March Winners Column: Which stocks do investors choose when the world is in lockdown?

News

News

Here are the most popular small cap stocks for March — a month dominated by numerous COVID-19 bandwagoners, online education and food delivery stocks, and a couple of big nickel discoveries.

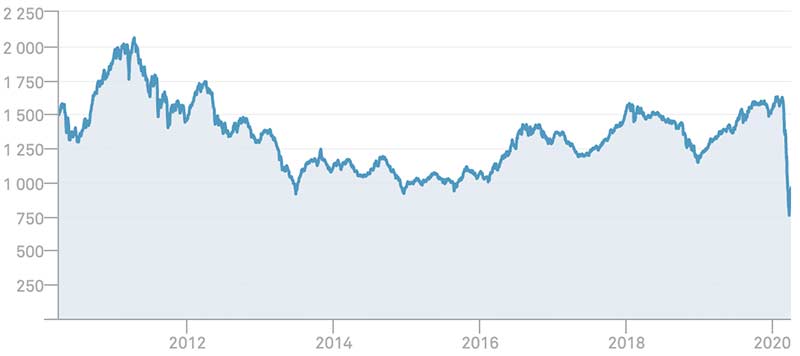

In February, mounting COVID-19-led uncertainty culminated in a late-month share price bloodbath. It was much the same in March, with Australian shares recording a broad-based 22 per cent decline.

The S&P/ASX Emerging Companies Index – which gauges the health of the microcap sector – plunged 12.3 per cent at the end of February to mid-2019 levels.

By the end of March, it had dropped another 30 per cent to all-time lows.

HERE’S THE TOP 50 SMALL CAPS FOR THE MONTH OF MARCH >>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop

| CODE | NAME | % RETURN | PRICE 31 MARCH | MARKET CAP |

|---|---|---|---|---|

| TDL | TBG DIAGNOSTICS | 862 | 0.250 | 54.40M |

| KAS | KASBAH RESOURCES | 245 | 0.038 | 5.14M |

| MMM | MARLEY SPOON | 208 | 0.800 | 126.82M |

| CHN | CHALICE GOLD MINES | 157 | 0.565 | 154.85M |

| CDY | CELLMID | 100 | 0.320 | 30.91M |

| LSH | LIFESPOT HEALTH | 64 | 0.054 | 4.74M |

| NZS | NEW ZEALAND COASTAL SEAFOODS | 63 | 0.013 | 6.89M |

| HT8 | HARRIS TECHNOLOGY GROUP | 60 | 0.016 | 3.05M |

| GSS | GENETIC SIGNATURES | 57 | 1.750 | 249.46M |

| ARO | ASTRO RESOURCES | 50 | 0.003 | 3.82M |

| AQS | AQUIS ENTERTAINMENT | 45 | 0.016 | 2.96M |

| SKN | SKIN ELEMENTS | 45 | 0.016 | 5.08M |

| OLL | OPENLEARNING | 45 | 0.225 | 31.42M |

| TSO | TESORO RESOURCES | 45 | 0.029 | 10.52M |

| CTE | CRYOSITE | 44 | 0.072 | 3.37M |

| AMT | ALLEGRA ORTHOPAEDICS | 43 | 0.150 | 14.93M |

| MRR | MINREX RESOURCES | 43 | 0.010 | 1.96M |

| WNB | WELLNESS AND BEAUTY SOLUTIONS | 43 | 0.005 | 5.17M |

| NSB | NEUROSCIENTIFIC BIOPHARMACEUTICALS | 41 | 0.190 | 14.89M |

| HMD | HERAMED | 38 | 0.145 | 15.04M |

| TSL | TITANIUM SANDS | 35 | 0.050 | 38.93M |

| WRM | WHITE ROCK MINERALS | 33 | 0.004 | 7.53M |

| RGS | REGENEUS | 32 | 0.070 | 19.45M |

| GSM | GOLDEN STATE MINING | 27 | 0.089 | 3.26M |

| DEG | DE GREY MINING | 27 | 0.235 | 251.96M |

| LEG | LEGEND MINING | 25 | 0.105 | 249.07M |

| FTT | FACTOR THERAPEUTICS | 25 | 0.002 | 2.61M |

| DLC | DELECTA | 25 | 0.005 | 3.48M |

| IEC | INTRA ENERGY CORP | 25 | 0.005 | 1.94M |

| DYL | DEEP YELLOW | 24 | 0.210 | 51.43M |

| 3PL | 3P LEARNING | 24 | 0.840 | 117.17M |

| ZEN | ZENITH ENERGY | 23 | 0.850 | 126.98M |

| JRL | JINDALEE RESOURCES | 23 | 0.320 | 12.32M |

| DTS | DRAGONTAIL SYSTEMS | 23 | 0.135 | 33.60M |

| LHM | LAND & HOMES GROUP | 22 | 0.011 | 11.54M |

| RAP | RESAPP HEALTH | 22 | 0.195 | 141.58M |

| ESK | ETHERSTACK | 21 | 0.200 | 22.70M |

| GES | GENESIS RESOURCES | 20 | 0.006 | 4.70M |

| SHE | STONEHORSE ENERGY | 20 | 0.006 | 2.40M |

| HAW | HAWTHORN RESOURCES | 20 | 0.098 | 32.01M |

| MNF | MNF GROUP | 17 | 4.650 | 391.75M |

| BLV | BLOSSOMVALE HOLDINGS | 17 | 0.280 | 17.20M |

| OKJ | OAKAJEE CORP | 17 | 0.035 | 3.20M |

| DXB | DIMERIX | 17 | 0.140 | 25.41M |

| NME | NEX METALS EXPLORATION | 15 | 0.015 | 2.89M |

| CI1 | CREDIT INTELLIGENCE | 15 | 0.030 | 31.81M |

| SOP | SYNERTEC CORP | 15 | 0.023 | 5.08M |

| VAN | VANGO MINING | 15 | 0.115 | 85.90M |

| SM8 | SMART MARINE SYSTEMS | 14 | 0.087 | 29.18M |

| ATH | ALTERITY THERAPEUTICS | 14 | 0.016 | 14.39M |

Digital health minnow Lifespot Health (ASX:LSH) climbed +60 per cent after announcing it was expanding its platform to help track fevers as a result of the COVID-19 pandemic.

Genetic Signatures (ASX:GSS) (+57 per cent) has EU approval for its COVID-19 testing kit and has applied for regulatory approval in Australia. It is already selling in both regions however, thanks to an exemption.

Hair loss curer Cellmid (ASX:CDY) (+100 per cent) is getting into the virus business after winning a supply agreement to sell a China-made COVID-19 rapid diagnostic test in Australia.

And Wellness and Beauty Solutions (ASX: WNB) (+433 per cent) is selling hand sanitiser, stocking its products in Chemist Warehouse and looking to sell in Asia.

Seems like everyone is looking to make a quick buck out of the pandemic right now. Some are legit, others may be less so.

The ASX is cracking down on listed entities that have made announcements with “potentially misleading claims” around COVID-19.

“These include entities that don’t appear to have had any prior meaningful involvement in similar activities, lodging announcements claiming to have found a cure or new treatment for COVID-19; their product kills the COVID-10 virus; or to have developed new forms of test kits for COVID-19,” it announced March 31.

“It also includes entities claiming to be gearing up to use their manufacturing facilities to manufacture masks, gowns, thermometers, hand sanitisers and other medical necessities in short supply with little or no details.”

TBG Diagnostics (ASX:TDL) (+862 per cent for this month) has since been suspended from trading over whether it disclosed news that an investee’s COVID-19 test kit had been approved for sale early enough.

Skin Elements (ASX:SKN) (+45 per cent) was also questioned by the ASX about a vague statement it made in its half year report about a new product launch for an antimicrobial liquid it’s dubbed Invisi Shield.

Nickel was back in the spotlight thanks to Chalice’s (ASX:CHN) virgin Julimar discovery near Perth, announced March 23.

The maiden intercept of 19m at 2.59 per cent nickel, 1.04 per cent copper, 8.37 grams per tonne (g/t) palladium and 1.11g/t platinum from 48m was made in fresh rock at the so-called ‘Conductor E’ target.

Then Legend Mining (ASX:LEG), which announced a new “Nova-style” discovery in the Fraser Range in December, hit three massive sulphide intercepts in a maiden diamond drill hole.

These stocks bucked the trend in a gloomy base metals market, shooting up +157 per cent and +25 per cent respectively for the month.

A world in lockdown means that online education, retailing, and food delivery stocks are doing pretty well.

On example is Marley Spoon (ASX:MMM), a company that delivers ingredients to your door in the form of meal kits.

The stock had fallen 83 per cent since its IPO last year until early March, when punters realised this was probably the type of stock to back in a world defined by ‘social distancing’.

On March 20 the company said the lockdowns had caused “an unprecedented surge in demand for Marley Spoon’s home delivered meal kits in all our markets”.

“Q1 2020 revenue is expected to be above €42m, showing accelerating growth of more than +40 per cent year-on-year compared to Q1 2019, with only the last two weeks of March showing the benefits of the recent surge in demand,” the company said.

It jumped 208 per cent for the month.

NOW READ: February Winners Column — wannabe virus fighters ride high in a rough month for stocks