Australian housing market slides for third straight month

Australia's house market was weaker in July but the outlook could change. Pic: Getty Images

Aussie house prices retreated 0.6 per cent last month, a third straight month of declines, as the market continues to be rocked by the fallout from the COVID-19 crisis.

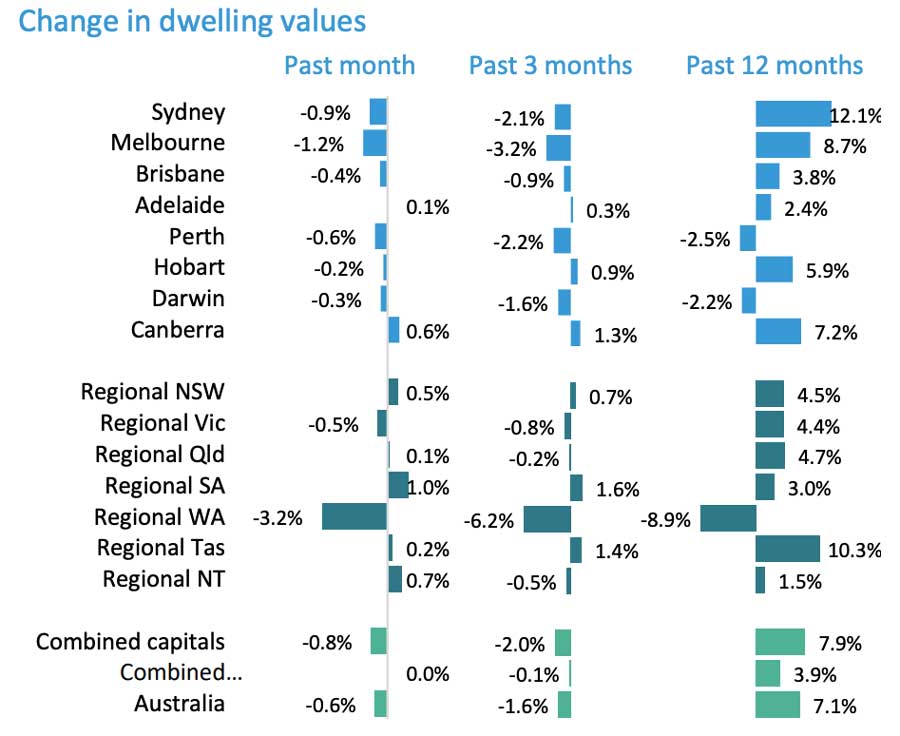

Property data firm CoreLogic’s house price index slumped 1.6 per cent in the June quarter to a median value of $552,900, although the annual rise is still at 7.1 per cent.

Head of research Tim Lawless said house prices had been resilient through the crisis so far, describing the recent price falls as “orderly to date” and adding that sales turnover has recovered since sharp falls in March and April.

Property prices by state

Melbourne house prices led the CoreLogic index lower, falling 1.2 per cent in the Victorian capital in July, and Sydney’s prices ticked down 0.9 per cent last month.

There remains a level of uncertainty over how house prices will perform once government support and loan repayment holidays are scaled back from late September, and again in January, and March 2021.

“Urgent sales are likely to become more common as we approach these milestones, which will test the market’s resilience,” Lawless said.

How JobKeeper, JobSeeker will impact property prices

Millions of Australian workers on the Australian government’s JobKeeper and JobSeeker support programs are set to see their payments decline sharply in September and October.

JobKeeper is an employee retention program that pays a wage subsidy directly to employers, while JobSeeker provides a fortnightly $550 Coronavirus top-up to those out of work as a result of the COVID-19 pandemic.

The Australian Treasury in July announced some important changes to the two programs.

JobKeeper was due to end next month but has been extended for a further six months to March 28, 2021, although payments will be tweaked from September 28 to reflect business turnover.

The JobKeeper payment declines to $1,200 per fortnight after September, from $1,500/fortnight currently, and then drops to $1,000/fortnight from January 3 to March 28, 2021.

Treasury estimates that 3.5 million employees are covered by the JobKeeper program.

A temporary Coronavirus supplement paid on top of JobSeeker payments drops to $250/fortnight from September 25 until the end of December.

The Australian government has put in place various other measures to stimulate the economy such as its $25,000 Homebuilder grant for new homes.

And it is providing a $259bn monetary injection in the form of short-term lending to businesses and support for the banking system.

Home loans frozen

In addition, around 800,000 Australians have paused their payments to lenders for business and personal loans and mortgage payments for six months, the ABC reported.

Customers may be eligible for a further four months grace period on a case-by-case basis.

“The next phase of bank support will avoid a ‘cliff’ for customers in September and give them the breathing space they need to work with their bank and get back on their feet financially,” Australian Banking Association chief executive Anna Bligh said.

The sheer scale of government support to the Australian housing market was revealed in a report by investment bank Morgan Stanley.

Based on its own survey of mortgage payers, the bank found that 55 per cent were in receipt of some form of government payment related to the COVID-19 crisis.

Property experts divided

Housing market analysts are divided on the fate of Australian house prices amid the country’s efforts to contain the spread of COVID-19 cases, particularly in Melbourne.

Louis Christopher, managing director of housing market research firm SQM Research, said in a radio interview last week that falling migration levels were causing a broader housing market downturn.

“Those migrants generally come to Sydney and Melbourne first, and they take up the surplus stock that we build each year in the Sydney and Melbourne housing market,” he told ABC radio.

“That’s not happening right now, so what we are seeing is surplus stock in the marketplace that is affecting the rental market. It is affecting the sales market.”

Housing market expert and principal of Digital Finance Analytics, Martin North, said an expansion in Australia’s money supply could decide what happens next to house prices.

He noted that Australia’s money supply had grown 10 per cent year-on-year in June “thanks to the Reserve Bank of Australia interventions, JobSeeker, JobKeeper, superannuation withdrawals, and other stimulus measures”.

“The question now becomes where will the money flow – to drive [house] prices higher as people buy more, or into the financial system to drive stocks and other financial assets higher?”

He provides a clue to the answer when he reveals that total lending for housing in Australia, both investor and owner occupied mortgages, grew to a record $1.76 trillion in June, according to Australian Prudential Regulation Authority data.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.