Kick Back: The biggest stories you might have missed on Stockhead this week

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Okay, it’s been a long 12 months stuck at home and eventually, boredom wins.

Another day, another round of lockdown news. The Aussies being rubbish at cricket. Politicians behaving badly.

Yawn.

So eventually you feel maybe it’s time check out one or two of those truther and anti-vaxxer videos our – let’s call them “less tech-savvy” – friends and mums keep telling us we need to watch NOW.

And that’s all it takes. Suddenly, the veil lifts and everything makes sense. There’s a motive behind everything and anything that happens and it’s all THE MAN. The ONE PER CENT.

And hoo-boy, there really is nothing so wild that you can’t Google all the affirmation you’ll ever need for it.

Except there is. This:

Apparently, the Ever Given, a 400m long, 200,000 ton cargo ship, got knocked aground by 40 knot winds while passing through the Suez Canal. But surely, given the importance of that shipping canal, if there were even a hint of such a thing happening, the people that run the Suez Canal wouldn’t let any of the 50-odd ships a day that pass through it even try?

In fact, in 2015, they didn’t. As 52 ships waited to enter on February 11, 2015, they were told to keep waiting. Winds had reached, coincidentally, 40 knots.

So yes, it can happen. Relatively mild winds – by ocean-faring standards – can toss a massive ship around. There isn’t a lot of room for error in the Suez Canal.

There is, however, enough room for a massive ship to execute this beautiful manoeuvre:

Which the Ever Given did, just before entering the skinny bit of the Suez Canal.

So, picture this. A week ago, you rang your Ladbrokes broker and asked “what odds will you give me that a cargo ship runs aground in the Suez in the next seven days”?

Yes, it has happened in the past, a couple of times. But literally, a couple of times – and 19,000 ships passed through in 2020. So you could still rightly expect something juicy from your broker.

Maybe worth a tenner. But then, you ask:

“How about a bit of a multiplier? What’s your offer on that same ship drawing a giant dick in the sea just before it gets wedged?”

You’d be told you’re having a laff. But sure, it’s your money and bad gambling habit. However much you want to lose on it, sir.

What we’re trying to establish here is the chance of the capatin of a ship drawing a giant dick in the ocean, then wedging it across the Suez Canal. A question which no one seems to be trying to answer because you can Google and get answers for “Donald Trump is a shape-shifting lizard“, yet not “Ever Given grounded on purpose”?

Okay, it’s a stretch. But is anything an actual stretch in 2021?

If you’re writing the script for the next James Bond movie, you just got the ultimate “evil villain trying to manipulate global markets” move handed to you on a silver platter, along with a bottle of Dom Perignon ’53 above the temperature of 38°F.

Surely it’s more conceivable – and interesting – than buying all the water for the day when the world runs out of water?

Well, it was a windy day. But oil prices did spike 6% on the news. Twelve per cent of global trade moves through that canal; $US9 billion worth of goods are being disrupted every day. So maybe follow the money, just for laffs.

And hey, ship captains are people too, who also get pissed off at their employers.

Come on all you truthers and anti-vaxxers. Lift your game.

Sigh. Back to reality, where apart from $US9 billion a day trade disruptions, the biggest news this week was a jobs board listed on the ASX.

IPO Watch: Airtasker is now ASX listed; shares gain 70pc on debut

Born in 2012, Airtasker is a platform connecting people and businesses needing tasks to be done with people that can do them. That, on a user base of 4.3 million people, equates to a job every 17 seconds, according to Airtasker.

And it helped ART raise $83 million at 65 cents a share, which rose to $1.10 on debut, which rose to as high as $1.90 on Wednesday.

It’s settling around the $1.50 mark, despite an absolutely dire effort by local redditors to lift it “to Saturn”, the saddest result of which was to claim an actual headline in an actually very well-regarded financial publication.

So what happens in the next five years? Is the whole online odd-jobs market one to get excited about?

There’s not a lot of competition in Australia. Hipages debuted at $2.45 late last year and hasn’t exactly lit up the sector it solely operated in.

(Hipages is, however, a News Corp digital asset and “News Corp” and “digital savvy” go together like “salmon” and “thickshake”)

Ironically, the best pop Hipages has had recently came on the day Airtasker debuted.

Regardless, don’t listen to us, because you can actually hear from Airtasker CEO himself, Tim Fung, about what happens in the next 5-10 years. He spoke to Nick Sundich the day after the IPO.

And if you prefer the talky-talk version to the ready-read one, we then hauled Tim into the studio for a longer chat with Dr Nigel Finch. Settle in.

Or here to listen with Apple podcasts, here for Spotify or here for Google Podcasts.

The ASX biggest IPO of 2020 is back under its IPO price. So is Nuix a buy or bust?

On the same day Airtasker made its ballyhooed debut, the last similarly ballyhooed debut slipped below its IPO price.

The share price of forensic data company Nuix (ASX:NXL) went into a tailspin in February after it admitted it had missed its prospectus forecast. It’s dropped more than 40 per cent since.

Eddy Sunarto asked investment adviser Adam Dawes, of Shaw & Partners, what went wrong. And obviously, because this is what we do, is Nuix a buy?

The tl;dr version – not much, and not yet.

But stick around and you’ll hear Dawes remind us of Nuix’s impressive Big Name client list, the globally recognised scandals its data forensics service has helped uncover, and why Nuix likes the end of half-years so much more than the beginnings.

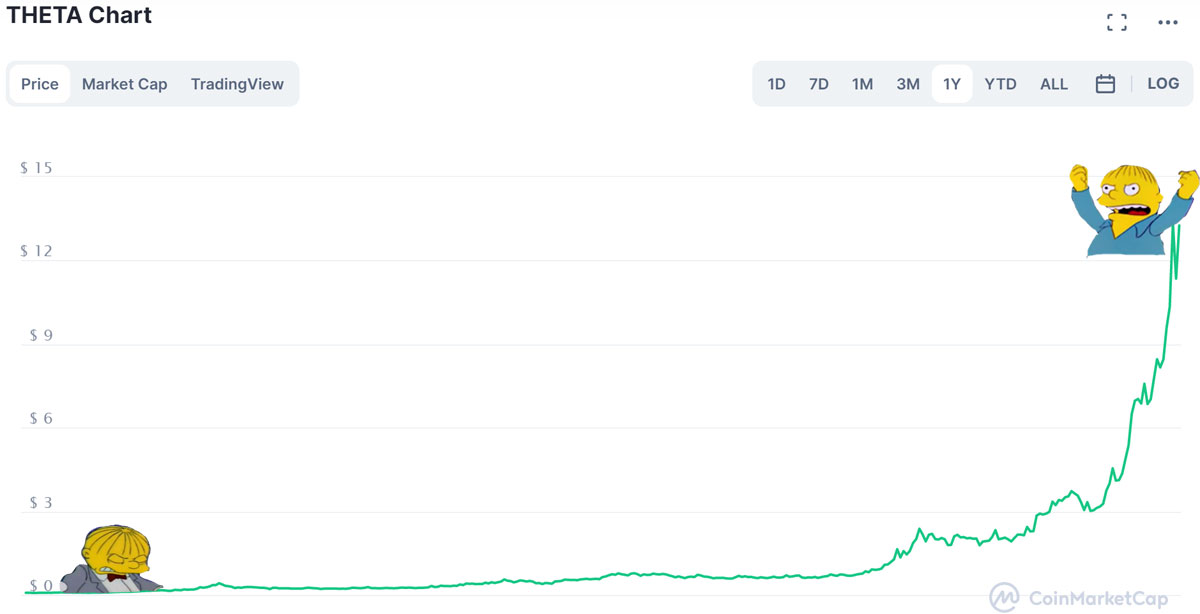

Theta riches: Young Aussie dad turns $17k crypto investment into $1.4m

Props to Grave. In April last year he “researched the shit out of” token Theta and after liking what he saw, the 23-year-old Aussie gamer bought 17,000 bucks worth.

It cost Grave… his girlfriend? Six or seven weeks later, she dumped him for “wasting my money on stupid fake internet currencies.”

A year later, Grave’s $17K investment was worth $1.180 mill. Sorry, Grave’s ex:

Grave spoke to Derek Rose about what that meant to him, besides a $300K new car, and why he took that plunge last year. For seconds, he’s now holding out for $1000 Thetas.

“I wish I’d bought more!” he tweeted last Saturday. But he didn’t need to, because another 50pc pop since then means Grave just made about $650,000 this week.

In other crypto news, we have it all in our new crypto news section. Say hello to Cryptohead.

Bitcoin $US288,000 by December? Why one expert is a ‘massive bull’

This is not investing advice. Please, for the love of everything holy, and your children’s future, understand that this is not investing advice.

It is, however, an enticing headline. We get that.

And it’s based – so far – on a prediction made by Plan B, who crypto fans know as the forecaster who said in March 2019 that “one or two years after the halving, in 2020 or 2021”, Bitcoin’s value should be around $US55,000.

Sound familiar?

Here’s Plan B’s case for Bitcoin to average $US288,000 ($370,000) during this four-year cycle. That means it will have to hit that price by about, ooh… December?

December close: $28,992

January close: $33,141

February close: $45,240

March 17 price: $55,000

We are only 3.5 months into the #bitcoin bull market. IMO BTC will not stop at $100K and will continue to S2FX $288K average price level (ATH will be higher). pic.twitter.com/skS6a7pepu— PlanB (@100trillionUSD) March 17, 2021

well 288 is the average for this 4yr cycle, so I guessed that we should be somewhere at that level by December this year, otherwise it will be difficult to keep the 4yr average at 288. That is the only reason I mention Dec 2021 frequently.

— PlanB (@100trillionUSD) March 17, 2021

Just remember, Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Perennial’s Brendan Lyons on the ‘new investment window’ in Australian capital markets

If you’re not paying attention to the IPO market, you probably should be.

There’s been about 20 new listings on the ASX already this year, after a Q4 surge which saw 47 companies hit the boards in the December quarter alone.

With IPO markets running hot, Stockhead got some front-row insights from Brendan Lyons — portfolio manager of Perennial’s second Private to Public Opportunities (PPP) Fund.

Lyon’s job is to provide capital and expertise for what he calls the LPO (last private offer), for private companies with established business models that are looking to public markets to fund their next stage of growth.

He says it’s a growing phase of Australian capital markets, with more companies choosing to stay private for longer to ensure that when they do list, they’re positioned to make the most of it.

Perennial now assesses around 700 companies a year looking to raise private funds. And if that’s anything to go by, investors should be on the lookout for the next ASX success story on its way to market.

The Secret Broker: As one door closes and whacks you on the arse, another one opens

Everything new is old.

Even these new-looking guys, who’ve just raised $50 million for their startup, Pipe:

That’s Pipe as in Pipe Dream. The lads’ big idea is to help fund companies’ cash flows which they then securitise and sell on to other players to hold.

So yeah, not a new idea at all. In fact, it’s kind of like that idea that Lex Greensill made billions off after founding Greensill Capital Australia. Made, then lost when GCA went bust after Credit Suisse froze four investment funds that had bought about $13 billion worth of its debt packages.

Anyway, good luck to the fresh faces at Pipe, says The Secret Broker. If one thing’s guaranteed, it’s that someone will win a heap of cash, eventually.

And TSB has a fair idea of who will win, because he remembers the difference between getting entertained in a corporate box at Lord’s Cricket Ground by start-up lawyers, and getting entertained in a corporate box at Lord’s Cricket Ground by wind-up lawyers…

Guy on Rocks: Gold selloff overshoots making juniors look attractive again

At what stage should you buy gold? It’s a curly one, especially when it seems like you’re the only person not making $650,000 a week out of crypto.

Harder – when the price over the past two years isn’t exactly one-way traffic:

Trent Primmer, head of trading at corporate advisory firm Barclay Pearce, has a simple answer, and it goes something like this:

“You should always have some gold exposure in your portfolio.”

So if you haven’t, get some. Here’s why Primmer says there’s no such thing as “a perfect entry price into something like gold”.

But wait, there’s more. Guy le Page is not only a stockbroker, he’s a former geologist. So unlike most gold holders, he’s actually, literally held gold.

He sees the recent selloff as an opportunity to buy into some juniors. Juniors such as, say, Lefroy Exploration.

Ack. Sorry if this is the first you’ve come across Guy on Rocks this week. Because if you read it on Tuesday when it came out, and bought a chunk of Lefroy, you be about 70 per cent up today.

That’s what pulling out cores with gold in them like this can do to a share price:

Guy on Rocks, now a Tuesday special. If you don’t want to miss it, and haven’t subscribed to our morning newsletter… why? Here’s the link.

ESG investing: Australia still ‘two years behind the curve’, says global funds network

We’re not saying we live in a backwater down here at the bottom of the world, but we are just a little slow on the uptake. Let’s just blame geography and leave it at that.

Soon enough, we’ll be investing like mad things in ESG, just like they have been for years in the UK and Europe.

(Psst. ESG stands for Environmental, Social and Governance and relates to investment strategies based on stocks and sectors that meet a standardised set of criteria around issues like environmental impact and corporate governance.)

Or, as network platform Calastone calls ESG investments, an “undisputed success story”. Hard to argue with when in the past two years, $US84 out of every $US100 of new funds flowing into the Calastone network was allocated to funds that meet globally recognised standards for ESG.

If you need that in billions, about $US15.1 billion out of total inflows of $US18.1bn.

We’ll get there. And here’s what you need to know about when that might happen, and who’s already positioned to take your money.

As ‘uniquely hostile’ Australia readies its EV tax, imports jump a whopping 500 per cent

Speaking of future-fearing rubes, did you know the Australian government thinks it might be a good idea to force people who collect free power from the – ugh – sun, to pay for the privilege of supplying it to the national grid so someone else can sell it?

That won’t surprise you if you already know that driving an EV in Victoria will soon cost you 2.5 cents per kilometre. The “EV equaliser tax” comes into effect on July 1.

“Uniquely hostile”, is what Electric Vehicle Council chief executive, Behyad Jafari, calls it, and don’t think the rest of the world doesn’t know about it.

The managing director of Volkswagen in Australia recently told the Sydney Morning Herald he was struggling to convince the Germany-based company’s head office to ship more EVs to Australia. But he’ll have to do a better job, because suddenly imports of Teslas and other EVs soared nearly 500 per cent year on year in February to almost $125m.

What is strange is we love nothing more than a good battery stock. Fun fact: There have been a dozen +11-bagger ASX battery metal stocks over the past 12 months.

If you’re still waiting to get on board that train, here’s your updated Table of Riches Gone Begging:

| CODE | COMPANY | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | PRICE | MARKET CAP |

|---|---|---|---|---|---|---|---|

| RNU | Renascor Resources | 59 | 259 | 1067 | 2700 | 0.14 | $ 208,213,729.25 |

| AVL | Aust Vanadium | 37 | 8 | 63 | 225 | 0.026 | $ 76,184,129.16 |

| SYA | Sayona Mining | 32 | 11 | 356 | 486 | 0.041 | $ 151,504,497.96 |

| VRC | Volt Resources | 27 | 12 | 27 | 217 | 0.019 | $ 45,226,233.92 |

| SBR | Sabre Resources | 25 | -29 | -58 | 400 | 0.005 | $ 8,415,318.25 |

| PUR | Pursuit Minerals | 25 | 49 | 483 | 2619 | 0.076 | $ 50,019,006.36 |

| LPD | Lepidico | 23 | 13 | 200 | 291 | 0.027 | $ 134,885,443.97 |

| ASN | Anson Resources | 21 | 18 | 421 | 450 | 0.099 | $ 84,916,475.99 |

| PRL | Province Resources | 20 | 95 | 506 | 3296 | 0.15 | $ 125,525,506.03 |

| PAM | Pan Asia Metals | 18 | 0 | 0.165 | $ 8,412,737.12 | ||

| PGM | Platina Resources | 18 | 10 | -22 | 342 | 0.053 | $ 20,562,678.16 |

| ALY | Alchemy Resource | 17 | -22 | -26 | 59 | 0.014 | $ 10,083,651.80 |

| IXR | Ionic Rare Earths | 17 | 6 | 489 | 833 | 0.056 | $ 181,738,772.30 |

| AZS | Azure Minerals | 16 | 6 | 61 | 446 | 0.355 | $ 112,451,288.17 |

| PLL | Piedmont Lithium | 14 | 48 | 603 | 1575 | 1.06 | $ 1,516,215,025.26 |

| AVZ | AVZ Minerals | 14 | 8 | 233 | 347 | 0.21 | $ 621,385,512.63 |

| IPT | Impact Minerals | 13 | 13 | 4 | 420 | 0.026 | $ 44,522,161.03 |

| AOU | Auroch Minerals | 13 | -12 | 185 | 626 | 0.225 | $ 60,577,574.20 |

| JRV | Jervois Mining | 12 | 4 | 55 | 264 | 0.51 | $ 409,168,425.30 |

| SRI | Sipa Resources | 11 | 3 | -25 | 50 | 0.06 | $ 10,491,813.53 |

| RXL | Rox Resources | 11 | 14 | -33 | 156 | 0.041 | $ 79,943,310.06 |

| AUZ | Australian Mines | 11 | -9 | 24 | 133 | 0.021 | $ 87,151,984.70 |

| CHN | Chalice Mining | 10 | 14 | 178 | 3042 | 4.87 | $ 1,649,580,952.23 |

| CNJ | Conico | 10 | 6 | 120 | 560 | 0.033 | $ 29,122,756.67 |

| MOH | Moho Resources | 10 | 13 | -29 | 59 | 0.089 | $ 8,966,015.72 |

| VR8 | Vanadium Resources | 10 | -2 | 61 | 275 | 0.045 | $ 16,468,207.27 |

| COB | Cobalt Blue | 8 | 8 | 306 | 370 | 0.39 | $ 99,398,738.80 |

| RLC | Reedy Lagoon Corp. | 8 | -4 | 100 | 1200 | 0.026 | $ 12,682,812.17 |

| VUL | Vulcan Energy | 8 | -6 | 612 | 3540 | 6.37 | $ 694,219,093.76 |

| SLZ | Sultan Resources | 8 | 0 | -5 | 186 | 0.2 | $ 13,559,205.86 |

| ARL | Ardea Resources | 8 | -4 | 14 | 173 | 0.545 | $ 67,027,055.55 |

| ARN | Aldoro Resources | 8 | -22 | 100 | 159 | 0.21 | $ 14,296,968.63 |

| JRL | Jindalee Resources | 7 | -1 | 288 | 418 | 1.63 | $ 76,110,662.88 |

| GLN | Galan Lithium | 7 | 17 | 225 | 215 | 0.52 | $ 112,915,082.32 |

| TMT | Technology Metals | 7 | 10 | 42 | 436 | 0.375 | $ 56,115,521.25 |

| QXR | Qx Resources Limited | 7 | -11 | 7 | 14 | 0.016 | $ 8,540,197.15 |

| EMH | European Metals Hldg | 7 | 31 | 309 | 1285 | 1.8 | $ 228,124,098.40 |

| LIT | Lithium Australia NL | 6 | -15 | 132 | 245 | 0.13 | $ 116,699,627.33 |

| TNG | TNG Limited | 6 | 9 | 8 | 118 | 0.105 | $ 131,197,189.20 |

| INF | Infinity Lithium | 6 | -5 | 100 | 517 | 0.18 | $ 76,470,098.57 |

| ARR | American Rare Earths | 5 | 2 | 185 | 782 | 0.097 | $ 33,129,715.95 |

| TLG | Talga Group | 5 | -10 | 80 | 567 | 1.37 | $ 430,586,466.52 |

| AQD | Ausquest Limited | 5 | -16 | -30 | 163 | 0.021 | $ 16,573,986.43 |

| NTU | Northern Min | 5 | -14 | 27 | 62 | 0.042 | $ 193,653,718.64 |

| RFR | Rafaella Resources | 5 | 44 | 44 | 92 | 0.115 | $ 14,069,612.81 |

| LEG | Legend Mining | 4 | 4 | -19 | 128 | 0.13 | $ 344,391,965.13 |

| REE | Rarex Limited | 4 | 13 | 83 | 900 | 0.13 | $ 56,373,616.52 |

| WKT | Walkabout Resources | 3 | -9 | -33 | 7 | 0.15 | $ 50,624,378.53 |

| GME | GME Resources | 3 | 8 | 32 | 25 | 0.066 | $ 36,753,217.38 |

| EUR | European Lithium | 3 | 8 | 17 | 75 | 0.07 | $ 62,959,087.78 |

| PSC | Prospect Res | 3 | 6 | -3 | 94 | 0.175 | $ 58,115,814.93 |

| HWK | Hawkstone Mng | 3 | -3 | 160 | 680 | 0.039 | $ 65,377,065.60 |

| ARU | Arafura Resource | 3 | -15 | 153 | 277 | 0.2 | $ 228,302,248.79 |

| BSX | Blackstone | 2 | -10 | 6 | 469 | 0.455 | $ 153,611,129.30 |

| FFX | Firefinch | 2 | -8 | 48 | 330 | 0.23 | $ 175,948,466.63 |

| VML | Vital Metals Limited | 1 | 72 | 236 | 1133 | 0.074 | $ 200,602,096.65 |

| ORE | Orocobre Limited | 1 | -5 | 73 | 136 | 4.83 | $ 1,696,699,294.96 |

| CXO | Core Lithium | 1 | 1 | 456 | 1071 | 0.22 | $ 270,023,968.42 |

| GXY | Galaxy Resources | 1 | -8 | 56 | 209 | 2.42 | $ 1,268,265,058.84 |

| OZL | OZ Minerals | 1 | 8 | 58 | 267 | 22.89 | $ 7,630,560,615.00 |

| LYC | Lynas Rare Earths | 1 | 10 | 154 | 468 | 6.39 | $ 5,640,751,904.54 |

| AML | Aeon Metals . | 0 | -5 | -31 | 59 | 0.1 | $ 67,756,972.70 |

| AJM | Altura Mining | 0 | 0 | 0 | 133 | 0.07 | $ 209,037,029.25 |

| ATM | Aneka Tambang | 0 | 0 | 0 | 0 | 1 | $ 1,303,649.00 |

| ADV | Ardiden | 0 | 6 | -37 | 850 | 0.019 | $ 45,030,680.81 |

| BSM | Bass Metals | 0 | 17 | 133 | 133 | 0.007 | $ 28,151,730.15 |

| BEM | Blackearth Minerals | 0 | -3 | 241 | 509 | 0.14 | $ 24,700,892.54 |

| CZN | Corazon | 0 | -4 | 10 | 42 | 0.055 | $ 10,964,923.78 |

| DEV | Devex Resources | 0 | -4 | -30 | 532 | 0.215 | $ 62,183,844.80 |

| ESS | Essential Metals | 0 | -4 | 19 | 44 | 0.115 | $ 24,098,076.00 |

| ESR | Estrella Res | 0 | -10 | 385 | 800 | 0.063 | $ 59,025,833.17 |

| GED | Golden Deeps | 0 | -17 | -41 | 11 | 0.01 | $ 7,748,514.40 |

| GBR | Greatbould Resources | 0 | -3 | -15 | 55 | 0.04 | $ 9,402,988.52 |

| HNR | Hannans | 0 | 7 | 14 | 167 | 0.008 | $ 18,879,817.54 |

| HXG | Hexagon Energy | 0 | 17 | 81 | 218 | 0.105 | $ 30,120,532.70 |

| INR | Ioneer | 0 | -8 | 300 | 419 | 0.42 | $ 805,980,702.78 |

| LML | Lincoln Minerals | 0 | 0 | 0 | 167 | 0.008 | $ 4,599,869.49 |

| LPI | Lithium Pwr Int | 0 | -4 | 23 | 80 | 0.27 | $ 82,421,323.33 |

| MAN | Mandrake Res | 0 | 77 | 104 | 1015 | 0.145 | $ 48,051,376.24 |

| POS | Poseidon Nick | 0 | -15 | 11 | 131 | 0.06 | $ 171,374,305.97 |

| S2R | S2 Resources | 0 | -3 | -31 | 89 | 0.17 | $ 51,957,044.54 |

| CTM | Centaurus Metals | -1 | -10 | 63 | 778 | 0.79 | $ 260,276,846.77 |

| MCR | Mincor Resources NL | -1 | -3 | 6 | 97 | 0.995 | $ 434,021,135.13 |

| PLS | Pilbara Min | -2 | -4 | 181 | 565 | 1.03 | $ 3,085,193,848.08 |

| CLQ | Clean Teq Hldgs | -2 | -11 | -16 | 104 | 0.255 | $ 230,344,779.08 |

| BOA | Boadicea Resources | -2 | 0 | 2 | 34 | 0.235 | $ 14,604,250.31 |

| SGQ | St George Min | -2 | -9 | -22 | 30 | 0.09 | $ 44,815,360.46 |

| IGO | IGO Limited | -2 | -6 | 38 | 86 | 6.26 | $ 4,816,223,290.68 |

| CLA | Celsius Resource | -2 | -2 | 34 | 617 | 0.043 | $ 39,609,813.65 |

| VMC | Venus Metals Cor | -3 | -12 | -26 | 42 | 0.185 | $ 27,949,556.36 |

| PAN | Panoramic Resources | -4 | -10 | 30 | 15 | 0.13 | $ 276,873,390.54 |

| G88 | Golden Mile Res | -4 | 14 | -28 | 67 | 0.05 | $ 7,228,953.06 |

| FGR | First Graphene | -4 | -2 | 92 | 170 | 0.24 | $ 128,531,919.12 |

| STK | Strickland Metals | -4 | -8 | -61 | 140 | 0.024 | $ 10,107,636.50 |

| MLX | Metals X Limited | -4 | 5 | 185 | 317 | 0.225 | $ 213,207,525.75 |

| BUX | Buxton Resources | -4 | 3 | -44 | 22 | 0.067 | $ 9,115,713.94 |

| BAR | Barra Resources | -5 | -13 | -5 | 110 | 0.021 | $ 14,229,770.12 |

| AGY | Argosy Minerals | -5 | -13 | 69 | 233 | 0.1 | $ 125,027,170.40 |

| MNS | Magnis Energy Tech | -5 | 3 | 50 | 466 | 0.3 | $ 259,877,864.83 |

| MIN | Mineral Resources. | -5 | 1 | 49 | 191 | 38.13 | $ 7,370,140,097.10 |

| NMT | Neometals | -5 | -4 | 103 | 217 | 0.375 | $ 223,594,019.06 |

| SYR | Syrah Resources | -5 | -3 | 136 | 647 | 1.12 | $ 577,346,435.04 |

| TKL | Traka Resources | -6 | -19 | -19 | 328 | 0.017 | $ 8,609,906.16 |

| TON | Triton Min | -6 | -9 | -9 | 200 | 0.048 | $ 55,588,935.28 |

| HAS | Hastings Tech Met | -6 | -20 | 60 | 244 | 0.19 | $ 294,288,096.38 |

| LTR | Liontown Resources | -6 | 13 | 131 | 562 | 0.45 | $ 825,442,955.16 |

| QPM | Queensland Pacific | -6 | 0 | 340 | 633 | 0.088 | $ 87,697,072.05 |

| MRC | Mineral Commodities | -6 | -12 | 0 | 95 | 0.36 | $ 182,496,628.40 |

| NIC | Nickel Mines Limited | -7 | 2 | 90 | 300 | 1.33 | $ 3,495,890,380.89 |

| LKE | Lake Resources | -7 | -8 | 442 | 1021 | 0.325 | $ 339,879,687.39 |

| BHP | BHP Group Limited | -7 | -6 | 18 | 63 | 44.45 | $ 132,268,727,590.60 |

| GAL | Galileo Mining | -8 | -33 | -15 | 92 | 0.23 | $ 33,628,783.18 |

| AXE | Archer Materials | -8 | 22 | 88 | 474 | 0.975 | $ 222,547,497.81 |

| PNN | PepinNini Minerals | -12 | -16 | 136 | 88 | 0.335 | $ 13,520,301.93 |

| BKT | Black Rock Mining | -14 | -29 | 136 | 353 | 0.125 | $ 89,503,285.50 |

| ADD | Adavale Resource | -14 | -31 | 23 | 105 | 0.043 | $ 12,848,970.47 |

| EGR | Ecograf Limited | -18 | -6 | 320 | 1067 | 0.63 | $ 307,113,834.83 |

| CWX | Carawine Resources | -20 | 40 | 14 | 93 | 0.28 | $ 30,489,172.56 |

| MLS | Metals Australia | -33 | 0 | -33 | 100 | 0.002 | $ 8,381,807.15 |

You’re welcome.

BONUS ITEM: News just in – looks like Fintwit has caught the drift:

Anyone tried zooming in on the Evergreen? pic.twitter.com/rd2k3Jb5Qx

— Fintwit (@fintwit_news) March 25, 2021

THEY DREW A DICK AND BALLS. Have a great weekend.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.