FREE WHELAN: And the Axeman Cometh upon the Stupidest Hour

News

In this Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

Writing to you from the second office in east Gippsland where I’ve escaped with my youngest (Ed: that’ll be the 2 x national jump rope champion) to work on some projects and catch some sea air.

The strategy of doing less in markets continues to work well and the fears and concerns of what was in all probability shaping up as the second instalment of the GFC has moved from the front pages.

I wrote and spoke, as it was happening, that yes it’s a serious cause for concern but the ability to fix it has never been better, bigger or faster.

Make no mistake, there is still some serious issues underlying the US and European economies regarding credit and commercial property but it’s not a reason to be going too overweight cash.

Also…

The volatility index, however, is really showing a level of complacency that I do not care for.

Also remember that we now move into the stupidest time of the year when rhyme based investing becomes the soup du jour. “Sell in May and go away something something another day” and I can’t stand it.

I also can’t stand it how often it works. This market has run a long way and we are due for the next “big thing” so I’m inclined to use this complacency to shave some profits off and pick up something cheap.

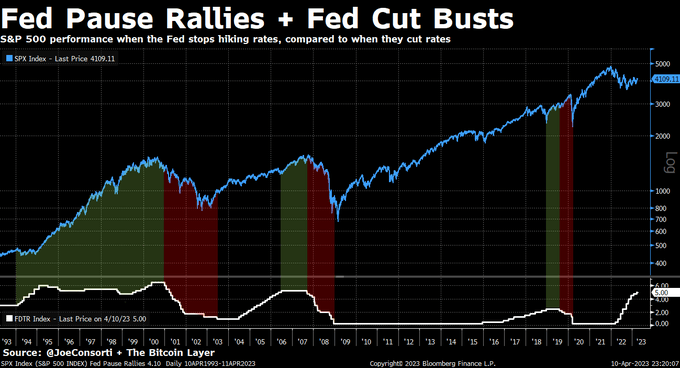

Note that the Fed pausing is bullish. The Fed cutting is not. Usually cutting is in response to some calamity. The rally happens before cuts, as it already has. Try not to squeeze too much more out of this.

2 things on staying in markets: We had a really great chat with the head of Airlie Funds Management Aussie Share Fund Emma Fisher. They’re all about value first and she had a great summary about investing in Australia where we don’t go from “boom to bust. Instead Australia goes boom to muddle through.”

Corporate debt is low here so there’s room to struggle through most types of recessions. Always be cautious but confident that we’ll always be ok.

Link here to the show with the new name, keen for feedback.

Secondly is a lovely chart like this that shows the annual returns of the S&P 500 along with the (red dot) intra year drop. We’ve already had an 8% return despite an 8% drop.

Last year was one of the anomalies to be sure.

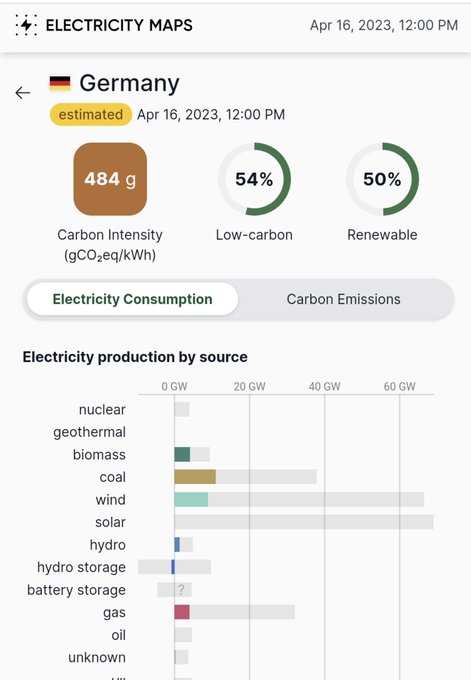

One of my memories of old was my father returning from a business trip to Germany with a gift for my eldest sister of a model nuclear reactor. Put on and old sheet of pine board and they built the model. It was quite a feat. I think I remember helping but

I do remember it being stored forever in the shed after construction. That was about 30 years ago and after all that time the Germans have finally pulled the curtain over what was an incredible nuclear program.

2 things happened immediately before and after the last reactor was turned off on the weekend.

Immediately before came a price announcement by electricity provider Eon that prices will rise by 45% in June.

Immediately after the turn off a check showed that a majority of generation was coming from coal.

I’m speechless. Truly stunned at this decision. Transitioning energy whilst only having part of it ready is foolish but there’s smarter people than me, and Elon Musk, saying that too.

There’s also still a war going on involving Russia. There’s no sign of that easing either.

Speaking of transitions (and no I’m not commenting on Bud Light’s marketing strategy)

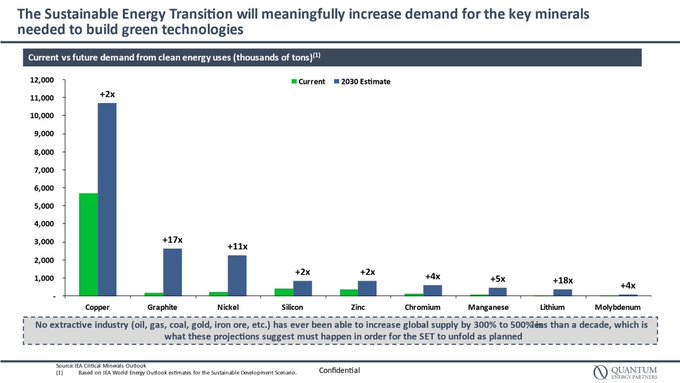

Another way of presenting the same thing I’ve been talking about for years. The Sustainable Energy Transition (which Germany is currently screwing up) needs anywhere from 2x to 18x more of the listed metals below. It’s not physically possible to get these things in the time needed.

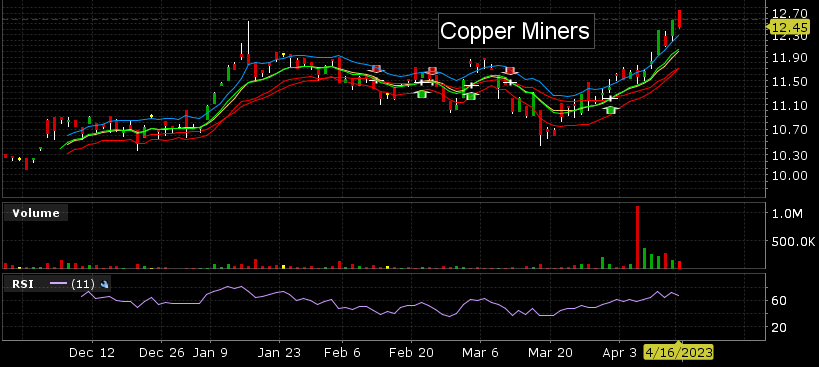

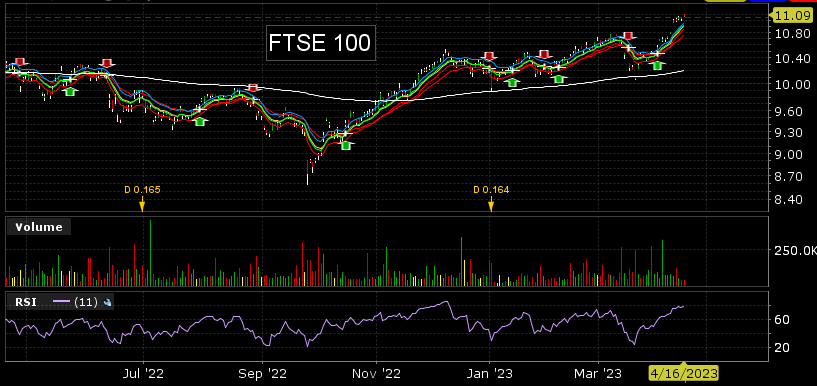

On the matter of thematic views like copper I’m taking the time here to have a look for the next “thing” ahead. Aside from the usual bonds and stock allocations which are performing admirably the three main themes I have this year are Copper, FTSE 100 and Energy, represented in the ETFs WIRE, F100 and FUEL.

As you can see they’re all preforming quite well but just look a little…stretched.

I’ll be putting these under the microscope, maybe looking for an allocation to gain more bonds access in the last interest rate rise next month.

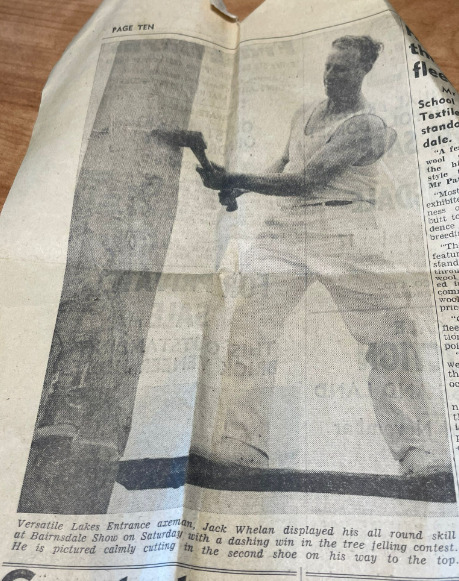

Finally, found this in a drawer. My grandfather would be 103 on the 18th April so I’ll be raising a glass for him and thanking him for inheriting my love of the axe and also for wearing cool singlets.

RIP Jack.

Stay safe and all the best,

James

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.