Horses for courses: After 2023’s biggest property blitz, auction volumes absolutely plummet in Australia’s most distracted city

News

News

After last weekend’s madhouse rush for residential real estate – the busiest batch of auctions for 2023 thus far – preliminary data suggests it’ll be even crazier in Sydney, while numbers in Melbourne are going to crash by more than one-third.

Calamitous falls they appear to be across Melbourne this weekend – with the expected auction numbers almost -38% below the 3,381 auctions seen last week and -11.0% below the average weekly volumes (2,365) seen through spring so far.

This week last year, the sad 2022 Spring selling conditions saw just 1,917 homes auctioned around the nation.

Since then of course, there’s been something of a sea-change.

For one, CoreLogic’s measurement of national residential property prices – the Home Value Index – has jumped +7.6% since the lows of January 2023.

National home prices accelerated again in October, rising 0.9% for the month, with the biggest increases in Perth (+1.6 per cent), Brisbane (+1.4 per cent) and Adelaide (+1.4 per cent)

“At this rate of growth, we will see the national HVI reach a new record high midway through November, recovering from the 7.5 per cent drop in values recorded over the recent downturn between May 2022 and January 2023,” said CoreLogic’s research director, Tim Lawless.

So why are auctions not jumping out of the gate again in Melbourne?

The crash is not because Australia has suddenly woken up to what a drab and grey city our southern cousins inhabit, but in fact because of the horses.

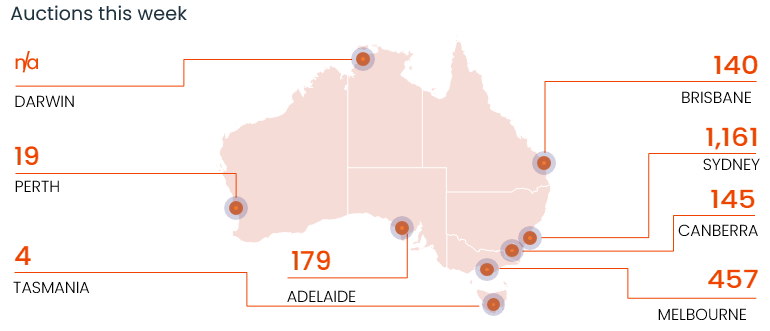

Yes, in anticipation of next week’s Melbourne Cup carnival, auction activity across Melbourne is set to plummet this week, with 457 homes expected to go under the hammer.

Last week (1,725) saw Melbourne host its busiest auction week since the week before Easter 2022 (1,795), while 797 auctions were held across the city this week last year.

Sydney, of course has no such qualms, being a city proven many times over its storied history to both walk and chew gum. It’s set to host Australia’s busiest auction market this week, with 1,161 homes scheduled for auction.

That’s a 8.4% week-on-week rise, and looks set to overtake last week (1,071) as Sydney’s busiest auction week since mid-April 2022 (1,490).

This time last year, the city saw 704 homes go under the hammer.

Adelaide is expecting its busiest auction week of the year-to-date, with 179 homes scheduled for auction, up 5.9% from the week prior (169).

Auction activity across Brisbane is set to decline -40.2% week-on-week, with 140 homes set to go under the hammer, while Canberra’s auction volume is expected to fall -12.1% to 145 this week.

Across Perth, there are currently 19 homes scheduled for auction.

On the brave little island that time and real estate forgot – Tasmania – there will be a grand total of four (4) auctions.

(Ed: That’s up like 400pc w.o.w, so, yeah)

Capital city auction activity skyrocketed last week, with 3,381 homes taken to auction across the combined capitals. With 2,690 homes auctioned on Saturday alone, last week overtook the week before Easter (2,687) as the capitals’ busiest auction week of the year and the busiest week in more than 18 months.

The previous week’s auction numbers (2,463) were 27.2% lower, while this time last year, 1,921 homes went under the hammer.

The additional auction numbers tested the depth of buyer demand, with 62.9% of auctions reporting a successful result. This was the lowest final clearance rate since the week ending 9th April (61.5%) when Easter impacted purchasing activity.

The clearance rate was 2.8 percentage points lower than the clearance rate recorded the previous week (65.7%), but remained 4.1 percentage points above the rate seen this time last year (58.8%).

Last week’s decline in the clearance rate was primarily driven by buyers, with more choice, less urgency and the prospect for a Melbourne Cup day rate rise seeing the portion of properties passed in at auction (29.0%) rising to its highest in almost seven months.

Meanwhile, vendors remained more resolute, CoreLogic says, with the withdrawal rate falling 30 basis points to 8.1%.