Closing Bell: An unlikely bunch of small cap heroes bring it home for the ASX on Tuesday

Via Getty

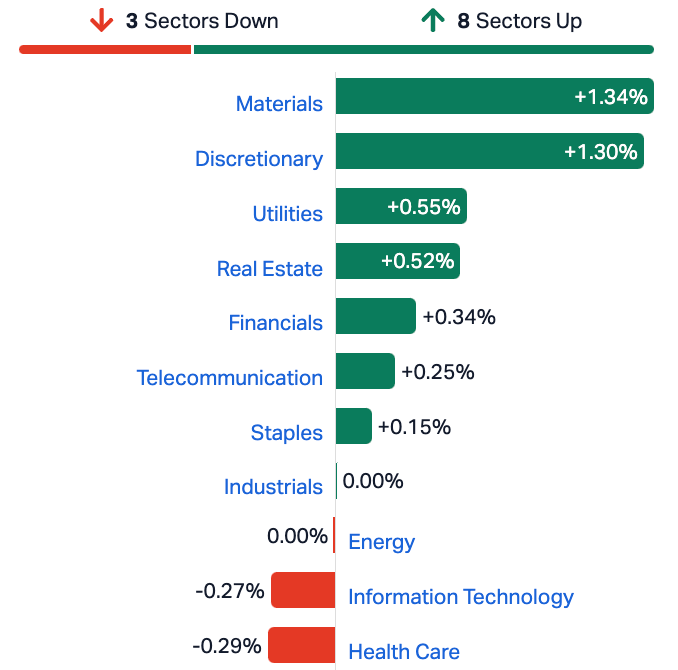

- ASX 200 closes about 0.5% higher after a half-decent lead in from Wall Street

- Material and Discretionary offset losses in Healthcare and IT

- Small cap winners led by EML payments, GCX Metals

It was exciting stuff on Australian share markets Tuesday, as a few familiar faces and some unlikely rock stars came out of their respective burrows following a bright lead from Wall Street.

Materials and Consumer Discretionary names lifted the ASX 200 to an easy 0.5% gain at the close, with Monday’s healthcare winners and the errant Aussie IT Sector not really turning up to work.

That’s a shame, because there’s been some good news about.

Over in Perth, they’ve shipped a first load of lovely barley out to China, with the Agriculture Minister Murray Watt Johnny-on-the-spot to celebrate with an awkwardly placed media conference outside the Kwinana grain terminal.

Beijing, out of ideas, nixxed the long-standing tariffs on barley trade a few weeks ago.

Watt told gathered reporters he’s got a bit of confidence now that exports might even find their way back to square one, before all the Morrison vs China stuff got started.

Absent for much of the reporting season, the Material Sector welcomed some positive toil from the iron ore heavyweights.

BHP (ASX:BHP), Rio Tinto (ASX:RIO) and Monday’s morose Fortescue Metals Group (ASX:FMG) rose 0.92%, 1.27% and 2.75% respectively.

Fortescue lapped up the little attention it could after its hellhole of a Monday session which followed the abrupt departure of now ex-chief executive of 6 months, Fiona Hick.

But that post-party sympathy’s been thin on the ground for FMG on Tuesday, with the stock losing any momentum after it was revealed another top-ranking soldier has also walked away from the FMG founder Andrew ‘Twiggy’ Forrest’s business empire. More on that anon.

The Sector put on a solid show, however, up 1.6% thanks to Mineral Resources (ASX:MIN) (up circa 6%) and Pilbara Minerals (ASX:PLS) (up circa 3%) which enjoyed their own reversals of fortune.

A chunkier dividend payout was largely behind the big day for MIN thanks to a decent result dropped late Monday after the market packed up.

Record lithium earnings were a highlight amid a full year profit down 30% to $244m, although the result was whacked ouit of shape by the $552m non-cash, post-tax impairment charges on the defunct bits of its Utah Point Hub and Yilgarn Hub iron ore operations.

Mineral Resources’ billionaire chief executive Chris Ellison talks up a good game and the punters usually listen.

Tyro dropped FY23 earlier today with earnings up x 4 to a record EBITDA of $42.3mn

A big day.

It was the payment firm’s 1st ever year of positive free cash flow as a public company. So that’s nice.

Here are the ASX sectors:

The ASX Small Ordinaries Index (XSO) ended 0.25% higher, and the ASX Emerging Companies Index (XEC) was just about dead flat.

RIPPED FROM THE HEADLINES

As briefly touched upon, Twiggy Forrest has been abandoned twice in 24 hours.

Today news has spread of the aptly named Paul Slaughter resigning the top job as the boss of the agricultural investments arm of Twiggy’s Tattarang business group, known as Harvest Road .

Slaughter’s departure is the No. 2 top exec exit this week, and one wonders if the Fortescue Metals chief executive Fiona Hick has started something of a movement out west.

Slaughter’s sword-fall comes after a hefty 3 years at the till, which in turn came after a very successful stint flogging Mrs Mac’s Pies.

Hang Seng finally gets some love

Further afield, the Hang Seng is surging on Tuesday, encouraged by some further fiddling about with supportive measures from Beijing, the Hong Kong Index is looking at a strong close to the rarified heights of almost one month highs. to boost China’s capital markets

The Hang Seng was near 2% higher at lunch, Sydenham time, extending gains from the Monday session where Beijing’s boost to China’s capital markets was offset by the ignominious return of debt-laden property developer China Evergrande.

In the meantime, investors also got a boost from China’s sleepy Finance Ministry, which must’ve gotten its own kick from Beijing – suddenly vowing to pop in a few handy, proactive fiscal tricks to try and help support China’s wandering economy and start facing the mountain of debt local governments and dudes like China Evergrande have left everywhere.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| GCX | GCX Metals Limited | 0.042 | 50% | 5,239,300 | $5,201,803 |

| CLE | Cyclone Metals | 0.0015 | 50% | 150,038 | $10,264,505 |

| VAL | Valor Resources Ltd | 0.004 | 33% | 224,750 | $11,485,004 |

| EML | EML Payments Ltd | 0.985 | 32% | 11,653,182 | $278,618,176 |

| ANP | Antisense Therapeut. | 0.068 | 31% | 3,229,650 | $46,880,338 |

| REZ | Resourc & En Grp Ltd | 0.019 | 27% | 3,908,236 | $7,497,087 |

| AON | Apollo Minerals Ltd | 0.035 | 25% | 13,913,604 | $14,744,321 |

| BXN | Bioxyne Ltd | 0.015 | 25% | 111,865 | $22,819,745 |

| OLI | Oliver'S Real Food | 0.015 | 25% | 100,689 | $5,288,783 |

| ADS | Adslot Ltd. | 0.005 | 25% | 15,714 | $13,066,471 |

| APC | Aust Potash Ltd | 0.005 | 25% | 4,623,669 | $4,154,749 |

| CYQ | Cycliq Group Ltd | 0.005 | 25% | 667,588 | $1,430,067 |

| INP | Incentiapay Ltd | 0.01 | 25% | 617,350 | $10,120,509 |

| MXC | Mgc Pharmaceuticals | 0.0025 | 25% | 3,980 | $7,784,719 |

| NNG | Nexion Group | 0.02 | 25% | 113,906 | $3,236,926 |

| SPA | Spacetalk Ltd | 0.031 | 24% | 794,967 | $7,781,073 |

| TMG | Trigg Minerals Ltd | 0.021 | 24% | 281,458 | $3,423,539 |

| SYA | Sayona Mining Ltd | 0.11 | 21% | 208,334,607 | $936,689,937 |

| RMC | Resimac Grp Ltd | 1.05 | 20% | 434,429 | $351,419,548 |

| AVM | Advance Metals Ltd | 0.006 | 20% | 150,000 | $2,942,794 |

| EEL | Enrg Elements Ltd | 0.006 | 20% | 151,492 | $5,049,825 |

| LNU | Linius Tech Limited | 0.003 | 20% | 501,000 | $10,574,477 |

| PUA | Peak Minerals Ltd | 0.003 | 20% | 550,000 | $2,603,442 |

| SKN | Skin Elements Ltd | 0.006 | 20% | 162,143 | $2,847,430 |

| MBK | Metal Bank Ltd | 0.049 | 20% | 159,001 | $11,335,906 |

GCX Metals (ASX:GCX), flying 78.5% higher this morning has ended at round 50% gain on news that it has entered into a binding conditional agreement to acquire the Dante nickel-copper-platinum group elements project located in the West Musgrave region of Western Australia.

Dante contains advanced large-scale magmatic Ni-Cu-PGE targets and PGE-Au Reef targets, including about 23km of outcropping mineralised strike grading an average of 1.1g/t PGE3ii, 1.13% V2O5, and 23.2% TiO2, with grades up to 3.4g/t PGE3.

It’s almost a turnkey operation at this stage, with a signed Native Title Agreement with the Ngaanyatjarra Land Council and initial heritage surveys already completed – and a strong enough proposition to attract experienced geologist and resource company executive Thomas Line as managing director & CEO of GCX, from his most recent role as CEO of Taruga Minerals (ASX:TAR).

Valor Resources (ASX:VAL) is up 33%, still basking in the cracking acquisition by Firetail Resources of a circa 80% stake in Valor’s Peru-based Picha and Charaque Copper Projects. Valor says the deal will streamline its global portfolio, allowing it to focus on its high-potential uranium and rare earth assets in Canada’s Athabasca Basin. More on that below.

Resources & Energy Group (ASX:REZ) is enjoying Tuesday after revealing that gold processing is about to kick off at East Menzies Gold Field, with the company’s ore from Maranoa identified as a prime candidate for the vat leach gold production campaign.

The campaign will initially treat 5000 tonnes of ore with a diluted grade of ~4.6g/t Au, and – once that’s up and running – REZ will get cracking on developing a larger-scale vat leach campaign to treat additional shallow resources which have been identified at the Maranoa (8,000oz) and Goodenough (43,000oz) gold deposits.

Apollo Minerals (ASX:AON) is up on news that it has entered into a conditional agreement to acquire 100% of the shares in Edelweiss Mineral Exploration, which holds the Belgrade copper project in Serbia.

Outside the diggers, a performance of note came from the self-coined ‘alternative residential mortgage lender’ Resimac (ASX:RMC) which rose strongly after a positive outlook for its mortgage market compelled traders to give it a go, despite dropping an after tax profit down 35 %.

RMC said it was optimistic of a turnaround following 12 months of interest rate rises and that the competitive loan market looked likely to drop off in intensity since interest expenses pretty much tripled off the back of the central bank’s psycho hiking policies.

And things haven’t been great of late over in ireland where the perpetually embattled Aussie fintech and payments play EML Payments (ASX:EML) does a fair share of its playing. Anyway, nonsense aside, the shares over there are on a tear. They jumped nigh up 30% in early business off the back of record revenues, which – in a possibly bad sign – beat its own expectations. Or accountants. Pick one.

Revenue came in at $254.2m with group underlying earnings of $37.1m also exceeding guidance. But EML still managed to pull off a pretty impressive net loss of circa $288m, the highlight of which was the God awful $260mn impairment.

EML ‘s shoddy management of its acquisition spree back in the day continues to play poltergeist with its numbers. In the half year to February EML was already writing-down the value of both PFS Group and Sentenial Group the troublemakers again for EML’s FY23 numnbers today.

Back then, EML had to recognise an $86n impairment expense to the carrying value of PFS Group, which was overpaid in the extreme in 2020 for $252 million.

T’were this time last year that the already exhausted EML share price fell over a again as Ireland’s central bank reported “deficiencies” in EML’s apparently lax approach to anti-money laundering. Same thing happened to Westpac – as regulators got tough on a company’s anti-money laundering and counter-terrorism compliance systems. But at least that appears to be in the rearview.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the least performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CCE | Carnegie Cln Energy | 0.001 | -33% | 37,314 | $23,463,861 |

| OAK | Oakridge | 0.12 | -31% | 12,500 | $3,009,244 |

| NMR | Native Mineral Res | 0.041 | -27% | 1,934,104 | $9,426,402 |

| TYM | Tymlez Group | 0.003 | -25% | 4,192,000 | $4,952,781 |

| GAP | Gale Pacific Limited | 0.175 | -24% | 797,049 | $63,570,400 |

| KNO | Knosys Limited | 0.04 | -20% | 655,950 | $10,806,935 |

| AL8 | Alderan Resource Ltd | 0.008 | -20% | 932,110 | $6,166,946 |

| TOY | Toys R Us | 0.008 | -20% | 1,616,567 | $9,229,180 |

| EXR | Elixir Energy Ltd | 0.066 | -20% | 5,495,534 | $76,410,659 |

| VGL | Vista Group Int Ltd | 1.4 | -19% | 33,045 | $406,338,032 |

| WYX | Western Yilgarn NL | 0.18 | -18% | 458,938 | $10,924,651 |

| BC8 | Black Cat Syndicate | 0.22 | -17% | 3,473,505 | $70,722,260 |

| EZZ | EZZ Life Science | 0.54 | -17% | 376,734 | $27,758,250 |

| AMD | Arrow Minerals | 0.0025 | -17% | 797,802 | $9,071,295 |

| HLX | Helix Resources | 0.005 | -17% | 1,017,568 | $13,938,875 |

| AM7 | Arcadia Minerals | 0.096 | -17% | 117,464 | $12,044,824 |

| MEL | Metgasco Ltd | 0.011 | -15% | 146,123 | $13,830,528 |

| HMI | Hiremii | 0.039 | -15% | 900,062 | $5,393,760 |

| PL3 | Patagonia Lithium | 0.14 | -15% | 63,001 | $8,085,578 |

| CI1 | Credit Intelligence | 0.115 | -15% | 78,571 | $11,272,387 |

| ANR | Anatara Ls Ltd | 0.029 | -15% | 117,347 | $4,077,415 |

| PSC | Prospect Res Ltd | 0.094 | -15% | 1,817,286 | $50,848,541 |

| RHK | Red Hawk Mining Ltd | 0.68 | -14% | 4,525 | $134,234,619 |

| ABC | Adbri Limited | 2.345 | -14% | 3,277,601 | $1,790,122,948 |

| MRZ | Mont Royal Resources | 0.18 | -14% | 42,008 | $17,281,936 |

LAST ORDERS

In today’s late mail bag, Firetail Resources (ASX:FTL) is putting the word out that drill planning is advancing at its Picha Copper Project in Peru and that the ambitious future works planned have won strong shareholder backing at 88%.

The news follows FTL’s acquisition of up to 80% interest in Valor’s Peru-based Picha and Charaque Copper Projects.

Valor Resources (ASX:VAL) says the deal will streamline its global portfolio, allowing it to focus on its high-potential uranium and rare earth assets in Canada’s Athabasca Basin.

Consideration comprised of $550,000 cash, 15 million Firetail shares and 20 million performance rights subject to certain vesting conditions. The equity consideration is equivalent to a 20.58% shareholding in Firetail on a fully-diluted basis.

FTL is all guns blazing, saying the exploration camp site works have begun, with onsite installation to start in September.

Final regulatory approvals have already been granted for the area of Picha, which allows for up to 120 holes to be drilled, comprising up to 40 drill platforms with three holes per platform.

The initial program will comprise up to nine diamond drill holes for a total of around 5,000m at the Cobremani, Cumbre Coya, Maricate and Fundicion prospects to test a range of potential mineralisation styles (copper-silver stratabound, carbonate replacement type, epithermal and porphyry).

The maiden diamond drilling (“DD”) program is scheduled to commence in early October 2023.

Executive Chairman, Brett Grosvenor said he was delighted with the strong support for the acquisition of the copper projects and was looking forward to starting exploration activities on the ground in the near-term.

“With the integration of the existing Valor geological team into Firetail, we have inherited an experienced team that has ensured the activities in Peru continue to progress, with the exploration camp build and detailed drill planning well underway.

“I need to acknowledge the technical rigour which has gone into the exploration approach at Picha by the in-country team with the support from Valor’s Perth office. It is a real credit to Valor, and the Firetail Board is privileged to have this continued involvement after closure of the acquisition.

“The targets identified represent the outcome of outstanding multi-disciplinary geological work which has significantly de-risked the exploration process and positioned the project to make a significant discovery.

“The Board, including our soon to be appointed Director George Bauk, are very excited to bring the significant work completed on Picha into the drill phase, unlocking the enormous potential of this asset.”

We’re also into global semiconductor technology and equipment makers, so here’s some late guidance from Revasum (ASX:RVS) which is advises investors it now expects Q3 FY23 revenue to be in the range of US$4.0 million to US$4.5 million, epresenting a 21.9 to 37.1% increase on Q3 FY22.

RVS says the updated guidance follows strong customer demand for tools and “other parts and services, internal operating improvements, and abating supply chain challenges.”

The company says it’s confident of achieving the revenue target in Q3 FY23.

RVS anticipates shipping two 7AF-HMG grinding tools and one 6EC polisher in the quarter. One 7AF HMG will be leased with an option to buy. That unit is intended for a grind wheel manufacturer for joint development activities in collaboration with Revasum.

There’s more too – but it’s late and I don’t know how keen everyone is to hear about ‘6EZ chemical mechanical planarization tools which maintain consistent performance in high volume manufacturing facilities.’

Here’s the Revasum CEO, Scott Jewler:

“Silicon carbide is clearly a bright spot in the semiconductor market, fueled by the rapid expansion of electric vehicle and charging station applications. Revasum’s IP portfolio and strategic relationships with top manufacturers should enable us to continue to scale our business as the industry increases manufacturing capacity of SiC devices on both 150mm and 200mm SiC wafer substrates. Silicon carbide is an extremely hard and difficult to process material.

Unlike competitors, Revasum’s flagship products, the 7AF-HMG and 6EZ, were conceptualized, designed and engineered specifically to meet the unique needs of processing silicon carbide. This dedicated approach provides our customers numerous advantages, such as high material removal rates and excellent material removal uniformity – features which are critically important to our customers.”

Share price is up about 7%.

TRADING HALTS

SQX Resources (ASX:SQX): Pending an announcement relating to changes at Board level.

Australian Pacific Coal (ASX:AQC): Pending news of a capital raise.

Dominion Minerals (ASX:DLM): Pending announcements in relation to the option to acquire the land on which the Georgia Lime Project is located; and a potential corporate acquisition.

Northern Minerals (ASX:NTU): Pending the release of an announcement in connection with an equity raising to be undertaken by way of an institutional placement.

88 Energy (ASX:88E): Pending an announcement by the Company in relation to the shortfall placement.

Ardea Resources (ASX:ARL): Pending the release of the results of an equity raising.

Rincon Resources (ASX:RCR): Pending the release of an announcement in relation to a capital raising.

Eden Innovations (ASX:EDE): Pending the release of an announcement in relation to a capital raising.

Elmore (ASX:ELE): Requested to allow the Company to finalise discussions in relation to extending the due dates for several of its loans and the postponement of the General Meeting due to be held on Wednesday 30 August 2023.

Next Science (ASX:NXS): Pending an announcement by Next Science in relation to a capital raising by way of a placement and a share purchase plan.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.