Kick Back: The 10 biggest stories you might have missed on Stockhead this week

'Wanna fight? Fight me." Picture: Getty Images

So much in America to keep us Aussies amused! There was the guy in Oklahoma who was caught with an open bottle of whiskey, a container of uranium, a rattlesnake and a gun during a routine traffic stop. Sure, the whiskey and gun, but uranium and a rattlesnake?

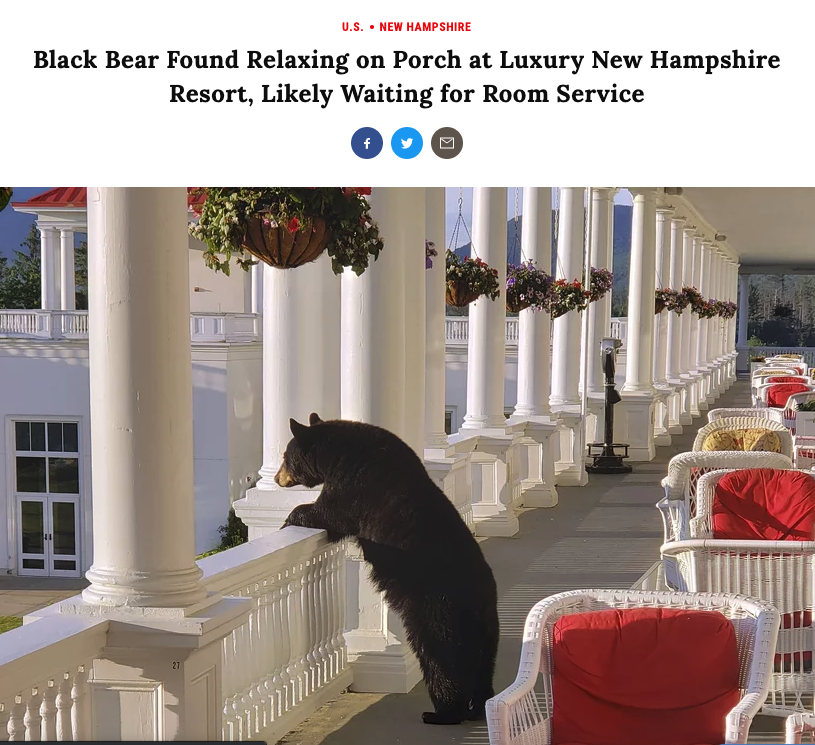

Then there was the black bear that was just chilling on the porch of a luxury New Hampshire resort.

Though the best story has to be the one about a petition to storm the infamous “Area 51”— you know, where the US government keeps all the aliens.

Fox 10 News reported this week that more than 250,000 people had signed up to join a raid on Area 51 in southern Nevada. The “group of alien hunters” are set to storm the controversial site at 3am on September 20.

Until then, here’s what you might have missed on Stockhead this week, but everyone else didn’t, and liked the most.

1. Tim Treadgold: Lithium burns as electric vehicle subsidies are lifted

Even though lithium isn’t doing so well right now, our readers still love a good battery metals tale.

Stockhead columnist Tim Treadgold gave readers his perspective on what’s happening in the sector – and it’s all to do with no more handouts.

When the Chinese government slashed electric car incentives earlier this year sales crashed and have not recovered.

And EVs are still far too pricey for the average Joe, so unfortunately growth in the uptake of EVs is lagging a bit behind expectations.

2. High purity alumina demand is far larger than analysts predicted

Another commodity readers can’t get enough of is high purity alumina (HPA), particularly when market watchers say demand is going to be much bigger than expected.

Last year, HPA was a niche industry building some momentum as analysts predicted a lithium-ion battery charged shortfall.

That’s because one of HPA’s fastest growing uses is coating the separators that keep apart the cathode and anode electrodes in lithium-ion batteries.

And there’s only five ASX-listed players with HPA projects.

Not surprisingly, CRU reckons previous estimates were too conservative. Apparently, HPA supply will not meet estimated demand over the next decade — even if every project in the pipeline goes into production.

Good spot to be in for Aussie HPA players.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

3. It’s been a good year for listed fintechs; here’s where analysts are staying bullish

It’s definitely been a good year for Aussie fintechs, particularly buy now, pay later stocks — I mean, just take a look at Splitit (ASX:SPT) which went from 20c to $2 within just six weeks of listing.

Then there’s QuickFee (ASX:QFE), which shot up 150 per cent on its first day as a listed company.

Having just crossed into a new financial year, we figured this week was a pretty good time to take a scoreboard check.

Check out those six-month returns – some pretty nice gains for some.

4. Barry FitzGerald: Macquarie turns bullish on lithium as VW steps up its EV push

Surprise, surprise lithium again. This one, however, paints a more positive picture for readers.

You see, one of the biggest local bears on the lithium sector, Macquarie Bank, has suddenly turned bullish on the battery metal.

Finally some good news for our bashed up lithium stocks.

This story in particular sent the Stockhead Twitter feed running hot. Check it out:

Finally some good news for our bashed up #lithium stocks #ASX #ausbiz https://t.co/cw9kvekCUW

— Stockhead (@StockheadAU) July 10, 2019

It seems German automaker Volkswagen’s push into EVs is going to drive lithium demand higher than expected.

VW board member Stefan Sommer told Reuters that the company would need 150 GWh of battery production in both Asia and Europe by 2025, and double that by 2030.

Macquarie’s response after some number crunching: “Assuming an average battery size of 60Kwh, that implies 5m units of full EVs by 2025 and 10m by 2030. Global EV sales were less than 2m units last year.”

Well OK then..

5. Money Talks: These copper juniors are hot targets for the big producers

Everyone’s a fan of our experts’ top stock picks. This week Adam Miethke, co-managing director at Discovery Capital Partners, did a deep dive into the copper sector.

He pointed out which junior copper plays he though would be ripe for the picking by the majors.

You can see his top three picks here.

6. Twiggy Forrest-backed Invex Therapeutics is enjoying life so far as a listed company

We’re pretty sure this one was a hit thanks to Andrew “ Twiggy” Forrest – I mean if the successful iron ore magnate is backing a biotech it’s gotta be good right?

Invex Therapeutics (ASX:IVX) took off the minute it lit up the boards last Friday – notching a 169 per cent gain on its first day.

Invex’s core valuation proposition is to build out a commercial use for Exenatide — a pre-approved diabetes drug — and repurpose it for use in the treatment of neurological conditions associated with intracranial pressure (ICP – pressure on the brain).

Not sure if good old Twiggy knows much about diabetes drugs and how to treat brain problems, but he likes the stock enough to have a 9 per cent stake in it via his Minderoo Group investment vehicle.

7. Which commodities cross the line into 2020 as winners?

Everyone wants to know which commodities are going to take off or continue their stellar runs, so we dusted off the crystal ball (not really, we asked some people) to give you a glimpse in to what is going to be hot heading into 2020.

Good news: gold, iron ore and rare earths will still be hot for a while.

Though base metals will potentially pull back and battery metals prices still suck, with the exception of vanadium which might get a little kick.

8. ASX blockchain small caps in 2019: The gainers are few, but ripe

Ah blockchain! Our readers still want to know what’s going on there.

Well, not much for some, while others are flying along.

Only eight out of the several dozen ASX-listed blockchain stocks have gained substantially. The average gain among these stocks is 112 per cent.

Why? Because the stocks that have gained this year are making revenue and have commercial partnerships that make the technology a reality with tangible benefits for users.

That is all. Read all about it.

9. Hydrogen: vital to the energy revolution or just a pipedream?

The success of hydrogen has many divided. But the key is to “follow the money”. At least that is the view of Wood Mackenzie’s Gavin Thompson.

Japan is the undisputed hydrogen fuel leader, but after talking to energy companies in Tokyo, Thompson says the consensus supported more money going into plug-in EVs over hydrogen fuel cells.

Carmakers like Toyota are increasing investment and output of hydrogen fuel cell vehicles, but sales remain tiny and growth is being driven through big subsidies.

So hydrogen isn’t going to take over the world, but we may still need it in our clean energy mix.

10. Could the reasons buy now, pay later stocks have succeeded be their undoing?

Back to the buy now, pay later thing. This article delved into what might come back to haunt these guys.

One is competition – after all they don’t want to end up like Blockbuster right? It met its demise after refusing a golden offer from Netflix – the streaming company offered itself up on a silver platter.

Check out what else could bring buy now, pay later stocks down off their pedestals.

That is all. Enjoy your weekend.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.