Kick Back: The biggest stories you might have missed on Stockhead this week

It's been real. Picture: Getty Images

Ding, dong. 2016-2020 is finally over. All hail President Not Trump.

Joe Biden’s Inauguration Day felt more like Woodstock than any hint of back to normal business. But amongst the poetry and Paris Accord promises, the Nasdaq climbed through to Wednesday, and kept climbing.

The S&P500 climbed to Wednesday and kept climbing.

And the Dow Jones climbed to Wednesday and kept climbing.

There’s been a lot of talk about how stonks have fared under Trump. Apparently, not as well as under Obama, and not nearly as well as under Clinton.

It’s true. The S&P made 126 new all-time highs under The Don (total growth +67.8%). That’s slightly more than Obama’s 123 (+74.8%), but still lower than Clinton’s… 263 (78.4%).

So he finished third. And delivered – in “cash made” terms – comfortably the best Republican result for 100 years.

Annualised return is probably the most reliable measure, where you’ll see Clinton bringing in 15.9%, Obama 12.1% and Trump 11.8%.

Then you have to go back to Reagan (11.3%) for the number 4 spot.

There’s a case for Obama getting a leg up because he came in at GFC lows, but broadly speaking, the US has been in the era of making the most money ever since 2001.

The moral of the story? Presidents don’t make money. Money makes money.

Here in Australia, billionaire iron ore champ Andrew Twiggy Forrest had an epiphany in 2020. After travelling the world with his exec team, he came home and told everyone his company is going green.

This is the real big deal this week. Twiggy isn’t going to stop mining iron ore though.

“The answer,” he told the audience at the ABC Boyer Lecture, “is iron ore and steel – made using, zero-emissions energy.”

In particular, made using hydrogen. It’s a big, interesting speech. In fact, it’s full of the kind of stuff that in the US would present as a set-up for a run for office. You can read it in full here or watch the ABC telly version on Saturday, January 23 at 2.30pm AEDT.

Please stay to the end for the moment Twiggy has a genuine crack at Tesla founder Elon Musk. He literally calls Musk “mind-bogglingly stupid”.

Vote 1 for Twiggy.

Here’s what else you might have missed.

Clinical Trials Tracker: The tests ASX healthcare companies have upcoming in 2021

You asked for it, so here it is – the ultimate Diary of a Clinical Trial Tracker.

You didn’t actually ask for it. But there is an obvious need for being on top of whose results are coming out, when.

What we didn’t expect was just how busy our biotechs are. Derek Rose got to a standing count of no less than 62 trials and results due in 2021 – and that’s without including CSL. (It’s got 25 different trials under way just on its own.)

This took a lot of work. And there’s a second part coming soon for those interested in 2022 and beyond.

Deep breath – here’s our inaugural cut-out-and-keep-on-your-massive-fridge ASX Clinical Trials Tracker for 2021.

The Secret Broker: Reddit, squeeze it, eat it, dump it, bank it. When a short squeeze really becomes Finger Lickin’ Good

We don’t really make a huge effort to work reddit’s patch, because the people there put a lot of hard work into making it their own. Constantly mining it for free content feels greasy.

But we do like to pay due credit to the more brilliant moments. And 2021 has seen the hugely popular wallstreetbets come into its own as a genuine market-moving force.

This story is all about the video game bricks and mortar retailer GameStop. In Australia, you’d know it as EB Games.

And with over 5,000 bricks and mortar stores, not much of an online presence, money and plenty of debt, it’s become a juicy target for short-sellers who figured the writing was on the wall, Blockbuster-style.

They’re now crying blood, because a mischievous billionaire called Ryan Cohen wanted to save GameStop, built up a three-boardroom-seat stake in it, and attracted the attention of the wallstreetbets crowd.

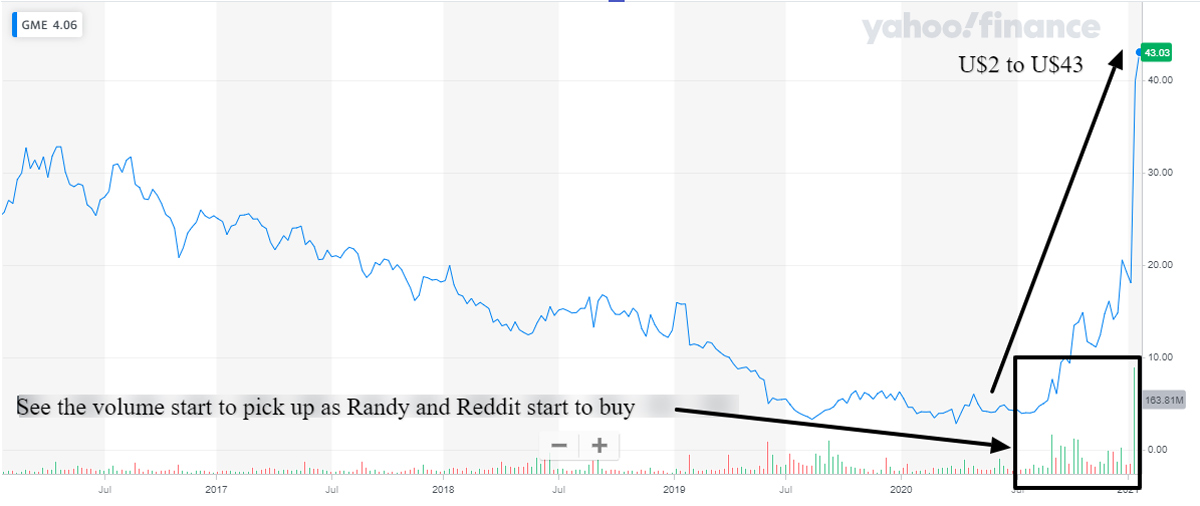

They piled in, and are still piling in. Here’s GME’s 2021 performance so far:

Here’s a GME short-seller yesterday. Or something like one:

It’s not too late to get in and enjoy the drama from here.

Expert View: Missed out on Tesla? ‘There are other opportunities’ to invest in battery technology

Speaking of Tesla-like stocks, did you think it’s was too late to jump in at US$300? And again at $US500? And again at… etc etc.

Here’s a special secret just for you. You don’t have to buy Tesla to ride the Tesla gravy train all the way to Mars.

Because Teslas need batteries, and batteries needs stuff to make batteries, so it feels like a no-brainer to go hunting for companies that make stuff to make batteries to stuff into Teslas.

Only there are a lot of those companies. Can’t I just invest in a whole bunch of them all at once, we hear you ask.

Yes. Yes, you can.

ESG guide: Here’s everything ASX investors need to know

Last September, the Responsible Investment Association Australasia (RIAA) estimated that of Australia’s $3.135 trillion funds under management, $1.149 trillion was managed by “Responsible Investment Managers”.

$1.149 trillion is a lot. And it’s an amount has nearly doubled in five years. It seems we really do care that our businesses are run nicely, by people who care. Care about things such as the environment, gender equality and not being greedy.

There’s a measure for it – it’s called ESG (Environmental, Social, Governance) and it’s a fast growing investment theme in Australia, including on the ASX.

It’s kind of the same thing as ethical investing, and a bit like impact investing, but it feels a bit more strongly defined. In fact, some of the ESG standards must be met for an ASX company to even operate.

They generally perform well, too. That’s heartening.

Here’s how you can feel good about making money in 2021.

Battery sector cries out for more graphite as shortfall looms

Here’s another way to cash in on $TSLA. While your friends are hoovering up lithium stocks, you could be That Guy at the bar who’s into something even betterer.

Fact – there is 10 times more graphite than lithium in a lithium-ion battery, with each EV requiring ~55kg of flake graphite to make the battery anode.

And right now, there are signs that demand for battery grade graphite could outstrip supply in 2021.

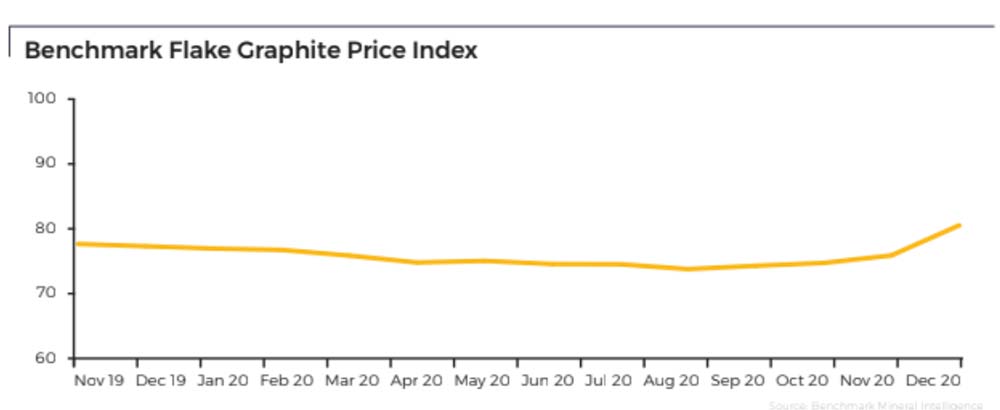

Prices? Already responding:

But before you rush off, be warned – all graphites are not equal. There’s a lot of downstream stuff to consider when you’re picking your battery graphite stock.

Fortunately, we here at Stockhead know which ones are more equal than others.

Cathie Wood’s ARK Innovation sees space as the next frontier for ETFs

Spaaaaace finally got some credible backing. Credible as in, not the billionaire playboy sci-fi dreams fantasy type, or the one where US soldiers duke it out in LEO with lasers and jetbacks.

Credible backing in the form of well-known disruptive technology portfolio manager and Tesla believer Cathie Wood, who really wouldn’t pile money into it until there was money to be made out of it.

She has now.

Her flagship ARK Innovation ETF pulled in a near 150 per cent gain last year. All up, Ark now oversees about $42 billion in ETF products. A year ago, that was less than $4 billion.

Next up – the ARK Space Exploration ETF. According to Bloomberg, Wood and her team plan to actively manage the ETF and will invest in domestic and foreign companies that do space things. About 40 to 55 of them, in fact.

If you need to know how big a deal it is that Cathie Wood wants to invest in something, Virgin Galactic rose 21.4 per cent on the day the news broke. Just because they might get a look-in.

Are there any Aussie players that could catch her eye? Maybe.

SPACs grew 4x in 2020: What do they do, and are they coming to the ASX?

SPACs – how do they work?

It’s a good question, and timely – 248 SPACs were launched on the US market last year, around four times as many as 2019.

In 2021, however, there will be no SPACs launched on the ASX. We know, because we asked ASX spokesperson David Park, and he said at present, “the ASX listing rules do not currently permit the listing of these vehicles”.

Interest is growing in Special Purpose Acquisition Companies, though, so it’s probably just a matter of time, because we Aussies love a good investment vehicle. And quite a few bad ones.

SPACs list via IPO, but with a twist; the company itself doesn’t have any operations.

It’s a shell business, listed for the express purpose of merging with a private company. Once listed, the SPAC has two years to find and complete a deal.

Most importantly, they exist to give investors early access to large private companies via a publicly-listed structure. And for “investors”, you can read “normal people like you and me”.

De-coding 4C reporting season with pro investor Josh Baker

While we’re learning things, it’s quarterlies reporting season, again. 4C reporting season, to be precise, which to astute investors means a useful scoreboard-check for companies with tight cash-flows.

How does that work? Josh Baker at Capital H Management reckons 4Cs are a useful way of uncovering reporting inconsistencies, a “pet peeve” of his in the microcap space.

Tracking 4Cs over time gives you an opportunity to piece together the operations of a business, and build a more sound understanding.

In other words, it’s a useful way to DYOR (do your own research). That’s three times we used the word “useful”.

Here’s his tips on how to decode and make the most of 4C reporting season. And they’re free.

Explorers Podcast: Veteran company director Neil Biddle talks torbanite, a rare product with 3 high value uses

Finally, remember Barry Fitzgerald?

The ‘Garimpeiro’ columnist is back in the studio! And kicking off 2021 with Neil Biddle, executive director of Greenvale Mining.

The veteran company director took Pilbara Minerals from sub-$10m shell to +$1bn lithium miner in under five years.

His latest project is small cap IOCG hunter Greenvale Mining. Here’s what he had to tell Barry about that:

And that’s all for the week. Hope it was good for you.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.