Corporate: Nuheara says it did receive a takeover bid, but now its not happening

Nuheara's potential suitor, Harman, has turned its back on the company (Pic: Getty)

Nuheara (ASX:NUH) has responded to an ASX query surrounding rumours Samsung made a $84m takeover bid for junior earbuds maker.

The company clarified that it had received an “indicative non-binding letter of intent” from American sound company Harman International Industries, which Samsung recently acquired but operates independent of the Korean tech giant.

- Scroll down for more ASX corporate news >>>

It also noted that the offer was not going ahead after Harman pulled out.

The ASX sent Nuheara a letter asking why it did not mention the offer in a market update released last Tuesday when it was aware at the time. The bourse also asked if it had revealed the bidder’s identity to investors in its recent capital raising.

Nuheara told the ASX it had to keep confidentiality with investors and while it had not revealed the bidder’s identity to investors, the company would now disclose it to them.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

It could not explain why the Australian Financial Review claimed it was Samsung or how the media outlet found out.

“The board notes that it has had no indication that Harman or any other party will present any offer for Nuheara in the future,” the company said.

“Nuheara will update shareholders of any further developments in accordance with its continuous disclosure obligations.”

Meanwhile, Nuheara has also topped up its coffers by $4m from a recent equity raise.

The placement was cornerstoned by the company’s largest shareholder, Farjoy Pty Ltd.

Nuheara said the cash raised would be used to fund an increase in sales and marketing activity to support new and existing products and accessories.

Shares advanced 5.5 per cent on Friday morning to 5.8c.

In other ASX corporate news today:

Fonterra (ASX:FSF) CFO Marc Rivers has had to explain to shareholders why the share price of the Kiwi dairy company fell 10 per cent on Thursday. Rivers admitted Fonterra’s “performance is not where it needs to be”, but that the company was working on fixing it. “We’re doing everything we can to turn that performance around and are undergoing a full strategy review,” he explained. “We know there are going to be some bumps along the way. Fonterra is committed to further strengthening our balance sheet and lifting our performance and we believe this will be reflected in the value of the Co-op over time.”

Australian Ethical Investment (ASX:AEF) has had another successful fiscal year. Its profit after tax is expected to come in at between $6.4m and $6.6m, which is 30 per cent better than the last financial year. Of the total, $450,000 is a performance fee paid for out on the success of the Australian Ethical Emerging Companies Fund. According to Bloomberg, the fund has gained 17 per cent in the last 12 months from $1.28 to $1.50. Official results will be released in late August.

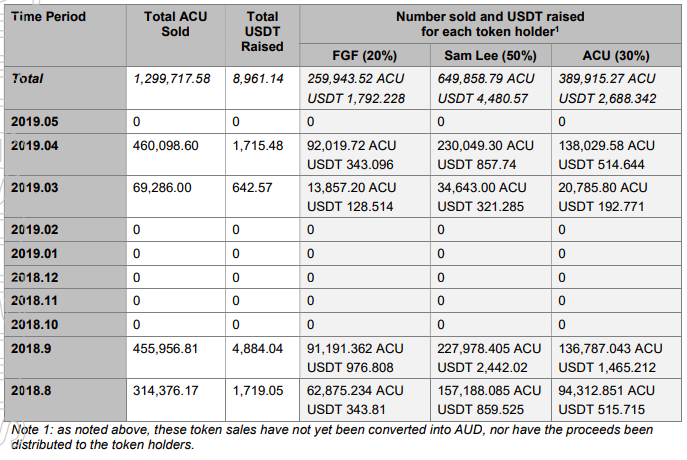

The ASX is continuing to investigate First Growth Funds (ASX:FGF). Although a deal to create crypto tokens with YPB is now off, the ASX is now inquiring about a similar deal with Acudeen Technologies. Tokens were listed last August on Australian blockchain crypto exchange BTCEXA, and FGF was entitled to 20 per cent of the tokens, which would be $US10m ($14.2m) based on the then market cap of $US50m. Also, if $US5m was not raised within 12 months of June 30, 2018 tokens were meant to be bought back and transferred to Acudeen. Having raised only $USDT9000 (USDT being a token value to tether cryptocurrencies to the “mainstream” US dollar) this was now due.

FGF told the ASX the buyback had not yet occurred, and if it did it wouldn’t impair the company because the tokens had no value. It also revealed some tokens had been converted to other tokens, but proceeds had not been distributed so no revenue had been made. FGF has been suspended for three months now — initially triggered by the YPB deal. Although that deal is off it took FGF until two weeks ago to concede it was changing activities and needed shareholder approval. The stock will be suspended until this occurs.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.