Kick Back: The 10 biggest stories you might have missed on Stockhead this week

Picture: Getty Images

We’re not going to mention the cricket in this week’s Kick Back.

Not because we don’t want to gloat over England fans’ pain as they watched Australia roar from 8-122 to close the first day’s play at 284.

But because some people do read this Saturday morning. And with the way cricket works these days, Ben Stokes could have taken his team to victory and been out kicking heads clubbing by then.

So no, let’s not mention the cricket, or the English fans’ inability to stay classy, ever.

And there’s definitely no need to be resharing this kind of stuff around:

— MickBman (@MBennallack) August 1, 2019

That kind of nasty jeering and finger-pointing just doesn’t have a place here in Australia. Let’s all leave well enough alone now and get on with what caught your eye on Stockhead this week.

1 – Reading tree leaves works – gold hunter Marmota hits grades of over 30g/t

Money does grow on trees after all.

ASX-listed gold hunter Marmota tried to tell us this back in March and we all wanted to believe it; we really did.

It said it had found a way to find gold deposits by analysing leaves for trace amounts, and was under way with a detailed “biochem program” to prove it.

Guess what?

On Wednesday, it notified the ASX it had hit grades of up to 30g/t gold at Aurora Tank in South Australia… having identified new zones based on analysing leaves in the area.

Huh.

“This is Marmota’s sixth successive drilling program at Aurora Tank: each and every one of these programs has been a success,” Marmota chairman Colin Rose told the market.

2 – Which ASX listed companies has Eric Sprott backed?

Last week, you fell over yourselves to find out what stocks Mark Creasy had in his portfolio.

That smelt a lot like clickbait to us. And because we’re not at all proud when it comes to things like that, this week we rolled out what small caps one of the world’s most prominent resources investors, Eric Sprott, likes the look of.

You might be surprised to find he holds shares in 16 ASX companies – all but two of which are small caps.

Yes, you can definitely expect more of this sort of post on Stockhead in the weeks to come. You people have that power.

3 – It isn’t a sexy metal, but here’s why bauxite is looking more attractive to juniors

Sexy – English cricketers:

Not sexy – bauxite:

Right? But at least you can say bauxite is suddenly worth watching.

That’s due to a confluence of reasons – and we don’t use the word “confluence” too often. Bauxite is the only raw material used in the commercial production of alumina, which can then be turned into aluminium metal.

You need about five tonnes of dried bauxite to make one tonne of aluminium. So there’s that.

But whereas it was once the cheapest option to build an alumina refinery right next to the bauxite deposit, it can – like many, many things in the world today – be cheaper to build the refinery in China, and ship in the bauxite.

So all of a sudden, bauxite is joining the ranks of DSO [direct shipping ore] resources. And with mining restrictions in China becoming more restrictive, that all adds up to the kind of forecast by independent consultant CM Group that claims Chinese demand for bauxite will increase by 65-70 million tonnes a year over the next five to seven years.

Say it with us – “confluence”.

4 – Hot Money Monday: The most in-demand stocks on the ASX right now

Who’s in the hot seat this week?

First, if you need to know how the Relative Strength Index (RSI) of a stock is calculated and why it’s a favoured trading metric, learn something here.

And if you want to know who smashed through the all-important 70 mark to be the past fortnight’s most over-traded stock, we’ll tell you. It was energy supplier Pacific Energy (ASX: PEA), topping the hot list after receiving a takeover offer at a healthy premium.

On the left-out-in-the-cold list, pot stock Elixinol Global (ASX: ESL) should feel a little short-changed. It found no investor love even after an active July in which it restructured its leadership team and obtained another production licence to “manufacture medicinal cannabis for extracts and tinctures of cannabis and cannabis resin”.

Which list is your go-to for buys?

5 – Lithium: It’s not all alike… and it’s not all for electric vehicles

Look who’s back! It’s lithium, on your radar again, readers.

Maybe that’s because there have been a couple of interesting moves from everyone’s fave lithium-based company, Tesla. It finally put its Model 3 in the hands of Aussies who plumped down a $1500 deposit three years ago.

And Tesla also released its “Megapack” energy storage system.

ESSs are close to well-established now as the world turns to renewable energy sources such as solar and wind power.

By 2020 North America will pass 1GWh installed and the industry is expected to be 17 times bigger in 2023 than it was in 2017. (And that’s a figure that has to be revised upward every year.)

Siemens unveiled its Junelight Smart Battery for homes in February. And Australian lithium producer – wait for it- Lithium Australia (ASX: LIT) this week announced a deal with Chinese battery producer, DLG, to produce a new range of lithium-ion batteries specifically for energy storage systems.

6 – Australia’s neobanks prepare for battle as big investors pile in

Fintechs were also back on the kind-of-a-big-deal reading lists this week.

For starters, neo-lenders have been busy raising capital, keen to capitalise on regulatory changes in 2017 aimed at improving domestic competition.

In particular, small business loans are an attractively neglected space, and new entrant Judo Bank wants in.

So does its backers. The SME lender’s final second-round equity raise was for $400m — double the $200m it was initially aiming for.

Here’s why big hitters like Abu Dhabi Capital, Bain and Goldman Sachs are out in support of this type of thing.

And on the BNPL side, Sezzle entered the ASX fray, listing on Tuesday after seeing heavy demand for its $43.6m funding round. And shares got a nice little boost. Ord Minnett is the lead broker for Sezzle.

7 – Money Talks: Cannabis could ‘easily’ be a $200b-plus market

Cannabis is hanging in there. In fact, Maxim Jacobs, managing partner at New York-based Edison Investment Research, reckons it’s still “by far” the hottest sector.

“This is a market that could easily be $200 billion worldwide,” he told Stockhead.

The main driver behind that claim is that “you no longer have to smoke it”. For example, just this week, Creso Pharmaceuticals cut a couple of deals to sell its pain relief CBD lozenges.

There are now over 30 ASX-listed companies with exposure to cannabis, and here’s a solid rundown on what some of the most active ones are up to right now.

And here’s Jacobs being given 90 Seconds to tell us exactly why he loves the pot industry so much:

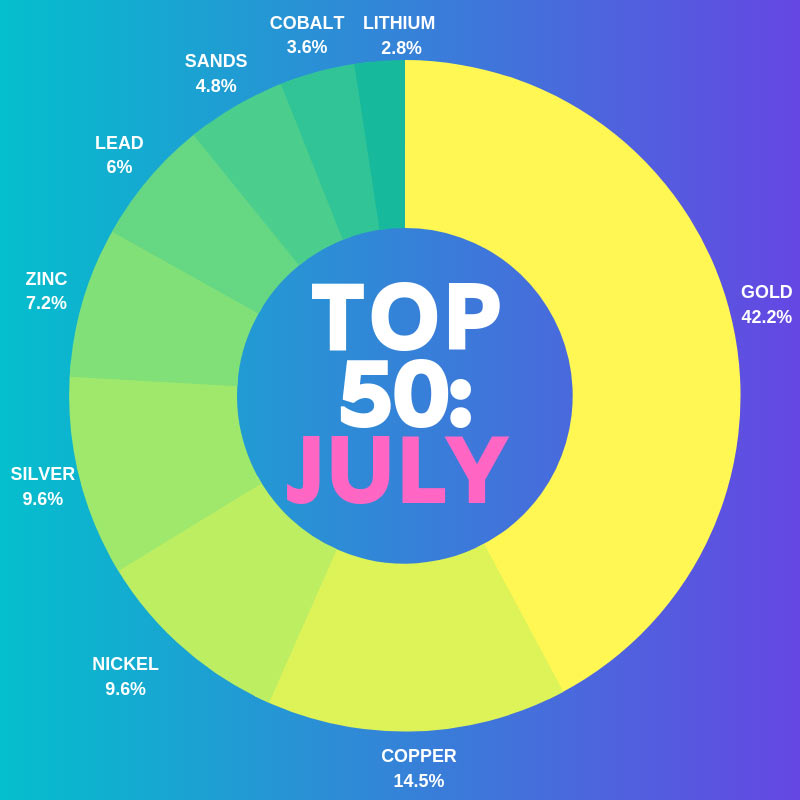

Here are July’s top 50 small cap miners and explorers.

It’s that time of the month. The beginning, where Reuben Adams looks back to see who won the hearts and minds of investors over the past four weeks.

In July, it was nickel’s time to shine as prices reached a 13-month high on fears that major producer Indonesia would resume ore export bans in 2022.

Result – nickel focused explorers jumped from 3.1 per cent to 9.6 per cent month-on-month:

But the big winner for the month was former gold miner Oro Verde (ASX:OVL). It put on a healthy 250 per cent after making a deal to acquire 60 per cent of the Makuutu project in Uganda.

That’s not gold. Oro Verde is now hunting “significant quantities of the much sought-after neodymium and praseodymium”.

You can read all about the rest of July’s winners here.

9 – High Voltage: Motorsport is boring and these flying motorbikes are the future

Motorsport really is boring, unless it rains on an F1 track and drivers are forced to actually drive their computers.

Airspeeder racing is much more exciting, and dangerous, surely:

That’s the brainchild of Aussie start-up Alauda Racing, unveiled at the Goodwood Festival of Speed in the UK.

Anyhoo, it’s electric, so something about lithium something.

This week’s small cap spotlight on battery metals showed that of the companies on our list, 56 lost ground, 53 were ahead and 43 were steady.

So, not awful.

The biggest winner was Lake Resources (ASX:LKE), enjoying a 19 per cent boost after announcing some very nice hits from the Cauchari lithium brine project in Argentina.

There were bigger – but they were up on no news, so that doesn’t count.

And finally, Monday sees kick-off time for the biggest mining conference of the year.

Yes, Kalgoorlie’s nightlife comes even more alive as thousands of investors and explorers descend for the Diggers and Dealers forum.

These days though, we’re all a bit better behaved than, say, this kind of thing, and Diggers and Dealers is nowadays actually lawful enough to attract even BHP (ASX:BHP) and Rio Tinto (ASX:RIO).

Tim Treadgold has been popping up there for years. This year, he reckons nickel will be the star of the show, in particular, a chat about the stuff by Eddy Haegel, president of BHP Nickel West.

It runs for three days. Our own Reuben Adams will be sleeping in the dirt for your benefit, teaming with Treadgold to bring you all the latest news as the small caps take to the stand.

For now, here’s Tim Treadgold’s picks for the stocks to watch, before and after they have their 25 minutes of fame in the Goldfields Arts Centre.

That’s all, Stockheads.

Well, almost:

Can’t believe he got permission to be at Edgbaston today… #Ashes pic.twitter.com/PwDDxs3UvI

— Sportsbet.com.au (@sportsbetcomau) August 1, 2019

Have a great weekend.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.