Dear Eliza: Why am I even living in Melbourne?

News

In what is almost certainly not news, property data firm CoreLogic has released new evidence suggesting Brisbane is better than Melbourne.

To be more succinct: places to live in Brisbane now cost more than places to live in Melbourne.

Or using the property parlance of the age: across December’s national greater capital city median dwelling value ranks, Melbourne has lost its spot to Bris Vegas.

To CoreLogic’s Head of Research and Evil Queen of Numbers Eliza Owen and her team, I simply refer to the American rapper and singer Amala Ratna Zandile Dlamini – Doja Cat – quoting from the first single (“Paint the Town Red”) of her fourth studio album Scarlet:

“Duh.”

Well said Doja.

Everyone knows Brisbane is the greater capital city.

First, it’s not in Victoria.

Second, there are theme parks.

Third, I could keep this list going without pause.

But… I reluctantly acknowledge that Eliza and her CoreLogic peeps are referring to the astonishing and ridonkulous capital growth homes in Brissy have revelled in over the past few years.

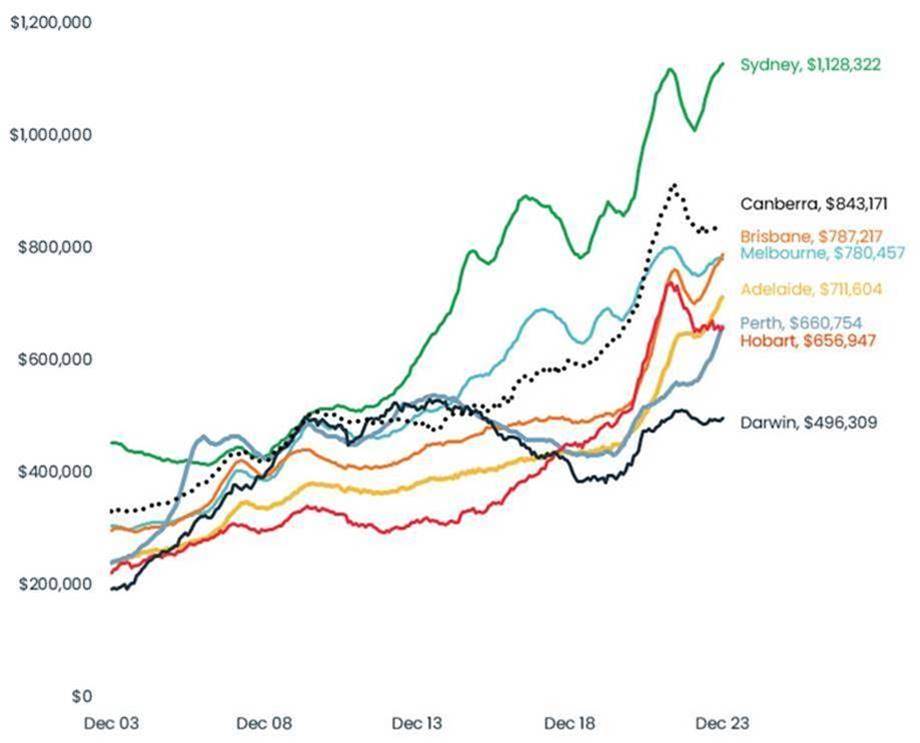

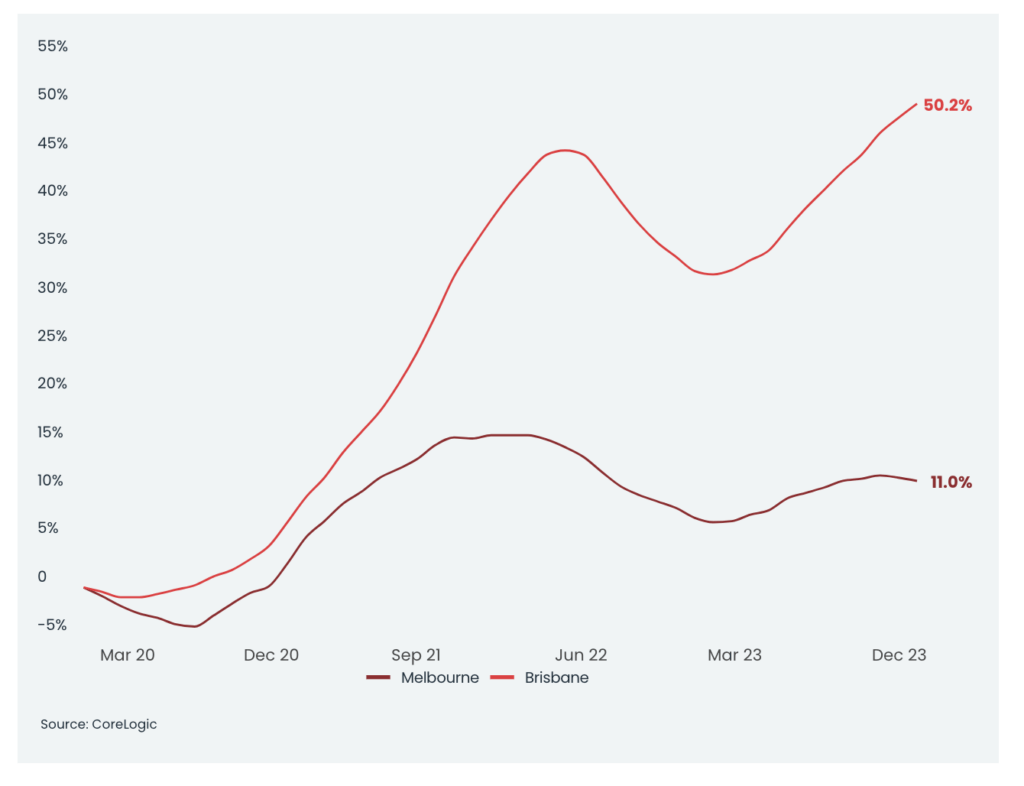

Yes, there’s been a national property resurgence and yes, who’d actually choose to live in Melbourne (!?)… but even in the context of absurd Aussie property prices it’s hella impressive that since the onset of the pandemic, the average Bris Vegas home now goes for 50.2% more than it did in March 2020.

The city now has the third-highest median dwelling value among Aussie capitals, behind Sydney and Canberra.

(Yes. Canberra.)

Eliza says that in December, the Greater Brisbane median dwelling value was $787,000, o’erleaping Melbourne’s median value for the first time since July 2009, by around $7,000.

“The city’s appeal amid an increase in remote work helped fuel strong population growth, increasing housing demand, driving down supply and making it a seller’s market,” Eliza told Stockhead.

And Stockhead agreed.

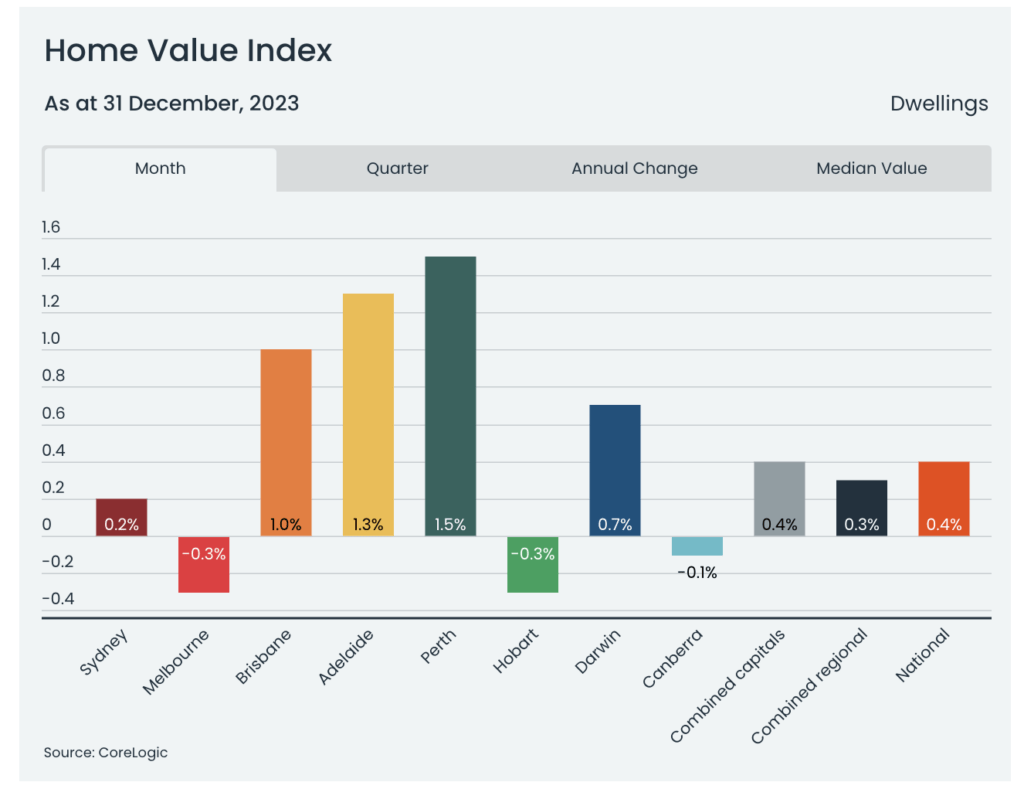

According to CoreLogic, national home values rose 8.1% last year, a big turnaround on the panic-laden 4.9% drop seen in 2022, but well below the 24.5% surge recorded in the pandemic times of 2021.

December’s 0.4% increase saw 2023 finish with a relatively soft monthly rise in home values.

That said, Brisbane’s ascension does recall Edwin Starr’s famous question, originally written under the Motown label and first performed by The Temptations, from the 1969 hit War:

“Huh(?)”

Or to be more succinct: So why has Brisbane surpassed Melbourne in the median dwelling value ranks?

Well, Eliza is, as a famous scientist once told spellbound Australian TV audiences, weekly, “glad you asked”.

First, it’s all about houses and flats.

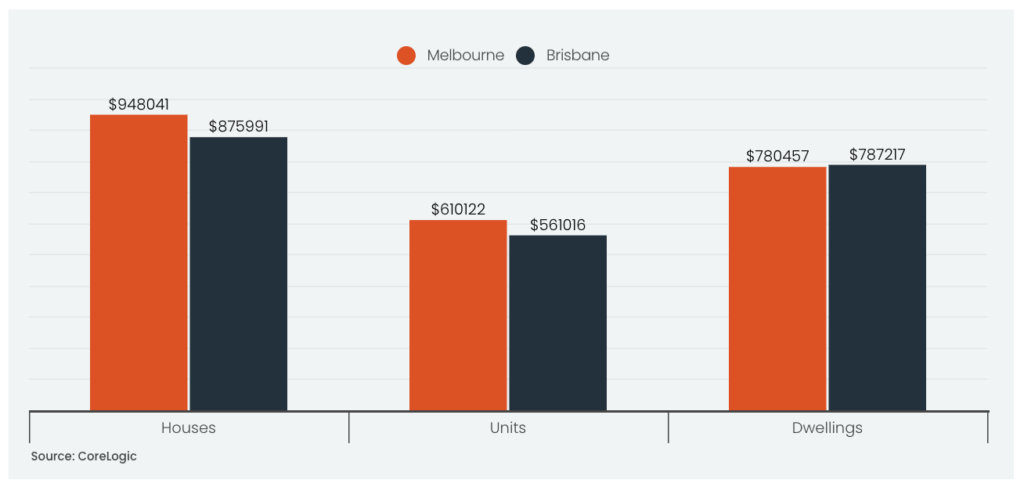

According to CoreLogic, despite recording a higher median dwelling value, Brisbane’s median house and unit values are still $72,000 and $49,000 below Melbourne’s medians respectively.

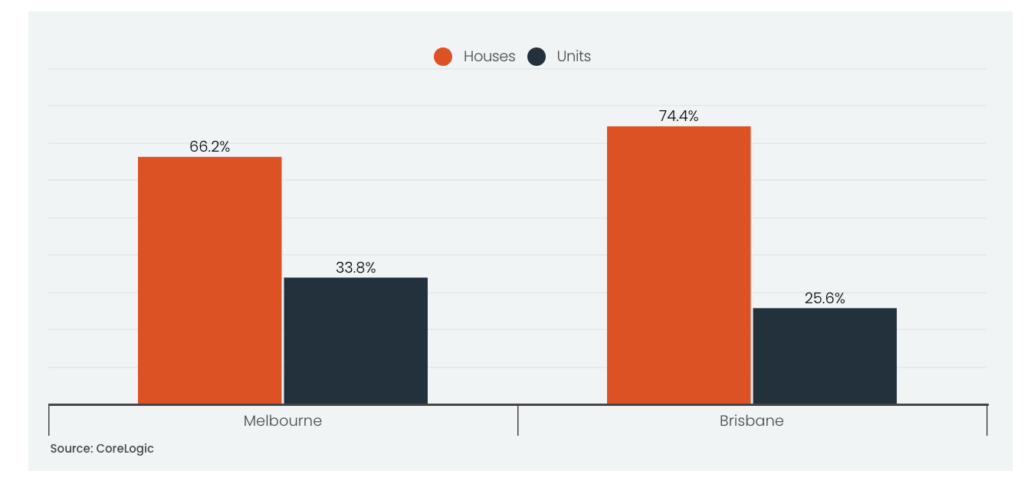

The reason for this is that Melbourne has a higher share of units as a portion of the dwelling market.

Eliza estimates that units make up 33.8% of Melbourne dwellings, compared to 25.6% of homes across Brisbane.

Ergo sum: Because units are generally lower value than detached houses, a higher portion of units brings down the median dwelling across all houses and units.

In the near term, this compositional difference might rebalance a little, CoreLogic suggests.

A glance at the latest Bureau of Stats’ building activity data shows that as of June last year, there were 1.4 units under construction for every house in Victoria, compared to 1.6 units for every house across Queensland.

This implies there could be a slightly higher concentration of unit stock to come across Brisbane.

Since the onset of the pandemic in March 2020, Eliza says, Brisbane dwelling values rose by more than half through to the end of last year.

Over the same period Melbourne values rose just 11%, which was the weakest increase of any capital city market.

This disparity in growth has seen Brisbane’s median dwelling value rise from $187,000 below Melbourne’s median in March 2020, to $7,000 higher in December last year.

“The reason for such varied capital growth outcomes may be partly due to lifestyle factors, where the appeal of South East Queensland rose through the pandemic,” Eliza told Stockhead.

“The normalisation of remote work for many professionals made interstate migration to Queensland more feasible, while Melbourne’s extended lockdowns from March 2020 through to October 2021 may have prompted people to leave the city.”

You can see this happening in the latest ABS migration data too, which has net interstate migration to Queensland clocking a new record high of 51,500 in the year to March 2022.

In the same period, net interstate migration to Victoria was -20,000, Eliza says.

“Net internal migration to Victoria bottomed out at a loss of -35,600 people in the year to June 2021, and was still negative as of June last year. Value falls across Melbourne were also exacerbated by the loss of overseas migration through COVID, but net overseas migration turned positive in 2022.”

These trends can be seen and enjoyed in the charts below, which show rolling annual interstate and overseas migration by state.

While the most recent migration data is only available at a statewide level, regional population data from the ABS showed that over the year to June 2022, Brisbane’s population grew by 2.3%, more than double the rate across Melbourne (1.1%).

Overall, Melbourne still had a higher estimated resident population at 5,031,000, compared to 2,628,000 across Brisbane.

Turns out Brisbane wasn’t the only city to ‘shift ranks’ in December, with the median values in Perth sneaking above Hobart.

Actually, Adelaide also surpassed the Hobart median earlier last year too, relegating the Tasmanian capital to the second-lowest median across Aussie capitals.

However, Eliza reckons these new rankings may be tested in the months ahead.

“Brisbane remains a seller’s market, but the pace of monthly growth in values has eased slightly, from 1.5% in October 2023 to 1.0% in December.

“As home values in the city continue to rise, there is less claim to Brisbane being relatively affordable, and some prospective interstate movers may decide to remain in their city.”

She says that the recent weeks have also demonstrated there’s some added risk to pockets of the Brisbane property market not least thanks to the extreme weather and flooding, which “could impact demand in the near-term.”

“Overall, the data reinforces the substantial impact that the pandemic has had on housing preferences, and shifting market dynamics.”

Yes it does.

It also reinforces the fact Melbourne’s cold, wet and dreary. No matter how many floods and cyclones Bris Vegas attracts.