How to place bets on the RBA’s next rate move

Making bets on the movement of interest rates. Picture Getty

- What is the Fed Funds rate and the RBA cash rate?

- How could traders profit from movements in these rates?

- We take a look at the 30 Day Interbank Cash Rate futures contracts traded on the ASX

Equity investors bolted for the door on Wednesday after the US headline CPI came in at 8.3% in August, higher than the 8.1% consensus forecast.

Core CPI – which strips out the volatile food and gasoline prices – measured 6.3% with the month-on-month gain twice as high as what economists had predicted.

The data is expected to keep pressure on the US Fed to hike rates by 75 basis points for the third-straight meeting, with some pundits already calling 100bp.

Prior to the CPI report, traders had expected the Fed rate to peak at 3.75%-4%, but now the market has priced in 4%-4.25% by the end of 2022.

But how exactly do we know that?

Well, to answer it we need to first understand what the Fed fund rate is.

When the Fed hikes rates, what it really means is that the Federal Open Markets Committee (FOMC) has come together in a meeting to agree on increasing the prevailing Fed funds rate.

The Fed funds rate is not a single rate, but rather a range between an upper and lower limit which the FOMC has set to guide overnight lending among US banks.

At the end of each business day, banks lend and borrow from each other to balance out their cash and liquidity positions.

For example, if a bank finds itself short at the end of the business day, they would go to the overnight cash market to borrow from another bank which has a surplus – done at the Fed funds rate.

In July, the FOMC set that Fed funds rate at 2.25% to 2.50%.

The market now expects that to peak at 4%-4.25% – meaning that traders think we have another 1.75% increase to go before the Fed stops hiking.

We can deduce this easily from the Fed funds futures contracts which are traded on the Chicago Mercantile Exchange.

As we can see, the Dec 2022 Fed funds futures closed at 95.985 on Wednesday. From this price, the Fed funds rate can easily be implied by deducting the futures price from 100.

In other words: 100 less 95.985 = 4.015%.

How Aussie traders can bet on RBA rates movements

Here’s the interesting part.

Aussie traders can try to make profits by betting on the future direction and size of the RBA cash rate.

The RBA Cash Target Rate is the Australian equivalent of the Fed funds rate, and is essentially the interest rate on unsecured overnight loans between Australian banks.

Instead of publishing it as an upper and lower range, the RBA simply publishes one rate.

At the moment, the RBA cash rate sits at 2.35% after the central bank increased it by 50bp earlier this month.

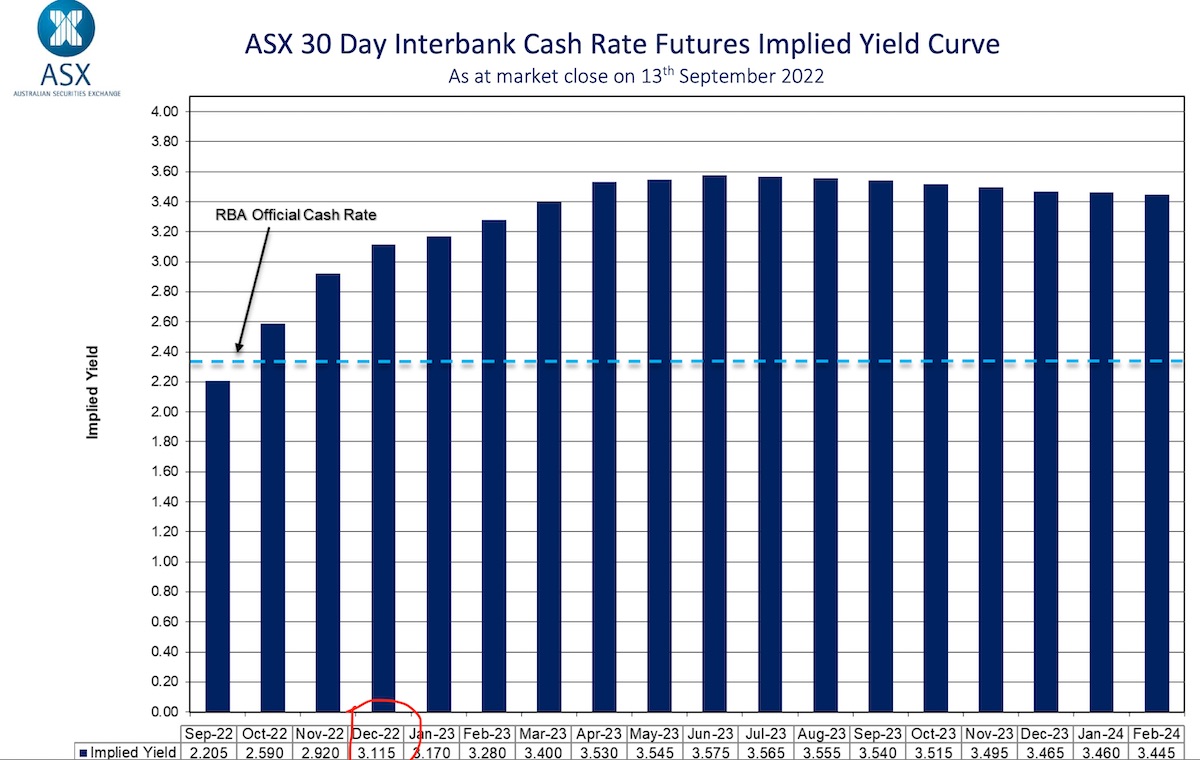

As of today, traders reckon this cash rate will go to 3.115% by year end, meaning they expect the RBA to hike by another 75bp by December.

If you have a view on this, you could potentially make money by trading the 30 Day Interbank Cash Rate futures contracts, which is listed on the ASX.

These futures contracts represent the forward RBA cash rate.

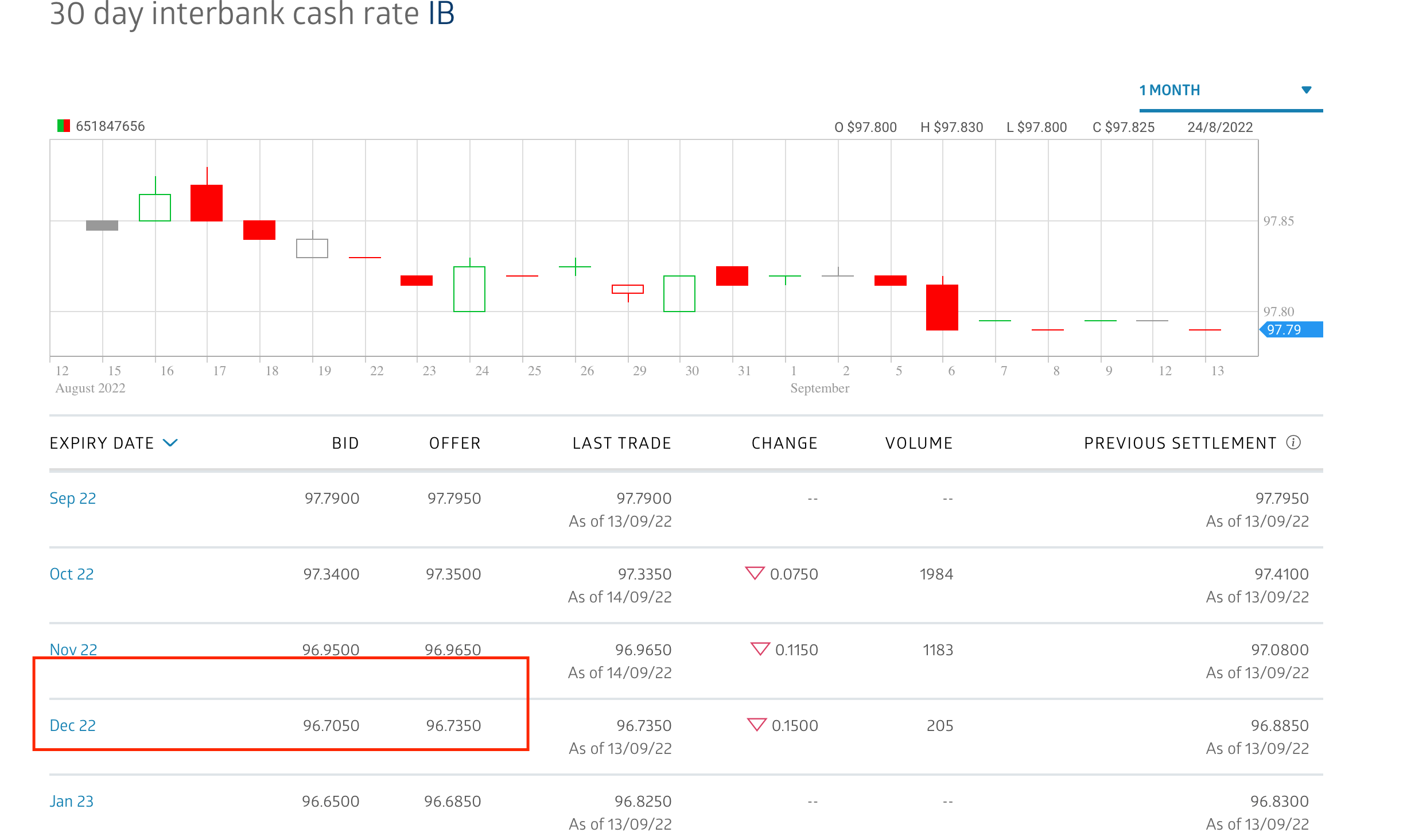

So if you think the RBA won’t be too aggressive in hiking rates (cash rate won’t reach 3% by year end), you could enter into a long (buy) position the December futures contract below.

Remember that the implied cash rate is just 100 minus the futures price. So when rates go down, futures price will go up – bagging you that profit.

Similarly, if you think the cash rate could go as high as 3.5% by year end, you would want to go short (sell) the December contract.

Note that a futures contract is a form of derivative because you’re essentially trading on margin – meaning that you will get margin calls if the trade goes against you.

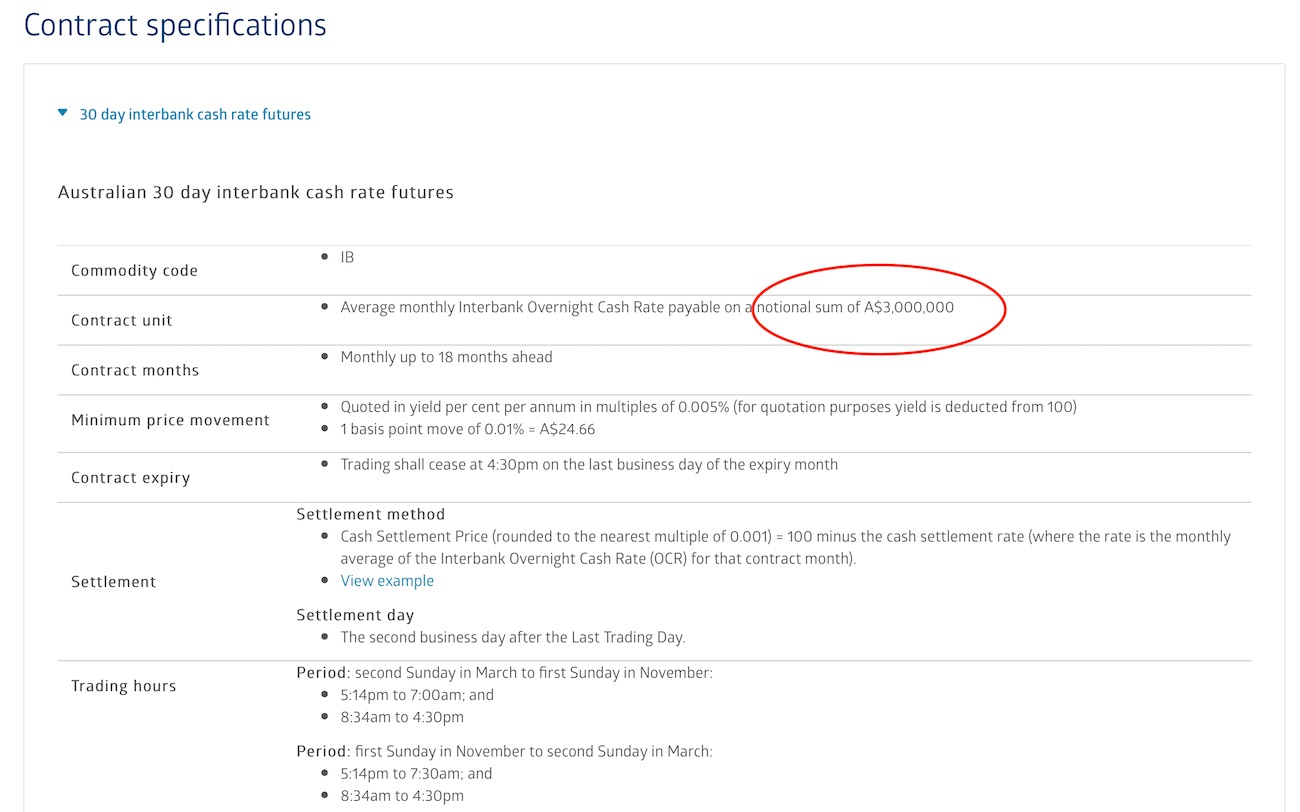

To illustrate this point, a quick look at the ASX specification for the 30 Day Interbank Cash Rate futures will show that each contract is based on a $3 million notional.

Since you’re only paying a much smaller initial deposit to your broker to initiate a futures trade, you’re essentially trading on leverage or margin.

The ASX has already kindly calculated the potential profit or loss by providing the minimum price movement, which is $24.66 for one basis point move.

So let’s say you bought one December 30-Day Interbank Cash Rate futures at 96.735 today (offer price). This implies a cash rate of 3.265% (100 – price).

If the RBA turns out to be less hawkish, it will reduce the expectations of a higher rate, increasing the futures price (lower rates = higher futures price).

In our example, if you manage to sell the contract at 97 (implied cash rate of 3%), your profit will simply be 26.5 bp x $24.66 = $653.49. If you had bought 10 futures contracts, your profit would be 10 times this amount.

But you could just as well lose money if the market’s expectations of future rates go the other way.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.