Kick Back: The 10 biggest stories you might have missed on Stockhead this week

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Long weekend:

Let’s not go too much into detail why. A day off is a day off.

Here are all the important bits what you might have missed on Stockhead this week, and others didn’t, but liked the best.

1 – Hot Money Monday: The most in-demand stocks on the ASX right now

Top of the pops again this week was Hot Money Mondays, our weekly look at how actions of the “herd” may drive the stock of a given company up or down. You might also know it as the relative strength index (RSI).

Over the past two weeks, 17 small caps recorded an RSI reading of at least 75 – above the level often seen as the that which signifies a company has been overbought.

Medical techs were all the rage, with platform Jayex Healthcare (ASX: JHL) and pain recognition specialists PainChek (ASX: PCK) still pulling the buyers in.

At the other end of the scale, Empired (ASX:EPD) and Lionhub (ASX: LHB) were coldest, a space they’ve shared for a few weeks along with Actinogen (ASX: ACW), Bojun (ASX: BAH), and TPC (ASX: TPC).

So here’s a thing. Across three weeks of data, only one company — Gazal Corp (ASX: GZL) — appeared in the Top 10 for more than one week. Conversely, there were six companies with an RSI below 25 that made repeat appearances, with half of them on the list for all three weeks.

What’s it all mean? As a famous TV scientist once said:

In terms of technical momentum, clearly it looks difficult for stocks to string together a long winning streak before the market pulls back on the reigns.

The higher rotations also suggest that markets are constantly reacting to the new flow of information, with money shifting into companies that provide a positive update which could change their earnings fundamentals.

But for companies that repeatedly make the “Cold” list, investors are implying that those stocks aren’t so much undervalued; moreso that recent developments and fundamentals merely give very little reason to invest in them.

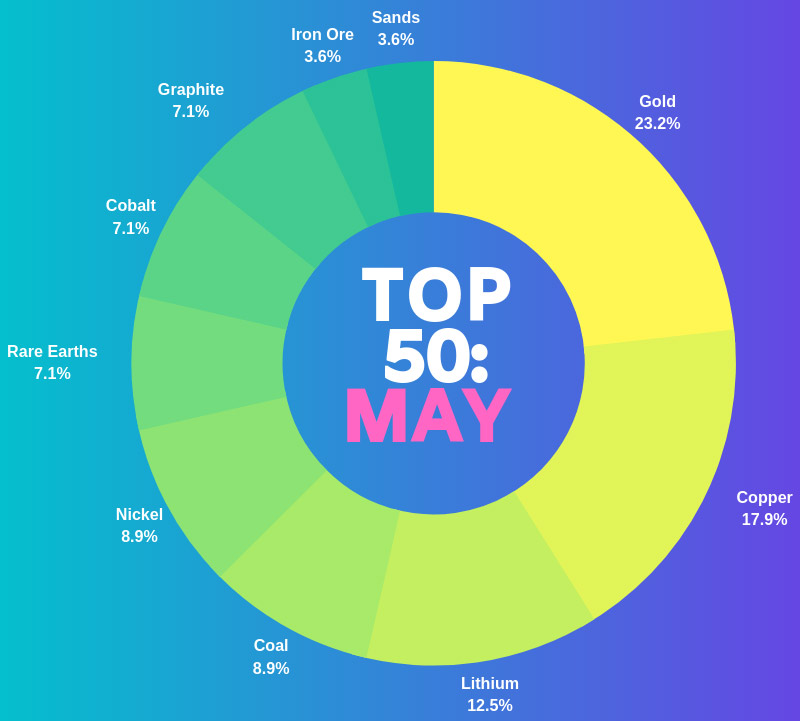

2 – Who made the gains? Here are May’s top 50 small cap miners and explorers

Let’s make this simple:

Once again, gold dominated the top 50 ASX small cap resources stocks. But all the action was in lithium, rare earths and coal plays.

The winner was Liontown Resources (ASX: LTR), which soared 307 per cent in May. Back in Novermber 2016, chairman Tim Goyder said the Kathleen Valley project it was trying to get its hands on “could quite quickly emerge as a company-maker” for Liontown.

He was right. In recent times, the high-grade lithium hits have come so thick and fast, it’s had to increase the exploration target twice.

But there are plenty of interesting bits in the other top 50 movers — including some Queensland coal caps that are pulling interest only because they might be able to jump on-board Adani’s pit-to-port infrastructure.

3 – Short and Caught: The stocks that have investors going short right now

Here we go again with the helping you make not lose money thing.

Short-selling is mildly controversial. Some people — namely, Elon Musk — think it should be illegal.

We’ll save you the explanation because. The Secret Broker did it better than we ever could, with entertaining parts, in last week’s column about, well, why you’re probably not ready to play the short game.

But if you are, you might be interested in this potentially weekly column Nick Sundich has cobbled together highlighting the stocks Proper Investors are betting will soon be taking a big fall. Hopefully, yours aren’t on the list.

Seriously, you should be paying us for this stuff.

4 – Money Talks: 80-20 Investments’ Angie Ellis shares her hot software stock tips

Speaking of which, here’s what TSB has to say about Angie Ellis’s stock tips:

Woke up to this article on @AngieJEllis from @8020invest and as I have said before, following Angie and her stock tip is like legal insider trading. Let her do all the hard yards with the research whilst you sit back and bathe in the profits

— TheSecretBrokerAU (@SecretBrokerAU) June 3, 2019

Why? Because she’s bloody ace at picking winners, that’s why.

Ellis has been investing full-time for five years and is featured regularly in The Age/SMH shares race. In the last race, she won and netted a 71 per cent return at the end of the six weeks.

Right now, she’s keeping her eye on the info tech sector, specifically, software. And in this post for us, she’ll tell you how to identify a good company, and three stocks she’s keen on right now.

5 – Fun fact – a single Tesla battery needs 50kg of nickel… and we’ll have to find a crapload more

How much is a crapload?

It’s a flexible word. You might say a Tesla needs a crapload of nickel to run, because there’s 50kg of it in the battery. And that sounds like a crapload.

But then consider most EV batteries are 60 per cent nickel, and there’s little doubt about the growth projections for the global EV market in the next decade or two.

Here’s another fact. Tesla isn’t the world biggest EV supplier. A Chinese company called BDY is. And China wants to increase the nickel content in batteries to 80 per cent nickel.

Then, at last week’s WA Mining Club luncheon, Mincor Resources (ASX:MCR) boss David Southam said he knows of at least one car maker that wants to increase that nickel content to 90 per cent.

That, to us, also sounds like a crapload.

6 – Evolving millennial and iGen client expectations are paving a new path for private banking

Did you know it is standard practice for a Swiss private bank to offer its clients accounts in five to 10 currencies with the investments held in those underlying currencies being managed as a natural hedge whilst taking advantage of the underlying economic conditions in the various regions?

No? Well, it is.

Yet in 2017 (there aren’t any more recent studies) just seven per cent of Australian high net worth individuals were found to have had a private banker.

That’s weird, considering:

- Per capita Australia is one of the wealthiest countries in the world

- Australia has the fourth highest proportion of people with wealth above $US100,000 in the world – at 67 per cent

- 278,000 Australians are considered high net worth individuals with investable assets of $US1 million or more, and

- Average wealth per adult across Australia totalled $US411,060 (!) last year – the second-highest in the world after Switzerland.

7 – Here’s a small-cap investing expert on how to use the P/E ratio when evaluating companies

Now it’s time to learn about P/E ratios.

That’s a well-known indicator used to assess whether a stock is good value or not – the ratio is calculated as the stock price (P), divided by company earnings per share (E).

If a company’s stock price is low compared to its underlying earnings, it may start to look undervalued (and vice versa).

The ‘P’ bit is simple; the ‘E’, not so much. There’s a bunch of information here to explain how it works, and Dean Fergie, director and portfolio manager at Cyan Investment Management upstairs from us, telling us how the pros use P/E to make decisions.

The important thing is the table. We won’t even make you click to see it:

| Code | Name | Price (5 June) | EPS | P/E Ratio | Market Cap |

|---|---|---|---|---|---|

| HZN | HORIZON OIL LTD | 0.11 | 0.021 | 5.30 | $143,217,936 |

| CUE | CUE ENERGY RESOURCES LTD | 0.064 | 0.013 | 5.00 | $44,679,664 |

| GTR | GTI RESOURCES LTD | 0.012 | 0.002 | 4.90 | $1,953,818 |

| SDV | SCIDEV LTD | 0.095 | 0.020 | 4.64 | $10,190,000 |

| BRU | BURU ENERGY LTD | 0.29 | 0.069 | 4.20 | $127,461,904 |

| TBR | TRIBUNE RESOURCES LTD | 4.28 | 1.342 | 3.20 | $237,552,944 |

| TAP | TAP OIL LTD | 0.096 | 0.032 | 3.00 | $40,892,884 |

| TAM | TANAMI GOLD NL | 0.04 | 0.015 | 2.70 | $47,003,880 |

| IEC | INTRA ENERGY CORP LTD | 0.014 | 0.005 | 2.60 | $5,428,137 |

| AMD | ARROW MINERALS LTD | 0.011 | 0.004 | 2.60 | $3,459,947 |

| NWC | NEW WORLD COBALT LTD | 0.014 | 0.007 | 2.10 | $11,581,859 |

| RND | RAND MINING LTD | 3.05 | 1.486 | 2.10 | $183,452,848 |

| SAN | SAGALIO ENERGY LTD | 0.003 | 0.002 | 2.00 | $613,980 |

| ERL | EMPIRE RESOURCES LTD | 0.007 | 0.004 | 1.90 | $3,730,888 |

| HGO | HILLGROVE RESOURCES LTD | 0.085 | 0.051 | 1.70 | $49,085,556 |

| AUH | AUSTCHINA HOLDINGS LTD | 0.003 | 0.003 | 1.00 | $3,346,155 |

| BKY | BERKELEY ENERGIA LTD | 0.3 | 0.312 | 1.00 | $73,648,392 |

| PDN | PALADIN ENERGY LTD | 0.125 | 0.234 | 0.50 | $219,010,528 |

| BNL | BIG STAR ENERGY LTD | 0.006 | 0.195 | 0.30 | $1,986,000 |

Oh wait, that was just the table with the lowest PE ratios. This is where you find the table with the highest PE ratios. Haha.

8 – The charts that show a small cap resources revival could be lurking just behind a tech bubble

Right now, the ASX-listed resources space is a two-speed market.

At one end you have the high performing ASX 100 Resources Index – led by companies like BHP and Rio Tinto. Since 2016, ASX100 investors have more than doubled their returns.

At the other, struggling juniors:

Lion Selection Group executive director Hedley Widdup’s professional opinion? Pretty stuffed.

Nothing to be alarmed about though. It’s because there are loads of small cap resources plays – up to a third of all ASX stocks – so liquidity is low. Especially as so much cash is currently flowing instead into unlisted tech and cannabis.

But that tech bubble will burst, one day. And when that happens, Widdup says, get ready for a lot of cash to pour back into the junior mining market.

Just like it has before, after the March 2000 tech boom and bust.

And the signs of a tech bust as never far away. Here be the charts you seek.

9 – What might be about to change in Aussie pot (hint: it’s not recreational)

Anything with the words “statutory review” in it is bound to be dull.

And even though it was about drugs, the review leading to a report on Australia’s marijuana licensing system due out on October 29, was no exception.

Except it is important. Quite.

The cannabis industry is growing at a snail’s pace in Australia compared to just about everywhere else, due to things like applicants must pay for the privilege of working with medical marijuana. It’s about $27,380 a year for a licence, $5040 per licence application, and $1830 for a permit application, the certification that allows commercial or research activities to actually start.

All squeezed through bureaucratic bottlenecks. So here are all the things big industry want to change.

And why is it more important than ever? Because just today, for the first time, an Aussie medical cannabis company got snapped up by an international.

The company was Creso Pharmaceuticals, and the price – a cool $122 million.

Talk about hits from the bong.

10 – The Secret Broker: No, this is when franking credits actually were a big deal

Anyone who watched the cricket understands Australians know how to get out of jail.

But so do Poms, who sent a bunch of us here a couple of hundred years ago to languish in a sun-drenched, beachside prison which didn’t turn out the way they intended.

Steadily, they made their way over as well, pretending they were on holiday but actually never intending to go back home.

And among them was The Secret Broker, to work in the Down Under office back when Paul Keating had just introduced franking credits to dividends paid. Only he did go back home — fast.

That’s because he quickly learnt an overseas holder would not be entitled to claim any franking credits.

Here’s how, for a short time, franking credits were worth far, far more to opportunistic brokers with feet in both Australia and the UK than they ever would be to a Baby Boomer now.

(Note: the loophole is now closed. Sorry.)

That’s all for this week. Enjoy your three days off and love your Queen, east-coasters.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.