,823,856 |

| FUL | Fulcrum Lithium | 0.090 | 27% | 64,671 | $5,360,500 |

| ERA | Energy Resources | 0.003 | 25% | 312,834 | $810,792,482 |

| SPD | Southernpalladium | 0.840 | 24% | 344,622 | $72,191,250 |

| COY | Coppermoly Limited | 0.016 | 23% | 42,000 | $11,474,547 |

| CC9 | Chariot Corporation | 0.120 | 20% | 1,472,339 | $15,994,663 |

| CR3 | Core Energy Minerals | 0.012 | 20% | 1,656,034 | $4,191,058 |

| EM2 | Eagle Mountain | 0.006 | 20% | 849,404 | $5,675,186 |

| TEG | Triangle Energy Ltd | 0.003 | 20% | 500,000 | $5,473,085 |

| ADD | Adavale Resource Ltd | 0.037 | 19% | 7,257,488 | $8,329,234 |

| KGD | Kula Gold Limited | 0.033 | 18% | 13,193,527 | $29,025,872 |

| HAR | Harangaresources | 0.115 | 17% | 6,247,284 | $29,228,006 |

| T3D | 333D Limited | 0.140 | 17% | 736,709 | $22,662,457 |

| AUK | Aumake Limited | 0.004 | 17% | 250,000 | $9,070,076 |

| AVE | Avecho Biotech Ltd | 0.007 | 17% | 229,627 | $19,040,782 |

| BUY | Bounty Oil & Gas NL | 0.004 | 17% | 131,250 | $4,684,416 |

| IPB | IPB Petroleum Ltd | 0.007 | 17% | 20,000 | $4,238,418 |

| IPT | Impact Minerals | 0.007 | 17% | 2,026,088 | $24,679,980 |

Yandal Resources (ASX:YRL) has hit more gold at Arrakis, with fresh rock intercepts including 50m at 1.3g/t from 122m and 16m at 0.7g/t from 140m, extending the discovery 400m northwest of earlier hits. The results confirm the same style and geometry seen in prior drilling, and point to the potential for a continuous system along the 2.2km trend. Follow-up diamond drilling kicks off in October alongside infill RC and heritage surveys.

Novatti (ASX:NOV) has scored a milestone with its 57% stake in AUDC, as AUDC signs a deal with Coinbase to list AUDD — the first Australian dollar stablecoin on the platform. From 29 September, Aussies can buy, sell and send AUDD on Coinbase, backed 1:1 with the Aussie dollar and held in high-quality liquid reserves. It cements AUDD’s lead in the local stablecoin race, with Novatti keeping upside exposure through its AUDC stake now valued at $7m.

Fulcrum Lithium (ASX:FUL) has confirmed a lithium discovery at Alkali Flats, with thick claystone hits up to 175m and grades peaking at 938ppm Li. Drilling shows mineralisation stretching across at least 9km², still open in all directions, and now moving the project from exploration into appraisal. Early metallurgy is underway, Phase 3 drilling is being planned, and FUL said the scale points to real potential for a maiden resource.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MTL | Mantle Minerals Ltd | 0.001 | -50% | 528,601 | $14,466,230 |

| PRX | Prodigy Gold NL | 0.002 | -33% | 7,675,000 | $20,225,588 |

| SFG | Seafarms Group Ltd | 0.001 | -33% | 2,500 | $7,254,899 |

| ASE | Astute Metals NL | 0.015 | -29% | 10,025,973 | $14,928,286 |

| BMO | Bastion Minerals | 0.002 | -25% | 500,000 | $4,409,906 |

| CT1 | Constellation Tech | 0.002 | -25% | 50,000 | $2,949,467 |

| EEL | Enrg Elements Ltd | 0.002 | -25% | 4,092,767 | $6,507,557 |

| MOM | Moab Minerals Ltd | 0.002 | -25% | 1,001,309 | $3,749,332 |

| PAB | Patrys Limited | 0.002 | -25% | 3,685,723 | $9,167,513 |

| RBD | Restaurant Brands NZ | 2.510 | -24% | 500 | $410,455,541 |

| QEM | QEM Limited | 0.029 | -22% | 1,793,918 | $8,746,813 |

| RLG | Roolife Group Ltd | 0.006 | -20% | 25,953,419 | $14,088,717 |

| DDT | DataDot Technology | 0.004 | -20% | 131,122 | $6,054,764 |

| RDN | Raiden Resources Ltd | 0.004 | -20% | 1,055,214 | $17,254,457 |

| RFT | Rectifier Technolog | 0.004 | -20% | 88,888 | $6,909,920 |

| DMG | Dragon Mountain Gold | 0.009 | -18% | 81,395 | $4,341,388 |

| AKG | Academies Aus Grp | 0.100 | -17% | 35,731 | $15,913,736 |

| 1AD | Adalta Limited | 0.003 | -17% | 1,957,654 | $4,380,616 |

| JAY | Jayride Group | 0.005 | -17% | 3,244,581 | $8,567,335 |

| TMX | Terrain Minerals | 0.003 | -17% | 19,200,000 | $8,045,443 |

| VEN | Vintage Energy | 0.005 | -17% | 435,620 | $12,521,482 |

| AU1 | The Agency Group Aus | 0.021 | -16% | 12,786 | $10,989,415 |

| WCE | Westcoastsilver Ltd | 0.190 | -16% | 5,726,037 | $72,821,112 |

| 8CO | 8Common Limited | 0.033 | -15% | 123,679 | $8,739,701 |

| AZL | Arizona Lithium Ltd | 0.006 | -14% | 2,674,051 | $37,662,201 |

Star Entertainment Group (ASX:SGR) said its Sydney casino licence suspension has been extended until 2026, with regulator-appointed manager Nick Weeks staying in charge. CEO Steve McCann is talking up transparency, but with AUSTRAC circling and the stock stuck at 94c, Star’s hard-won licence is suddenly looking shaky too.

IN CASE YOU MISSED IT

Argent Minerals’ (ASX:ARD) new orogenic gold and porphyry copper-gold targets highlight the clear potential for a large mineralised system at West Wyalong.

Micro-X (ASX:MX1) has been granted $4.4 million by the Australian government to build and trial a world-first stroke-diagnosis-capable ambulance using its Head CT device.

Sovereign Australia AI says it can build a locally owned and hosted AI model for under $100 million and fairly compensate copyright holders.

Investigator Resources (ASX:IVR) is poised to deliver real progress at its Paris silver project with experienced and proven mining engineer Lachlan Wallace at the helm.

LAST ORDERS

Cold cathode X-ray technology company Micro-X’s (ASX:MX1) US subsidiary has been awarded an optional contract extension of up to $2.5 million by the US Department of Homeland Security for Passenger Self-Screening Checkpoint detection algorithms.

At Stockhead, we tell it like it is. While Micro-X is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.