Kick Back: The 10 biggest stories you might have missed on Stockhead this week

Picture: Getty Images

Well, that was an interesting week.

Australia started it by confirming something that an entire Twitter audience had refused to accept for four weeks of election campaigning.

And Britain could end it tonight by changing party rules so it can dump a Prime Minister who couldn’t deliver what its people voted for, and replacing her with a leader its people didn’t vote for.

Heady times like these call for a strong cup of tea and a lie down.

Maybe something to read, and you could do worse than take your mind of things by sifting through the biggest items on Stockhead this past week.

They were… a mixed bunch.

1 – Hot Money Monday: These are the most in-demand stocks on the ASX right now

We did a new thing – and it worked. Huh.

Well, Sam Jacobs started a new weekly column based on an old thing — Relative Strength Index.

RSI is a momentum gauge which indicates whether a stock has been overbought or oversold. It’s derived from the number of days a stock closes higher (or lower) from the previous session, and the size of those daily moves.

Broadly speaking, that can help you, the investor, decide whether a stock is shifting on fair value or momentum. A reading of 70 indicates a company’s been overbought; 30 or below, and it may be undervalued.

Handy.

So here’s the list from Monday of the companies that were running hottest and coldest over the previous two weeks. We’ll be updating it every Monday morning from now.

2 – Everyone wants the next Silicon Valley but which Australian state has the hottest tech sector?

State of Origin! Except with brains!

At Pitt Street Research’s Semiconductor Conference last week, the boss of chip-builder Revasum (ASX:RVS) Jerry Cutini said: “We didn’t come (to the ASX) by accident, we came on purpose because we thought it was the right market.”

And Australia’s tech sector collectively lifted its face out of the kindie toilet bowl where it had been sobbing for 10 years and was suddenly all:

So we asked the important question – who’s best at it? Or – who’s recovered best from hideous naming conventions such as “WAAAX” and “Melbourne Tech City”?

Here’s what the stock performances have to say.

3 – Nuclear fusion: Here’s the latest entry in the ambitious race for clean, near-limitless energy

Probably the most frustrating thing on Earth is not actually on Earth. It’s in the Sun, which mocks us every day, burning from within thanks to a near-limitless power source.

If we can fuse atoms together in a controlled way, we can tap into nearly four million times more energy than burning coal, oil or gas.

But as crazy as “building a miniature sun” sounds, boffs are actually trying to do that right now. The biggest experiment is the $20 billion ITER device in southern France, which should be turned on around the end of 2025.

China is one of the countries helping out, and some results came in this week on how hot its Experimental Advanced Superconducting Tokamak got when someone flicked the switch last year.

100 million degrees Celsius says it’s time to reach for your asbestos underpants.

4 – IG Markets stops all trading in pot stocks, tells investors to sell by May 24

Today’s the day IG Markets stopped all trading in 19 cannabis stocks. If they didn’t see the warnings a month ago, holders were told via text yesterday, along with the notice that IG would sell investors’ stocks on their behalf if they refuse to sell themselves.

Why? It was all due to:

“The evolving political and regulatory landscape surrounding recreational cannabis-related securities.”

IG can do that because those investors don’t own the stock — a custodian does. The Australian custodian is Citicorp Nominees Pty Limited.

Here are the seven ASX-listed stocks that copped the IG big stick. And here’s why IG Markets chose to ban just 19 pot stocks out of the 1000 it looked at.

5 – How can the battery sector hedge against volatile vanadium prices?

It’s a bit low on the list, but you can’t keep a good vanadium story down.

Vanadium prices have retreated well off last year’s peak of $US38/lb, but the good news on that is VRFBs — that’s short for vanadium redox flow batteries — could now kick off in a big way.

VFRBs are expected to grab a big piece of a global stationary storage pie that BNEF reckons will be worth about $US620bn in investment by 2040.

VRFBs are a perfect fit for large scale stationary storage — even better than lithium-ion in a number of ways.

The only problem is, 90 per cent of vanadium production is used to strengthen steel, so it’s difficult to find a stable price for the stuff right now.

Here’s how we might be able to move around all that.

6 – The CSIRO is putting the power of tornadoes in tanks to help miners

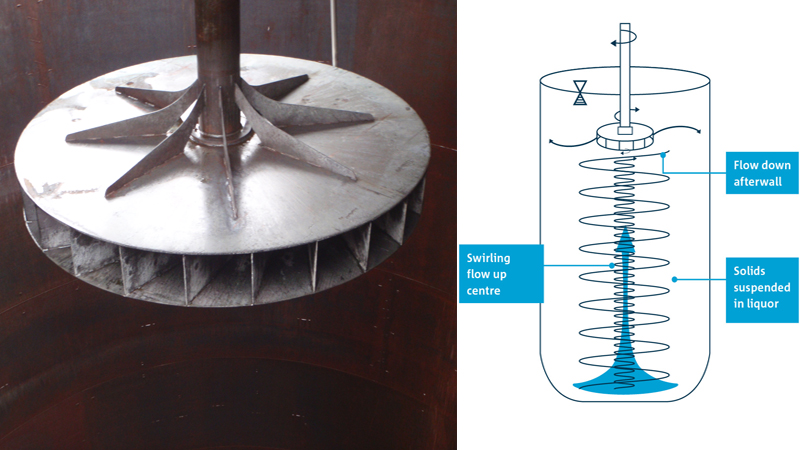

That’s not a blender — this is a blender:

The CSIRO built it, and says it has the “power of a tornado”. Cool.

The science agency has developed it and a technology it calls Swirl Flow to help mining companies clean their slurry tanks.

So far, traditional agitators have left “dead zones” on the walls of tanks, which put the peeps who had to clean it off in various dangerous situations.

It’s being trialled both here and abroad, and one alumina miner reckons it’s saved them up to $200K per mixing tank, per year.

7 – Intel got rich off semiconductors and these Aussie stocks think they can too

Semiconductors are sexy. We know that because there’s a band called Hot Chip and the kids go mad for them:

Back in 1968, Robert Noyce and Gordon Moore had the hottest chips around, and used them to found a company called Intel, which made them a stack of cash.

The chip business is still going strong, especially in this Age of Sensors where we need smaller, faster, cooler ones more than ever to manage our Internet of Things devices.

And who said the Australian tech sector had its head stuck in the toilet? There are currently 11 – 11 semiconductor stocks on the ASX, and four of those are truly, bluely Aussie.

Some of them are even making money.

8 – Cann is Australia’s pot king after scoring a manufacturing licence through IDT

It’s all in the headline — we have a new pot king.

Cann Group (ASX:CAN) scored the big trifecta this week, collecting a cannabis manufacturing licence to send to the pool room and sit alongside its research and cropping licences.

Only AusCann (ASX:AC8), Little Green Pharma in West Australia and MediFarm in Queensland share that honour.

It’s the final hurdle for actually growing marijuana legally in Australia. Here’s what we can expect from Cann moving forward.

9 – FBR releases another robot video… and it’s getting harder for brickies to ignore

There’s another line here for much cruder publications about how brickies are really feeling when the see the latest videos from FBR.

To be fair, they haven’t had a lot to be concerned about in the two years since Fastbricks announced its one-armed bricklaying robot Hadrian actually worked.

But a video released this week ramps things up. Hadrian can not only cut the bricks to size – not a single human finger lost – it also applies a glue, and can store the offcuts and can identify the offcuts for use later.

Oof. Here’s the gluing bit:

And here’s the video of Hadrian building the walls for a three-bedroom, two bathroom house in three days.

10 – The Secret Broker: In which I go big on an inside trade and get everything I deserve

There was a lot of drinking, papers clearly marked ‘CONFIDENTIAL’ and a someone known as “little Jimmy Shuffle Shoes” involved. What could possibly go wrong?

A lot, for The Secret Broker in London in the early 80s. Because by the time he was tempted to make a sneaky motza, insider trading had been banned.

(Yes, there was a time when it was perfectly okay.)

Fortunately, he escaped a prison sentence. But he definitely left a good chunk of dignity behind on the barroom floor when he found out how much of a sucker he’d been played for.

If it sounds too good to be true… run away.

Thanks for reading. Now go and play with your kids or something.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.