Crypto tops Aussie ETF leader board in 2024 as industry smashes records

The Global X 21Shares Bitcoin ETF was Australia's top ETF performer for 2024. Pic: Getty Images

- The Global X 21Shares Bitcoin ETF was the top performer for 2024, delivering a 146% return

- The Australian ETF industry broke new records in assets and net flows in 2024, finishing with a total market cap of $246.3 billion

- International equities was top broad category for inflows in 2024, followed by Aussie equities and fixed income ETFs

Final figures for Australia’s ETF industry in 2024 have dropped, with crypto and tech-focussed ETFs topping the performance table as records tumble in terms of assets and net flows.

Betashares’ annual review shows the Global X 21Shares Bitcoin ETF (CBOE:EBTC) was the top performer for 2024, delivering a 146% return, followed by the Global X FANG+ ETF (ASX:FANG), up 65.7%, and the Munro Climate Change Leaders Fund (managed fund) ETF (ASX:MCCL), which rose 65.6%.

Launched in May 2022, EBTC and the Global X 21Shares Ethereum ETF (CBOE:EETH) are Australia’s only spot cryptocurrency ETFs tracking performance of the price of Bitcoin and Ethereum respectively in Aussie dollars.

Bitcoin soared more than 120% in 2024, including ~50% since Donald Trump was elected US President in November. Investors are betting on expectations that flagged favourable cryptocurrency policies of Trump’s second term will further propel gains.

The FANG ETF had a strong year boosted by a strong performance of the so-called FANG stocks, including Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla, which was driven by continued excitement in artificial intelligence.

Record year for ETF growth

Betashares said the Australian ETF industry recorded its highest annual funds under management increase in 2024, breaking new records in terms of assets and net flows.

The industry ended the year at an all time high, with the total industry market capitalisation sitting at $246.3 billion, representing 38.8% year on year growth. The industry grew by a record $68.9 billion in 2024.

Betashares said ETF industry flows smashed the record set in 2021, with net new money for the year of $30.8bn, doubling the $15bn of net flows received in 2023.

Annual ASX ETF trading value was up 23% in 2024 on 2023 figures with a record $141bn of ETF value traded on the ASX compared to $114bn in 2023.

Betashares said there were currently 53 issuers of ETFs in Australia. Vanguard, Betashares and iShares were the top three issuers in terms of flows in 2024, recording ~$24.4bn in net inflows between them and collectively accounting for nearly 80% of industry flows.

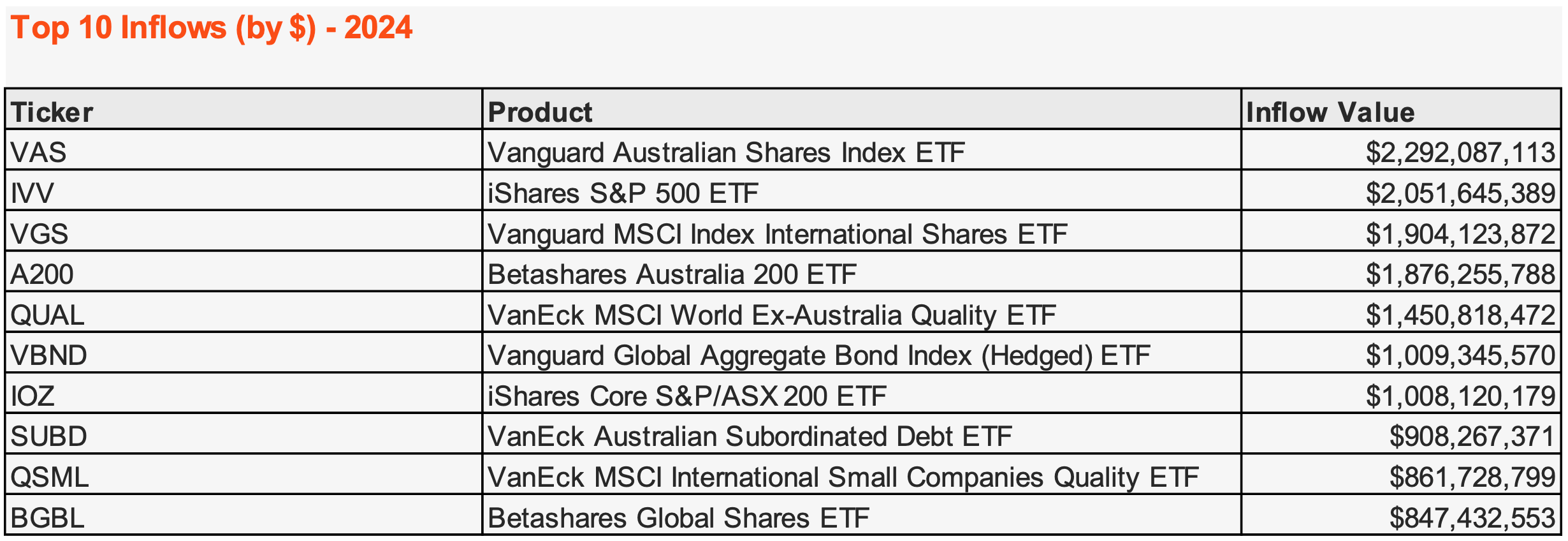

Top inflows and outflows for 2024

There were no new entrants to the top 10 largest products this year with only some shuffling to the order.

BetaShares reported that core allocations continued to dominate investor preferences in 2024, with the largest inflows directed toward broad market equity ETFs.

Passive exposures led the charge, capturing 81% of total flows, primarily through market cap-weighted passive ETFs.

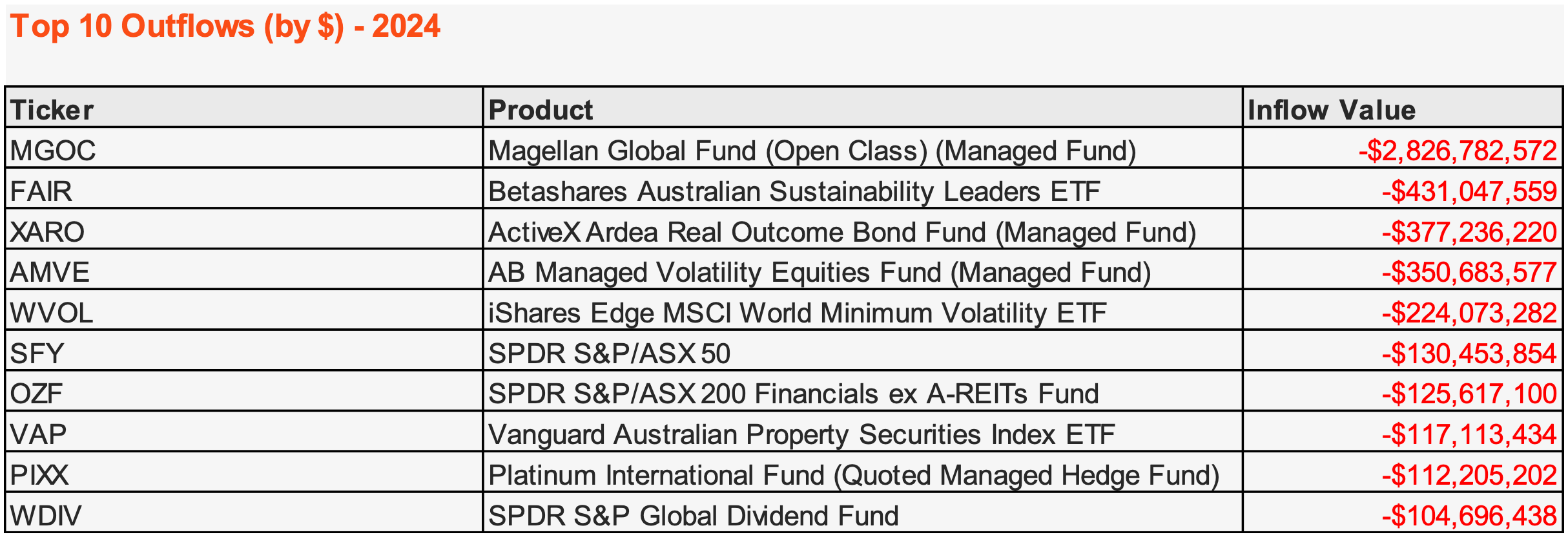

Active ETFs experienced net outflows totalling around $734 million, largely due to ongoing redemptions from the Magellan Global Fund (ASX:MGOC), which had another tough year with ~$2.8bn in outflows. In 2023 MGOC also topped the list for outflows with ~$2.5bn.

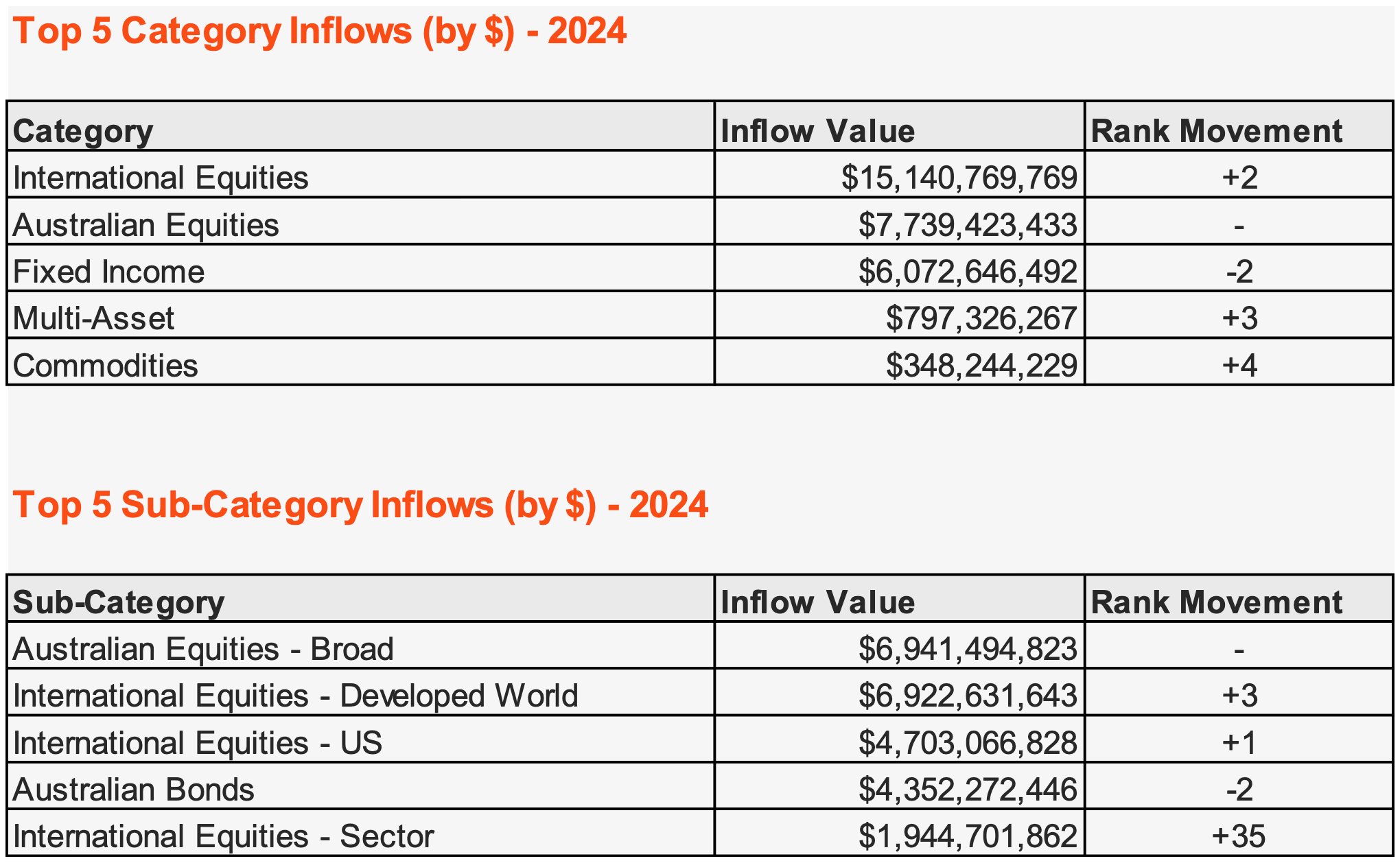

Investors return to global equities in 2024

Betashares said investors returned to international equities in a big way after taking a more defensive stance in 2023. International equities was the number one broad category for inflows in 2024, followed by Australian equities and then fixed income ETFs.

Fixed income was the top category inflow for 2023 as investors took a more defensive stance in their asset allocations.

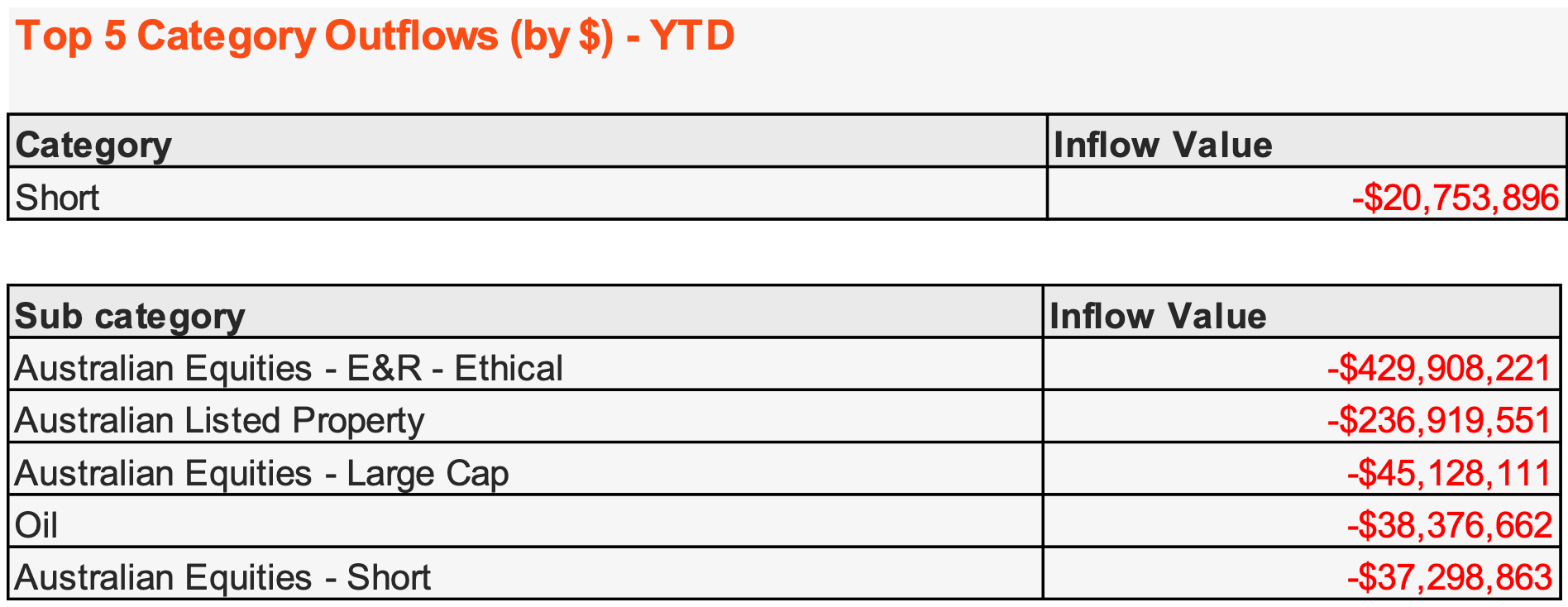

Betashares said there were very limited outflows at a category level, with short funds seeing small redemptions in 2024.

Biggest year for product launches

Betashares said 2024 was the biggest year on record for ETF launches. There were 66 new ETFs launched on the ASX and CBOE, compared with 56 in 2023.

There were 30 products closed during the year, compared to eight closures in 2023. There are now a total of 403 ETFs traded on the ASX and CBOE.

Betashares is forecasting the growth trajectory for the Australian ETF industry to continue with the market cap likely to exceed $250bn in Q1 CY25 and $300bn by the end of 2025.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.