Hong Kong brokers latest target in China regulatory crackdown, listed shares punished

News

News

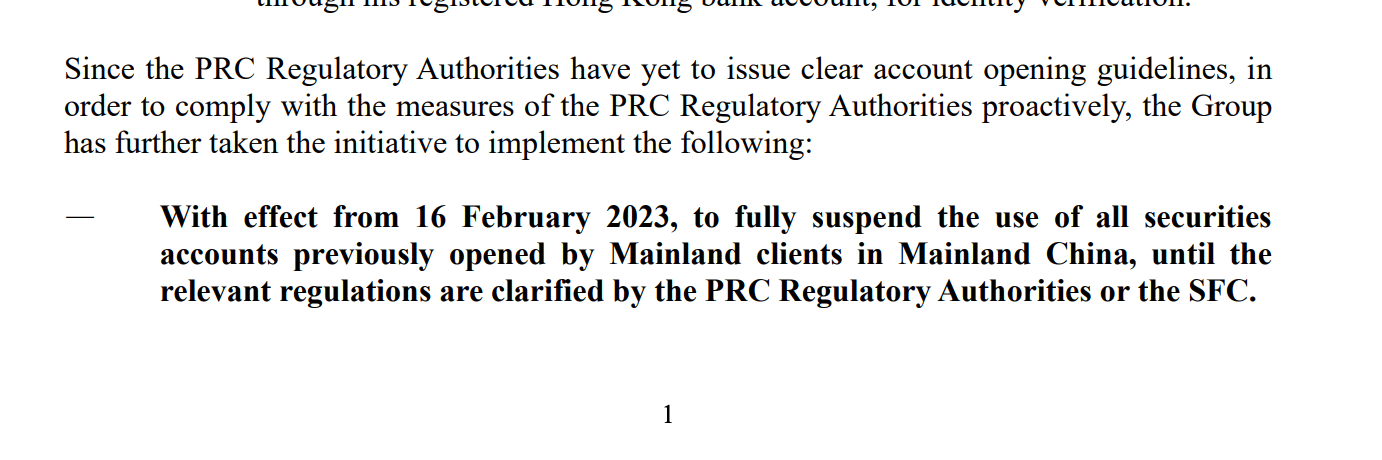

Bright Smart Securities, one of Hong Kong’s largest brokers, is being forced to kill the accounts of all mainland Chinese customers set up in China from this Thursday, according to an unhappy stock exchange filing on Monday.

The Hong Kong-listed Bright Smart has also been feverishly sending a quiet heads-up to its cashed-up mainland clients, warning that their favourite funnelling accounts are about to get suspended “until further regulatory clarification.”

Bright Smart has since asked mainland clients to just go sell their stock holdings and cash out their funds in about 10 days.

Unsurprisingly that news hasn’t won them many friends, as word got out on Monday it triggered a broad sell-off of the firm’s Hong Kong-listed shares.

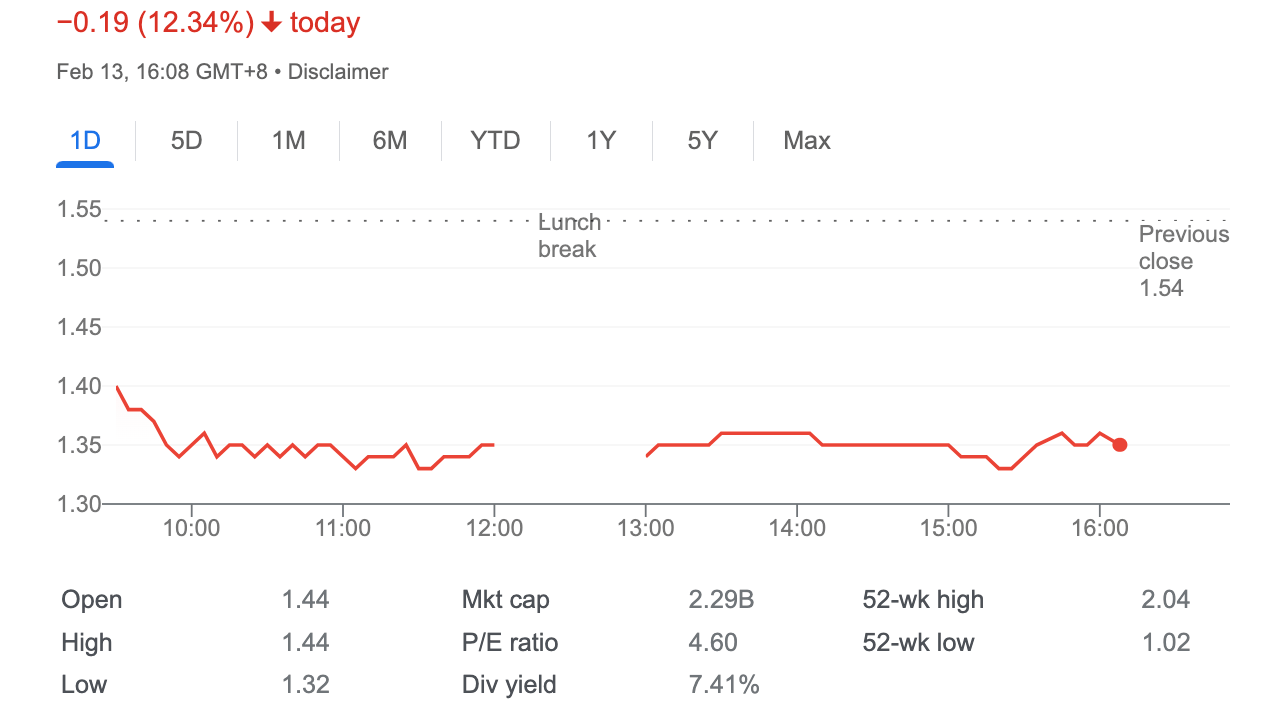

Bright Smart stock crashed by circa 12.3% on Monday.

The move follows a an equally quiet January 16 missive from the cross border securities watchdog, China Securities Regulatory Commission (CSRC) that it would follow through on a new regulation from February 28, which could, among all kinds of new pinch points, bring on a new wave of scrutiny for the increasingly opaque universe of HK’s cross-border share trade.

Another of China’s top brokers in Honkers, Guotai Junan Securities also issued a similar notice but later took it down from the public domain, as per Bloomberg on Monday

Bright Smart will suspend the accounts of all mainland Chinese customers set up in China from Thursday, it said in a filing to the Hong Kong Stock Exchange on Monday.

The CSRC issued a warning to ban the services of two online brokerage operators, Futu Holding and UP Fintech Holding, for allegations of unlawful securities business. The watchdog ordered both firms to stop onboarding new clients from mainland China.

While there’s been nothing useful out of official channels, the latest haphazard move by the Chinese regulator is clearly targeting the massive cash outflow moving away from its strict capital controls. China currently allows citizens to invest in offshore securities and insurance under its US$50,000 annual foreign currency quota.

But with crazy little oversight and often official compliance, international online brokers allow clients to breach that cap with awesome regularity.

In this regard and many others the international online brokerages in HK exist in a twilight regulatory zone when onboarding lucrative clients from mainland China with an eye on moving funds out of the shadow of Beijing.

The proliferation of these platforms has been legion, not least because they haven’t needed to go hunting down a local Chinese operating licence.

With China seeking to build its coffers and straighten out the often very wobbly bits of its public markets, their success and accelerating popularity looks like being the next obvious target for a regulator tasked with cleaning up China’s act.