I don’t want to jump the gavel but this data says it’s time to head back out on the auction trail

Via Getty

House hunting is so much more fun in a target rich environment and ours just officially became a buyers’ market with new data telling punters to grab some cash and get ready to splash.

And that’s what Spring is for anyway, right?

New analysis of the latest auction data combined with the volume of new listings on Aussie property site realestate.com.au reveal pretty clearly that Australian buyers have a lot more choice, while sellers face a lot more competition ahead of the critical pre-Christmas sales season.

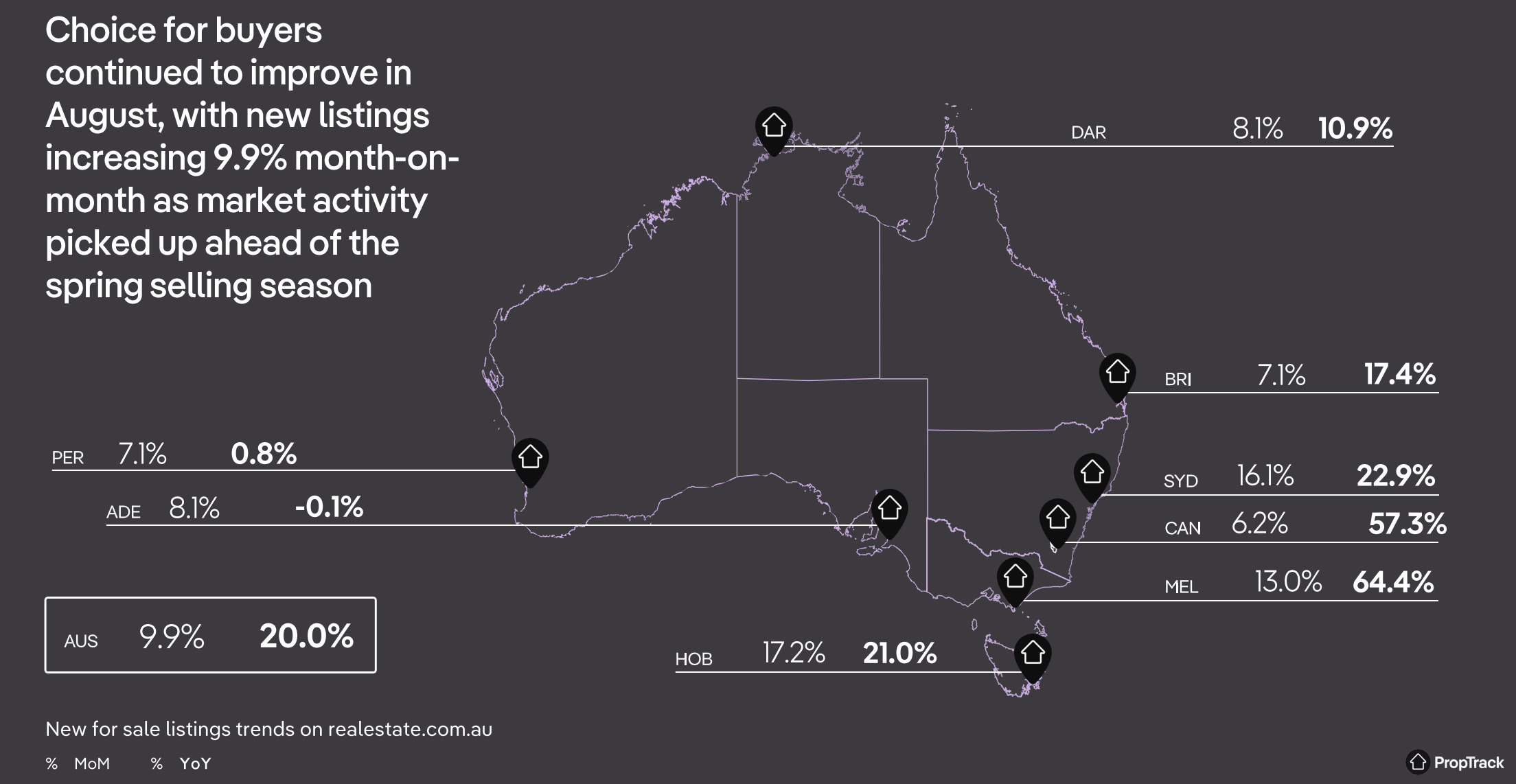

According to PropTrack economist Angus Moore, after the busiest winter for new listings in five years, activity in property markets around the country ramped right up in August driving momentum into the peak Spring selling season.

“New listings nationally on realestate.com.au were 9.9% higher month-on-month in August.”

Moore: There’s more

Every single capital city had more listings in August than in July

The stock of available regional properties listed for sale remains low, but has improved in most states, with new listings picking up 7.9% overall in the month to August.

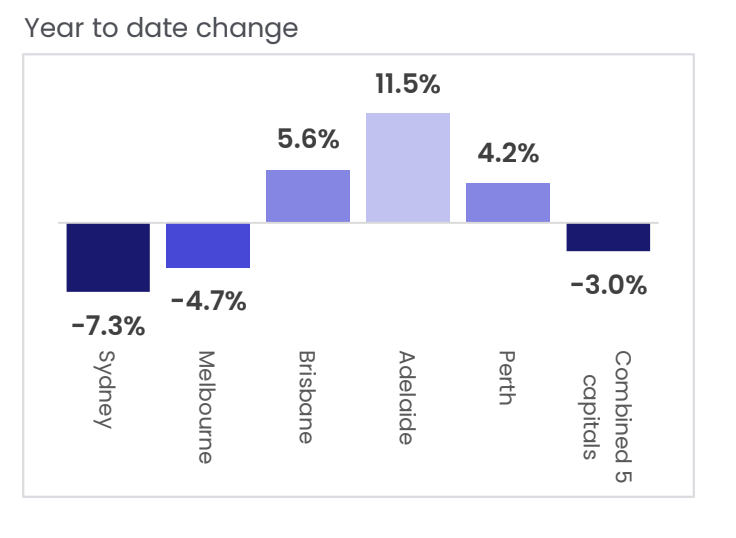

“Despite the pick-up, selling conditions have tempered from their very strong levels earlier in the year. Measures of buyer demand have moderated, it is taking longer to sell homes, and auction clearance rates have fallen,” Moore said.

CoreLogic’s preliminary auction results show there were 1,920 auctions held across Australia’s combined capital cities this week, up from 1,823 over the previous week and 1,453 this time last year.

Of the results collected so far, 61.7% were successful, down slightly from the previous week’s clearance rate of 62.3%, which was revised down to 59.4% at final figures.

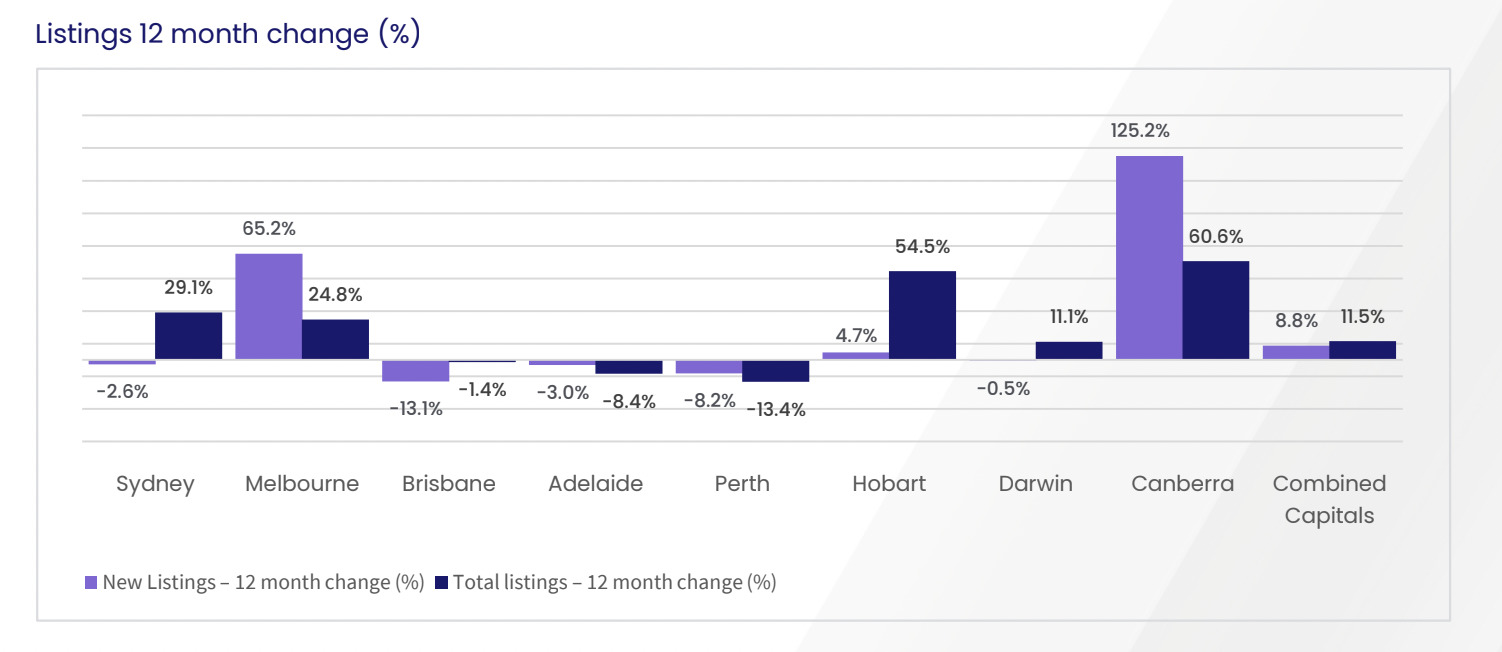

CoreLogic: Capital city/combined capitals total listings

This time last year, 73.7% of auctions were successful.

CoreLogic reckons this week could be the domestic market’s busiest since late June, with more than 2,200 auctions currently on the radar across the combined capitals.

There were 702 auctions in Sydney last week, up 6.2% on this time last year when 661 auctions were held across the city. 60.6% were successful, about the same as last week but way, way down on the 82.8%

Withdrawal rates remain high across the city, with 23.5% of the 571 results collected so far reported as withdrawn, compared to 7.8% in Melbourne where 701 results have been collected so far.

More supply: It’s a matter of choice

“A notable change heading into this Spring compared to last year is that buyers have more properties to choose from. The wave of new supply coming to market over the first half of the year, coupled with longer sales times, has lifted the stock available on market and helped make conditions a bit less competitive for buyers,” Angus Moore says.

“Sydney, Melbourne, and Canberra all have levels of total stock available for sale around or above their prior decade average.”

According to PropTrack even in the tightly-held party towns of BrisVegas and Adelaide – where choice has been limited for some time – there are signs that conditions are improving.

“Home prices have continued to decline in most cities after growth hit multi-decade highs in 2021. The Reserve Bank of Australia has continued to raise interest rates at a brisk pace, with a fifth consecutive interest rate rise in September, which has brought the cash rate up more than two percentage points in just five months.”

Moore says the RBA is likely to continue raising rates over the course of 2022, which will reduce borrowing capacities for prospective buyers and place greater downward pressure on prices in the near term.

“While market conditions have changed, the fundamental drivers of demand remain strong, with unemployment very low, wages growth expected to pick up over this year, and international migration increasing.

“With that in mind, we’d expect to see activity pick up over the next few months as we head into the typically seasonally busy spring season.”

Earlier this month CoreLogic’s Eliza Owen warned serious sellers will need to be more realistic about their price expectations.

To get the price action they want, they’ll need to ensure they have a quality marketing campaign behind the property in what is likely to be “a more competitive selling environment” through Spring and early Summer.

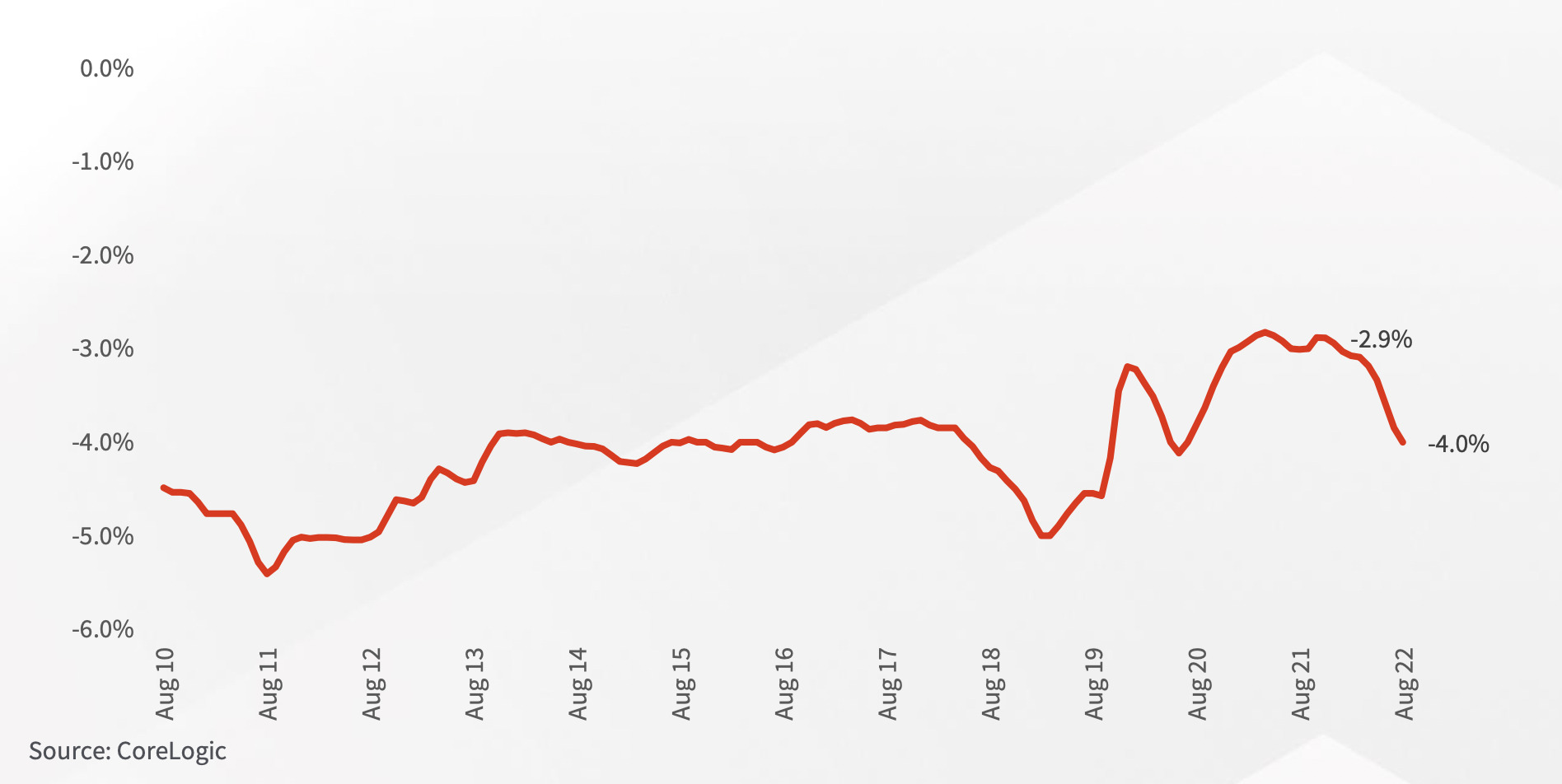

CoreLogic: Median vendor discount of sales – rolling 3 months – national:

This reduction in price is largely a function of rising mortgage rates, where buyers may not be able to afford as much debt as they could a few months ago.

The average owner-occupier home loan size has fallen nationally, from a recent high of $617,608 in January of 2022, to $609,043 in July.

As the cash rate is expected to just keep on keeping on in the coming months, Owen says borrowers are also likely to become more constrained.

PropTrack: What you need to know now

• Activity began to pick up in Australia’s property markets in August ahead of the typically busy Spring season.

• New listings nationally on realestate.com.au were 9.9% higher month-on-month in August, capping off the busiest Winter for new listings in five years.

• This brought new listings up 20% year-on-year in August, though let’s not forget this is comparing to life when Sydney, Melbourne and Canberra were all in quarantine, red alert lockdown status.

• All capital cities saw more new listings in August than in July, with Sydney (+16.1%), Melbourne (+13%) and Hobart (17.2%) seeing the biggest month-on-month upticks.

• Brisbane (+7.1%), Adelaide (+8.1%), Perth (+7.1%), Darwin (+8.1%) and Canberra (+6.2%) all experienced monthly increases in new listings.

• Regional markets also began to… (wait for it) bloom ahead of Spring – new listings picking up 7.9% in August compared to July.

• Regionally, the total stock of properties listed for sale remains low but has improved in recent months.

• The total number of properties listed for sale in regional areas was up 3.8% month-on month in August, the fourth consecutive monthly increase.

• The busier month for new listings helped lift the total stock of properties listed for sale nationally by 3.9% month-on-month.

• This brought total listings up by 13.7% compared to August 2021, the largest year-on-year increase since 2010.

• The increase in stock has brought the total number of properties listed for sale in Sydney and Canberra 10% above the prior decade average and around 1% above in Melbourne.

The nitty gritty: Where is it now cheaper to buy than it was pre-pandemic?

This is just for houses.

But it’s bargain basement – comparatively – across the Sydney enclaves of Rhodes, Balmain (East, yes there’s an East Balmain), and Wollstonecraft (named after Frankenstein).

All these suburbs had lower median sale prices year-ending July 2022 compared to March 2020.

In the undoubtedly fine Melbourne suburbs of Caulfield East, Clayton, and East Melbourne, house prices also fell to pre-pandemic levels.

“These suburbs are among those with prices much higher than their capital city median, which supports the idea that demand for higher-end locations is weakening as mortgage repayments increase,” according to Megan Lieu, economic analyst at REA Group

“All up, there were seven suburbs with median house prices below what they were before the boom. The number of suburbs where unit prices are lower than pre-pandemic times is considerably larger and a lot more varied in terms of cost and location,” Lieu added.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.