Income into CBA bank accounts has ‘surged’ since COVID-19 hit — so where’s it all going?

Data from CBA shows household savings have increased materially during the COVID-19 pandemic. (Pic: Getty)

The COVID-19 pandemic has given rise to some historically significant once-offs in both markets and the economy.

And new research from Commonwealth Bank adds another interesting data point to the unusual changes taking place.

Analysis by the bank of its own retail account data shows there’s been a “surge” of additional income flowing into CBA accounts since the pandemic began.

The insights form part of a broader look at the current state of the economy by CBA chief economist Stephen Halmarick.

Covid cash

Breaking down the data, Halmarick said wages and salaries, which includes the initial $70bn component of JobKeeper, had fluctuated since March.

But with additional payments — JobSeeker, plus two $750 payments for eligible welfare recipients and the $550 coronavirus supplement — government benefits have surged by 20 per cent annually.

That’s up from a pre-COVID average of around 5 per cent, which Halmarick called a “staggering outcome” that illustrates the importance of government support in propping up the economy.

He added that he was happy to see the programs had been extended beyond September, albeit at a lower rate.

The net result is that by the end of July, the average savings rate in CBA accounts — comprised of mortgage-related savings, as well as transaction and savings accounts — had risen by a healthy 14 per cent.

Even with interest rates brought down to almost zero, CBA said growth in term deposits had also increased by around 3 per cent annually.

“We also know that the surge in savings is also on the back of the early withdrawal of a little over $31bn in superannuation to mid-August,” Halmarick said.

Where’s it going?

With some extra cash in household bank accounts, CBA’s data showed spending rates also increased — to a peak annual growth rate of around 12 per cent in early July.

That’s since come off slightly, with spending growth falling to around 5 per cent as at August 21.

“Not surprisingly, the most recent weakness in spending (as measured by CBA credit/debit card use) is largely related to the introduction of stage four lockdowns in greater Melbourne,” Halmarick said.

By state, annual spending rates in Victoria have slumped by around 10 per cent in August. That contrasts with NSW, where spending growth is tracking slightly below 10 per cent, while growth in WA and Queensland is closer to 20 per cent.

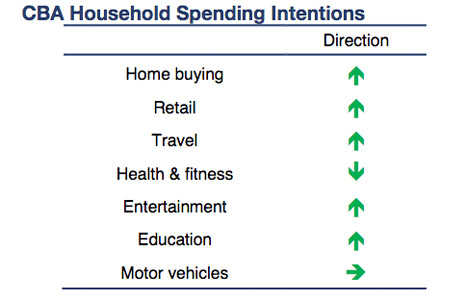

The interesting question for stock investors is where all that money is going, given that such trends can act as a secondary indicator for sector growth:

For example, CBA flagged retail and travel as two sectors which have seen an increase in recent months.

And based on a pickup in activity among home loan applicants, it also indicated that more Aussies are considering a move into the property market on the back of recent house price falls.

However, in what could be construed as a concerning leading indictor of COVID-19 beer bellies, Halmarick flagged ongoing declines in spending towards health and fitness.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.