Kick Back: The 10 biggest stories you might have missed on Stockhead this week

Pic: d3sign / Moment via Getty Images

By the time you’re reading this, you’ll probably be doing all you can to ignore the fact you have to vote tomorrow for someone you could care a whole lot less about than Bob Hawke.

Just remember to get a good sleep. This from a press release just in:

“We know from international studies that tired voters may simply forget to go to the polling booth.

“On top of this, we’re concerned that people who are sleep deprived vote rashly, without the careful consideration required. They are also at greater risk of mis-reading the instructions and accidently casting an invalid vote.”

Thank you, the Sleep Health Foundation and Australasian Sleep Association.

Here’s what you may have missed this week.

8 – The Secret Broker: I shared a bath with Alan Bond

We’re starting at number eight today because of course we are.

Where do we start? His posh London club mates who “made me sit outside because I was a bit on the nose”.

The fact it led to him scrubbing up in what he’d later learn was Alan Bond’s bathtub?

Or the “copious amounts of aftershave from the world’s biggest bottle of Brut”.

Who is this guy?

1 – These are the ASX small caps that equity analysts talk most about

Normal top 10 service resumes.

Investing in small caps is generally exciting. But it can also be hard.

A lot of them haven’t been around a long time, and you know that because – hopefully this isn’t a spoiler alert for you – they’re small.

So your options to read up on them are limited, because analysts don’t have anywhere near the same volume of trading and financial history to reference.

Stockhead is there for you. Nick Sundich has found nearly 30 stocks that in the last 12 months have been covered by four firms or more in the last 12 months.

It doesn’t mean they’re great buys – but at least you know they’re interesting to people who make a living off knowing where value lies.

2 – ‘Underpriced’ Alliance won’t go cheaply as lithium M&A hits the spotlight

Suddenly, everyone’s looking for the next Kidman.

It won’t be WA lithium miner Alliance. At least, not yet, says boss Mark Calderwood.

Calderwood reckons Alliance is still underpriced, and the lithium market still has some ways to run. But the fact that Wesfarmers wants in to the sector, and isn’t a major lithium miner, downstream processor, battery manufacturer or EV maker, is very interesting.

Here’s why the move could be a bit of a gamechanger for lithium players.

3 – Zoono is a $24m company. It just sold $33m worth of product

Monday was another good day for a couple of biotech stocks.

Sleep breathing device maker Somnomed has the a-OK from the all-powerful US FDA for a new sleep apnea product.

Volpara got news its AI-based breast density analysis works better than a visual assessment by a human radiologist.

Then Zoono arrived. The miniature anti-microbial company signed a deal to sell a bespoke antimicrobial “system” to car care company Turtle Wax.

That’ll do.

The formula was developed specially for the business over the last 12 months, and news of the final handshake sent ZNO up 92% on the day.

That’s not surprising – the deal was to sell $33m worth of Microbe Shield. Zoono, at the time, was a $24m company.

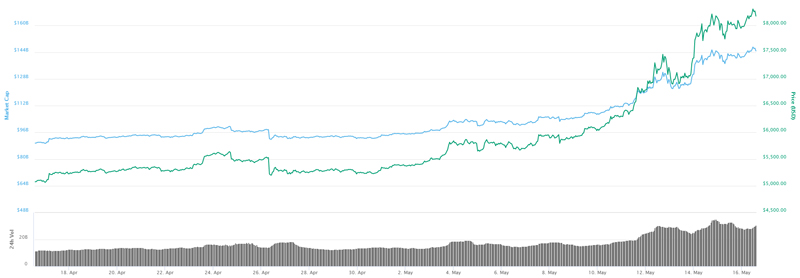

4 – This crypto exchange CEO reckons Bitcoin’s boom is due to a ‘halving’ event – and it’s still a year away

Bitcoin continues to rise. Look:

Why?

DigitalX CEO Leigh Travers reckons it’s mostly due to the trade war between China and the United States, and BTC is now becoming a safe-haven asset.

Adrian Przelozny, CEO of local crypto exchange Independent Reserve, has a different theory – and it has to do with future scarcity.

When BTC was created in 2009, the block reward for mining new coins was 50 BTC. Since then, the reward has been halved twice — it’s now 12.5 BTC.

If you want to try to understand what all that actually means, it’s spelled out in the article.

The important part is, if Przelozny is on the money, it will halve again around May next year.

5 – Orthocell’s 377pc one-day gain was big – but not a record. Here are the biggest this decade

Orthocell scored a hit last week. Its CelGro technology, which aims to help damaged nerves regain sensation and muscle function, had trial patients all:

Result – a 377 per cent single day rise. Incredible, right?

Well, it is the largest single-day gain on the ASX in 2019, and as it happens, the largest Stockhead has covered since we launched in July 2017.

But we wound back the clock a decade or so. Remember that time you got in early on Stemcell’s 3054 per cent one-day gain in 2017?

Or Mission New Energy soaring 2500 per cent in 2015?

Nope? That’s because you’re probably in the Bahamas right now, not reading or caring about any of this.

But if you’d held onto those stocks, it might be a very different story…

5b – Uber had the worst first-day dollar loss ever of any US IPO

For the biggest single-day loss in US IPO history, see Uber this week.

Yes, it’s not a small cap – yet – but we couldn’t resist.

6 – Whatever tantalum even is, Australia could steal its market share from Africa

If you like your electronic devices small and fast, you can thank tantalum. It’s great.

It’s also good for preventing corrosion, making superalloys for aerospace tech, and electric components that store energy.

Even better, it’s a by-product of lithium mining.

But up to now, most tantalum production comes from Africa; specifically Rwanda, the Democratic Republic of the Congo and Nigeria.

And because those countries are a bit on the nose until they pick up their ethical game, Australia – which produces around 5 per cent of primary tantalum supply – may find itself into the 30+ per cent range by 2021.

These are the ASX small cap producers that will help you say loudly in a bar, “I’m in tantalum, actually”.

7 – Uranium stocks guide: Here’s everything you need to know

Our Primers are a bit of a service for you. They’re a reference point to dip into when you’re looking for more information on a lithium stocks, for example.

You’re not supposed to like them. That’s like Volume G in the Encyclopedia Brittanica making it into the top 10 Books of 1932 list.

Although it’s great that you do. Especially this one on uranium, which is clearly a commodity that actually never went off anyone’s radars since the price dropped to as low as $US18/lb in 2017.

Ten years before that – before Fukushima – it hit $US135 a pound.

But things have changed on the supply side since then, and suddenly there are some compelling reasons to check back in on the most controversial commodity of them all.

Here’s all you need to know about uranium right now.

9 – Money Talks: Could one of these stock picks be the next ‘billion-dollar biotech’?

Our most popular expert this week was the owner of this winning, here-take-all-my-money smile:

That’s Stuart Roberts, co-founder of Sydney-based Pitt Street Research. He’s into biotech.

“Ever since the end of the global financial crisis there’s been a steady flow of successful US biotechs jumping into the post-billion-dollar category,” he told Stockhead.

The next Australian one can’t be too far away, Roberts reckons.

Here’s the two he’s watching closely right now, and why.

10 – Bubs founder sells $5.9 million in shares – 20pc – to buy a house

Bubs Australia founder Kirsty Carr sent a few conniptions through shareholders when they found out she’d ditched approximately 20 per cent of her shares in the company.

That made no sense.

Since listing in January 2017 at 10 cents the stock has risen to $1.32 off the back of success in the Chinese market. Its most recent half-yearly revenue was $21 million.

But Carr has no intentions of abandoning her company. The company on Wednesday assured the ASX and shareholders that:

“Mrs Carr has advised that the sale of the shares was for entirely personal reasons to acquire a new family home”

Captain’s Call: Who’s all business at the front, party at the back today?

Just admit it – you made this one of our most popular stories of the week, because secretly, you want this king mullet in your life:

Either on your head, or in your bed.

Jarrad Crickel, you’re a National Living Treasure. Well played, son.

Enjoy your weekend, and thanks for being a Stockhead.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.