Lunchtime ASX small cap wrap: Who’s feeding the pigs today?

News

News

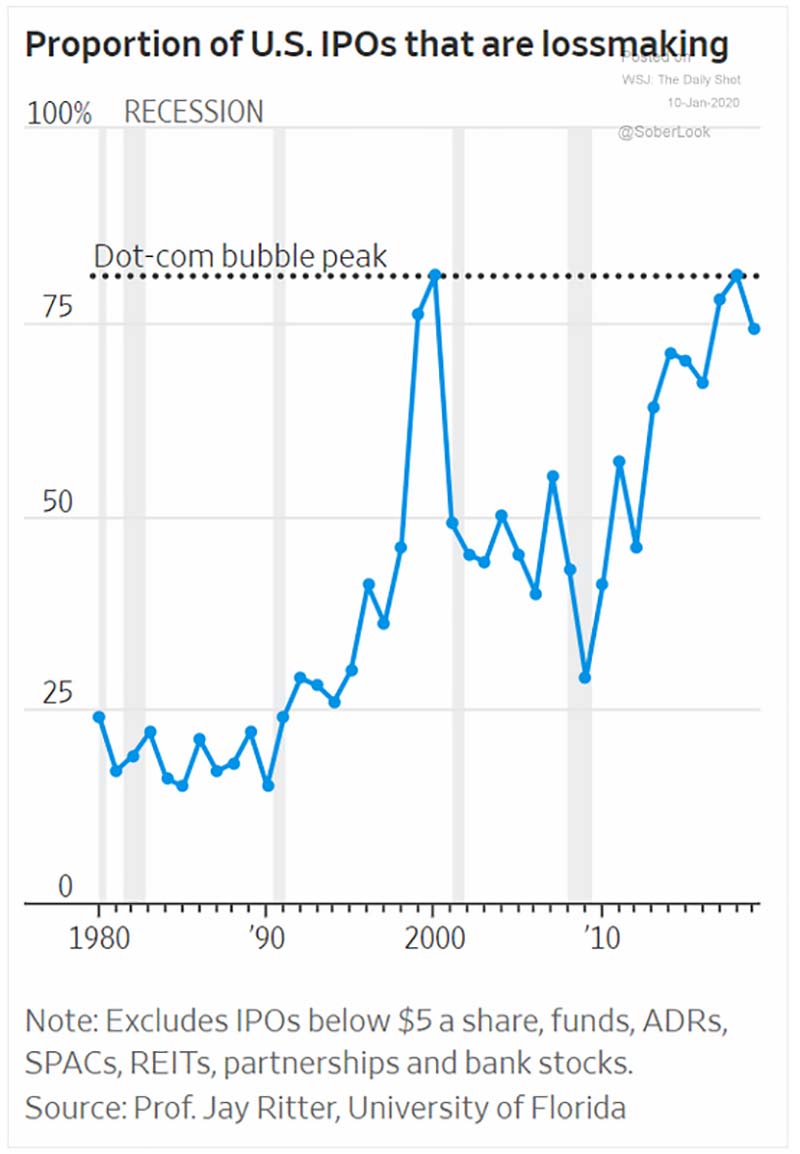

This chart, from a recent Wall Street Journal story, shows — over time — how many US IPOs are losing money:

Right now, it’s a lot. As you can see, the last time this “clear danger sign” popped up was on the brink of the dot-com collapse in 1999, says Brad Lamensdorf, portfolio manager for AdvisorShares Ranger Equity Bear ETF.

“When pigs squeal, feed them,” Lamensdorf says.

In other words, stuff the stock market — or feed the pigs — with overpriced companies while the public still has an appetite for risk.

“Over-priced IPOs usually occur toward the end of a long bull run when stocks in general become very overpriced,” Lamensdorf says.

“Why does this happen? Generally, because investors have lost their sense of reality. They are willing to buy stocks on hyped stories instead of the facts.”

Still, for now things are looking rosy. US share markets closed at record highs on Thursday, with the US-China phase one trade deal boosting investor sentiment and fresh economic data generally meeting (or exceeding) expectations. The ASX200 and Small Ord Indexes followed the US up in morning trade.

Here are all your key small cap winners and losers in morning trade for Friday, January 17:

The Biotech stock jumped sharply after announcing it had completed the necessary clinical trials and will now lodge a submission for approval to use of its Prizma device in the massive Chinese market.

“The company will shortly lodge the required documentation to the regulator and we are confident that NMPA approval will be received towards the middle of the year,” chief exec Dr Yacov Geva says.

“Following this, the provisions for our device sales and services are expected to be able to materialise quickly via our existing established in-country partners, as well as to allow for additional partnerships to be explored.”

Creso impressed the market with strong December quarter revenues of almost $2m.

For the full year 2019, unaudited revenues were $3.651m “showing strong growth in market acceptance for Creso Pharma products and successful penetration of new markets”, chief exec Dr Miri Halperin Wernli says.

“The company’s products are now sold across Europe and Oceania and will soon be available in South Africa.”

READ: Cannabis stocks guide — Here’s everything you need to know

Here are the best performing ASX small cap stocks at 12pm Friday January 17:

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Chg | Market Cap |

|---|---|---|---|---|

| EER | East Energy Resources | 0.006 | +100.00% | $19.2M |

| TYX | Tyranna Resources | 0.003 | +50.00% | $2.9M |

| XPE | Xped | 0.0015 | +50.00% | $2.6M |

| RFN | Reffind | 0.004 | +33.33% | $2.6M |

| PRM | Prominence Energy | 0.002 | +33.33% | $2.6M |

| RFR | Rafaella Resources | 0.15 | +30.43% | $10.6M |

| DVL | DorsaVi | 0.03 | +30.00% | $5.7M |

| GMV | G Medical Innovations | 0.12 | +27.78% | $47.0M |

| CPH | Creso Pharma | 0.19 | +26.67% | $33.1M |

| CI1 | Credit Intelligence | 0.03 | +25.00% | $25.4M |

| MSR | Manas Resources | 0.0025 | +25.00% | $6.6M |

| EHX | EHR Resources | 0.12 | +23.66% | $14.6M |

| SIS | Simble Solutions | 0.02 | +21.05% | $3.9M |

| CFE | Cape Lambert Resources | 0.006 | +20.00% | $6.7M |

| XPL | Xplore Wealth | 0.08 | +20.00% | $23.2M |

| AOA | Ausmon Resources | 0.003 | +20.00% | $1.9M |

| CLZ | Classic Minerals | 0.003 | +20.00% | $21.0M |

| WJA | Wameja | 0.1 | +17.28% | $115.0M |

Gold producer Pantoro (ASX:PNR) took a +15 per cent hit after releasing a shaky looking quarter report yesterday — just 9,403oz of gold was produced from the halls creek operation at a very high all in sustaining cost of $1,940/oz.

On the upside, Pantoro had $31.7m in cash and gold at the end of the quarter “and remains debt free”. Silver linings and all that.

READ: Tim Treadgold — Pantoro is trying to solve the puzzle at one of Australia’s richest goldfields

The rest of the losers column was predominantly driven by ‘no-news’, sub $10m market cap exploration plays like Moreton Resources (ASX:MRV), New Age Exploration (ASX:NAE), Inca Minerals (ASX:ICG), and Viking Mines (ASX:VKA).

Here are the worst performing ASX small cap stocks at 12pm Friday January 17:

Swipe or scroll to reveal the full table. Click headings to sort.

| Code | Name | Price | % Chg | Market Cap |

|---|---|---|---|---|

| AIV | ActivEX | 0.06 | -68.33% | $11.7M |

| MRV | Moreton Resources | 0.002 | -33.33% | $6.2M |

| NAE | New Age Exploration | 0.003 | -25.00% | $2.7M |

| ICG | Inca Minerals | 0.0015 | -25.00% | $6.1M |

| VKA | Viking Mines | 0.01 | -23.08% | $3.1M |

| ROG | Red Sky Energy | 0.002 | -20.00% | $3.3M |

| MGT | Magnetite Mines | 0.004 | -20.00% | $3.9M |

| AUH | AustChina Holdings | 0.004 | -20.00% | $6.2M |

| PDI | Predictive Discovery | 0.008 | -20.00% | $4.9M |

| LRS | Latin Resources | 0.004 | -20.00% | $1.4M |

| DLC | Delecta | 0.004 | -20.00% | $3.5M |

| GTR | GTI Resources | 0.009 | -18.18% | $4.2M |

| RVR | Red River Resources | 0.12 | -17.24% | $61.9M |

| NWE | Norwest Energy | 0.005 | -16.67% | $23.2M |

| BUY | Bounty Oil & Gas | 0.005 | -16.67% | $4.8M |

| WEC | White Energy Co | 0.07 | -16.67% | $38.7M |

| TRT | Todd River Resources | 0.02 | -16.00% | $5.2M |

| PNR | Pantoro | 0.11 | -15.38% | $129.4M |