Is history’s greatest investor breaking up with technology’s greatest company?

News

Let’s not all lose our minds because Warren Buffett’s Berkshire Hathaway (BRK) has offloaded some 10 million of its very many, but very precious Apple (AAPL) shares.

A raft of new SEC filings tells us it actually essentially amounts to a wee portion of its giant AAPL stake.

But the symbolism is significant.

In 2020 during an interview with Yahoo, Buffett spoke of his love for Apple’s sticky deliciousness.

“I just think of the utility of those products to an ecosystem that is demographically terrific and finds that instrument useful dozens and dozens of times a day. It’s almost indispensable, not only to individuals, business, I mean, everything.”

It’s total Warren Buffett. He doesn’t give a damn about whatever tech the business exploits.

Buffett likes businesses which make products people cannot cope without.

Famously in the 1980s he said, unfashionably from a modern perspective, that he loved the cigarette business because: ‘It costs a penny to make. Sell it for a dollar. It’s addictive. And there’s fantastic brand loyalty.’

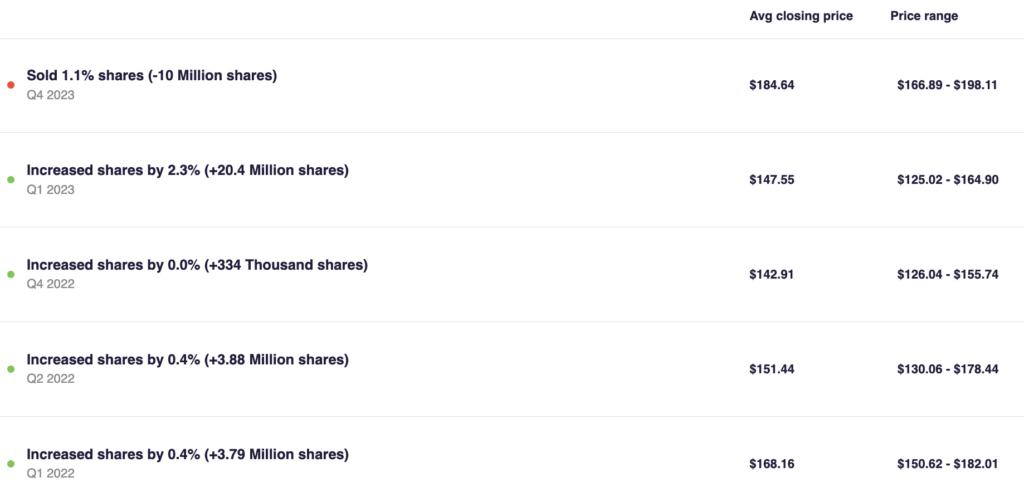

As per Berkshire’s quarterly 13-F filed with the US equities regulator this week, the wonderfully immense conglomerate’s holding in the iPhone maker is now shorn of some 1.1%, to stand at circa 905 million shares – worth around $166 billion.

APPL still occupies a circa 48% place in the heart (arms and legs) of Berkshire’s stupendous $350bn portfolio and is equal to a 5.6% bite of Apple.

Berkshire Hathaway, which owns a million little things including US insurance giant GEICO and Dairy Queen, is Buffett’s holding company and it’s a great big bellwether for what traders should be thinking about at any given time.

Right now, everyone’s thinking what’s the moving parts behind Buffett being off about Apple to the tune of more than 1%.

Warren loves Apple.

He first started buying shares in the iPhone maker during the first quarter of 2016. And since the start of that year, shares had risen 615%.

Warren bleeds Apple cider.

Berkshire Hathaway reported a quieter fourth quarter for its equity investment portfolio, with net sales, exclusive of purchases, coming in at an estimated $1.8 billion based on the insurer’s recent 13F filing.

A few other names of note who got a trim last quarter were media giant Paramount Global (PARA) cut by one third, and PC and printer maker HP (HPQ) , down from 80 million shares to 23 million shares. Some ended up on the other side of the corporate fence.

Buffett’s holding company, which owns GEICO, BNSF railroad and Dairy Queen, sold off about 1% of its stake in Apple in the last quarter of 2023, the company revealed in new SEC filings.

The first Apple trade was made in Q1 2016. Since then Warren Buffett bought shares 13 more times and sold shares on six occasions.

The stake cost Buffett US$35.9bn, netting a gain of 365% so far.

And while Buffett did sell some of that stock a few years back, he said the decision was “probably a mistake” in 2021.

The news comes as Bloomberg reports Apple Inc., racing to add more artificial intelligence capabilities, is nearing the completion of a critical new software tool for app developers that would step up competition with Microsoft Corp.

Bloomberg says it’s been an urgent undertaking for Apple as it tries to play catch up on the next wave.

Craig Federighi, Apple’s senior vice president of software engineering, has reportedly told his teams to develop as many new AI features as possible for this year’s operating system updates.

Apple shares, which had been down as much 1.5%, briefly turned positive on the news. They were little changed at the close Thursday, trading at $183.86. Microsoft fell less than 1% to $406.56.

Buffett’s sprawling conglomerate, which owns the and Geico insurer, first invested in the iPhone maker in 2016 at the direction of one of his two investment deputies: Todd Combs and Ted Weschler.

Buffett later supercharged the investment as he warmed to the technology company, and he spent tens of billions of dollars buying its stock. In 2022, he disclosed the cost of that stake was just over $31bn.

So far, so very, very good. Even after the share sales, Berkshire’s 5.9 per cent position in Apple dwarfs its second-largest publicly traded investment: Bank of America.

Apple stock has sunk 5.6% since the start of the year, while its sparkling reputation has taken a rare hit – to which Buffett’s own glossy status as a stock picker non-pareil has now further tarnished.

In January, it lost its spot as the world’s most valuable company to Microsoft, which has a market cap of US$3trn.

Apple’s market cap currently stands at a not entirely disgraceful US$2.8trn.

But the traders’ inner Sherlock Holmeses know full well that the game’s afoot.

Microsoft swooped on its long-time nemesis last month as the universe’s most valuable company earlier this year, after the iPhone-maker dropped quarterly earnings for the December quarter, featuring a gaping China-shaped revenue hole of about 13% year-over-year. And then the stock copped some headline broker downgrades over the ongoing fears for iPhone demand, especially in China.

At the same time Apple’s attracted unwelcome regulatory attention around the way the company wields its App Store policies.

Add the change of heart out of Omaha, and the short-term for Apple just got distinctly mealy.

The Oracle – sans his longtime partner Charlie Munger who sadly passed late last year – has shown himself to be as active and unsentimental as ever when it comes to trimming long-held positions.

But most excitingly, as pointed out by the FT.com, for a second straight quarter, Berkshire also disclosed it had omitted at least one investment from the quarterly report, noting it had sought confidential treatment from the SEC. The company usually makes that request when it is in the midst of a significant purchase.

Berkshire’s stakes in HP and Paramount have been gutted – the first by 78% and the latter by a third.

Buffett also culled eeight companies entire over the last 12 months. Major names too. General Motors, UPS, and Procter & Gamble.

Berkshire fully exited four positions in the last quarter of the year. The two largest sell-offs were nearly 11 million shares of financial services company StoneCo (STNE) and nearly 6 million shares of home construction firm D.R. Horton (DHI). Berkshire also closed out two smaller stakes in insurance companies Globe Life (GL) and Markel (MKL).

Berkshire also added about 30 million additional shares of Sirius XM (SIRI), more than quadrupling its position.

Famous for his long-term buy-and-hold approach to investing, Buffett did not take on any new positions over the period.

But there’s no missing Berkshire Hathaway’s brand-new scoops in the oil and gas sector.

During the last months of 2023, Berkshire snapped up up a further 16 million shares of Chevron (CVX) and another 19 million shares of Occidental Petroleum (OXY), both pre-existing stakes in US energy firms

Shell predicted on Wednesday that the world will want 50% more liquified natural gas by 2040, as developing Asian countries – not least, China – tuck into the cleaner alternative to traditional fuel.