FREE WHELAN: All bets are off here guys. Invest accordingly.

Pic: Getty

In this Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

Another weekend of Ukrainian war, and more oligarch merch being taxed.

The Ukrainians continue to put up one helluva fight, and the world continues to bring more and more hammers down on Russian transactions and internet.

Quite frankly if you cut Netflix, Disney, Facebook and CNN from most people’s lives you’d find happiness increasing and people exercising much more, but that’s just me I guess.

News out of Russia is that with Mastercard and Visa ceasing in-country operations, Russian Bank Sberbank’s will issue Mir (it’s payment system) via China’s UnionPay.

Watch this space for more of that.

Battle lines

The more we isolate Russia in the way we’re doing, the closer they get to China and the stronger a separated financial system will become.

China basically already has its own separate internet. In for a penny, in for a pound as they say.

I just received a tweet telling me that Russia was forcing all of its companies to go to a .ru domain.

They’re walling their internet. Expect hackers to be slapping the keyboards on overtime if this appears true.

My preferred Cybersecurity ETF is HACK by Betashares.

However, the way things are going there could be a 500% increase in direct attacks to Western servers, in which case the companies in this ETF would probably still go down.

High-profile US investor Bill Ackman, who’s been busy scaring the world with his “we may already be at the start of WW3” chat, may be a little exaggerated.

However, I do believe we are setting the stage for the future to have an even bigger East vs West line drawn through it.

I have a hunch that the reason Chinese stocks are getting sold again now has a little to do with folks not wanting to carry the risk that what happened to Russian stocks happens to Chinese stocks sooner rather than later.

If there’s a new catalyst that draws China into this war (or Taiwan gets mentioned a little more), then next thing you know your manager needs to dump Ali Baba (which you probably should have sold earlier because it was already in a bearish trend in a risk-off environment).

No one wants to be late to that game.

As for that other thing…

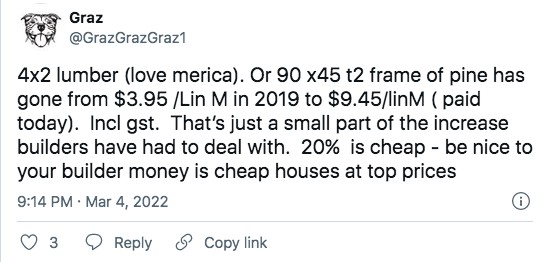

Now to inflation. It always pays to keep an ear to the ground on people who are at the coalface, and here’s a mate of mine in the building game telling us exactly how much he’s paying for lumber.

Any key supply input jumping from $3.95 to $9.45 is bad, and it’s the real inflation story.

I can’t put it any clearer. Things are getting more expensive. In a big way.

Companies either pass that through to the consumer or eat it out of their margins. Consumers are getting strapped for cash so either way it’s a lose/lose scenario. Stay well clear.

Commodities are really unhealthy at the moment. Spikes like the ones we’ve seen in oil and wheat are not healthy for economies.

Fuel now being almost unaffordable, meaning people globally will simply opt not to go anywhere.

It’ll be like 2020 again except far more expensive.

People will still need to eat and drive to important places but those important places probably won’t be to eat.

A lot of folks saying they’ve never seen the oil market so disjointed. Um…this happened not even two years ago.

I’m not going to lie — after telling everyone to own commodities these last few weeks (years), the absolute state of the space is freakishly hot.

Palladium, wow. Wheat, wow. Oil, wow.

However, there’s no end in sight for oil and gas disruption.

And if you asked me to put a price tag on oil and I said “US$300” you’d laugh at me.

At which point I’d hold the graphic of crude trading at NEGATIVE 37 DOLLARS ONLY 2 YEARS AGO.

All bets are off here guys. Invest accordingly.

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.