Has the Danish pharma Novo Nordisk won the war on obesity?

Happy Danes. Via Getty

“Oh, that this too, too solid flesh would thaw, melt and resolve itself into a dew…”

William Shakespeare’s Hamlet, Prince of Denmark

Shakespeare’s introspective Prince of Denmark might be pleased to discover that the Danish pharmaceutical giant, Novo Nordisk (NOV) has just launched its hugely popular Wegovy injectable weight-loss drug into the British Isles this week.

While the famous Dane never made it to England despite his conniving uncle’s best laid plans, NOV is well on the way to conquering the UK with a growing portfolio of drugs which have gained a rep for handily melting solid flesh, despite continuing challenges the company has been facing in meeting surging demand for the treatment.

Even Our Elon, the Tesla billionaire, admitted sometime last year to having used the drug.

Novo Nordisk is riding a tidal wave of exceptional sales growth in anti-obesity treatments, which soared about 160% in the first half of 2023.

Results like these have compelled the company to hike its already judicious forward guidance.

Last year sales hit 176.95 billion kroner (€23.7 billion or US$25.4bn). This year the forecast is for a rise of almost one full third to around US$35bn.

For the time being, its market capitalisation of 2,984 billion kroner (over €400bn) exceeds Denmark’s GDP, which stood at 2,832 billion kroner last year.

Copenhagen vs Paris

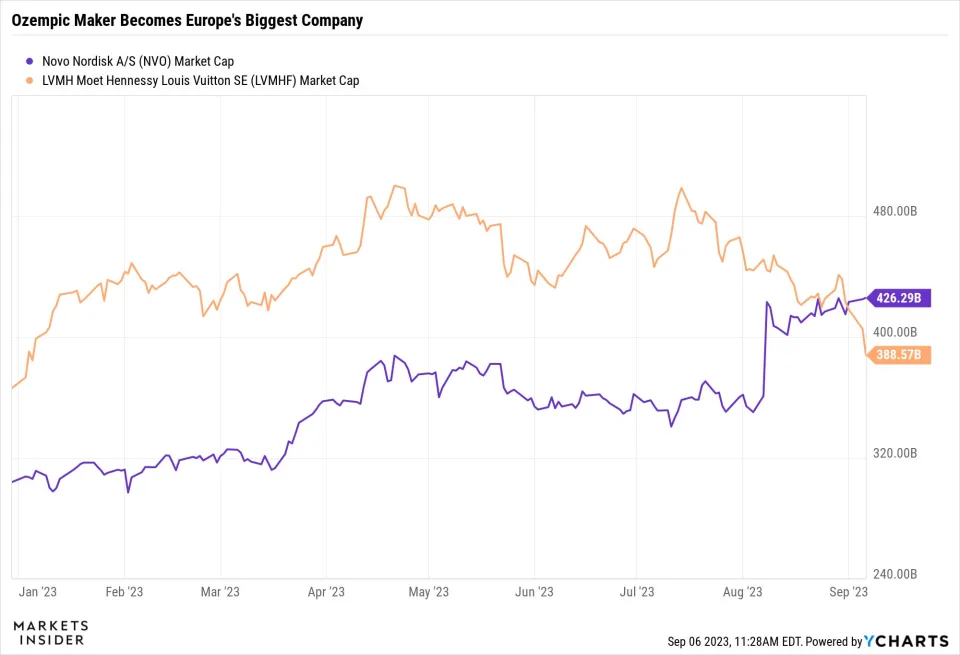

On the back of its hit Glucagon-like Peptide (GLP-1, weight-loss drugs which mimic the action of hormones that produce more insulin to lower blood sugar levels) the Danish pharmaceutical giant last week overtook French luxury conglomerate LVMH Moet Hennessy Louis Vuitton as Europe’s most valuable company.

Here we go, a chart is worth at least 4 or 500 words:

And such is the gravitational pull of this new Euro-star, Novo’s one-time rival, Eli Lilly (ELI) is piggy-backing its own success with another weight-loss offering – Mounjaro (or tirzepatide) and is not too far off Novo Nordisk’s peak position in the obesity landscape.

A very good year: Eli LILLY

And yet the opposite is happening down here.

ResMed (ASX:RMD) is actually the world’s number 1 maker of CPAP devices. These, for you non-snorers, help people with sleep apnoea. Anyhoo, RMD missed market forecasts by a significant -5% on slower-than-anticipated margin recovery.

At the same time, its share price underwent a hard and fast de-rating (-24%) as hedge funds and short sellers over on Wall Street – where RMD shares are also listed – start to bet the field as clear winners and speculative losers emerge from the awesome sight of giants Eli and Novo climbing the charts on the anti-obesity craze.

UBS, for one, believes “constrained health care budgets will limit penetration for obesity”.

“Positive results from Novo’s Wegovy cardiovascular outcome trial SELECT, indicating a risk reduction of 20%, have rekindled the debate on how big the obesity market could become, with bullish estimates (circa) $100bn.

“Whilst SELECT has given Novo a data point to use with insurance companies, it is unclear to what extent the benefit shown in overweight or obese patients with established cardiovascular disease is likely to drive wider reimbursement of GLP-1s as treatments for obesity (Glucagon-like Peptide agonists are a class of drug that mimic the action of hormones that produce more insulin to lower blood sugar levels).”

The world is challenged by obesity (this has been the case for decades); and UBS argue that the problem is too complex, and today’s pharmacology too expensive, to offer sensible health-economics.

In the UBS camp, the view is – due to HealthCare budget impacts – “patient flow in obesity is likely to become increasingly restricted” and, as a result, they reckon “more efficacious products” will have time to likely find their way onto a market and “gain greater new patient share”.

FN Arena’s wonderful Belgian, Rudi Filapek-Vandyck does not agree.

“Analysts covering the company and its sector believe the assumption that sleep apnoea is simply a result of obesity and that ResMed’s growth will be stunted because of popular weight-loss pills is misplaced and misguided,” Rudi says.

“…but most investors will be hesitant to catch the proverbial falling knife, instead biding their time and see when exactly those shares find support.”

Obesity: A big opportunity

GlobalData forecasts the obesity market to reach $37.1bn across seven major markets, including the US, France, Germany, Italy, Spain, UK and Japan, by 2031.

Soaring demand for Novo’s barnstormingly successful appetite-suppressants has resulted in all kinds of global shortages, even though it’s prescription only for people with obesity and users have to inject the drug every week.

The short-term success of the drugs seems pretty clear, although a long-term study is lacking.

The Danish pharma’s strategy to control demand is to allocate the drug to people in specialist NHS weight management services who meet the National Institute for Health and Care Excellence (NICE) eligibility criteria (a body mass index of 30 or over and weight-related co-morbidities) or privately registered healthcare professionals.

The New England Journal of Medicine, which showed that Wegovy (2.4mg subcutaneous semaglutide) could reduce heart-failure-related symptoms in people with obesity.

Entering the UK with hands tied

The ludicrous popularity has tied Novo Nordisk’s hands and the manufacturer has decided to hold back some lower-strength starter doses of Wegovy in the US as it seeks to safeguard supplies for patients already using the drug amid surging demand.

The Danes said on Monday that the drug would be introduced to the UK “through a controlled and limited launch, culling global supplies as it tries to ramp up manufacturing”.

Amid the popularity of Wegovy, Novo Nordisk’s diabetes drug Ozempic has also seen soaring demand, with patients using it to treat obesity as it shares the same active ingredient as Wegovy, leading to shortages of the drug among patients who use it for treating diabetes.

Year to date, shares of Novo Nordisk are up 42%, whereas shares of LVMH are up about 12%.

Investors have grown even more loopy now that the New England journal says NOV’s weight-loss drugs can also play a role in cutting the chance of heart attacks in overweight users.

Novo Nordisk’s market capitalisation currently stands at US$428bn.

Were it listed in the States the Danish pharmac-giant would currently weigh in as the 15th largest company by market cap.

You’d find it on the S&P500. Just above JPMorgan Chase Bank.

A very good year: NOVO NORDISK

After Novo Nordisk launched Wegovy in the UK on Monday, its share price rose 0.7% to Danish kroner 1,310.80 (£150).

That gave it a market value of €388bn (or US$428bn) – which makes it worth more than the entire Danish economy.

LVMH, meanwhile which comprises all sorts of celebrated luxury brands (incl. Louis Vuitton, Dior and Givenchy), closed down 0.4% at €772.60 a pop, giving it a flimsy market value of under €388bn (£331bn).

Something is terrific in the state of Denmark

Novo Nordisk meanwhile is single-handedly transforming the Scandanavian economic landscape. The home of the GLP-1 antagonist drugs now boasts a higher market capitalisation than the yearly GDP of its home country.

The Danish economy lifted by 1.7% year-on-year over 1H23, according to the Danish statistic people.

Strip out the local pharma sector, (led by NOV) and Denmark’s GDP would have fallen by -0.3%.

At the time of writing, the International Monetary Fund (IMF) projects Denmark’s 2023 GDP to reach $405.6bn, whilst Novo’s market cap sits around $418.1bn.

AFP reports that over in Denmark, it’s not only the government coffers that have benefitting, but the ordinary Dane on the street – with employment rates lower and many of Scandy-nation going in as shareholders.

Novo has been a specialist diabetes drug manufacturer for over 100 years and has enjoyed reasonable success in this niche, but since FDA approval of Ozempic for diabetes in 2017 its growth has been unstoppable.

So Wegovy launched in the UK on Monday. It’ll be quasi-available via the country’s National Health Service (NHS) – this was the early catalyst which powered NOV on past LVMH on the fat-cat scale.

That said, the drug is already roaming free in the states. But that’ll be costing someone exactly US$1,349.02 a month, but surging demand has meant supply shortages.

Morgan Stanley said last month that annual global sales for weight-loss drugs could clock US$77 billion by 2030, way higher than its previous US$54 billion forecast.

On the obesity market, Novo Nordisk and Eli Lilly will be the big winners, they said, defying UBS – saying 82% of the market will be split between the two giants.

Eli Lilly, which has its own weight-loss drug called Mounjaro, is worth around US$100 billion more, as of last Friday’s closing price. It’s now rallied 52% this year.

While Europe does trade at a discount to the US, that might suggest more upside for Novo Nordisk.

Other corners of Wall Street are also bullish on both, with 62% of analysts rating Novo as Buy and 76% Overweight on Eli Lilly, according to Refivitiv data. But they see a slim chance of stocks moving much, with price targets for both sitting close to current levels.

Novo Nordisk has reached Europe’s top spot having only launched Wegovy in five markets—Denmark, Norway, Germany, the US and now the UK.

The cost of treating all adult obese patients in the US would far exceed annual healthcare spending on serious chronic conditions associated with obesity and, in their view, this option looks to be prohibitively expensive.

The US: A growing problem

Healthcare costs in the US are anticipated to rise from US$4.7 trillion in 2023 to US$7.2 trillion by 2031. For example, even if only those who are severely obese received treatment, it would still cost in excess of $400bn annually.

The Institute for Clinical and Economic Review (ICER) has said the annual price of Wegovy would need to at least shed a few thousand – from US$9,700 to to $7,500 to – for it to be cost effective.

Put another way, Medicare stats show the cost per patient per year to treat obesity-related co-morbidities such as stroke and heart attacks, and how that compares to the potential savings from using Wegovy.

If the occurrence of these co-morbidities were to be permanently reduced, the cumulative saving of circa US$30bn does not chime with the US$326bn it would cost to treat all obese Medicare patients (i.e., there’s a x10 disconnect).

They’re also of the school of doubters which argue of the complete lack of long-term evidence or research which shows a lasting benefit from using NOV’s drugs.

Nevertheless, the Thursday session saw NVO gain a further 2.2% after none other than its neighbour in market cap, JP Morgan Chase, hoisted its price target from 1,500 kroner (US$216) per share, well up from the 1,200 kroner (US$173) estimate.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.