Kick Back: The 10 biggest stories you might have missed on Stockhead this week

Going for the big one Picture: Getty Images

Phew. After all that eating, drinking and gambling during our three-day working week, it’s time for a break.

Here are all the big stories on Stockhead you might have missed in your semi-holiday haze.

1 – Not a story about lithium

Well done you. We finally dragged your attention away from battery metals.

All it took was a new regular column about how people with pots of money make pots of money.

We’ve got a long list of experts now in our little black book, so it makes sense to share their knowledge – and more importantly, their current stock picks – with you.

Welcome to Money Talks. We’ll be pushing it out several times a week. So far we’ve got:

- Dean Fergie, director and portfolio manager at Cyan Investment Management, with his top tech stocks

- Rob Brierley, executive at Perth-based financial services provider RM Capital, with his top copper stocks; and

- Lee Iafrate, founding chairman of Melbourne-based boutique investment firm Armytage Private, with a potential financial services takeover tip.

2 – High Voltage: Lithium-ion is on fire… literally

Normal service resumes.

The weekly wrap of the most talked about metals right now has something for everyone – exploding cars, trade wars, price plunges… oh my.

But despite the continued interest, the sector remains a bit of a dog.

We even made a data GIF to prove it.

Of the battery metals players on our list, 51 advanced, 67 remained steady and 74 lost ground this past week.

3 – Less than 9pc of ASX small caps paid dividends – but these 13 paid 10 cents or more

Less than 9 per cent of ASX companies with a market cap below $500 million have paid half yearly dividends.

But you probably already know dividends are a rare thing among small cap stocks. Because where’s my 10-bagger, right?

Still, there’s a few notable exceptions. Property developer Tamawood (ASX: TWD) will pay a total of 33 cents per share, despite poor first-half results. That’s a 9 per cent yield.

Which was impressive enough for us to have a closer look at the 152 small caps that did pay half-yearly divvies and stick them all in a table for you.

4 – The Explorers: Spectrum Metals’ Paul Adams on dodging bullets and that 1 month, 525pc share price increase

There was a time Spectrum Metals (ASX: SPX) was a rare earths explorer, with a $5.3 million market cap. Around February 20 this year, to be precise.

Then it bought a couple of old gold mines at the near legendary Penny West site in WA.

By the end of March, Spectrum was riding high on a $26.3 million market cap. Happy days.

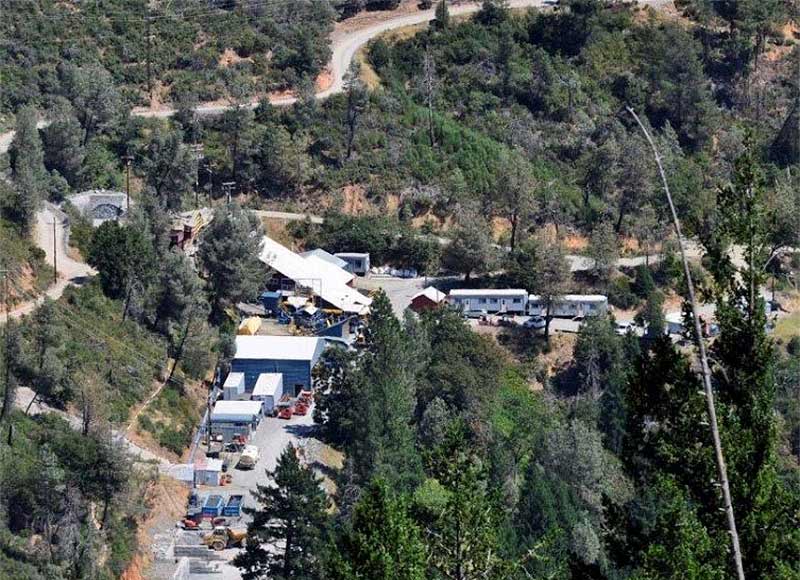

Reuben Adams caught up with managing director Paul Adams and heard a tale about just avoiding buying a Californian mine operation five days before it was destroyed in a wildfire, and the “eyewatering” bonanza grade intersection it hit at Penny West.

The words “rollercoaster ride” are rarely more applicable.

5 – Tim Treadgold: We’re about to find out Apollo’s plans for its red-hot WA gold find

Here’s another chunky WA find.

While the gold price fell during April, low-profile (for now) explorer Apollo’s price nudged from 16c in February, to 20c a month ago, to 23c last week, when it took a break from trading.

On Tuesday, the rumours were confirmed. Apollo was back with a share placement to raise $6 million for an accelerated drilling campaign at Lake Rebecca.

That’s because it’s looking like the more it drills, the more it finds – and Apollo could be on the verge of a major gold discovery on Kalgoorlie’s doorstep.

6 – IPO Watch: Resources who? The tech scene is where it’s at now

Then there’s West Australia-focused gold explorer Coolgardie Minerals (ASX:CM1), which couldn’t even make it a year as an ASX-listed company before going into administration, so don’t get too excited.

Angela East had a look at IPO performances in the past 12 months and more than 68 per cent have lost ground.

Just three of the 22 recent resources listings have made gains, and three are back trading at their IPO issue price.

It looks like the IPO momentum has swung back into tech’s favour, both in terms of launch numbers, and success rates.

Here’s who’s leading the race right now, and what’s coming in May.

7 – Invest to invest: SelfWealth says it has made investors 39pc richer

Online broker SelfWealth (ASX:SWF) takes your investment and invests it in its platform, which allows more people to… invest in shares on the ASX.

Welcome to the slightly meta diversified financials section of the ASX small cap market, where things are all a bit:

All you need to understand is it seems to be working.

SelfWealth’s most popular portfolio model, the SelfWealth Top 10, takes the top 20 stocks from the top 10 investors and gives them equal weighting — it is then rebalanced at the start of every quarter.

Result? It’s outperformed the ASX200 by 39 per cent in the last two years.

Here’s how harnessing the power of a 60,000 strong investing community can help you make more money.

8 – There’s talk of a South American ‘lithium cartel’ – and it could give Aussie miners a leg up

Something about “South America”, something about “cartel”. Click.

But there’s nothing dodgy going on here, unless you consider OPEC, uh, dodgy.

There’s a thing called the “lithium triangle” and it basically involves the half of the world’s lithium supply that comes from Bolivia, Argentina and Chile.

Two of them – Bolivia and Argentina – want to form a lithium cartel, not dissimilar to what major oil-producing countries did when they formed OPEC, which seemed to work out okay for them.

Sounds like a good time to take a look at what ASX-listed companies have projects in South America.

It’s these 14, to be precise and 10 of those have projects in Argentina.

9 – Gold: Pouring your first gold bar is always a good reason to work through Easter

Did you work on Easter Monday? No, because you weren’t pouring this:

These three bars are doré – unrefined gold which roughly contain about 20 per cent silver. So Laneway Resources (ASX: LNY) is looking at 20kg of gold – 700 odd ounces – or close to $900,000.

That’ll do. Enough to finance exploration across the wider 648 sq km Agate project, plus progress its NZ gold assets and its Ashford king coal project in NSW, for starters.

So it’s no surprise Laneway’s share price has been on a recent tear, up 180 per cent over the past three months.

10 – Hazer has its first Australian patent for producing hydrogen and graphite – but what does that mean?

Patents? Nobody wants to read about patents.

Except you lot did, after Aussie tech company Hazer (ASX: HZR) announced it had locked down a process for producing hydrogen and graphite from natural gas and iron ore.

It took Hazer two years to score its very first Australian patent, which it can now pursue globally.

Both hydrogen and graphite are becoming bigger deals every day, and Hazer has already signed one taker, Mineral Resources (ASX: MIN) to the graphite side of things.

Next up, proving it can produce large amounts of both by building a demonstration plant.

Captain’s Call – The National Stock Exchange taps private markets to help more companies go public

Come for: News that the National Stock Exchange of Australia (ASX: NSX) is looking west for investors in… the National Stock Exchange of Australia.

Stay for: Actual pic of an NSX heading west.

Thanks for tuning in. Enjoy your even-more-break this week and no excuses for being grumpy on Monday.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.