Guy from The Big Short: You have no idea how short I am

Via Getty

Keen followers of real-life people played by Batman actor Christian Bale will no doubt be aware that one Dr Michael Burry is back quietly making bets again.

Breaking :

Michael Burry is back buying stocks again

In Q3 he purchased more $GEO and made new buys of $QRTEA, $CXW $AJRD, $CHTR, & $LILAK

His portfolio is now over 50% in prison stocks

— Michael Burry Stock Tracker ♟ (@burrytracker) November 14, 2022

Apparently, they’re very big bets:

— Michael Burry Archive (@BurryArchive) November 16, 2022

And as if to crown the moment, Bloomers earlier on Wednesday reported that the share price of Qurate Retail Inc. rallied like a champion on the very smell of Burry, overnight enjoying its biggest daily gain in two years.

According to regulatory filings, Burry’s picked up $10mn worth of Qurate, the happy owner of US mega home shopping channels QVC and HSN.

Following a good year to stay under cover, Burry, one of the few – aside from Ryan Gosling – who famously picked and played the US subprime mortgage crisis, has moved quickly to, perhaps, light a fuse under his new position.

“You have no idea how short I am,” Burry cryptically quipped this week on Twitter.

It’s anyone’s guess exactly what Burry is targeting.

According to Christian Bale’s interpretation he could be sitting anxiously in his pokey office shuffling stuff in his duffle bag, shorting whatever nasty creeping illness has started to infect any of many specific sectors or stocks… or perhaps it’s just the whole market.

It’s also not clear to Christian if Burry is implying he is betting against the market at all. Or if he’s just trying to help Elon rebuild interest in Twitter.

https://t.co/Q3Xz8tqnNv pic.twitter.com/d438STyi5X

— Michael Burry Archive (@BurryArchive) November 11, 2022

Burry has a unique take on that – he pops off cryptic declaratory and rather ominous tweets and then routinely deletes them after posting.

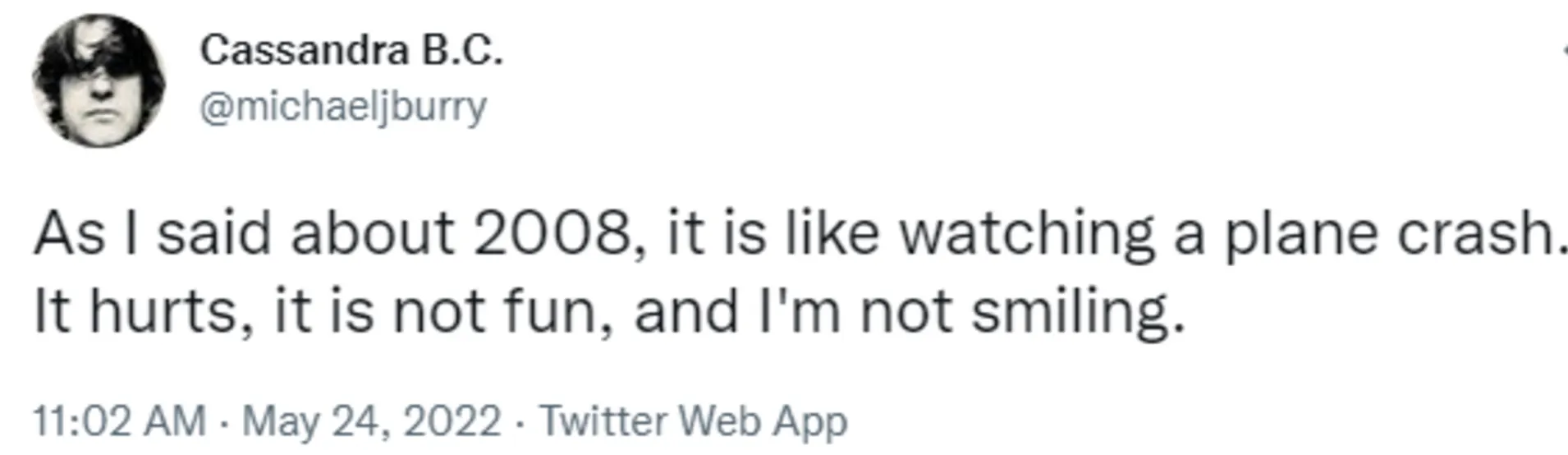

Thankfully strange people on Twitter protect the sacred thoughts. Like this one:

— Michael Burry Archive (@BurryArchive) November 15, 2022

And lo. The recent stutter in the obscene strength of the USD has started a currency switch to dollar-denominated commodities, which in turn is lifting the price of gold to a more than three-month high.

Burry, who runs hedge fund Scion Asset Management, could be implying gold could well kick higher while crypto has its pants down.

He picked that too, although even Christian could’ve.

— Michael Burry Archive (@BurryArchive) November 9, 2022

In fact the legendary contrarian and Wall Street anti-hero not only called the dramas of 2022 thus far, but picked the tech fizzle of June and the ensuing job cuts at Elon’s Twitter and The Zuck’s Meta Platforms, which is culling 15% of its previously expanding staff.

No problem. Burry cashed his Meta and Alphabet chips way back in Q2.

Poor old crypto meanwhile is trying to stem the bleeding following the cataclysmic collapse of exchange FTX which has already gone for Chapter 11 bankruptcy in the states.

So where does the man who’s been adding then deleting ideas on Twitter connecting 2022 to 2008 sit?

Burry has been everywhere and nowhere all year.

He attacked SPACS. Picked the pile of compressed earnings and corporate warnings… and now Cheddar Flow – not me – is onnit.

‘Big Short’ investor Michael Burry says the epic market crash he predicted is in full swing — and flags crypto, SPACs, and meme stocks as early victims — Market Insider

— Cheddar Flow (@CheddarFlow) September 9, 2022

And of course he reckoned we’d pay for the “addictive” nature of our spending, consumption and the fire it lights under inflation.

Michael Burry is warning that Americans are spending too much https://t.co/sck0RpgR0J

— Bloomberg Wealth (@wealth) August 12, 2022

Now where does the Dark Knight investor head as the world of meme stocks falls down around our ears?

According to a regulatory filing everyone’s been poring over since Monday, it’s spaceships and prisons.

After Qurate retail, Burry’s next biggest holdings are in the US private detention provider – CoreCivic. The next one is rocket maker Aerojet Rocketdyne Holdings.

The filings covering Q3 show Burry has pretty small positions in just six stocks.

In August Burry snapped up Geo Group, another company which focuses on private prisons and mental health sites.

Since he made the move on Geo in mid-August, the stock price has found some fulsome support, gaining about 25%.

The benchmark S&P 500 is showing some signs of life, but remains easily down in double figures for the year to date.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.