Kick Back: The 10 biggest stories you might have missed on Stockhead this week

Pic: metamorworks / iStock / Getty Images Plus via Getty Images

It’s Friday, and we’re in love with these 10 must-read posts from Stockhead this week.

You’ll laugh, you’ll cry, they’ll change your life*.

1 – Carmakers, battery manufacturers are calling nickel companies direct as supply shortfall looms

While gold and Bitcoin are enjoying glorious runs as safe havens in these uncertain times, you can’t beat a good shortfall.

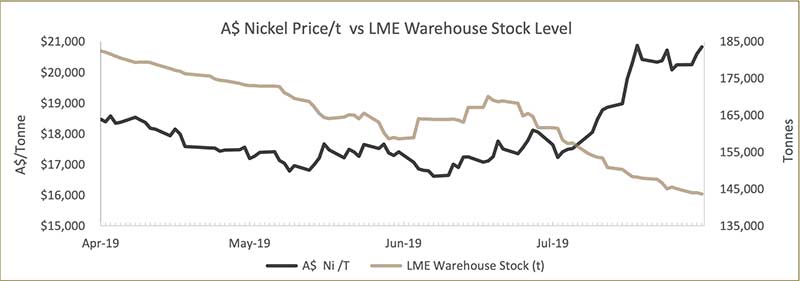

We’ve heard a bit about declining copper inventories this year, but the real standout when it comes to shrinking stockpiles in 2019 is nickel.

There’s a couple of things going on here. One, nickel prices were subdued for a long time, so explorers have shelved plans to develop nickel mines in favour of shinier things.

Second, suddenly, EVs are threatening too and guess what metal is kind of a big deal in renewables world?

“Getting the quantity of nickel that EVs will need by the mid-2020s will be a challenge,” Gavin Montgomery, Wood Mackenzie research director said in late July.

That’s because lead times on nickel projects can stretch out to 10 years.

Do we need to draw you a picture? Oh, okay then:

Here come the reports that carmakers are on the blower direct to nickel companies scrambling to lock in supplies.

2 – Cobalt shortfall now much closer thanks to closure of the world’s largest mine

No, this is not an echo.

If you’ve got a suitcase of cobalt stuffed under your bed, you can thank Glencore for generously bumping its value up by 8 per cent this week.

And for roughly the same reasons as nickel above. The price of cobalt has been thumped this year, down to just under $US30,000 a tonne from around the $US45K mark in January.

That means it sucks to be Glencore’s Mutanda cobalt mine in the Democratic Republic of Congo, because it’s now getting mothballed for two years at the end of this year.

“One mine?” we hear you cry. “What difference will that make?”

About 20 per cent to be precise. Mutanda is a juggernaut that pumps out a fifth of the global supply of cobalt every year.

3 – Barry FitzGerald: Looking for lead in all the wrong places? Pacifico pops up

When it comes to glam metal stakes, lead – the dull, grey one – is Britny Fox to gold’s Cinderella.

You probably should be into it, but you’d never dare admit it 1.5km down in the Gwalia crib room.

Maybe you would if you’d got on board with Galena Mining (ASX:G1A) early this year. The stock has more than doubled since the start of the year to 36.5c for a market value of $145m.

And that’s while the lead price has fallen 20 per cent in the first half of this year from the previous corresponding period.

Now he’s got your attention, here’s Barry FitzGerald with who might be your next big play in sinkers and wheel balance weights.

Hint: It’s Pacifico Minerals (ASX:PMY), trading at 0.9c a share.

When you’re done there, sit back somewhere warm and comfy with a shot of Ximinez and listen to Barry shoot the breeze with Nigel Ferguson, managing director of AVZ Minerals (ASX:AVZ).

You’ll learn all there is worth knowing about the DRC President and staying squeaky clean in Africa.

4 – Micro-encapsulation matters and this $5.5 million infant formula deal proves it

Back in the day, we got our dose of Omega-3 from cod liver oil, and it was foul. We knew, because we had to drink it from a bloody teaspoon every night.

Kids these days don’t know how easy they’ve got it. Especially when their fish oil can be hidden in… milk?

Ugh, surely not. Except there’s a thing called “micro-encapsulation” and yes, really, you can Science things like Omega-3 oils into infant formula powder and nobody knows they’re even there.

Handy, because the EU are prescribing a minimum quantity of DHA (a type of omega-3) to go in infant formulas, because it believes it is so beneficial for kids.

Who’s doing it best, we hear you ask. That’s hard to say, because it’s pretty clever sorcery, but we did speak with BioScience Managers advisor Bruce McHarrie about why his fund chose Pharmamark.

He said it was because Pharmamark stood out on these three factors.

5 – Here’s one way to tell if your stock is ‘recession-proof’

If you were paying attention to your yield curves on Wednesday, it would have been impossible to miss something a touch alarming.

The yield on 10-year US Treasuries dropped below those paid on 2-year Treasuries. It inverted.

That’s not ideal, because you’re supposed to get a better return for buying government debt over 10 years than you are for buying it over two.

But it has happened before. And every time it has happened in the last 40 years a US recession has occurred within two years.

What are you going to do? Dump all your stocks and buy gold? Booze? Mascara?

Ease up, Turbo. There’s a way to spot stocks that are more likely to hold firm, or even grow during a recession.

It’s all about how to calculate a company’s beta. (This one goes out to you, Excel fans.)

And yes, we have all the tables you need of stocks that should rip through a recession.

Don’t believe us? There’s more where this came from:

| Code | Name | 1 Month Beta | Market Cap | Price 15-Aug |

|---|---|---|---|---|

| CY5 | CYGNUS GOLD LTD | -2.01 | 4.37M | 0.07 |

| IPT | IMPACT MINERALS LTD | -2.07 | 13.22M | 0.01 |

| AUH | AUSTCHINA HOLDINGS LTD | -2.12 | 5.57M | 0.004 |

| N1H | N1 HOLDINGS LTD | -2.17 | 2.85M | 0.04 |

| MBM | MOBECOM LTD | -2.42 | 11.12M | 0.04 |

| DTR | DATELINE RESOURCES LTD | -2.45 | 32.54M | 0.004 |

| MSM | MSM CORPORATION INTERNATIONA | -2.59 | 11.27M | 0.01 |

| SAN | SAGALIO ENERGY LTD | -2.61 | 409.32k | 0.002 |

| DDT | DATADOT TECHNOLOGY LTD | -2.65 | 5.67M | 0.01 |

| MCX | MARINER CORP LTD | -2.65 | 618.21k | 0.05 |

| IBX | IMAGION BIOSYSTEMS LTD | -2.66 | 16.19M | 0.05 |

| A1G | AFRICAN GOLD LTD | -2.71 | 9.37M | 0.17 |

| RMG | RMG LTD | -3.14 | 7.01M | 0.01 |

| BLY | BOART LONGYEAR LTD | -3.15 | 157.78M | 0.01 |

| OLV | OTHERLEVELS HOLDINGS LIMITED | -3.24 | 2.58M | 0.01 |

| RXH | REWARDLE HOLDINGS LTD | -3.29 | 3.16M | 0.01 |

| GMR | GOLDEN RIM RESOURCES LTD | -4.59 | 13.14M | 0.02 |

| AKN | AUKING MINING LTD | -4.77 | 932.58k | 0.001 |

| CFO | CFOAM LTD | -5.14 | 17.61M | 0.15 |

| LKO | LAKES OIL NL | -5.43 | 33.37M | 0.001 |

| APG | AUSTPAC RESOURCES NL | -9.83 | 2.91M | 0.001 |

| MLS | METALS AUSTRALIA LTD | -10.1 | 5.85M | 0.002 |

| CDH | CHONGHERR INVESTMENTS LTD | -19.36 | 1.69M | 0.01 |

6 – Short & Caught: The stocks investors are shorting right now

It’s time for our fortnightly chat about shorting.

For starters, it’s restricted under Australian law, so that makes any substantial shorting of stocks worth knowing about – even if you own these stocks and only trade long.

Since we started watching shorts, we’ve found the most consistently changing metric is the percentage change in short interest. It’s the one that shows investors have recently begun to short the stock.

We’ve found 23 ASX small caps with a short interest percentage change above 200 per cent and more than $100,000 short interest against it.

And in the last fortnight, a couple of small caps darlings have found their way onto the list – notably, Splitit (ASX:SPT), Dacian Gold (ASX:DCN) and Myer (ASX:MYR).

What a bunch of Negative Nigels you lot are.

7 – In 2015, Steve Smith reportedly invested $100K in mattress startup Koala — his stake is now worth $12 million

Remember back in 2018, when Australian cricket captain Steve Smith’s life crumbled?

He was caught trying to do what England’s always done tamper with cricket balls and got banned from playing for Australia for a year.

Apart from the humiliation and damage done to Australian cricket’s sparkling image, the headlines screamed – “HE’LL LOSE MILLIONS”.

And he did. As much as a stonking $5m in sponsorship and match payments.

Oh, wait. Except back in 2015, Smith laid out about $100k to invest in a mattress startup, Koala. Today, that stake is worth about… ooh, $12m?

And he’s back smashing the Poms. There’s a lesson in all this, somewhere.

We think.

8 – Where they began: these are the backstories of ASX CEOs

One was a florist.

One was a cleaner.

One made pipes all night.

And one “was an excellent marksman and was encouraged to take up sniper training”.

They all ended up being CEOs of ASX small caps. Fortunately so, because they’ve proven themselves to be excellent at their jobs.

And if they weren’t ASX CEOs, where would they be?

Click here to find out who’s got an unrealised ambition to spend her life “translating medieval French manuscripts”.

9 – The Secret Broker: How to make £1.6 billion disappear in a day

Another cautionary shorting tale.

This week it was Burford Capital’s turn to bear the brunt of a tell-all tweet, when Californian mob Muddy Waters Research dropped this eight-hour ticking bomb:

Muddy Waters is now in a blackout period until tomorrow 8am London time when we will announce a new short position on an accounting fiasco that’s potentially insolvent and possibly facing a liquidity crunch. Investors are bulled up about this company. We’re not.

— MuddyWatersResearch (@muddywatersre) August 6, 2019

No, this is how to make £1.6 billion disappear in a day, without a scrap of sandpaper in sight.

Read all about the couple of Australian connections, the outing – and subsequent dismissal of – the CFO as the CEO’s wife, and a cautionary tale about imperfect cake in a perfect world.

Although we’re pretty sure this entire post is just a front in order for TSB to make fun of German accents.

10 – Everything you ever wanted to know about boron… including how it may save the world

And finally, let’s just get this out of the way – boron. It’s anything but.

In fact, as James McGrath eloquently puts it, boron is about to get a lot more attention, “much like a tomboy who suddenly puts on a dress”.

Among the regular uses for boron are insulating materials, ceramics, detergents, eye drops, mild antiseptics, washing powders, tile glazes and killing cockroaches.

No really, stick around. It gets better, promise.

Boron, as it turns out, is also a micronutrient in plants that strengthens their cell walls and helps them not dry out.

And what’s happening to plants the world over in this magical age? They’re drying out.

So boron, as it turns out, has role to play in saving the world. It’s kind of a potash/phosphate V2.0.

If you don’t believe us, a recent QY Research report showed the refined boron market is headed for about $2.9 billion by the end of 2025 with a compound annual growth rate of about 4.5 per cent.

There are just a handful of producers controlling the entire supply. And you guessed it, one of them is an ASX small cap.

It’s been great, thanks for tuning in and being a Stockhead for another week. And remember:

Enjoy your weekends.

*It’s called the butterfly effect and don’t even try to @me.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.