Hot Money Monday: Momentum investing is the best strategy in today’s macro environment, say experts

Momentum trading strategy works best under current macro conditions, says expert. Picture Getty

- Momentum trading strategy works best under current macro conditions, says expert

- Momentum trading bets that recent winning stocks will remain winners

- We look at 3 signals used by traders to gauge momentum in a stock

Economic growth in the US has been more resilient than expected; and while a slowdown threatens the final month of the year, the consensus is that we no longer expect a recession.

The Eurozone seems to be enduring a more rapid deceleration, but the region will most likely avoid recession, experts believe.

In China, there are signs recent policy support is helping economic activity levels, although more stimulus is likely to be needed.

Meanwhile, the Israel-Palestine conflict has increased geopolitical tensions, but so far has only modestly added to headwinds to global growth – though there are risks of escalation and we continue to monitor developments closely.

So against this backdrop, which equity investment style might work best going forward?

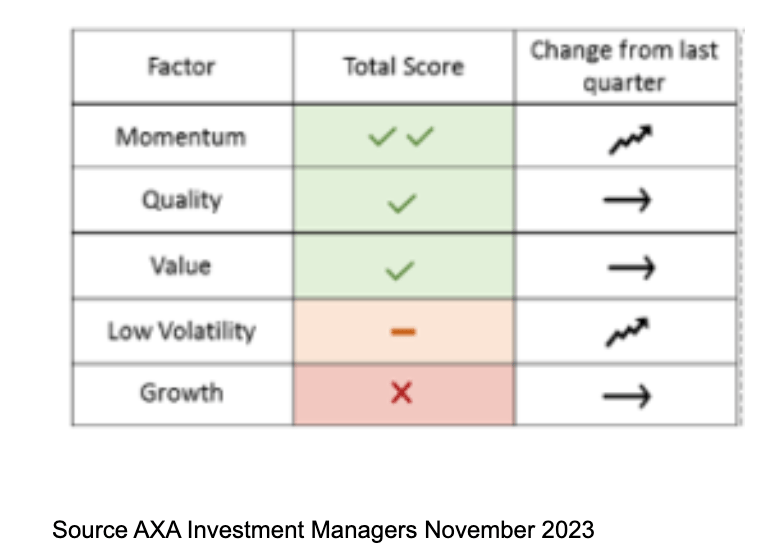

Jonathan White, head Of Investment Strategy & Sustainability, and Daniel Gradeci, quantitative researcher, at AXA Investment Management have come up with a dashboard showing which strategies would work better.

According to White and Gradeci, Momentum Strategy is the highest-ranked factor on AXA’s score card, because typically momentum performs well when macro momentum is in the early acceleration phase of the cycle.

“Momentum valuation while modestly elevated in absolute terms is trading in line with its historical average, leaving the overall score on valuation neutral,” White said.

“Technicals ie; the level of crowding, and short-term volatility levels, are also supportive. We would note that the factor is at risk in any downside surprise to the macro outlook – for example if either the US or Europe enters recession. “

What is momentum investing?

Momentum investing involves betting that the stock market’s recent winners will remain winners in the medium to long term.

Momentum investing uses the strength of stock price movements as a foundation to open positions. The strategy seeks to use momentum to enter a trend as it picks up steam.

Stocks that have maintained a sustained rise over a period are often labeled “momentum stocks” or “high-flyers”.

Another benefit of the momentum strategy is that it can generate high returns for day traders, especially in volatile markets.

Obviously there’s a bit of risk involved in short-term momentum trading because in essence, you’re making a decision to buy a stock based on recent buying activities of other traders.

So to be a successful momentum trader, one needs to be able to identify the best stocks quickly and accurately.

The goal for momentum traders is basically to enter into trades at key points in the trend in order to maximise profits.

There are several indicators to quantify momentum, and here we look at three main signals used by the market:

- 52-week high

- Simple Moving Average

- Relative Strength Index

10 ASX small caps nearest or at 52-week highs

Traders often view the 52-week highs as entry signals.

This is due what’s called the “52-week high effect” – where if a price has broken out above its 52-week range, there must be some factor that generated enough momentum to further continue the price movement in the same direction.

On the other hand, if a stock is far away from its 52-week high, chartists believe the momentum will continue going that way.

10 ASX small caps at 52-week high

(data from Commsec)

| Code | Name | Price | How far from 52-Week High? | 1 mth return | 6 mth return | 12 mth return |

|---|---|---|---|---|---|---|

| MYG | Mayfield Group | $0.500 | 0.00% | 11.11% | 21.95% | -- |

| RIM | Rimfire Pacific Mining | $0.013 | 0.00% | 30.00% | 85.71% | 85.71% |

| CI1 | Credit Intelligence | $0.250 | 0.00% | 6.38% | 72.41% | 2.04% |

| ACP | Audalia Resources | $0.016 | 0.00% | 33.33% | -- | 33.33% |

| URW | Unibail-Rodamco-Westfield | $5.210 | 0.19% | 24.34% | 43.92% | 30.90% |

| REG | Regis Healthcare | $2.990 | 0.33% | 9.52% | 32.89% | 49.50% |

| SKT | SKY Network Television | $2.690 | 0.37% | 1.13% | 16.96% | 25.70% |

| ACF | Acrow | $0.975 | 0.51% | 10.17% | 30.87% | 65.25% |

| CUP | Count | $0.715 | 0.69% | 10.00% | 32.41% | 9.16% |

| AGI | Ainsworth Game Tech | $1.205 | 0.82% | 15.31% | 19.31% | 8.07% |

The electrical and telco infrastructure provider has been rising since announcing in September that it has generated total new orders of $21.2m across its subsidiaries, ATI Australia and Mayfield Industries, for the FY24 to date.

These new orders cover both electrical and telecommunications infrastructure with a spread of end-use applications.

Of particular significance, Mayfield says, are new contracts supporting projects in the developing lithium and hydrogen production sectors, part of the renewable energy economy, data centres supporting the digital economy, and essential services supporting communities.

The company said its order book has a healthy mix of clients, industries (mining, renewables, utilities, essential services, education), project types (capital and services) and order value.

All projects are expected to convert to revenue in the current financial year.

Ainsworth Games Tech (ASX:AGI)

The $400m market-capped gaming company said it has recently appointed Macquarie Capital as its financial advisor to undertake a review of all potential opportunities available to the company.

This process is in the early stages and no expressions of interest have been received by the company.

The process will look to review and assess all strategic alternatives, and will include a broad range of potential organic and inorganic alternatives.

Ainsworth says it remains committed to driving sustained, long-term growth through delivering on its product strategy and continued investments in R&D.

10 ASX small caps with prices above SMA

Simple Moving Averages (or SMA) is another indicator that can be used to gauge momentum.

SMA is often used to determine whether a stock price will continue in the same direction, or if it will reverse a bull or bear trend.

As a general rule, if the current stock price is above the SMA, the price trend is up. If the price is below the SMA, the trend is down.

10 ASX small caps at prices above SMA

(data from Commsec)

| Code | Name | Last Price Value | Price vs. Simple Moving Average | Price vs. 20 day SMA | Price vs. 50 day SMA | Price vs. 200 day SMA |

|---|---|---|---|---|---|---|

| BTR | Brightstar Resources | $0.02 | >5% Above SMA | >5% Above SMA | >5% Above SMA | >5% Above SMA |

| ADX | ADX Energy | $0.11 | >5% Above SMA | 1 to 5% Above SMA | 1 to 5% Above SMA | >5% Above SMA |

| CKA | Cokal | $0.12 | >5% Above SMA | >5% Above SMA | 1 to 5% Above SMA | -1 to -5% Below SMA |

| AEI | Aeris Environmental | $0.03 | >5% Above SMA | >5% Above SMA | >5% Above SMA | -1 to -5% Below SMA |

| ANG | Austin Engineering | $0.32 | >5% Above SMA | >5% Above SMA | >5% Above SMA | 1 to 5% Above SMA |

| ARE | Argonaut Resources NL | $0.11 | >5% Above SMA | >5% Above SMA | >5% Above SMA | < -5% Below SMA |

| ASE | Astute Metals NL | $0.04 | >5% Above SMA | >5% Above SMA | 1 to 5% Above SMA | < -5% Below SMA |

| FFG | Fatfish Group | $0.01 | >5% Above SMA | 1 to 5% Above SMA | >5% Above SMA | -1 to -5% Below SMA |

| LPD | Lepidico | $0.01 | >5% Above SMA | 1 to 5% Above SMA | -1 to -5% Below SMA | < -5% Below SMA |

| ATP | Atlas Pearls | $0.12 | >5% Above SMA | >5% Above SMA | >5% Above SMA | >5% Above SMA |

Brightstar Resources (ASX:BTR)

Brightstar has been rising since reporting its Maiden JORC2012 Mineral Resource Estimate at the Link Zone of +21koz @ 1.1g/t Au from shallow, near surface material at the Menzies Gold Project.

Brightstar said it has identified the Link Zone as having the potential for early-stage mining opportunities to generate operational working capital to organically fund exploration and development activities.

The company has also recently begun a ~5,000m RC drilling program at both the Aspacia and Link Zone prospects.

BTR is eyeing potential additional underground mining opportunity at Aspacia to complement the open pit and underground mining outlined in recent Scoping Study.

Read more: Brightstar starts drilling at Menzies on the hunt for an underground gold mine

The coal company has been rising since giving an update on the Bumi Barito Mineral (BBM) metallurgical coal mine (Cokal 60%).

The barging of BBM Coal has resumed along the Barito River, where water levels are now at safe operating levels following recent rainfalls.

Barging of BBM coal from the Krajan Jetty to the Batu Tuhup Jetty has restarted, with three barges already successfully completing the trip. Scheduling of customer barges to collect coal from the Batu Tuhup Jetty is now the primary focus.

Initial revenues from coal sales also continue to be Cokal’s primary focus, with more details to be revealed soon.

10 ASX small caps with low RSI (Oversold)

Here’s another momentum signal used by the market – the Relative Strength Index (RSI).

RSI is a measure of the strength of a stock’s momentum, either in the upward or the downward direction, and is used to indicate whether a stock is oversold or undersold.

Generally speaking, an RSI above 70 means a stock is overbought; and an RSI below 30 indicates that it’s oversold.

An RSI above 80 meanwhile is strongly overbought, and an RSI below 20 is strongly oversold.

10 ASX small caps at prices with RSI Oversold signal

(data from Commsec)

| Code | Name | 2 Day RSI | 9 Day RSI | 14 Day RSI |

|---|---|---|---|---|

| BBX | BBX Minerals | Oversold | Oversold | -- |

| EYE | Nova Eye Medical | -- | Oversold | -- |

| G6M | Group 6 Metals | -- | Oversold | -- |

| GRX | GreenX Metals | Oversold | Oversold | -- |

| MVP | Medical Developments | -- | Oversold | -- |

| IOD | IODM | -- | Oversold | -- |

| NMT | Neometals | Oversold | Oversold | -- |

| ABA | Auswide Bank | Oversold | Oversold | -- |

| YPB | YPB Group | Oversold | Oversold | -- |

| PPY | Papyrus Australia | Oversold | Oversold | -- |

Shares of PPY have been falling since the board announced a proposal to consolidate the Papyrus Egypt (PPYEg) enterprise within Papyrus Australia.

The company said this move will strategically align and support the future direction of the company’s operations in Egypt, and presents PPY with a number of advantages, including the ability to recognise revenues and profits from PPYEg at PPY level through consolidated financials.

Presently, Papyrus Australia owns 50% of the Papyrus Egypt enterprise in its own right and approxinately 39% of the PPYEg joint venture partner, Egypt Banana Fibre Company (EBFC), through equity acquired in the past two years as previously announced to the market.

This gives PPY a 50% economic interest in PPYEg and 50% of the voting rights in relation to the joint venture.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any perceived financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.