Corporate: ServTech’s Virtual Reality will be taken for a ride by Volvo

Pic: Getty

Volvo liked an interactive VR experience from ServTech (ASX: SVT) so much, it’s going to to implement it.

The Italian subsidiaries of these companies signed a one-year agreement where ServTech will help Volvo roll out VR technology in its vehicles and sales operations. It came after the pair collaborated as part of a world-wide presentation for the E.V.A. initiative which aims to raise awareness about women’s safety in automobiles.

Now Volvo will roll out ServTech’s technology across its operations.

- Scroll down for more ASX corporate news>>>

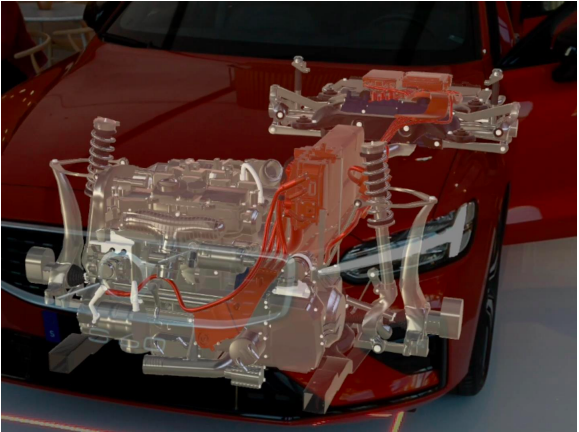

New cars are usually only made once the consumer buys them and VR will help customers visualise their new car and ensure it is made how they want it. This is more cost-effective and likely to be relevant to the final product for customers than test models or even 2D visualisation.

In addition to customising the colour of the cars and interior design, the VR trip will showcase the car’s security systems and the engine.

It’s also anticipated the technology will be used in training manufacturing staff. While this morning’s announcement was light on agreed details, ServTech noted its solution could help employees learn the ropes in a environment where mistakes will not be harmful.

As well as this, Volvo will use ServTech’s technology to visualise safety equipment. It will be installed in Volvo’s Milan studios this month.

One problem in safety visualisations is that crash test dummies are almost exclusively male – and hence women are at a higher risk of injury than men in automotive crashes. This was what the E.V.A. campaign aimed to raise awareness of, and Volvo and ServTech hope the VR tech can help solve the problem.

Volvo’s Italian sales & marketing director Chiara Angeli said ServTech had earned the deal.

“Vection was able to produce a compelling experience for Volvo Car Italia for the E.V.A. initiative,” Angeli said. “We look forward to seeing what can be done to incorporate the technology into other Volvo Car Italia business verticals.”

ServTech’s managing director Gianmarco Biagi hinted more deals were to come, noting it was still negotiating with other companies.

He said the Volvo deal, “forms part of the company’s broader global partnership strategy aimed at positioning Vection as the leading VR software provider for Tier 1 companies.”

“Furthermore, this close collaboration with Volvo cements Vection’s positioning in the automotive industry, supporting Volvo in its growth & development strategy.”

Shares were up 17 per cent in the first hour of trading and after today’s rise have now doubled this year.

In other ASX small cap corporate deals and moves today

E-Tech hardware retailer Dicker Data (ASX: DDR) will distribute Kaspersky Lab’s products in Australia and New Zealand. The deal with the Moscow-headquartered cybersecurity firm comes into effect today. They join the company of dozens of firms including Microsoft, HP and Samsung in Dicker Data’s product range.

After nearly five years of service, Stellar Resources (ASX: SRZ) director Miguel Lopez has left the company. The company, which searches for tin in Tasmania, credited him as well as his strategic planning and finance skills in growing the company. It has not yet announced a replacement but promised it would occur soon.

In the aftermath of quarterly season, the ASX often queries several companies about their cash flow. Many of these are mining companies that will usually raise capital soon afterwards. But one company that received a query was ad agency Adcorp (ASX: AAU). Its quarterly predicted cash outflows of $6.2 million for the current quarter when it only had $1.2 million cash on hand at the end of the preceding quarter.

Adcorp told the ASX it had enough cash, having increased its current funding facility only the previous week and reminded the ASX it was in the middle of a restructure.

Intrepid Resources (ASX: IAC) is now all clear to acquire the rest of fellow gold explorer AIC Resources (ASX: A1C). As of the last substantial holder notice, lodged on Friday afternoon, it had 96.17 per cent.

While it crossed the 90 per cent threshold a few weeks ago, this morning it gave notice to the ASX for compulsory acquisition. AIC shares will be suspended five business days after the ASX formally receives the notice.

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.