Kick Back: The 10 biggest not GameStop stories you might have missed this week

Pic: DKosig / iStock / Getty Images Plus via Getty Images

We’ve all heard just about enough of the GameStop saga. Right?

Okay, one more round. Let’s talk about Keith Gill, aka, RoaringKitty, aka Deepf..kingvalue.

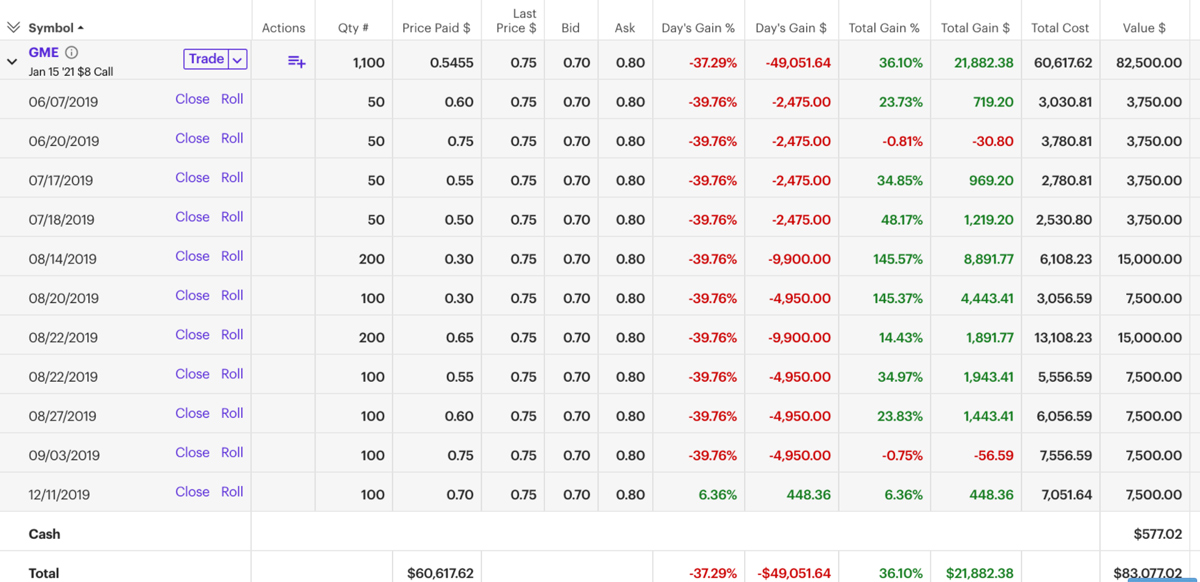

Keith made his position known on GameStop way back in July last year. And it was a biggie – over six or so months he’d built it up to around the $US775,000 mark.

Over at r/wallstreetbets, they were a torrid six months for Keith. Or at least, they would be a torrid time for anyone but Keith.

Keith, as it turns out, is a bit special in the courage and conviction department. Here’s a snapshot of his GME buying spree in the back end of 2019:

The best bit is, as always, the comments at the time. The begging. The pleading. The burning:

“Damn, you’re real determined to make that money disappear. Props”

“Dude just…wtf. So many names to be long on and you do this. They cut EPS guidance by 90%. What the hell is your bull thesis here?”

“Sell ASAP. Why would anyone Long this flaming dumpster fire”

But then, scroll through DFV’s replies and you might learn a thing or two about rationale and resolve.

“Dude everyone thinks I’m crazy, and I think everyone else is crazy. I’ve dealt in deep value stocks for years but have never endured bearish sentiment this heavy. I expect the narrative to shift in the second half of the year when investors start looking for ways to play the console refresh and they begin to see what I see.”

Boom. The “console refresh”. A year before the release of the new Playstation and Xbox, Keith saw a bricks and mortar retailer with millions of members, plummeting to bargain basement prices. Most likely because its short sellers were the type of millionaires whose last joyful gaming experience involved a hoop and a stick.

Over to you Keith. WHAT ABOUT THE CHARTS?

“Of course charts are only a minor part of the equation in my opinion. The fundamentals are much more important in a situation like this.”

(That’s our emphasis.)

Gill’s $750K turned into $48 million about a week ago. And yeah, he lost a chunk of it. But he kept $22 million – good enough – and made a lot of his fellow redditors millionaires as well as their faith in him grew.

Now:

Those short-sellers’ mates The regulators could be coming for him. Until January 21, Gill worked for Boston-based insurance firm MassMutual. He was supposed to have “produced content for the company meant to promote financial wellness and education”, according to the The New York Times.

And, because he holds a CFA licence, it’s possible he might have been obligated to disclose his GME position.

(“Before we proceed, I am obliged to inform you I have millions invested in this dog stock game retailer that every memestonk redditor in history has warning me for 18 months to pull out of. Please stick with us here at MassMutual though.”)

That’ll do. Let’s have a look at what you missed while all that was going on.

1. The Secret Broker: Would you like woofers and tweeters with your bank account, Sir?

Old people. It seems like they’ve been around forever.

And just like the old person in the record shop not knowing the difference between a 33 and a 45, there are still bank tellers in branches out there that don’t know their Revolut from their Dogecoin.

So TSB found out when he wanted to open a new account at a branch he already held accounts at, and was instead accosted by a Tipp-Ex wielding, purple-haired prune who demanded yet another 100 points of ID and his wife’s approval.

This is the story of things that take four weeks when they should take four minutes, and why local businesses die, taking jobs with them.

2. Chart of the Day: US Defense link boosts Anteotech (ASX:ADO) to 85pc rise

Love a good cup-and-handle, three crows or Fibonacci retracement? Course you do!

Not having a Chart of the Day is a bit of an oversight on our behalf here but to be fair, if we did it would be along these lines:

I'm learning charting. Is this how you do it? pic.twitter.com/hTMsYCVo5I

— Brodie Ferguson (@brodieferguson) February 4, 2021

And our journos are already incredibly busy bringing you Australia’s best coverage of small cap discoveries, medical breakthroughs and revolutionary technologies. For free.

Lucky for us Collette Capital’s Steve Collette, who’s just mad for charts, dropped by and casually offered to send through his best spots of the day (again, for free, how good is free?)

In.

The winner? You. Here’s his first offering – Anteotech’s big rise after one of its customers, Ellume, got a score from the US Department of Defence.

3. A brief primer on how to win by aligning your stock with big US tech

While we’re on the topic of bigly partnerships, there are some fairly obvious keywords to search for when you’re looking for positive ASX announcements every morning.

They don’t come along all that often, but generally, if your small cap signs a deal with Samsung, Microsoft, Amazon, Tesla or Apple, it’s going to be good 24-hour ride.

Or longer, even. Oneview Healthcare (ASX:ONE) shares more than doubled on Monday after signing a deal with the US division of Samsung, and have held that position for the week.

Last June, Etherstack (ASX:ESK) saw its share price quadruple in one day after getting the Samsung golden touch.

And virtual reality company Vection Technologies (ASX:VR1) capped a run of positive news with a Microsoft tie-up in the December quarter which pushed its stock up 10x for some investors.

Here’s a brief history of big US tech tie-ins and how it can turn a small cap around, instantly. Don’t miss the next one.

4. V-Con: Medical cannabis – green grass, green growth

2021 is looking like a good year for ASX pot stocks. Finally, our government seems to have come around to the idea that not all cannabis is bad, hmmkay?

The biggest shift finally came this month when the Therapeutic Goods Administration began accepting applications for low-dose CBD oils and pills to be listed on the Australian Register of Therapeutic Goods as Schedule 3 drugs. It will take a little time to work through the system but soon such treatments will be able to be bought from a pharmacist without a prescription.

And next week, MGC Pharma somehow managed to secure top spot in the race to be the first medicinal cannabis company to list on the London Stock Exchange. Huh.

Next problem – where to invest? Well, we’re working on that and will update you soon. But for now, we’ve given six executives from pot companies with very different approaches up to 20 minutes of fame to sell their pot pitch to the world.

It’s our V-Con series of investing-focused videos, and we just let them do the talking. Go.

5. This ASX aviation stock climbed 80pc in 12 months and is up, up and away on a new Qantas deal

Psst! Wanna buy 14 Embraer E190s for just over US$79 million?

You should, because just four years ago, they were worth around $US50 million – each. A lot of that price drop can be attributed to the drop in demand, aka Covid.

So in June, at the height of Covid lockdowns in Australia, ASX listed airline Alliance Aviation (ASX:AQZ) made a brave call, raising the $121 million it needed through an underwritten institutional placement and a share purchase plan, and snapped up the cheap, near-new 100-seaters.

This week, Alliance announced to the ASX it had found a use for some of them – leasing them to Qantas (ASX:QAN).

Congratulations, Alliance. You’re the biggest 12-month winner in ASX aviation sector.

6. Bevan Slattery’s latest ASX small cap investment just doubled

So yeah, buddying up with big US tech can get you an instant 100 per cent gain. Being a smart aviator equals 84 per cent liftoff in 12 months.

Peanuts.

If you really want to stop piffling around and make some real money, you need to see this guy:

That’s Bevan Slattery on the right. He’s responsible for such hits as intelliHR (up 320 per cent) and Pointerra (+890 per cent).

That kind of track record earns an investor evangelical support status. So no surprise that when he announced a $2 million investment in Rent.com.au (ASX:RNT) on Tuesday, that stock soared 144 per cent on the day.

It’s sitting at 22 cents this afternoon. A week ago it was a 4c stock. Onya Bev.

7. What the ETF? China-focused ETFs are among the best performers on the ASX

Or if you’re confused about which pot stock to buy, just buy them all.

Spreads are a great way to smooth out your wins and losses. A bit of a safe bet, maybe, although Cathie Wood’s ARK Invest has a lot of people talking about ETFs right now.

(And, see what we did there, because her latest position is $US34m in sports betting company DraftKings.)

Exchange Traded Funds aren’t exactly setting the ASX on fire though – yet. On average, they’re up 1 per cent in the last month and 12 per cent in six months.

But they are growing in popularity and because we’re into that sort of thing, we’ll start taking a fortnightly look at the best performers. It’s called What the ETF? and it kicked off this week with – not surprisingly – what the best ones right now have in common.

8. These ASX battery companies are well-placed to meet stricter European regulations

The big news in battery metals this week was GM finally realised electric cars might be a thing.

It’s pledged to end production of carbon emitting vehicles by 2035.

But there are a couple of other huge shifts going on right now in the way the world combusts its engines -and a couple of ASX small caps are all over them.

The European Union has raised its targets for battery waste recovery to 65 per cent by 2025, and to a level of 70 per cent by 2030. So it was happy days for battery company EcoGraf (ASX:EGR) as it reached a milestone in its recycling process that recovers graphite anode material for re-use in lithium-ion batteries for EVs.

That’s a big deal. An EV’s battery spews more than 40 per cent of its vehicle’s total carbon emissions over its product lifespan.

It was a big deal for EGR’s share price too – it’s up 70 per cent for the week.

You know what comes next – here are the other ASX small caps poised to cash in on the new European emissions regulations.

Here’s the ultimate list of who’s into battery recycling right now.

And here’s Tesla supplier Piedmont Lithium joining the US Nasdaq exchange. But don’t panic, lithium fiends – it will keep its ASX listing as well.

9. #silversqueeze is probably phoney. Here’s why

Let’s just revisit reddit one more time. How can you look away?

So once the dust started to settle on the GME squeeze battle, everyone’s attention turned to silver. And things got a little silly, best evidenced by this tweet:

My friend runs a major, major gold and silver dealer that’s been around for three decades. I just text him this. And his response #silversqueeze pic.twitter.com/FrLHGO2sfU

— Quoth the Raven (@QTRResearch) January 31, 2021

Hilariously, Aussie silver stocks flew in response, for one glorious afternoon on Monday.

The #silversqueeze, they yelled from the battlements, was on.

Except it wasn’t, for long. And here’s why there’s a 99% chance it never could be, and probably was all a bit phoney to begin with.

It was fun though, for a minute.

10. Money Talks: Excuse me, this stock is a little on the rare side

After the past fortnight, we probably need to get back on track by hearing from a genuine expert.

So here’s Simon Popple of UK-based Brookville Capital, who genuinely makes money quite often, and has been for a while, consistently, by specialising in investing in junior mining companies.

Here, he establishes his credentials by reminding you what happened last time you didn’t take his tips on board.

But he’s not mad. He understands the allure of 5967% gains as much as the next person who thinks it’s their right to become a multimillionaire overnight by watching a few memes tossed around the internet.

So here’s a peace offering – Simon’s Popplewell’s stock which is a little on the rare side.

Tuck in. And thanks for being a Stockhead.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.