Brightstar starts drilling at Menzies on the hunt for an underground gold mine

The company commenced mining operations this year via a profit share JV with BML Ventures. Pic: via Getty Images.

- Brightstar Resources begins ~5,000m RC drilling program at Aspacia and Link Zone prospects at the Menzies Gold Project in WA

- Drilling at Aspacia following up high-grade hits up to 39g/t Au from previous drilling

- BTR eyeing potential additional underground mining opportunity at Aspacia to complement the open pit and underground mining outlined in recent Scoping Study

Special Report: Brightstar Resources has begun a ~5,000m Reverse Circulation (RC) drilling program at its Menzies gold project in WA after the completion of a heritage survey.

Back in May, the company completed a merger with Kingwest Resources which saw the strategic consolidation of Brightstar’s Laverton gold project and Kingwest’s Menzies gold project.

Menzies includes the high-grade gold field which has historically produced 787,200oz at 18.9g/t gold between 1895-1995.

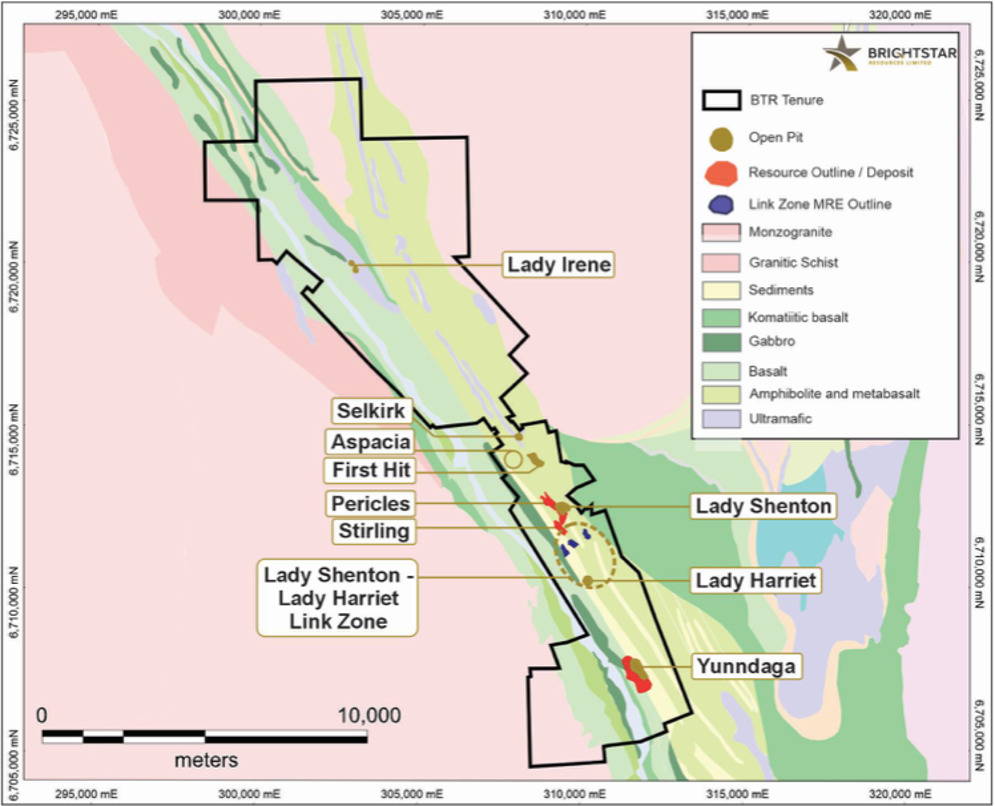

This year, Brightstar Resources (ASX:BTR) commenced mining operations at the Selkirk deposit in Menzies via a profit share Joint Venture with BML Ventures, and last month announced a maiden resource of 21,200oz at 1.07g/t gold for the Link Zone prospect, bringing the total resource estimate at Menzies to 525k oz @ 1.3g/t Au.

The heritage survey has now been completed by the Watarra Darlot Native Title Group covering proposed mining areas at Lady Shenton, Yunndaga and Link Zone and key exploration areas.

The current RC program is targeting shallow, near surface mineralisation at Link Zone and potential high-grade underground material at Aspacia.

Potential for underground mining at Aspacia

The Aspacia program is designed to confirm strike lengths of ~700m with drilling down to 170m vertical depth in certain sections; whilst Link Zone represents an opportunity for Brightstar to expand on the recently announced maiden resource – and prove up additional shallow mineralisation for potential fast-tracked open pit mining opportunities.

Historic records indicate that past production at Aspacia was modest in size but very high grade with a production head grade of 35.7g/t1 including a 100m deep shaft at Aspacia.

Notably, Aspacia is approximately 800m south of the Selkirk deposit, which is currently being mined under the mining joint venture with BML Ventures – and results from this current RC drilling program will help determine the scale of the potential mining opportunity in this area.

The company said positive results could justify advancing Aspacia into the Pre-Feasibility Study (PFS) currently underway as a potential high-grade underground mine to complement the Lady Shenton open pit mines immediately to the south.

In addition, Brightstar believes that the Link Zone has the potential for early-stage mining opportunities to generate operational working capital to organically fund exploration, similar to the Selkirk mining JV currently underway.

Expanding strike and depth extensions

“In preparation for mining activities at Menzies, we have recently spent a week onsite with members of the Watarra Darlot Group conducting a comprehensive archaeological and ethnographical survey of our Menzies gold project,” BTR MD Alex Rovira said.

“Key areas of focus for the survey were the mining centres outlined in the scoping study, the Link Zone and important exploration areas including Aspacia and the underexplored Northern Trend at Menzies.

“Importantly, the survey has cleared previously unsurveyed areas within the Northern Trend at Menzies, where Brightstar will be conducting further greenfields exploration.

“We’re excited to recommence drilling at our Aspacia and Link Zone prospects, with the program expected to refine and expand our knowledge of strike and depth extensions to known mineralisation previously intercepted by Brightstar drilling throughout 2023.”

PFS underway and diamond drilling planned

A diamond drilling program is also planned for the Cork Tree Well deposit (Laverton gold project) to commence in January for geotechnical assessment and metallurgical testwork purposes.

The upcoming PFS will build on the results of a scoping study released in early September which estimated roughly 40,000ozpa gold production over an initial eight years across the Menzies and Laverton projects, generating post-tax NPV of $103 million, IRR of 79% and payback in 1.5 years.

The PFS is also considering a potential restart of its mothballed processing plant near Laverton, which was recently valued as having a $60.9 million replacement cost.

BTR’s global resources currently total 1.036Moz gold, including 511,000oz across its Laverton assets.

This article was developed in collaboration with Brightstar Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.