June Winners Column: It’s solid gold, baby

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Here’s our Top 50 small caps for June, but first — a quick recap of 2020, so far.

There were a healthy mix of companies in our January Top 50. #1 was Singapore-based ‘bottom of the sock drawer’ minnow Netccentric (ASX:NCL) with a 300 per cent gain.

In February, coronavirus-led uncertainty was mounting. This led to numerous potential coronavirus fighters — including any company that mentioned ‘hand sanitiser’– featuring heavily in the top 50. #1 mover was gold explorer De Grey (ASX:DEG) with a 285 per cent gain.

Then came the share market bloodbath in March — a month dominated by COVID-19 bandwagoners, online education and food delivery stocks, and a couple of big nickel discoveries. Our #1 mover was now-suspended COVID-19 test kit spruiker TBG Diagnostics (ASX:TDL) which gained +862 per cent for the month.

April was a month of tentative recovery. The S&P/ASX Emerging Companies Index was up 23.5 per cent, recapturing a big chunk of March’s losses. Gold came to the fore and most of those COVID-19 bandwagoners fell away, but the biggest mover was unremarkable oil and gas company Jupiter Energy (ASX:JPR) with a decidedly remarkable 3650 per cent gain.

By May, gold was number #1 with investors. But money also found its way into early stage uranium explorers like GTI Resources (ASX:GTR) and TNT Mines (ASX:TIN) which were up 231 per cent and 259 per cent, respectively, over the month.

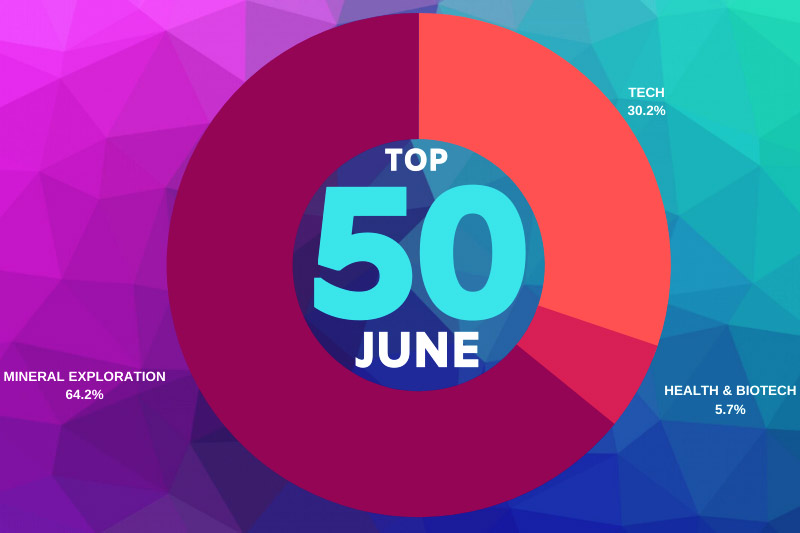

In June economies floundered, markets surged, and gold was king. A massive 51 per cent of the companies on our winners list were gold-focused:

… which could be the norm for the foreseeable future, as gold prices punch though $US1,800/oz on their merry way to $US2,000oz.

In June, 33 small cap companies posted gains of 100 per cent or more, down from 58 last month. Still, there was plenty of good stories for investors to sink their teeth into.

HERE’S THE TOP 50 SMALL CAPS FOR THE MONTH OF JUNE >>>

Scroll or swipe to reveal table. Click headings to sort.

| CODE | NAME | TOTAL MONTHLY RETURN % | MARKET CAP |

|---|---|---|---|

| ESK | ETHERSTACK | 1150 | 198.61M |

| NME | NEX METALS EXPLORATION | 525 | 24.09M |

| MCT | METALICITY | 362 | 51.68M |

| IMC | IMMURON | 225 | 46.35M |

| RXL | ROX RESOURCES | 223 | 167.08M |

| AUT | AUTECO MINERALS | 220 | 213.72M |

| DW8 | DIGITAL WINE VENTURES | 208 | 25.20M |

| MGV | MUSGRAVE MINERALS | 200 | 216.11M |

| TAR | TARUGA MINERALS | 200 | 15.23M |

| AUC | AUSGOLD | 200 | 46.46M |

| BPH | BPH ENERGY | 187 | 8.58M |

| ICU | ISENTRIC | 186 | 4.07M |

| GSM | GOLDEN STATE MINING | 178 | 26.63M |

| SUH | SOUTHERN HEMISPHERE MINING | 173 | 3.26M |

| KAI | KAIROS MINERALS | 171 | 58.59M |

| CAD | CAENEUS MINERALS | 167 | 13.99M |

| GTE | GREAT WESTERN EXPLORATION | 165 | 10.12M |

| ELT | ELEMENTOS | 150 | 12.74M |

| SLX | SILEX SYSTEMS | 142 | 133.89M |

| AL8 | ALDERAN RESOURCES | 142 | 37.62M |

| AUR | AURIS MINERALS | 140 | 19.62M |

| SPT | SPLITIT PAYMENTS | 138 | 415.78M |

| RGL | RIVERSGOLD | 136 | 24.40M |

| SUP | SUPERIOR LAKE RESOURCES | 125 | 16.44M |

| SVD | SCANDIVANADIUM | 125 | 11.75M |

| XTD | XTD | 124 | 7.73M |

| FFR | FIREFLY RESOURCES | 122 | 6.40M |

| RAC | RACE ONCOLOGY | 119 | 81.52M |

| NVX | NOVONIX | 112 | 302.94M |

| SCN | SCORPION MINERALS | 105 | 9.20M |

| VPR | VOLT POWER GROUP | 100 | 18.34M |

| MNW | MINT PAYMENTS | 100 | 14.57M |

| MLS | METALS AUSTRALIA | 100 | 6.41M |

| AR9 | ARCHTIS | 98 | 18.55M |

| AYR | ALLOY RESOURCES | 92 | 8.38M |

| WWI | WEST WITS MINING | 91 | 21.49M |

| KP2 | KORE POTASH | 91 | 18.04M |

| CAE | CANNINDAH RESOURCES | 87 | 2.90M |

| HWK | HAWKSTONE MINING | 86 | 13.83M |

| TYM | TYMLEZ GROUP | 85 | 16.83M |

| IP1 | INTEGRATED PAYMENT TECHNOLOGIES | 85 | 6.25M |

| AYS | AMAYSIM AUSTRALIA | 84 | 174.12M |

| HRN | HORIZON GOLD LIMITED | 84 | 35.20M |

| DTM | DART MINING | 83 | 7.06M |

| TLM | TALISMAN MINING | 83 | 30.79M |

| ARV | ARTEMIS RESOURCES | 81 | 59.96M |

| LSR | LODESTAR MINERALS | 80 | 7.68M |

| MRQ | MRG METALS | 80 | 11.11M |

| DLC | DELECTA | 80 | 6.26M |

| REE | RAREX | 77 | 32.63M |

Gold explorers dominated the Top 50. Again. Get used to it.

Leading the pack were joint venture partners Nex Metals Exploration (ASX:NME) +525 per cent, and Metalicity (ASX:MCT) +362 per cent.

The buzz around the historic, high-grade Kookynie gold project in WA lit a fire under their respective share prices in June.

There’s some work to be done before we find out if this is another Penny West or Bellevue type rediscovery – but early results indicate that project manager Metalicity is on the right track.

Rox Resources (ASX:RXL) also gained 223 per cent on an incredible, 25m-long intersection grading 34.79 grams per tonne (g/t) gold at the Grace prospect, part of the Younami project in WA.

Rox’s subsequent 223 per cent monthly gain saw the share price hit a seven-year high.

Youanmi project partner Venus Metals (ASX:VMC) (30 per cent ownership) also gained, up 66 per cent for the month.

Market darling Auteco Minerals (ASX:AUT) has been flying since buying a historic Canadian gold project called Pickle Crow in February this year.

In June, Auteco – spearheaded by the same team that made Bellevue Gold (ASX:BGL) such a success — defined a maiden 830,000oz at 11.6g/t gold resource.

The former vanadium-titanium explorer is now up 1500 per cent so far in 2020.

And then there’s Musgrave Minerals (ASX:MGV), which uncovered very high, thick and shallow gold at the new ‘Starlight’ discovery, part of its flagship 613,000oz Cue gold project in WA’s Murchison district.

Intercepts like 12m at 112.9g/t gold 36m from surface (including 6m at 143g/t) sent the stock up +200 per cent in June to all-time highs.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.