Lunch Wrap: ASX softens as tech, retailers and goldies feel the squeeze

ASX gets squeezed as Wall Street cools off. Picture via Getty Images

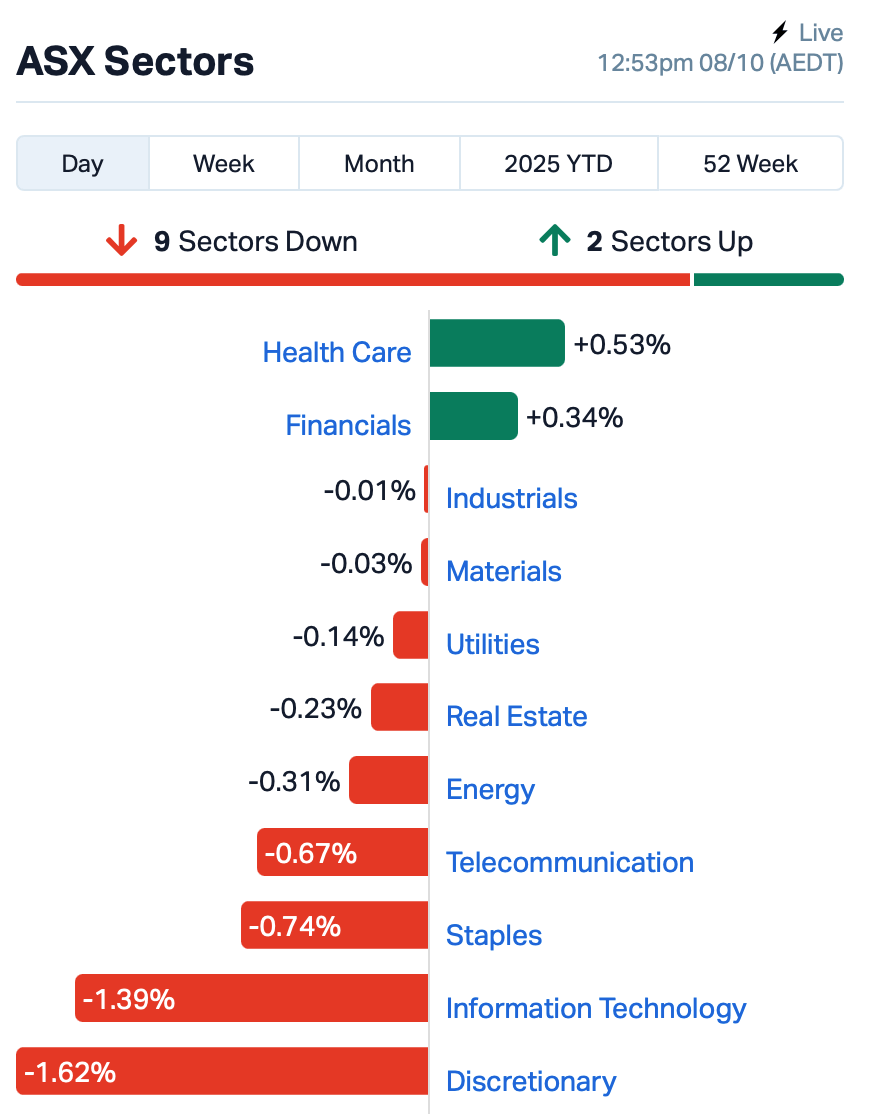

- ASX edges lower as Wall Street cools off

- James Hardie soars while gold miners lose shine

- Pro Medicus lands $10m German hospital deal

By lunchtime in the east, the ASX was trading about 0.12% lower as Wall Street finally remembered that stocks can, in fact, go down.

Overnight, US markets hit the brakes after a marathon run of record highs left traders gasping for air. The S&P 500 slipped 0.4%, and the Nasdaq by 0.7%.

And when Wall Street sneezes, the Nasdaq-sensitive end of the ASX catches a cold.

Life360 (ASX:360) slid more than 3%, while Xero (ASX:XRO) and WiseTech Global (ASX:WTC) dipped around 1%.

Retail stocks didn’t fare much better. After months of holding up surprisingly well, consumer names are showing cracks as rate fatigue meets reality.

Then there’s gold – the one shining spot, you’d think.

The precious metal futures contract clinched another record near US$4,000 an ounce overnight, boosted by jitters over the US government shutdown.

But when prices run this hot, traders often take profits faster than you can say “safe haven”.

This morning, gold stocks like Newmont Corporation (ASX:NEM) and Northern Star Resources (ASX:NST) all dipped.

In large cap news, the big one this morning came from James Hardie (ASX:JHX).

The building materials heavyweight surged 9% after jumping more than 8% in New York overnight.

The rally came after it posted preliminary second-quarter sales that smashed analyst estimates, proving there’s still demand for housing materials even in a sluggish market.

Elsewhere, Magellan Financial Group (ASX:MFG) gained about 1% after reporting a $600 million lift in assets under management during the September quarter.

This is a rare win for a fund manager that’s been out of favour longer than most investors can remember.

Still in large caps, Catalyst Metals (ASX:CYL) slumped nearly 4% after reporting September gold production below expectations – 17,600 ounces versus the forecast of 19,600.

The company says it’s still on track for full-year guidance of 100,000-110,000 ounces, but the market doesn’t like hiccups when gold’s already on a heater.

Meanwhile, in med-tech, Pro Medicus (ASX:PME) added another feather to its cap, announcing a $10 million, five-year deal with Heidelberg University Hospital in Germany.

The contract will see it replace three legacy imaging systems across Heidelberg and the German Cancer Research Institute.

ASX LEADERS

Today’s best performing stocks (including small caps) intraday:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| XST | Xstate Resources | 0.055 | 162% | 98,890,560 | $5,278,998 |

| CBL | Control Bionics | 0.050 | 52% | 831,088 | $11,099,159 |

| RKB | Rokeby Resources Ltd | 0.006 | 50% | 3,319,864 | $7,303,527 |

| RLC | Reedy Lagoon Corp. | 0.003 | 50% | 30,000 | $1,553,413 |

| GG1 | Greengoldminerals | 0.290 | 45% | 381,509 | $11,631,110 |

| PNN | Power Minerals Ltd | 0.178 | 37% | 16,240,481 | $22,311,524 |

| ALM | Alma Metals Ltd | 0.007 | 30% | 2,169,192 | $9,286,186 |

| FGH | Foresta Group | 0.034 | 26% | 2,120,526 | $71,628,474 |

| QXR | Qx Resources Limited | 0.005 | 25% | 11,362,237 | $7,370,598 |

| PGY | Pilot Energy Ltd | 0.009 | 21% | 17,176,105 | $15,110,620 |

| OLL | Openlearning | 0.030 | 20% | 4,751,215 | $12,070,199 |

| BYH | Bryah Resources Ltd | 0.006 | 20% | 2,627,902 | $5,142,663 |

| CRB | Carbine Resources | 0.006 | 20% | 2,834,089 | $5,959,329 |

| FIN | FIN Resources Ltd | 0.006 | 20% | 1,181,685 | $3,474,442 |

| TKL | Traka Resources | 0.003 | 20% | 3,000,000 | $6,055,348 |

| DAF | Discovery Alaska Ltd | 0.025 | 19% | 80,000 | $4,918,929 |

| EQS | Equitystorygroupltd | 0.019 | 19% | 940,387 | $2,829,566 |

| FUN | Fortuna Metals Ltd | 0.170 | 17% | 763,931 | $27,164,893 |

| HIQ | Hitiq Limited | 0.021 | 17% | 1,198,405 | $8,726,984 |

| AUK | Aumake Limited | 0.004 | 17% | 2,704,402 | $9,070,076 |

| AVW | Avira Resources Ltd | 0.015 | 15% | 525,132 | $2,990,000 |

| MTB | Mount Burgess Mining | 0.015 | 15% | 8,082,480 | $5,533,298 |

| RAG | Ragnar Metals Ltd | 0.030 | 15% | 342,811 | $12,323,635 |

| BKY | Berkeley Energia Ltd | 0.690 | 15% | 78,132 | $267,478,029 |

PainChek (ASX:PCK) has secured landmark FDA De Novo clearance for its PainChek Adult app, making it the first and only regulated medical device for pain assessment in the US.

The FDA created a new product code “SGB” to classify the technology, opening a US$100 million per year initial market across 3 million long-term care beds. With partnerships already in place with PointClickCare and Eldermark, covering about 60% of the US and Canadian aged care market, PainChek is now positioned to launch commercial sales in the near term.

The announcement points to an excellent US regulatory and reimbursement landscape for pain management, expanding PainChek’s total addressable market to as much as US$582 million when hospitals and home care are included.

And the clearance also provides a streamlined path for expansion into hospitals and home care, and sets the stage for faster approvals in markets such as Japan’s and Europe’s.

Xstate Resources (ASX:XST)’s Diona-1 well has hit a promising stretch of gas-charged rock in Queensland’s Surat-Bowen Basin. Drilled to 2,479 m so far, it cut through the primary Jurassic target with no hydrocarbons, but once it entered the deeper Permian section, it struck a 181 m over-pressured gas column, strong early signs of hydrocarbons. It’s now drilling the final few dozen metres to about 2,530 m before running wireline logs to confirm the find.

Power Minerals (ASX:PNN) has locked in an option to acquire the high-grade Gamma Heavy Rare Earths Project in California, right in the same district as MP Materials’ world-class Mountain Pass Mine. Early sampling has shown standout grades of up to 2.03% total rare earth oxides and uranium hits over 1% U₃O₈, though the data predates JORC 2012 and will need to be verified through new drilling.

OpenLearning (ASX:OLL) has raised $2.6 million in a strongly backed placement at 2.2 cents a share. The fresh funds will help it push deeper into new markets like the Philippines and Brazil, ramp up product development, and strengthen working capital. Major shareholder Education Centre of Australia chipped in around $1.25 million.

ASX LAGGARDS

Today’s worst performing stocks (including small caps) intraday:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RNX | Renegade Exploration | 0.005 | -29% | 30,352,465 | $14,364,211 |

| LNU | Linius Tech Limited | 0.002 | -25% | 500,000 | $14,254,387 |

| PAB | Patrys Limited | 0.002 | -25% | 5,000,000 | $9,167,513 |

| DTR | Dateline Resources | 0.500 | -21% | 37,887,892 | $2,146,001,753 |

| ZNC | Zenith Minerals Ltd | 0.123 | -21% | 4,970,101 | $82,258,850 |

| CR9 | Corellares | 0.004 | -20% | 2,185,602 | $5,037,849 |

| MRQ | Mrg Metals Limited | 0.004 | -20% | 699,250 | $13,632,593 |

| PLC | Premier1 Lithium Ltd | 0.008 | -20% | 8,408,600 | $3,680,606 |

| WEL | Winchester Energy | 0.002 | -20% | 5,500,000 | $3,407,547 |

| AIV | Activex Limited | 0.017 | -19% | 80,870 | $4,525,554 |

| SRL | Sunrise | 4.040 | -19% | 749,271 | $614,618,614 |

| KGD | Kula Gold Limited | 0.036 | -16% | 10,860,291 | $49,517,386 |

| LSR | Lodestar Minerals | 0.032 | -16% | 4,770,701 | $32,637,070 |

| NES | Nelson Resources. | 0.009 | -15% | 23,605,450 | $21,799,277 |

| BIT | Biotron Limited | 0.003 | -14% | 2,343,019 | $4,645,360 |

| JAV | Javelin Minerals Ltd | 0.003 | -14% | 3,401,576 | $26,495,787 |

| LNQ | Linqmineralslimited | 0.200 | -13% | 1,630,837 | $14,225,500 |

| CMG | Criticalmineralgrp | 0.135 | -13% | 34,776 | $14,034,376 |

| GBE | Globe Metals &Mining | 0.063 | -13% | 100,000 | $50,015,017 |

| LPM | Lithium Plus | 0.105 | -13% | 946 | $15,940,800 |

| ORP | Orpheus Uranium Ltd | 0.042 | -13% | 459,898 | $13,521,462 |

| T3D | 333D Limited | 0.145 | -12% | 750,010 | $32,810,879 |

| CDR | Codrus Minerals Ltd | 0.029 | -12% | 461,960 | $6,822,235 |

IN CASE YOU MISSED IT

Power Minerals (ASX:PNN) has moved to acquire the Gamma heavy rare earths project, strategically located near the only producing REE mine in America.

RLF AgTech (ASX:RLF) has locked in agribusiness veteran Stuart Upton as COO to turn its Nutrien deal, fresh funding and reset into real scale.

Everest Metals Corporation (ASX:EMC) is growing its foothold in WA’s Murchison after acquiring a new exploration licence to bolster its Revere gold project.

LAST ORDERS

Micro-X (ASX:MX1) has secured a $5.1 million research and development tax rebate from the Australian Tax Office, having accessed $3.99 million via an advanced funding facility that has now been repaid.

MX1 expects to receive another $310,000 should an ongoing amendment to its tax incentive be approved, bringing total rebates to $5.39 million.

Neurizon (ASX:NUZ) has begun trading on the OTCQB Ventures market, expanding exposure to US investors and increasing liquidity of NUZ shares. The move comes just as NUZ is preparing to begin its ALS platform trial.

At Stockhead, we tell it like it is. While Micro-X and Neurizon are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.