Lunch Wrap: ASX battered as ‘Liberation Day’ looms; copper downgraded while gold hits records

The ASX has been battered on Monday so far. Picture via Getty Images

- ASX drops heavily on “Liberation Day” worries

- Gold hits record (yep, another one) as investors keep flocking to safe haven

- Big losses for iron ore, tech stocks and Qantas

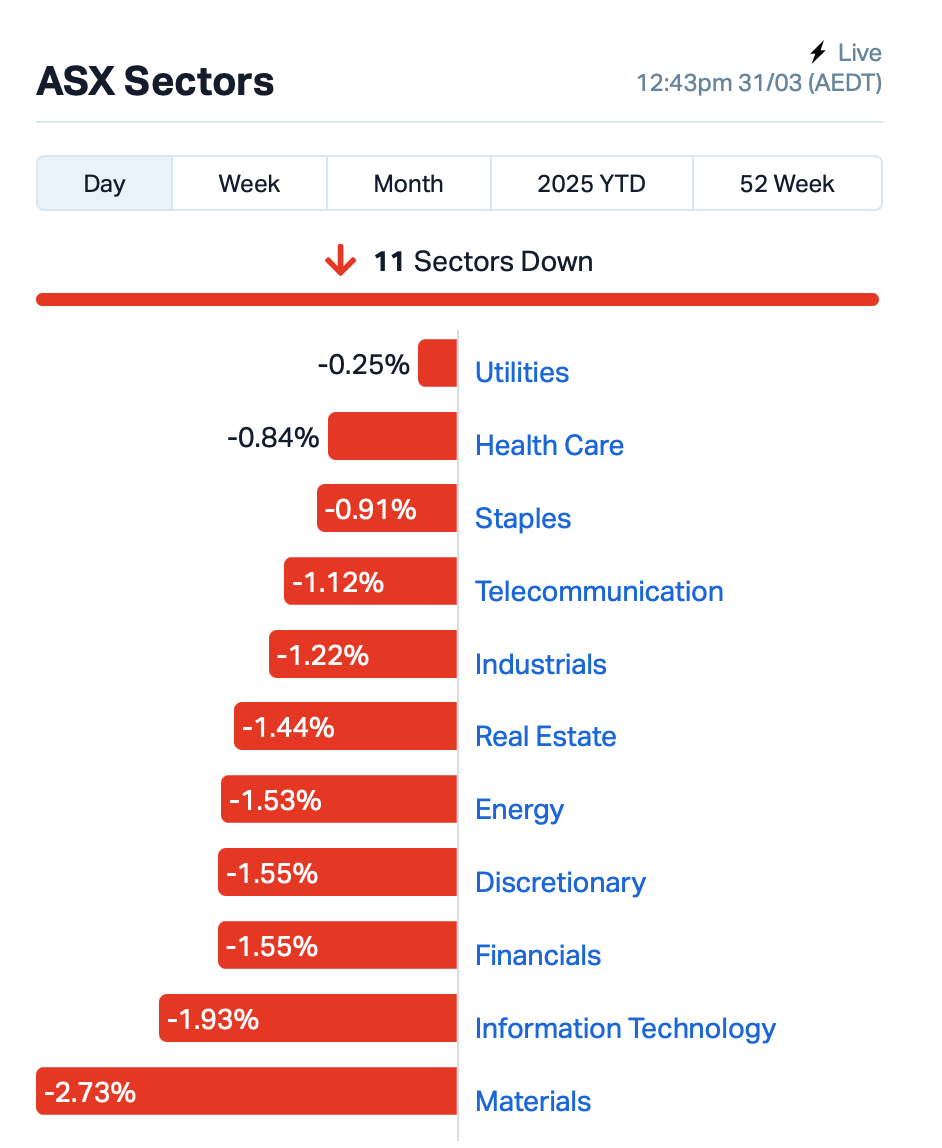

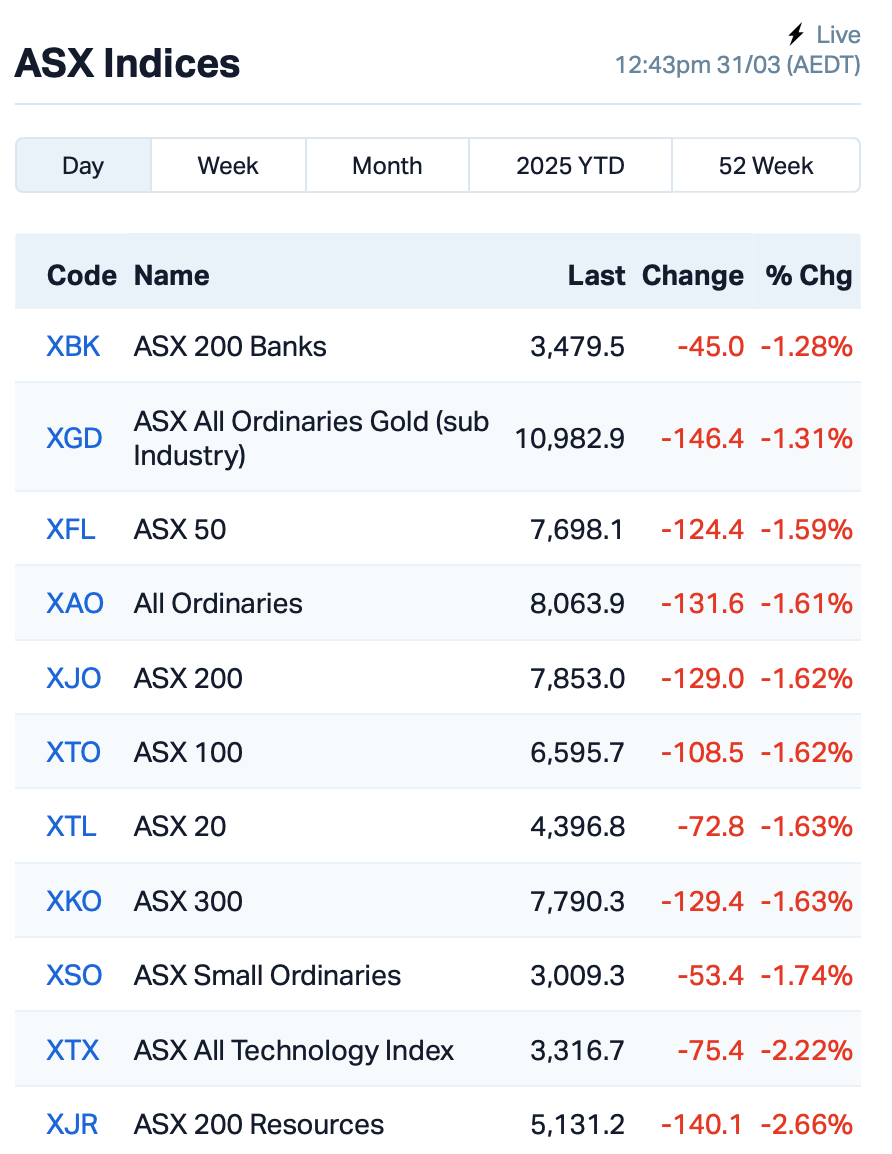

The ASX fell heavily to start the week, down by 1.5% at lunch time AEDT following a big sell-off in the US on Friday.

On Wall Street, the S&P 500 plummeted 2% and the tech-heavy Nasdaq by 2.7%.

The market was rattled by the growing uncertainty around the US’s new tariffs, set to start on Wednesday and referred to by President Trump as “Liberation Day”.

That’s caused a fair bit of nervousness, particularly as forecasts for the US economy continue to look gloomy.

Analysts at BNP Paribas also predict copper prices could fall to US$8,500 per ton by the end of Q2 2025, as demand decreases and tariffs are likely imposed sooner than expected.

The bank also cut its forecast for global copper consumption, predicting a supply surplus of 460,000 tonnes this year.

“No one wins from trade war, and clouds are gathering over the global growth outlook,” said Emmanuel Cau, at Barclays.

“Negotiations will likely start after April 2, which leads to an extended period of uncertainty about the final scope, level and timing of tariffs.”

But as markets fear unfolded, gold hit a new record on Friday as investors rushed to the safe-haven metal. The gold price was up around 2% for the week, its fourth consecutive weekly gain.

Back home, these concerns had a ripple effect on the ASX this morning.

Despite record gold prices, precious metal stocks like Newmont Corporation (ASX:NEM) couldn’t escape the selling pressure, slipping 1.75%

Iron ore giants also took big hits, and tech stocks weren’t spared either.

In large caps news, Qantas (ASX:QAN) dropped 3.5% after announcing that long-time director and advertising expert Todd Sampson would be leaving the airline.

WiseTech Global’s (ASX:WTC) stock was under pressure once again, down 0.3% as shareholders demanded the company publish the findings of its internal review into founder Richard White.

WiseTech has also appointed two new non-executive directors to its board to strengthen its governance, but the pressure to publish the review’s findings remains.

And, Downer EDI (ASX:DOW) has secured a massive $540 million contract with Powerco in New Zealand to provide electricity field services.

The contract will span up to 12 years, replacing an existing contract and providing services like maintenance and fault repairs across the North Island.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for March 31 [intraday]:

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| HCD | Hydrocarbon Dynamics | 0.003 | 50% | 1,445,248 | $2,156,219 |

| NFL | Norfolk Metals | 0.170 | 36% | 1,784,563 | $5,114,492 |

| MRQ | MRG Metals Limited | 0.004 | 14% | 750,000 | $9,542,815 |

| RLG | Roolife Group Ltd | 0.004 | 33% | 11,363,000 | $4,263,094 |

| SFG | Seafarms Group Ltd | 0.002 | 33% | 251,500 | $7,254,899 |

| DXN | DXN Limited | 0.044 | 26% | 1,357,314 | $10,454,627 |

| AKM | Aspire Mining Ltd | 0.345 | 25% | 183,216 | $139,600,171 |

| INF | Infinity Lithium | 0.025 | 25% | 1,163,121 | $9,251,842 |

| ROC | Rocketboots | 0.125 | 25% | 3,309,377 | $11,662,585 |

| ADD | Adavale Resource Ltd | 0.003 | 25% | 1,039,000 | $4,574,558 |

| DWG | Dataworks Group | 0.010 | 25% | 500,000 | $16,335,887 |

| LNR | Lanthanein Resources | 0.003 | 25% | 179,341 | $4,887,272 |

| HTG | Harvest Tech Grp Ltd | 0.016 | 23% | 671,777 | $11,538,808 |

| M2M | Mtmalcolmminesnl | 0.027 | 23% | 1,860,756 | $4,982,464 |

| IXR | Ionic Rare Earths | 0.009 | 21% | 25,028,581 | $36,668,998 |

| LGM | Legacy Minerals | 0.230 | 21% | 2,290,976 | $23,733,532 |

| BEZ | Besragoldinc | 0.054 | 20% | 523,919 | $18,697,003 |

| ADG | Adelong Gold Limited | 0.006 | 20% | 1,542 | $6,987,431 |

| PV1 | Provaris Energy Ltd | 0.013 | 18% | 505,773 | $7,624,470 |

| BTM | Breakthrough Minsltd | 0.088 | 17% | 5,556,026 | $3,589,462 |

| ALV | Alvomin | 0.070 | 17% | 222,266 | $7,029,533 |

| C7A | Clara Resources | 0.007 | 17% | 140,000 | $2,933,998 |

| RLL | Rapid Lithium Ltd | 0.004 | 17% | 37,500 | $3,734,834 |

Norfolk Metals (ASX:NFL) has locked in an earn-in agreement for the Carmen copper project in the Atacama Region. Norfolk has the chance to earn up to 100% of the project by sinking $3m into exploration over the next three years. The area’s got potential, with both oxide and sulphide copper resources, and Norfolk said it’s ready to expand it fast, especially with the push for copper in electric vehicles and renewable energy. With a huge 46.6 km2 concession, it’s close to major mines and already has solid drilling results showing high-grade copper. The company is now raising $1m in capital to support the deal.

Modular data centre specialist DXN (ASX:DXN) has executed an option to buy the land and building for SDC Darwin for $2.1 million, as part of a deal that’s been ongoing since 2021. DXN said it is already working with lenders to sort out financing and wrap it up within the next 60 days. The property and data centre have been valued at $10 million, and DXN believes this deal will increase value for shareholders.

Infinity Lithium (ASX:INF) has secured some promising exploration assets in eastern Victoria that haven’t been explored much in recent years. With gold prices strengthening, the plan is to move quickly and cost-effectively to test these assets. At the same time, Infinity is still pushing forward with its mining licence application for the San Jose lithium project in Spain. The company is aware of the downturn in the lithium market, and some delays with the San Jose permitting process.

Besra Gold (ASX:BEZ) has updated the Mineral Resource Estimate (MRE) for its Jugan Gold Project, now sitting at 13.5 million tonnes at 1.7 g/t Au for a total of 721k oz of gold. This includes 209k oz measured, 434k oz indicated, and 78k oz inferred. The new MRE adopts a hybrid mine plan with both open-pit and underground mining, compared to the previous plan that only focused on open-pit. The revised plan is more in line with local expectations, aiming to reduce environmental impact and improve land-use.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for March 31 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| BLZ | Blaze Minerals Ltd | 0.003 | -25% | 289,231 | $6,267,791 |

| BMO | Bastion Minerals | 0.003 | -25% | 5,996,665 | $3,378,899 |

| EMT | Emetals Limited | 0.003 | -25% | 500,000 | $3,400,000 |

| GGE | Grand Gulf Energy | 0.002 | -25% | 3,867,903 | $4,900,774 |

| PKO | Peako Limited | 0.003 | -25% | 295,000 | $5,950,968 |

| CHM | Chimeric Therapeutic | 0.004 | -20% | 50,000 | $8,100,749 |

| CRR | Critical Resources | 0.004 | -20% | 1,237,242 | $12,321,106 |

| FRX | Flexiroam Limited | 0.004 | -20% | 2,796,843 | $7,586,993 |

| TFL | Tasfoods Ltd | 0.004 | -20% | 5,900,249 | $2,185,478 |

| A1G | African Gold Ltd. | 0.098 | -18% | 6,771,130 | $45,803,642 |

| ORN | Orion Minerals Ltd | 0.014 | -18% | 1,989,860 | $116,457,613 |

| VML | Vital Metals Limited | 0.003 | -17% | 1,651,999 | $17,685,201 |

| ADO | Anteotech Ltd | 0.011 | -15% | 10,726,631 | $35,168,904 |

| H2G | Greenhy2 Limited | 0.011 | -15% | 2,045,497 | $7,776,394 |

| NVU | Nanoveu Limited | 0.036 | -14% | 1,013,523 | $31,182,070 |

| AYT | Austin Metals Ltd | 0.006 | -14% | 4,548,981 | $9,269,339 |

| AZL | Arizona Lithium Ltd | 0.006 | -14% | 2,229,948 | $31,932,702 |

| DGR | DGR Global Ltd | 0.006 | -14% | 185,111 | $7,305,872 |

| C1X | Cosmosexploration | 0.073 | -14% | 240,932 | $8,794,661 |

| LKY | Locksleyresources | 0.019 | -14% | 461,529 | $3,226,667 |

| BRX | Belararoxlimited | 0.260 | -13% | 527,241 | $43,189,234 |

| I88 | Infini Resources Ltd | 0.165 | -13% | 366,136 | $9,452,052 |

| GT3 | G360 Technologies | 0.034 | -13% | 600,000 | $39,371,101 |

| BNZ | Benzmining | 0.340 | -13% | 279,743 | $50,386,364 |

IN CASE YOU MISSED IT

Blue Star Helium (ASX:BNL) has spudded the Jackson 29 development well at its Galactica project in Las Animas County, Colorado. Next steps involve preparing to drill through the intermediate hole section.

Commencing trading on the US-based OTCQB is Vertex Minerals (ASX:VTX) under the ticker VTXXF. The Aussie gold company believes it’ll offer greater exposure to a network of US investors, data distributions and media partners, while also streamlining trading access for US-based investors.

Although still early days, HyTerra Limited (ASX:HYT) believes the Hoarty NE3 well at the Geneva project in Nebraska, USA, could be a “world first”, with double-digit hydrogen and helium values detected from the same well. Through its subsidiary Neutralysis, HyTerra holds a 16% earn-in interest in the venture, with further assessment and appraisal operations required to determine the well’s potential for commercial hydrogen and helium production.

Optiscan (ASX:OIL) has made some management changes, announcing a new CFO along with other executive appointments. The company’s finance manager, Darius Ooi, has been promoted to CFO, while Belinda Williamson and Jessica Ward have been appointed chief commercial officer and Optiscan’s US-based director of clinical and regulatory affairs, respectively.

Pursuit Minerals (ASX:PUR) has completed its previously announced placement of just over $1 million through issuance of 17,166,668 shares at 0.6 cents apiece. The funds will accelerate the ongoing development of Pursuit’s Rio Grande Sur lithium project in Argentina.

Also raising fresh cash is Western Yilgarn (ASX:WYX), tapping investors for $520,000 through a placement to advance exploration at its Julimar West and newly acquired New Norcia bauxite-galium projects in WA. The raise was announced at 0.36 cents a share, with strong support from sophisticated and professional investors.

At Stockhead, we tell it like it is. While Blue Star Helium, Vertex Minerals, HyTerra, Optiscan Imaging, Pursuit Minerals and Western Yilgarn are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.