FREE WHELAN: Oil tanked, rates popped, everyone went nutty. We bought FUEL ETF

Via Getty

In this legendary Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a damn fine money manager.

Once again, we watch a tragedy unfold live and hope as much disaster can be averted as possible. It is my professional feeling, however, that we will not see the end of events in Israel and Gaza for some time.

There are too many takes being sprouted, especially by the Twitter crowd who turned from Russia/Ukraine experts after being Covid experts. So I’ll avoid wild predictions and commentate on what I can.

To begin, oil, after having a disastrous week just gone, opened with strong support for a host of obvious (and not so obvious) reasons.

The expectation of ongoing escalation of tension in the region is the base case for all expectations in the Middle East.

Any bridges that were being built between Israel and the Saudis are now delayed indefinitely.

We will have a look at our FUEL ETF we hold with a view to add, which was a tentative view held last week anyway. Remember these are the global energy companies like Chevron, Shell, Exxon etc.

Oversold on many counts. (Ed: see candles, top right)

I believe rumours of the world’s impending slowdown are a little overblown. (I’ll get to the interest rates doing the market’s job in a moment.)

Also, this from the WSJ… wow.

That’s direct.

Rates

Last week was some kind of week. Rates popped and everyone went a little nutty.

Basic synopsis: bonds were sold off with a few theories as to why, one being on the US economy being stronger than expected (along with some other things – see last week’s note) so rates need to stay higher for longer to match. That then made everyone freak out a little about what happens to the world if higher for longer happens.

Oil also tanked. Hacks on Twitter were writing “call your mother” next to a graph of the 10-year. Seriously.

Still…

Yes, a higher cost of money does change things. That’s for a much different and longer note.

But you should call your mother anyway, not because of this.

The prophecy

As such the market has regained its head, and even in the face of double the expected jobs numbers on Friday the market still had a bounce. Granted, wages had the lowest gain since June 2021 so there was a glimmer of slowdown. Investors of most walks will continue to love the big, cashed up, quality names for all the reasons I’ve written about before.

The self-fulfilling prophecy of higher yields solving many of their own problems re growth has already taken place. Remember, however that higher rates don’t necessarily stem inflation, since people raise the prices they can control to afford higher rates and so on and so on.

As such, markets are now expecting a higher likelihood of no new rises from the Fed (or a lower likelihood of new rises from the Fed, whichever you find easier to read).

Two weeks ago there was 50% chance of a raise by December, last week 40%, now it’s about 30%.

Does something still break?

Probably

The all-important US consumer has been cutting back on card payments due to higher rates according to new data from WalletHub. We’ll be watching because it’s exactly in line with where we need things to travel. Expect ordinary outlooks from retailers over the next few weeks.

I will be opening some long positions on shorter dated US Treasuries in USD over the next day or two. Mostly on the back of the above reasoning.

Finally

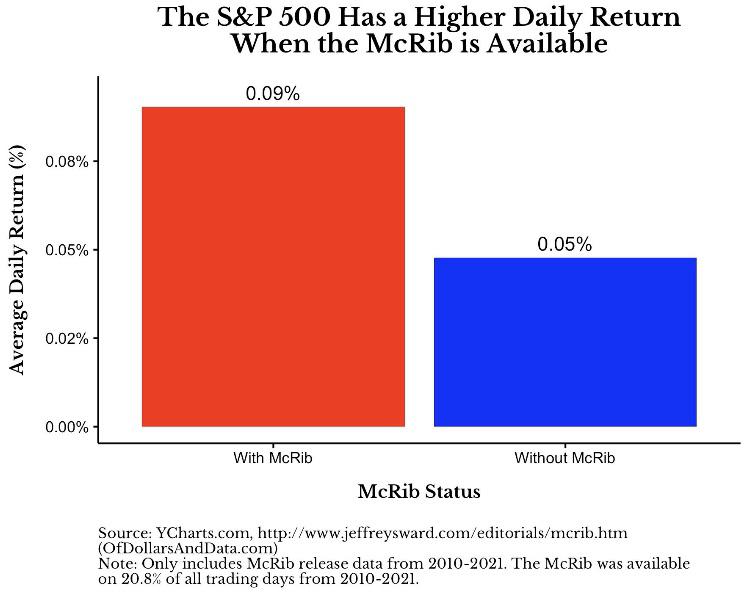

The McRib is back on the menu in the US. There’s a whole note in this phenomenon and I’ve mentioned it in the past but it’s a good reminder to always have exposure to markets no matter what.

r/wallstreetbets – Bullish on McRib

It relates to pork prices and other variables but don’t let words get in the way of a good chart.

Stay safe and all the best.

We will be monitoring recent events closely and advising accordingly as always.

Episode of the latest podcast is here.

James

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.