You might be interested in

News

Closing Bell: Star Casino ruled unfit to reclaim licence; Cassius jumps 40pc as AustChina exits lithium deal

News

ASX Small Caps Lunch Wrap: Things are looking brighter today… okay, maybe not for The Star

News

News

Australians have always been a fairly optimistic bunch with the old expression ‘She’ll be right mate’ helping us believe that at any given time whatever is wrong has a way of working out.

But the latest global research by State Street Global Advisors, the investment management division of State Street Corporation which is one of the world’s fourth largest asset managers, shows us Aussie investor attitudes aren’t overwhelmingly glass half-full throughout the latest economic and market uncertainty.

The research compared Australian investor attitudes on the world economy, markets and investor intentions with those of investors in the US, UK, Switzerland, Netherlands, Israel, Japan and Singapore.

It was to mark the 30th anniversary of ETFs, with State Street launching the first one, the SPDR S&P 500 ETF trust, which has become the largest in the world, back in 1993. (We’ll have another story on how far the ETF sector has come and what it offers investors next week.)

We’re more optimistic on some aspects of our personal finances, markets and the economy but we are also more pessimistic. Note there was no mention in the survey about realism.

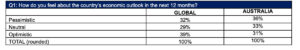

Aussies investor attitudes are evenly divided between pessimism and optimism for the economy over the coming 12 months, which according to the survey is consistent with other countries.

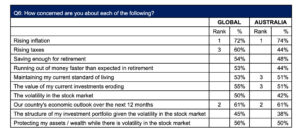

But three-quarters of Aussie investors are concerned by rising inflation in 2023, with 60% worried about the country’s economic outlook over the coming 12 months.

Australia’s inflation rate rose to a 33-year high in the last quarter to 7.8% YoY, or 1.9% QoQ. The headline figure, which was 7.3% in the previous quarter, came in better than the RBA predicted at 8%, but higher than the economists’ consensus of 7.5%.

While rising taxes concern 60% of global investors, only 44% of Australians worry about the same thing, pointing to the strength of the current Federal Government budget position.

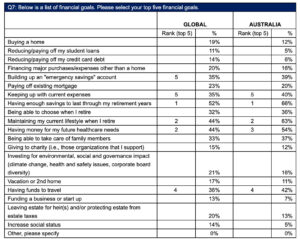

Aussie investors are staying the course and are more comfortable with their current investment settings than those overseas, with 56% of Australian investors maintaining their long-term investment strategy in 2023, while 49% plan to do so.

A further one in six or 16% of Australians are investing more in 2023, looking for value.

Furthermore Aussies are split on which way they believe the S&P500 will trend in 2023, with 30% believing it will go up, 30% saying it will be neutral and 23% being bearish, which is largely consistent with the rest of the world.

A greater proportion of Australians believe volatility in the stock market will continue in 2023 than the rest of the world, 75% in Australia compared to 68% globally.

But we are less stressed by it with 23% in Australia compared to 44% globally. There are 76% of Aussies buying opportunities in Australia compared to 68% globally.

Global and Aussie investors are worried about both present and future cost-of-living considerations, but it seems our concerns are focused on the future.

For example, 66% of Australian investors are concerned with having enough money to last through their retirement years and 54% are concerned with having money for future healthcare needs. Globally these concerns are 52% and 44% respectively.

And it seems we all still like a holiday… but only 33% feel confident of being having enough money to fund travel

But in a positive sign, Australia’s entrepreneurial ecosystem means 100% of investors are confident of being able to fund a start-up business, compared with only 66% of global investors.